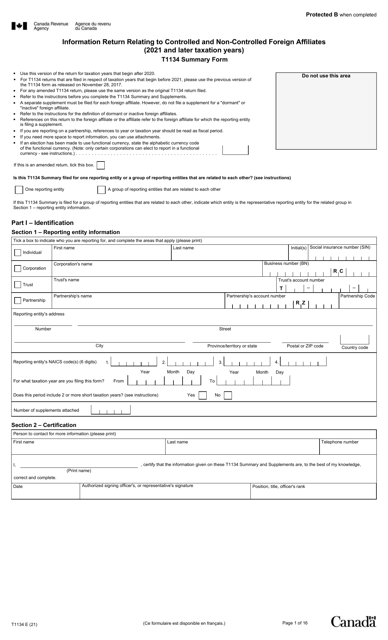

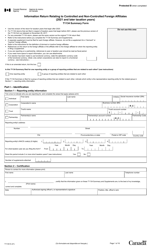

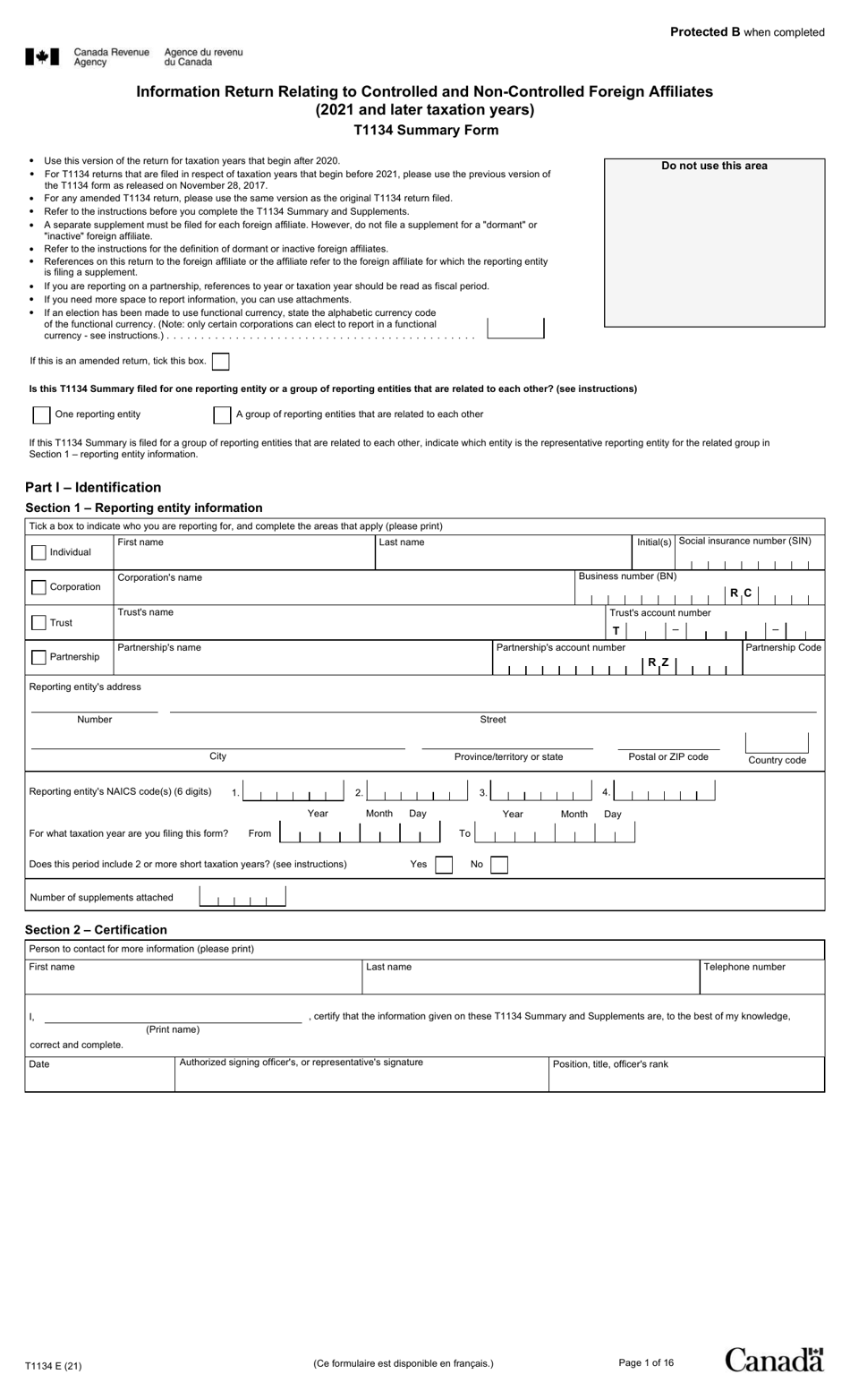

Form T1134 Information Return Relating to Controlled and Non-controlled Foreign Affiliates (2021 and Later Taxation Years) - Canada

