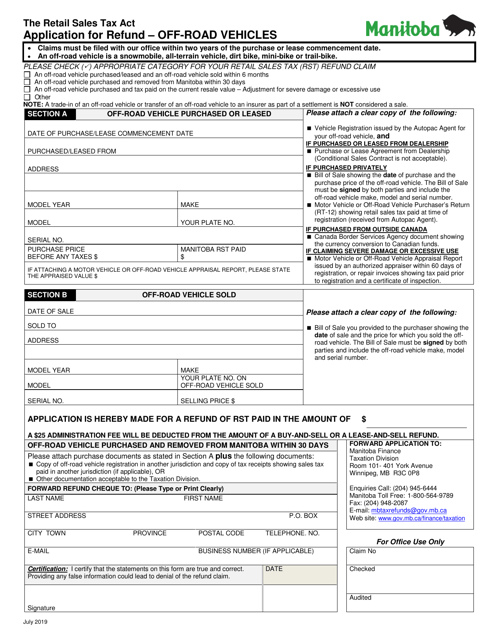

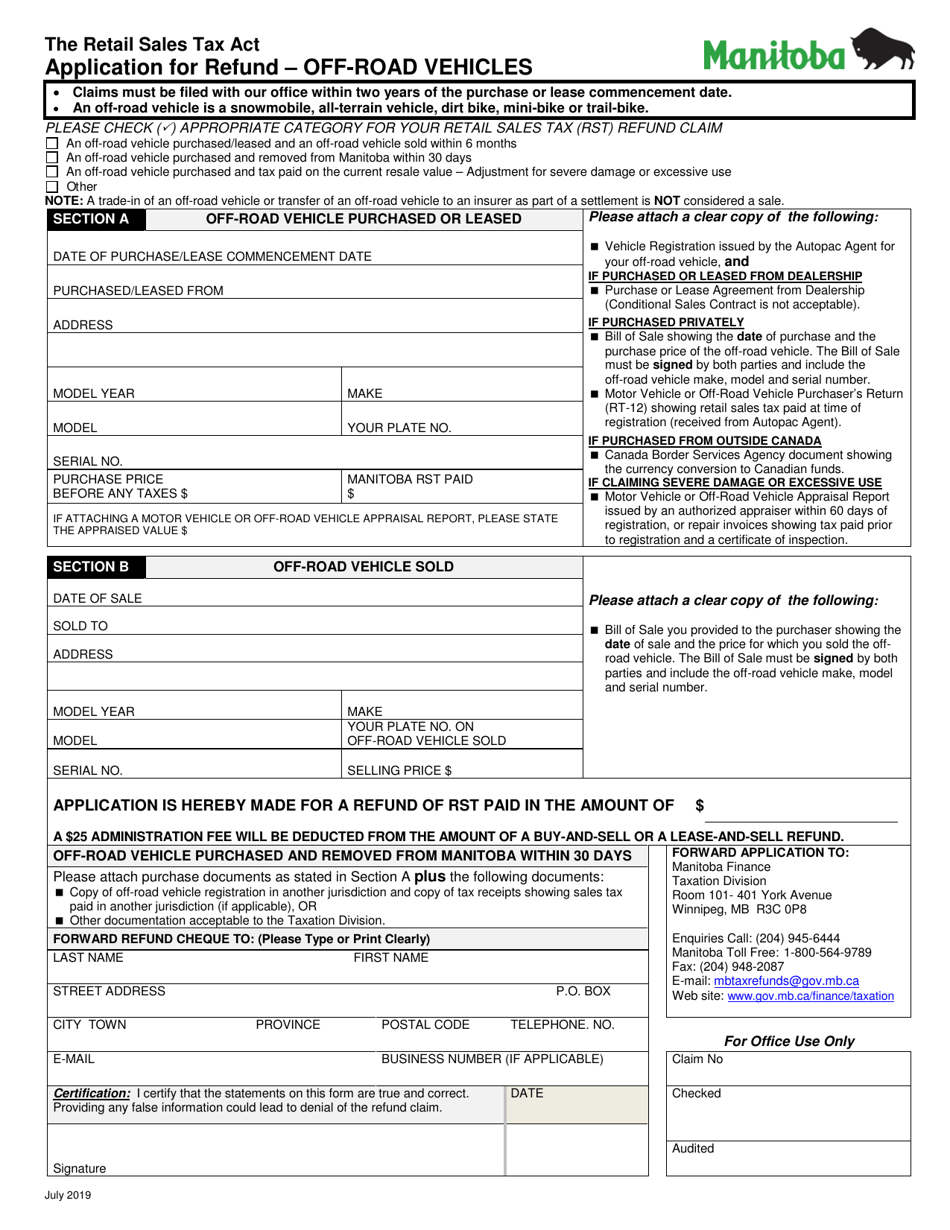

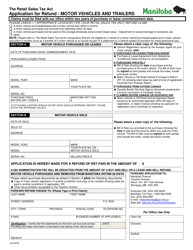

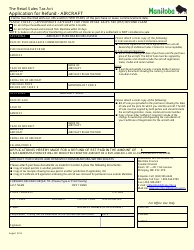

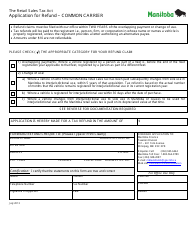

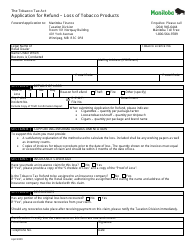

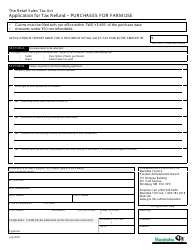

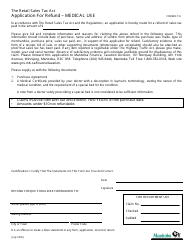

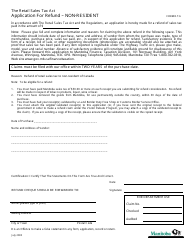

Application for Refund - off-Road Vehicles - Manitoba, Canada

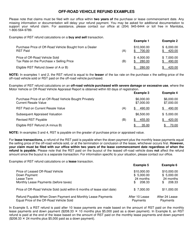

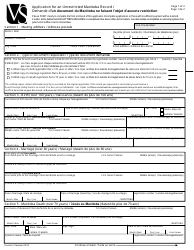

The Application for Refund for off-road vehicles in Manitoba, Canada is used to request a refund of the provincial sales tax (PST) paid on the purchase of off-road vehicles. The application is for individuals who purchased an eligible off-road vehicle for use exclusively off-road and want to claim a refund on the PST portion of the purchase price.

The application for refund for off-road vehicles in Manitoba, Canada is typically filed by the vehicle owner.

Application for Refund - off-Road Vehicles - Manitoba, Canada - Frequently Asked Questions (FAQ)

