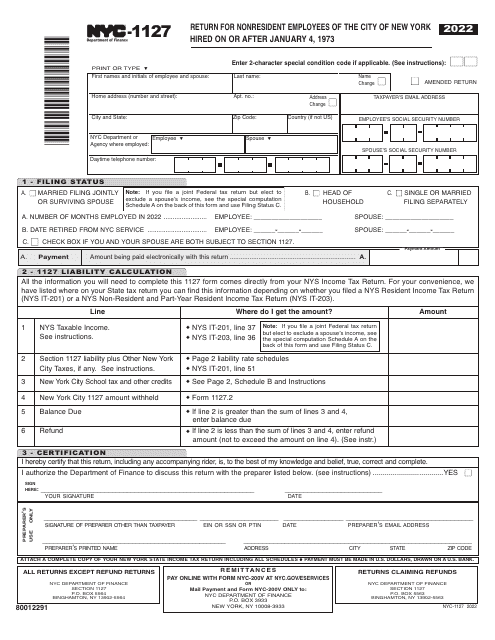

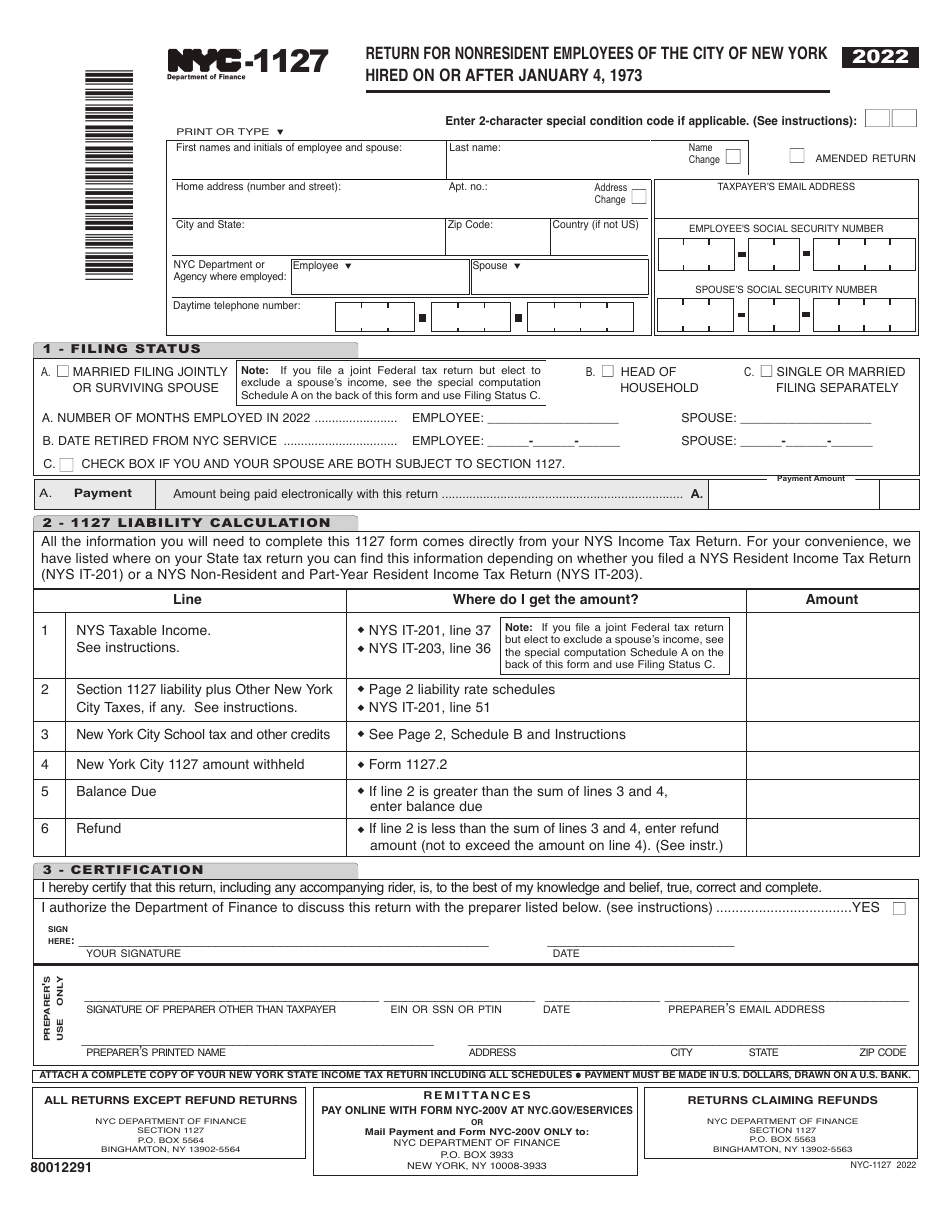

Form NYC-1127 Return for Nonresident Employees of the City of New York Hired on or After January 4, 1973 - New York City

What Is NYC-1127?

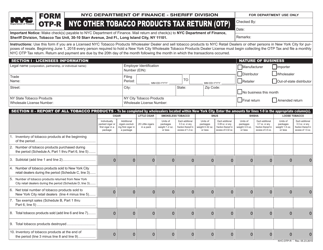

Form NYC-1127, Return for Nonresident Employees of the City of New York , is a personal income tax form that must be completed for New York City employees who reside outside of the 5 boroughs as if they resided in New York City and were hired on or after January 4th, 1973.

Those who are considered as New York City employees that are employed by agencies such as the FDNY, NYPD, Department of Sanitation, Department of Finance, etc. This form must be completed if you worked within the City of New York during the year. You should also have received a 1127.2 Tax Statement from your employer during the tax season (the statement is a part of your W-2), which will be used to complete the NYC-1127 Form.

This form is issued by the New York City Department of Finance and was last updated in 2022 . An NYC-1127 fillable form is available for download below.

Form NYC-1127 Instructions

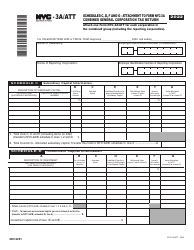

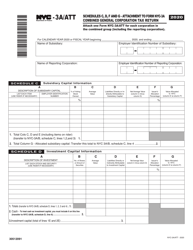

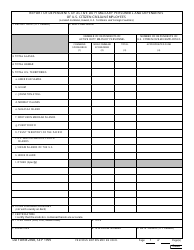

The NYC-1127 Form contains six sections that will need to be completed.

- The first section will ask for the name(s) of the employee and spouse, home address, Agency or NYC Department that the filer is employed by (as well as spouse's, if applicable), phone number, email address, and the employee's and spouse's social security numbers.

- The second section will ask for the filing status (married filing jointly or surviving spouse, head of household, or single or married filing separately). It will also ask for the number of months the filer and spouse was/were employed in 2019 and the date the filer retired from NYC service (if applicable). There is also a box to check if both the filer and spouse are subject to Section 1127. Finally, the last portion of this section has the filer list the amount that will be paid with this return.