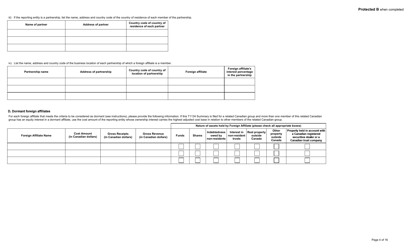

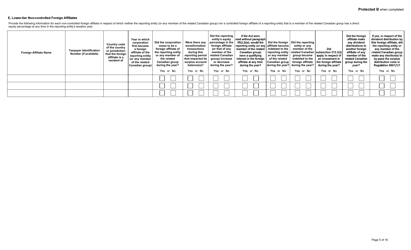

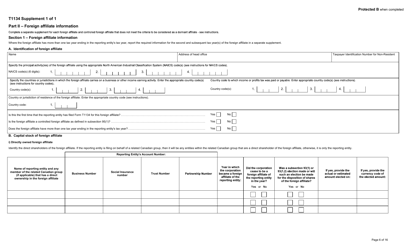

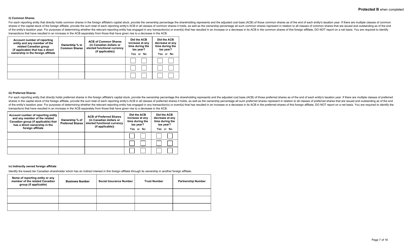

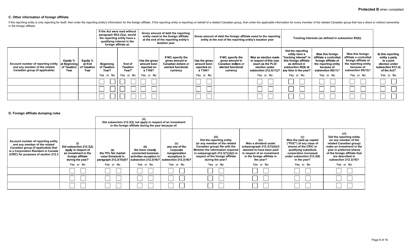

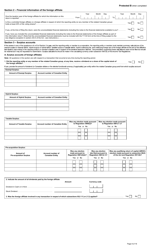

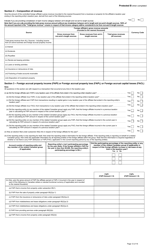

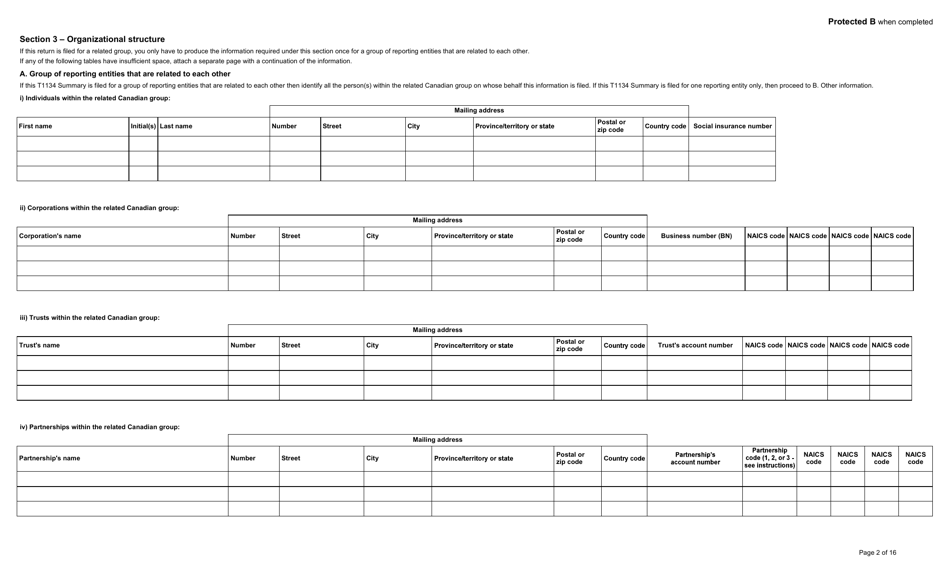

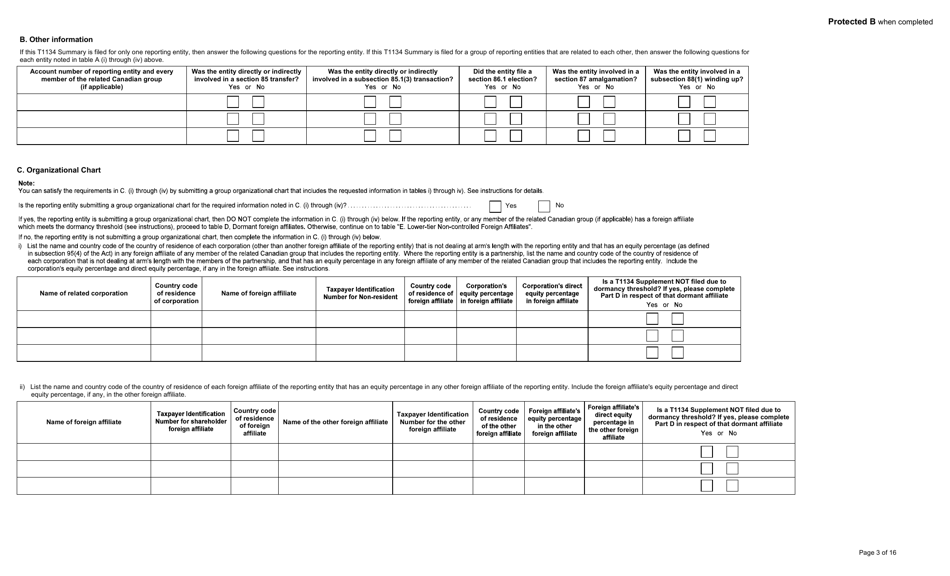

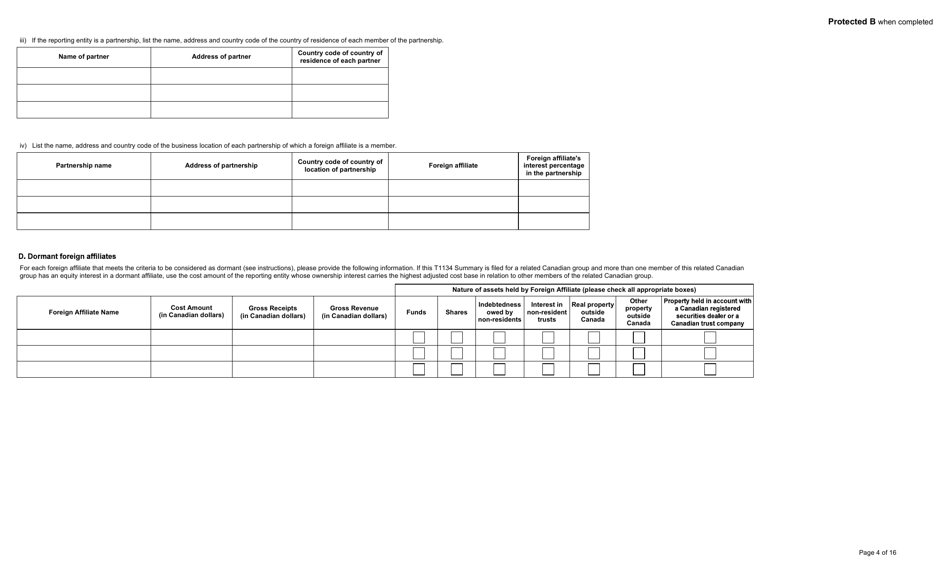

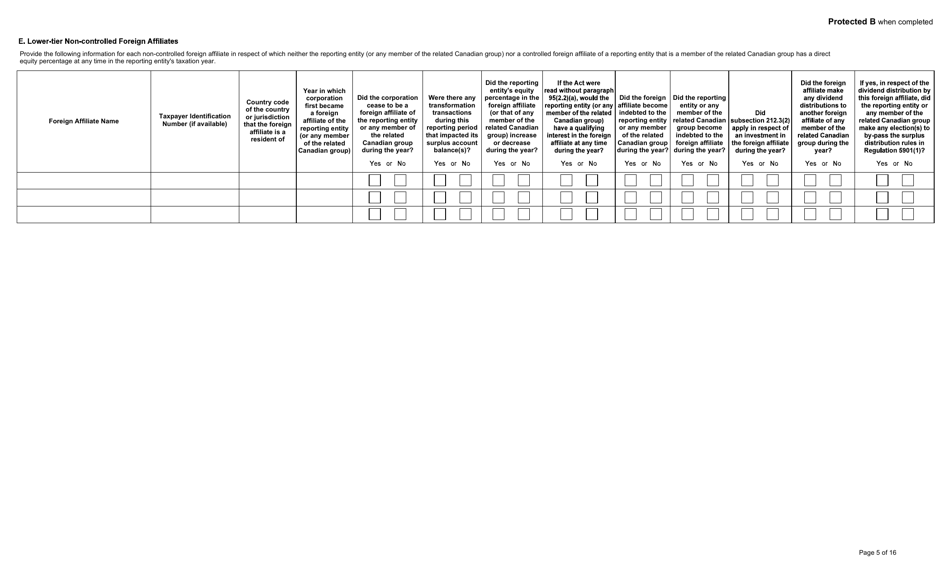

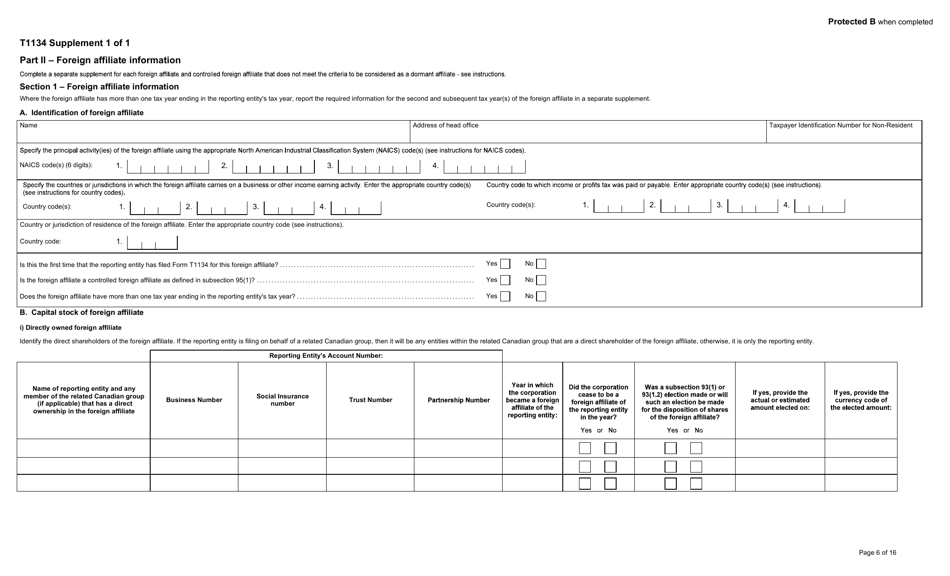