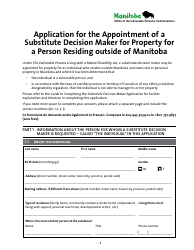

Q: Who is eligible for a refund for off-road vehicles in Manitoba?

A: Owners of off-road vehicles who meet certain criteria are eligible for a refund in Manitoba.

Q: What is the refund for off-road vehicles in Manitoba?

A: The refund is equal to 80% of the sales tax paid at the time of purchase.

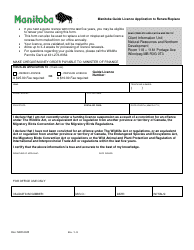

Q: How can I apply for a refund for my off-road vehicle in Manitoba?

A: You can apply for a refund by completing the Application for Refund - Off-Road Vehicle form and submitting it to the Manitoba Tax Assistance Office.

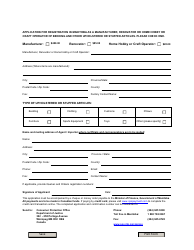

Q: What documents do I need to include with my refund application for off-road vehicles in Manitoba?

A: You need to include proof of payment of the sales tax, such as a receipt or bill of sale, along with your application.

Q: Is there a deadline for applying for a refund for off-road vehicles in Manitoba?

A: Yes, you must apply for a refund within two years of the date of purchase.