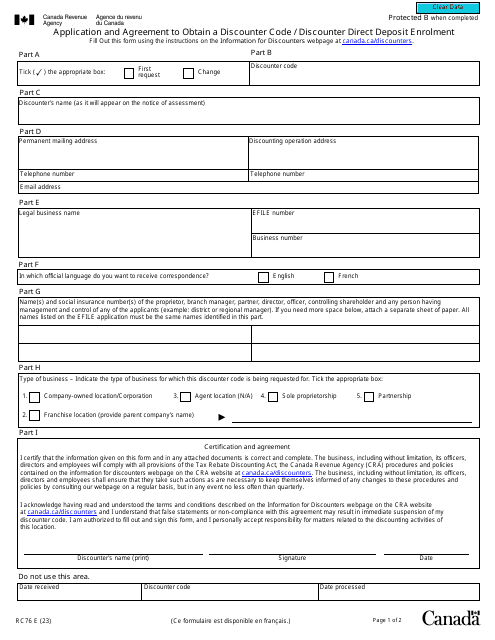

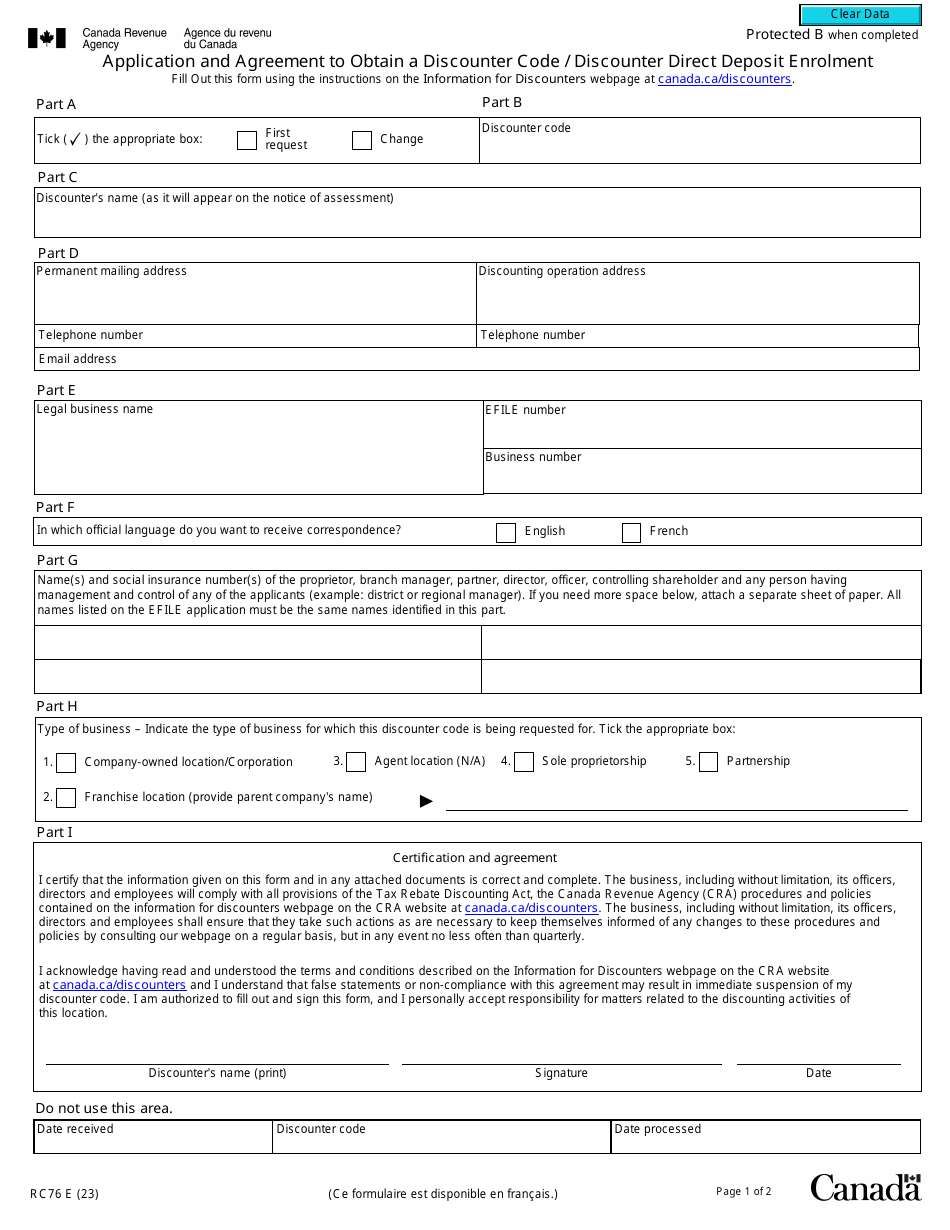

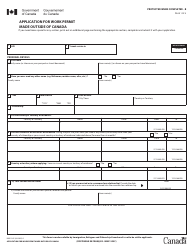

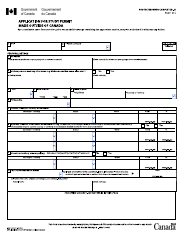

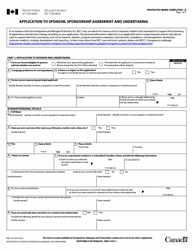

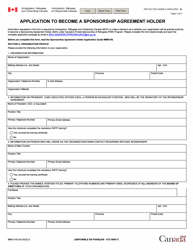

Form RC76 Application and Agreement to Obtain a Discounter Code / Discounter Direct Deposit Enrolment - Canada