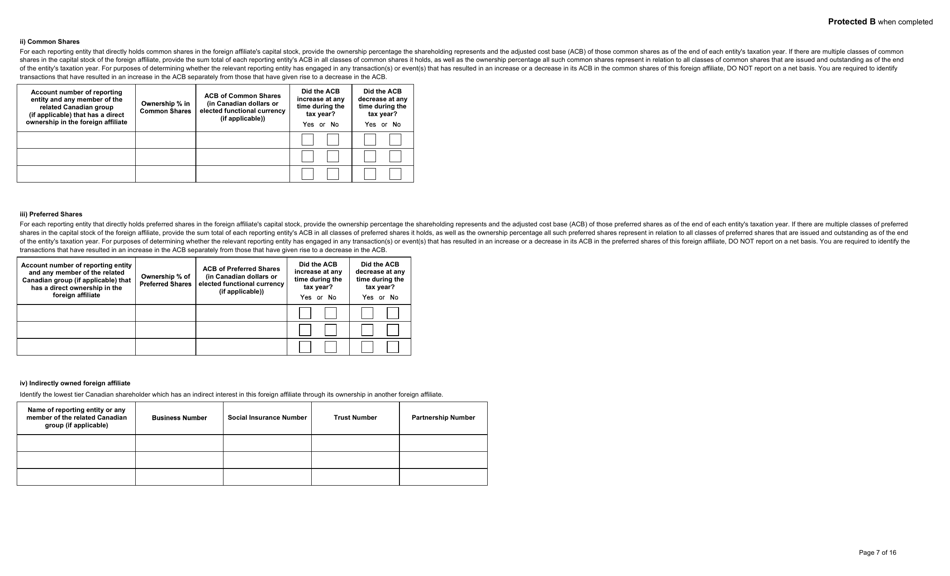

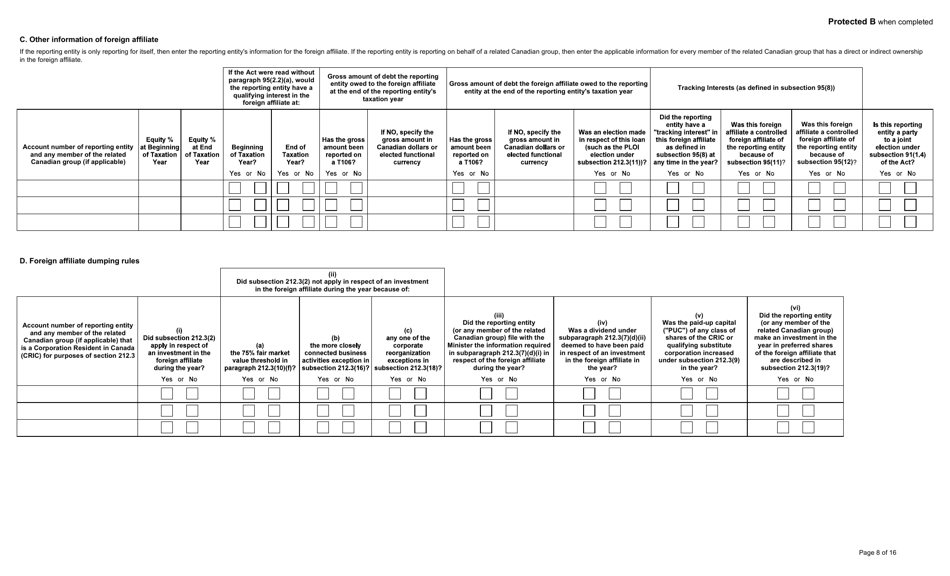

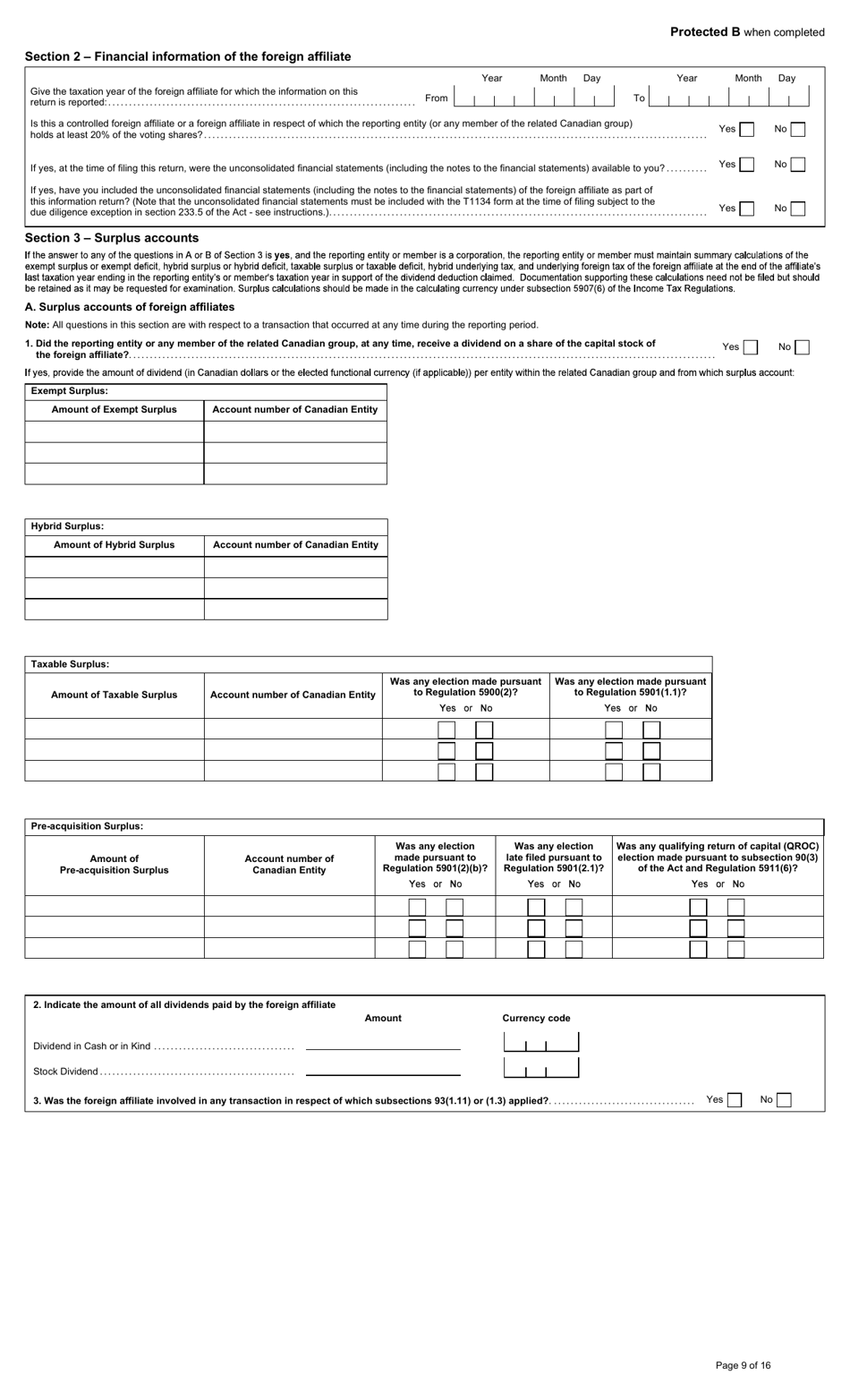

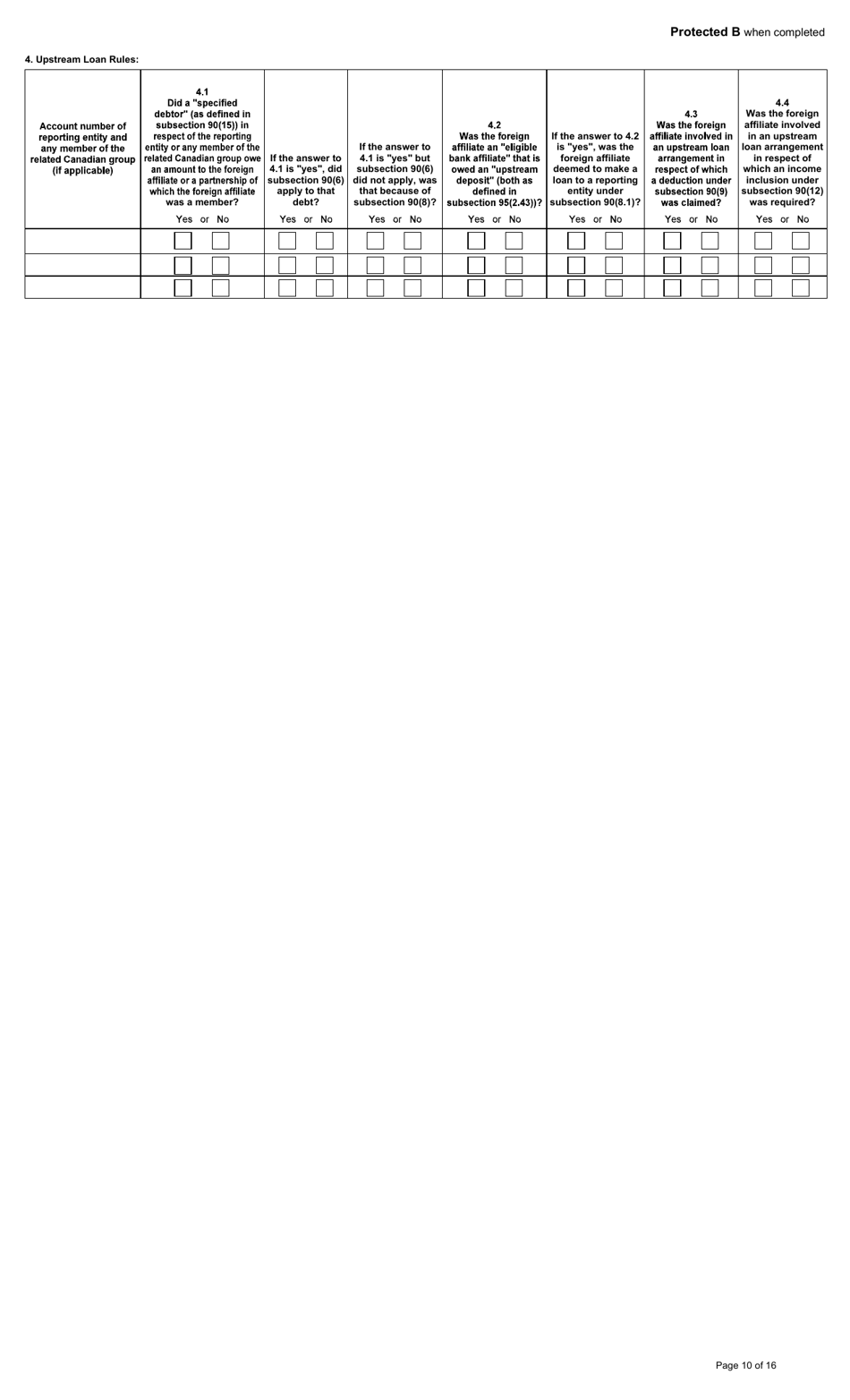

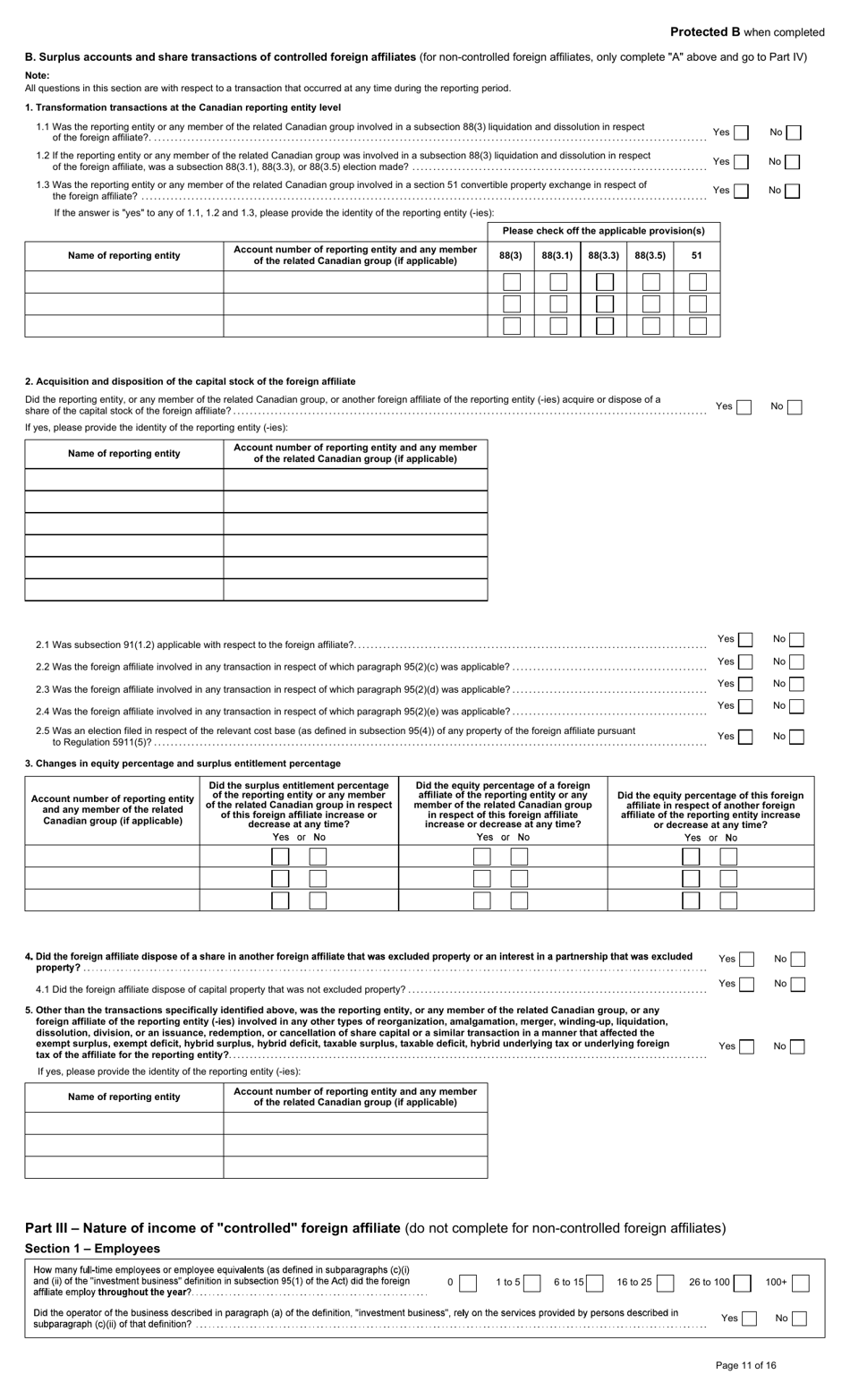

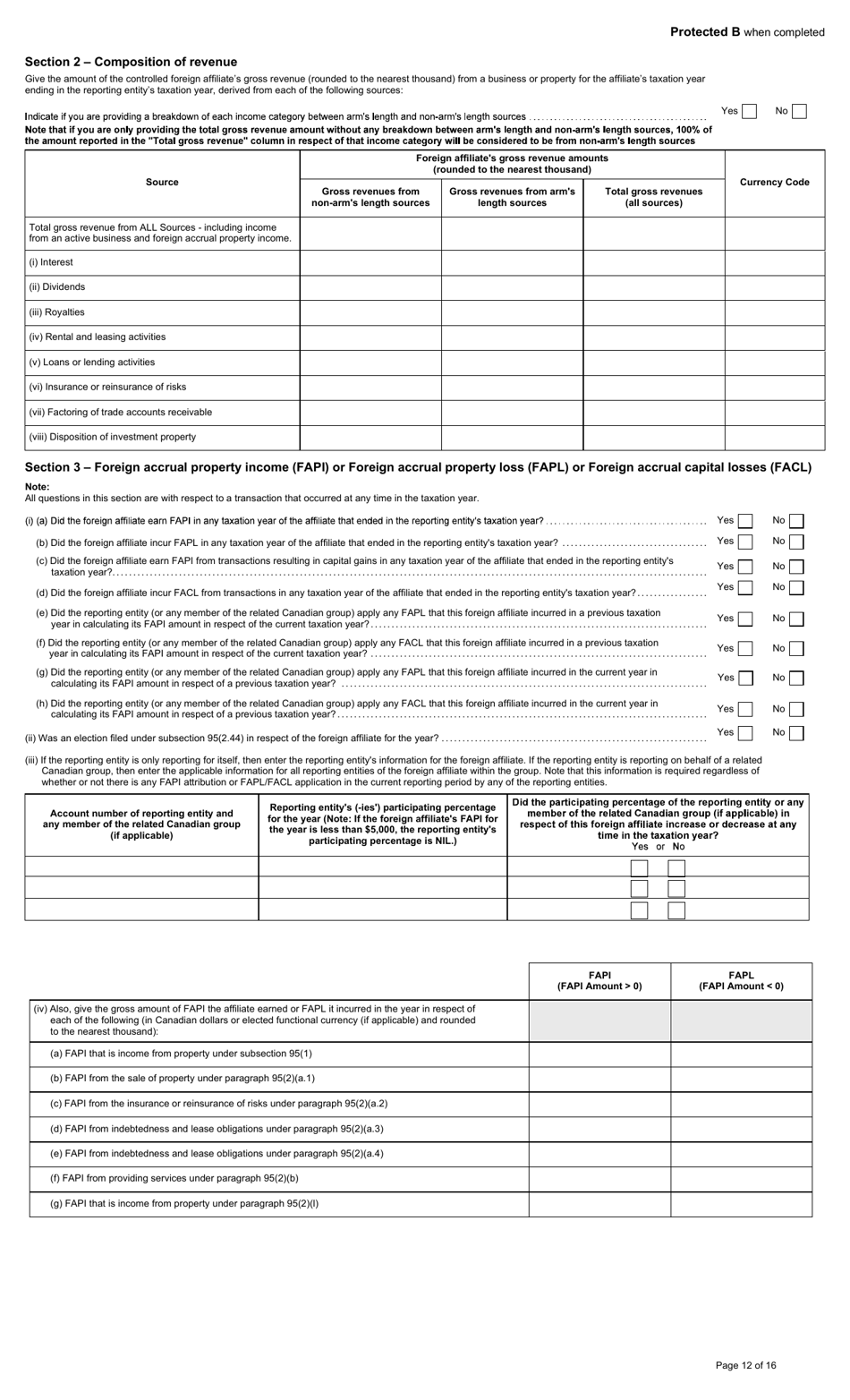

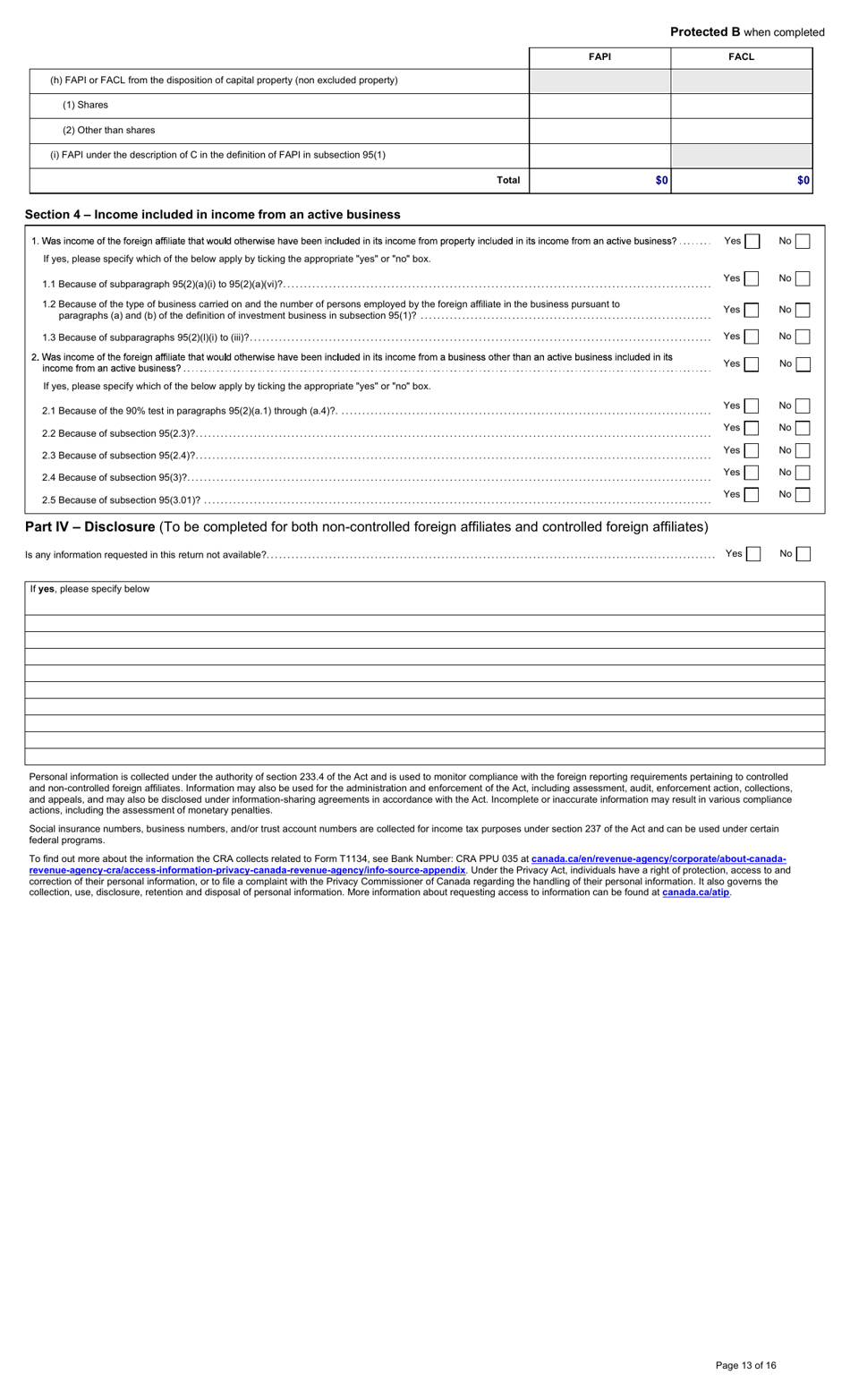

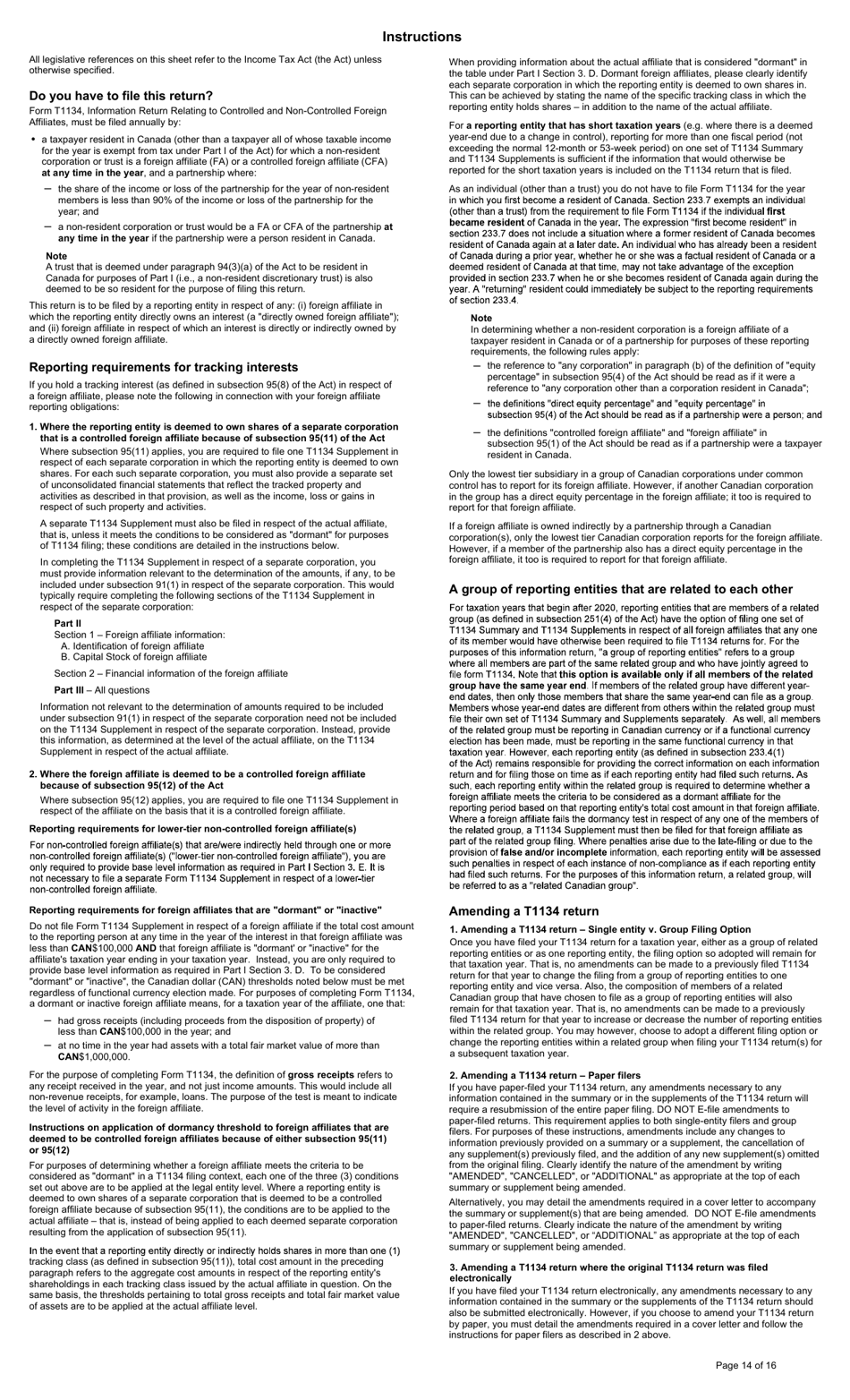

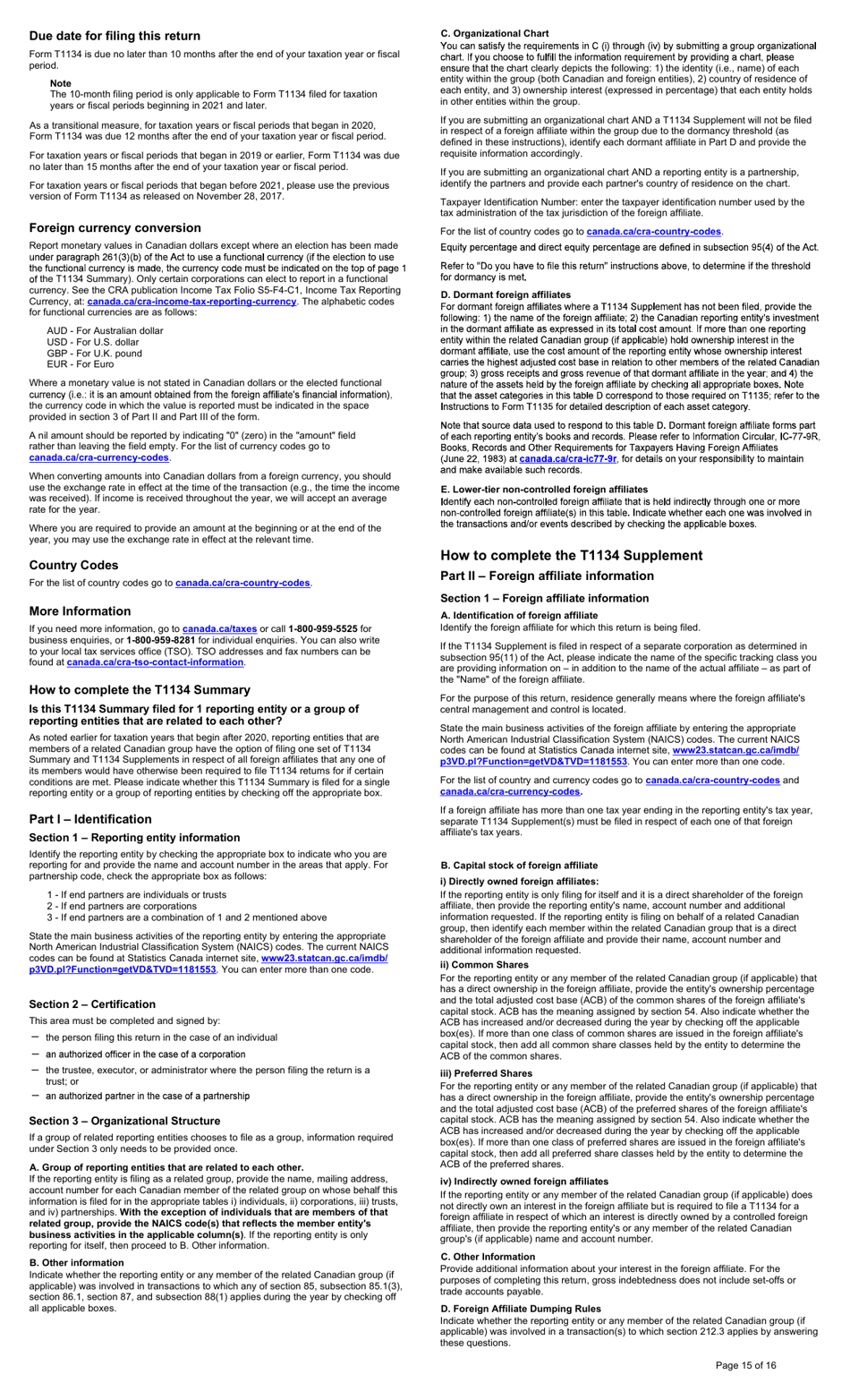

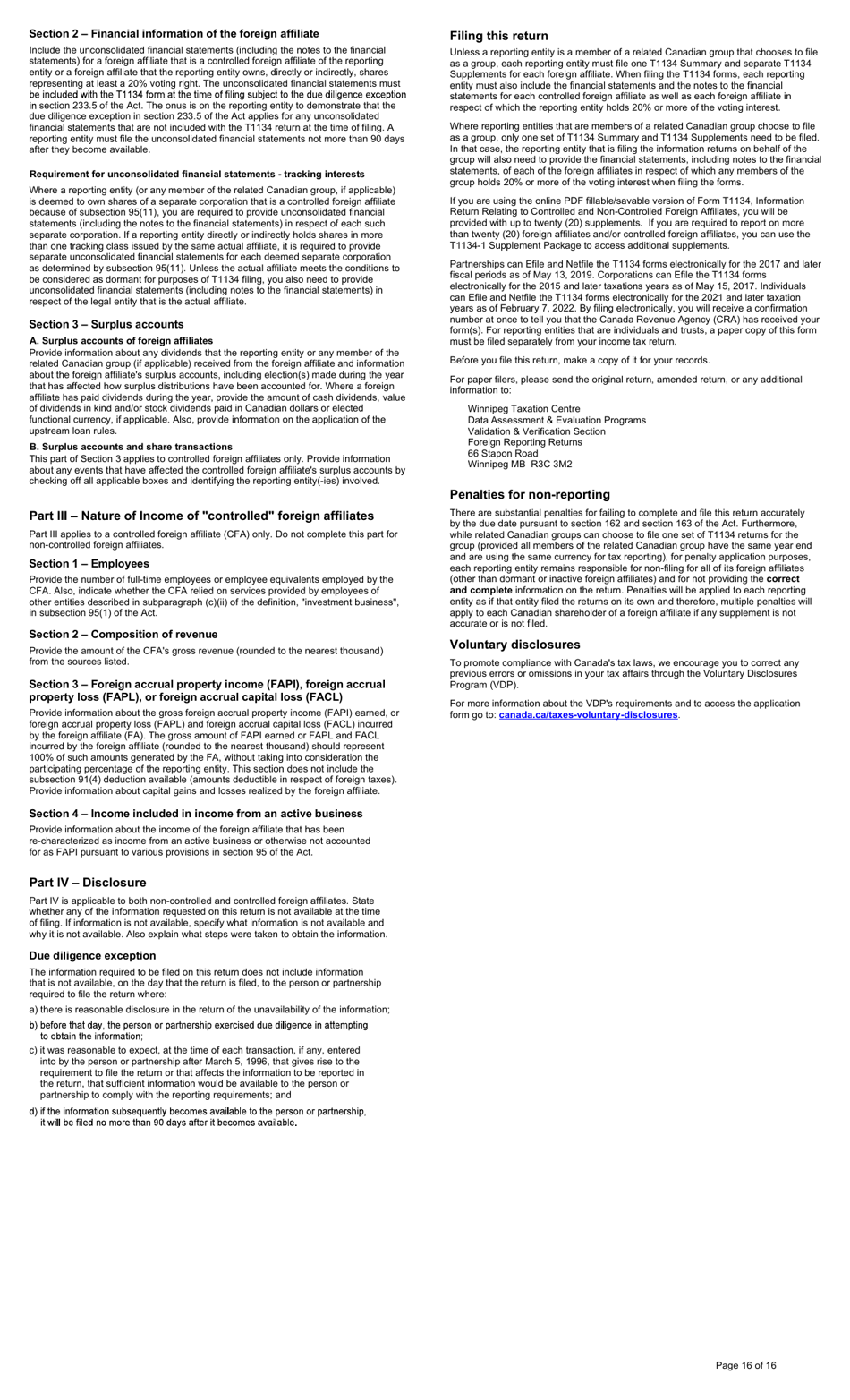

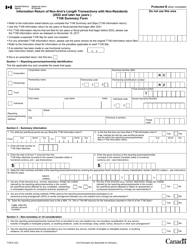