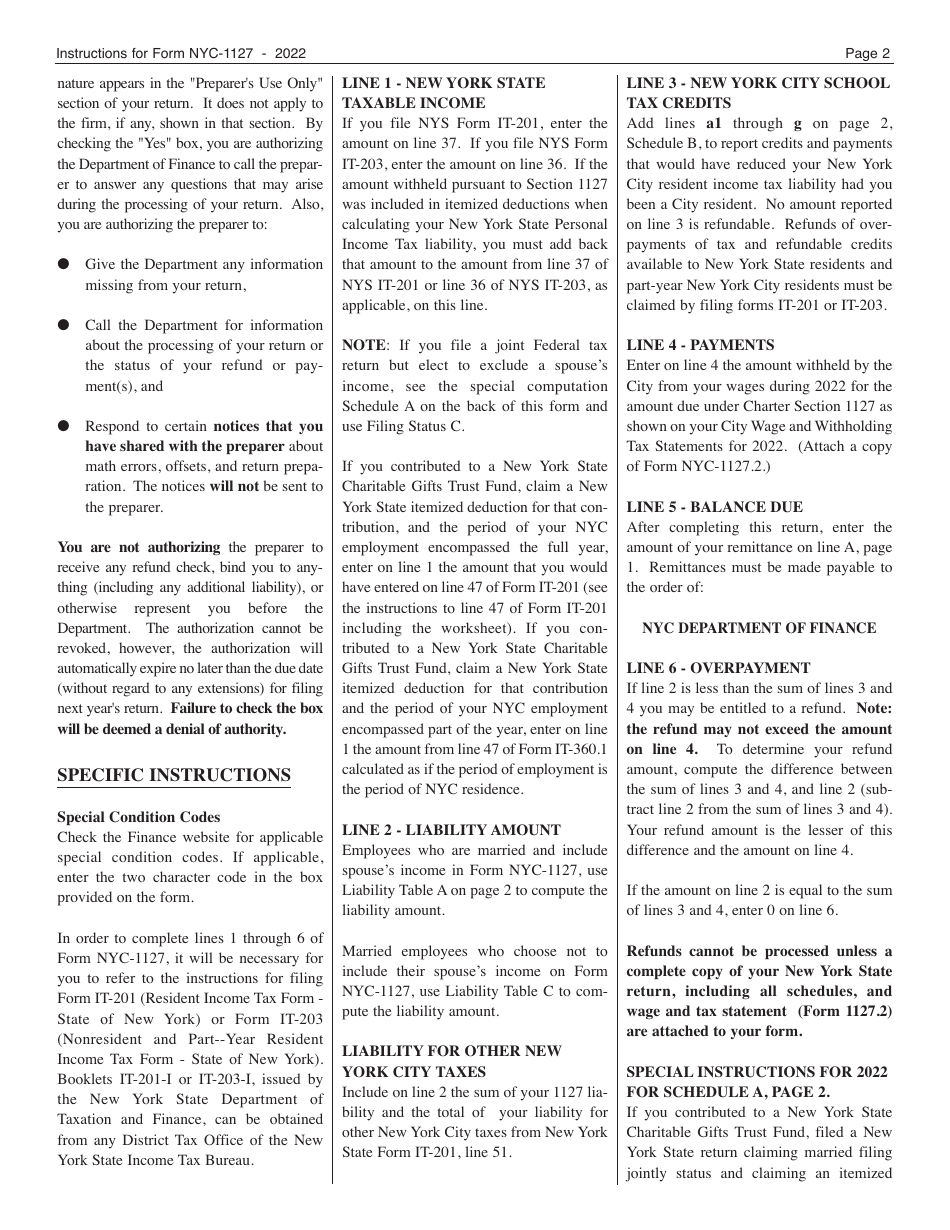

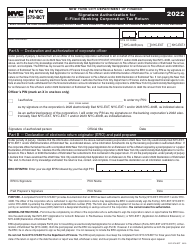

- The third section is the liability calculation and this information can be gathered from your NYS Income Tax Return. There are six lines within this section that you will need to complete based on income tax return information, including additional taxes, credits, withholdings, balance due, and refund. Each line also contains instructions for where to find the correct amounts listed on the NYS Income Tax Return. You will need to attach a complete copy of your NYS Income Tax Return with all schedules completed.

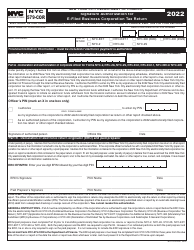

- The fourth section is a certification of the information and will require the filer's signature as well as the signature of any preparer's.