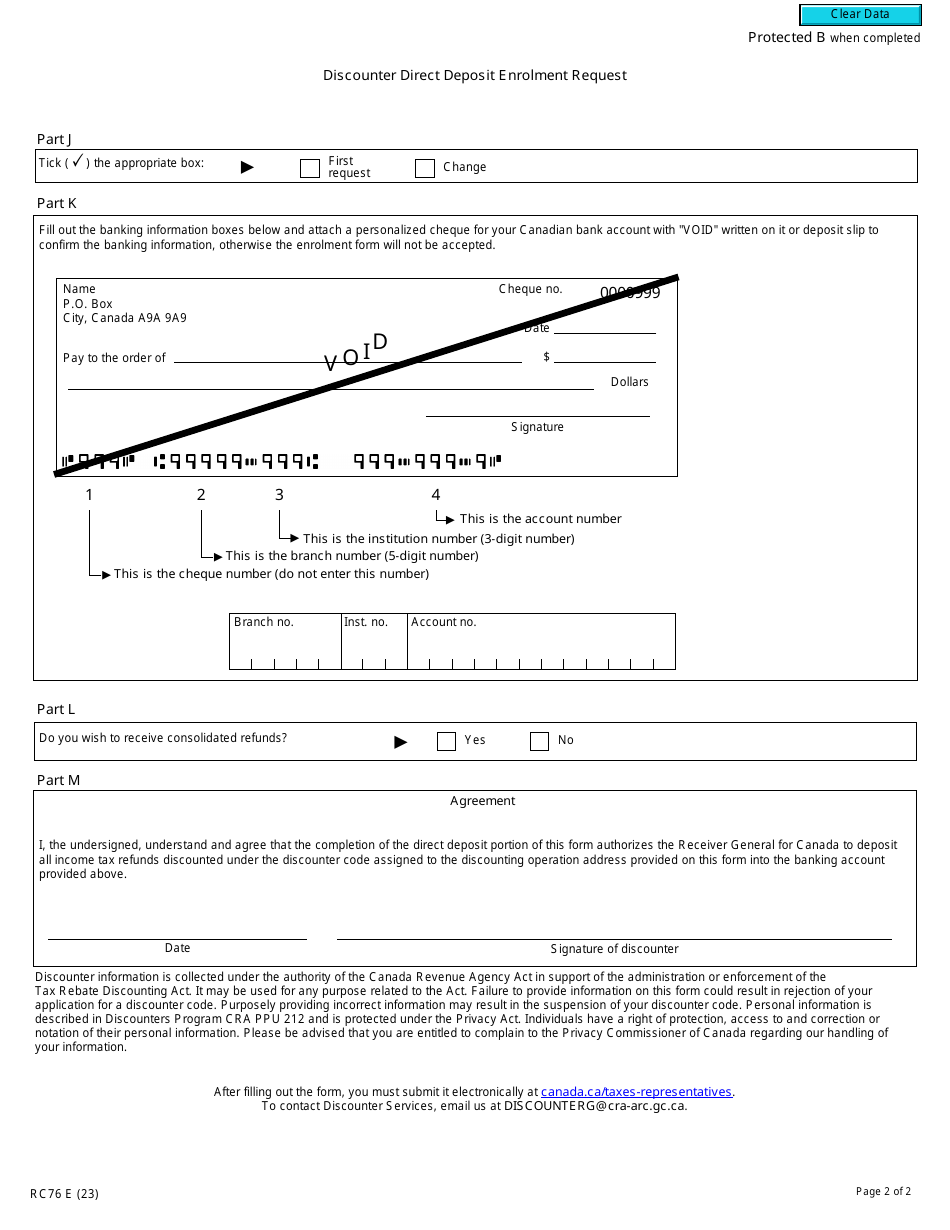

Form RC76 Application and Agreement to Obtain a Discounter Code/Discounter Direct Deposit Enrolment - Canada is used for businesses that want to apply for a discounter code or enrol in the Discounter Direct Deposit program. It allows businesses to receive direct deposits from the Government of Canada electronically for certain tax transactions.

The Form RC76 Application and Agreement to Obtain a Discounter Code/Discounter Direct Deposit Enrolment is filed by businesses in Canada who wish to enroll as a discounter and receive payments through direct deposit.

Form RC76 Application and Agreement to Obtain a Discounter Code/Discounter Direct Deposit Enrolment - Canada - Frequently Asked Questions (FAQ)

Q: What is the Form RC76?

A: Form RC76 is an application and agreement form used to obtain a Discounter Code or enroll in Discounter Direct Deposit in Canada.

Q: What is a Discounter Code?

A: A Discounter Code is a unique identifier used by businesses to report and remit sales tax to the Canada Revenue Agency (CRA).

Q: What is Discounter Direct Deposit?

A: Discounter Direct Deposit is a method of electronically depositing sales tax refunds into a business's bank account.

Q: Who should use Form RC76?

A: Form RC76 should be used by businesses in Canada who wish to obtain a Discounter Code or enroll in Discounter Direct Deposit.

Q: Are there any fees associated with Form RC76?

A: No, there are no fees associated with Form RC76.

Q: What information is required on Form RC76?

A: The form requires information such as business name, business number, contact information, banking details, and signature of the business owner or authorized person.