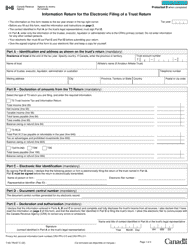

Form T1134 Information Return Relating to Controlled and Non-controlled Foreign Affiliates is used by Canadian residents or corporations to report information about their foreign affiliates. It provides details about these affiliates, such as their ownership, income, and activities. This form helps the Canadian government ensure compliance with tax laws and prevent tax evasion.

The Form T1134 Information Return is filed by Canadian resident taxpayers who have controlled or non-controlled foreign affiliates.

Form T1134 Information Return Relating to Controlled and Non-controlled Foreign Affiliates (2021 and Later Taxation Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1134?

A: Form T1134 is an information return that needs to be filed by Canadian taxpayers who have controlled or non-controlled foreign affiliates.

Q: Who needs to file Form T1134?

A: Canadian taxpayers who have controlled or non-controlled foreign affiliates need to file Form T1134.

Q: What is the purpose of Form T1134?

A: The purpose of Form T1134 is to provide information about the taxpayer's controlled and non-controlled foreign affiliates.

Q: When is Form T1134 due?

A: Form T1134 is generally due on or before the taxpayer's filing due date for the taxation year.

Q: What information is required to be reported on Form T1134?

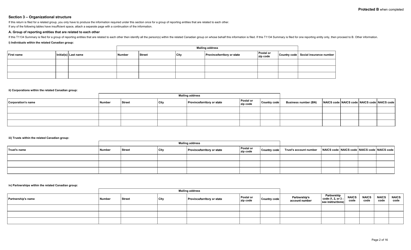

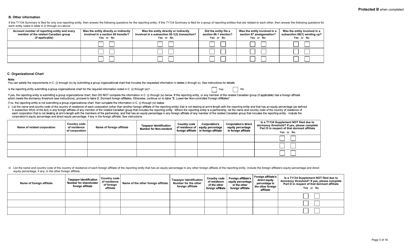

A: Form T1134 requires the taxpayer to report information about their foreign affiliates, such as their name, address, business activities, and financial information.

Q: What are controlled foreign affiliates?

A: Controlled foreign affiliates are foreign corporations or entities in which the taxpayer has a significant level of control, typically through ownership or voting rights.

Q: What are non-controlled foreign affiliates?

A: Non-controlled foreign affiliates are foreign corporations or entities in which the taxpayer does not have a significant level of control.

Q: Are there any penalties for not filing Form T1134?

A: Yes, there are penalties for not filing Form T1134 or for providing false or misleading information on the form. The penalties can be substantial.

Q: Are there any exceptions or exemptions for filing Form T1134?

A: Yes, there are certain exceptions and exemptions for filing Form T1134. It is recommended to consult the CRA or a tax professional for specific guidance.