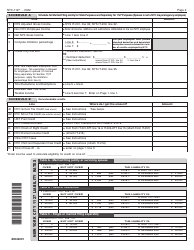

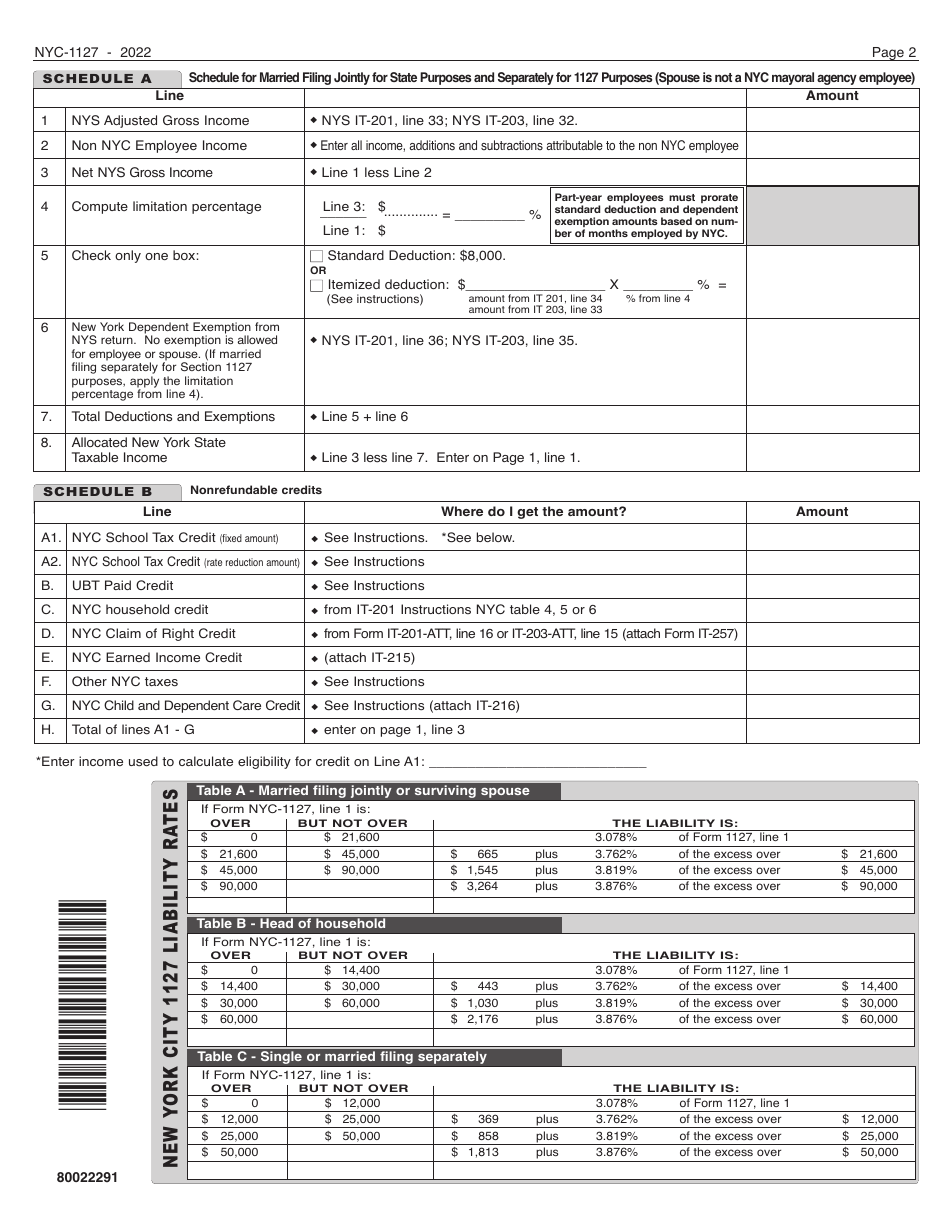

- The fifth is for married filing jointly income information (in cases where the spouse is not an NYC mayoral agency employee).

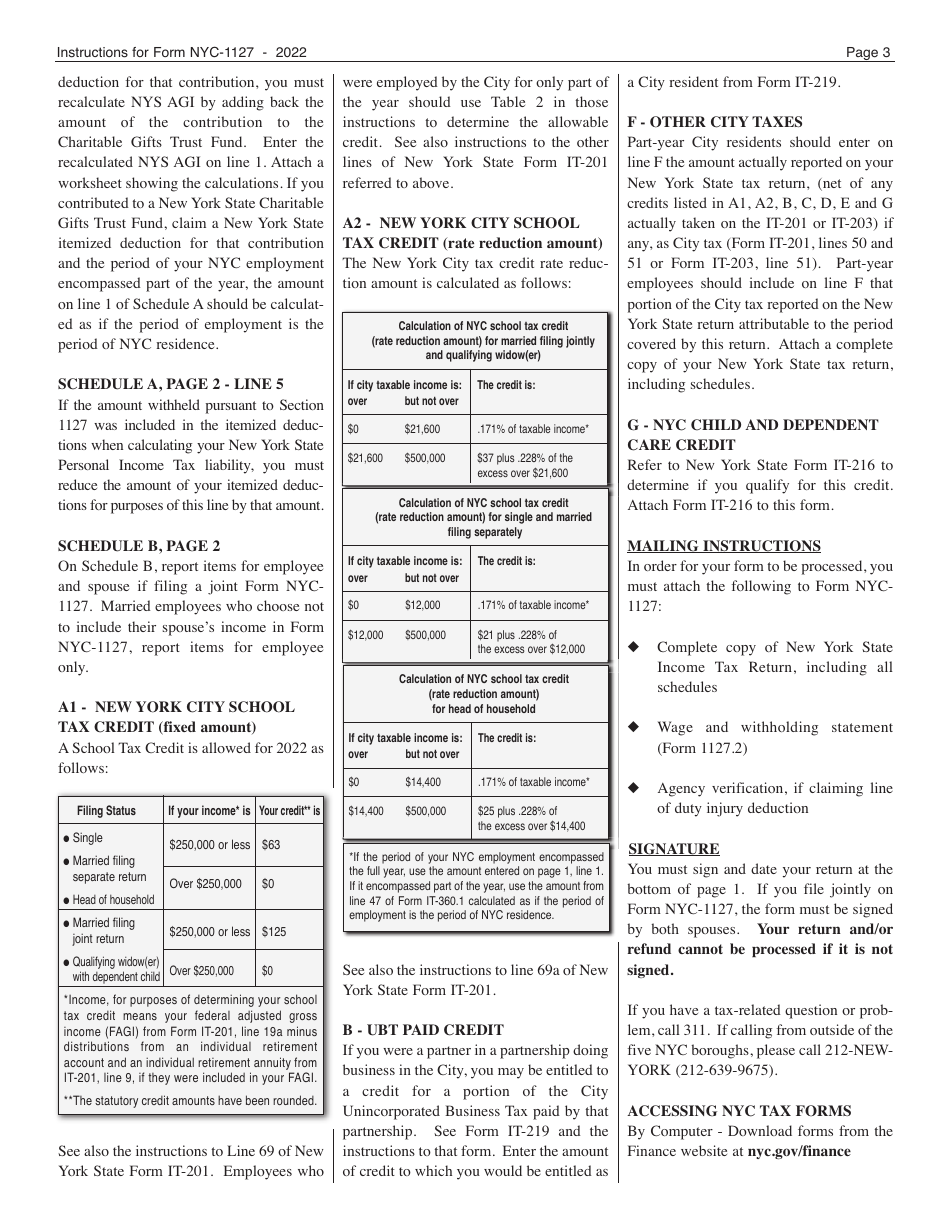

- The sixth schedule is for listing non-refundable credits.

How to File NYC-1127?

Completed NYC-1127 Forms must be sent in with the 1127.2 Tax Statement on or before May 15, 2020, and may be mailed with payment or filed online at nyc.gov/eservices. The form must be completed online since there are several drop-down menus in the sections.

If you are claiming a refund from this form, you will need to send the form to a separate address from the address for forms that require payment. To check the NYC-1127 refund status you can call 311 if you live within the five boroughs, or 212-NEW-YORK if you reside outside of the five boroughs.