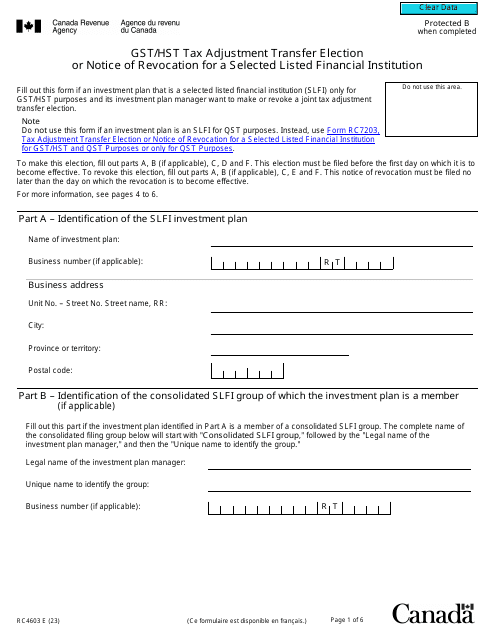

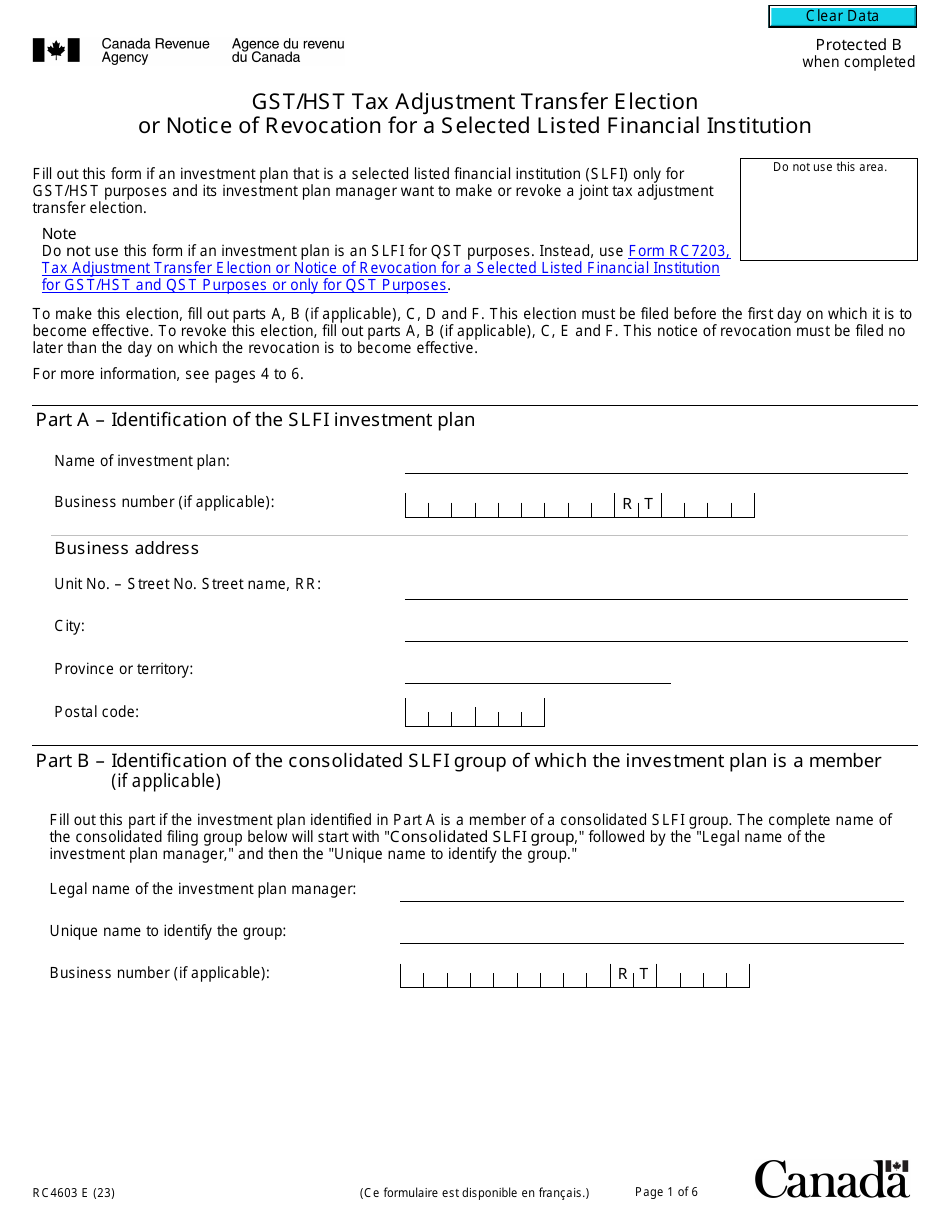

Form RC4603 Gst / Hst Tax Adjustment Transfer Election or Notice of Revocation for a Selected Listed Financial Institution - Canada

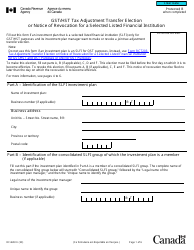

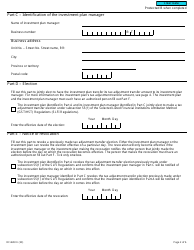

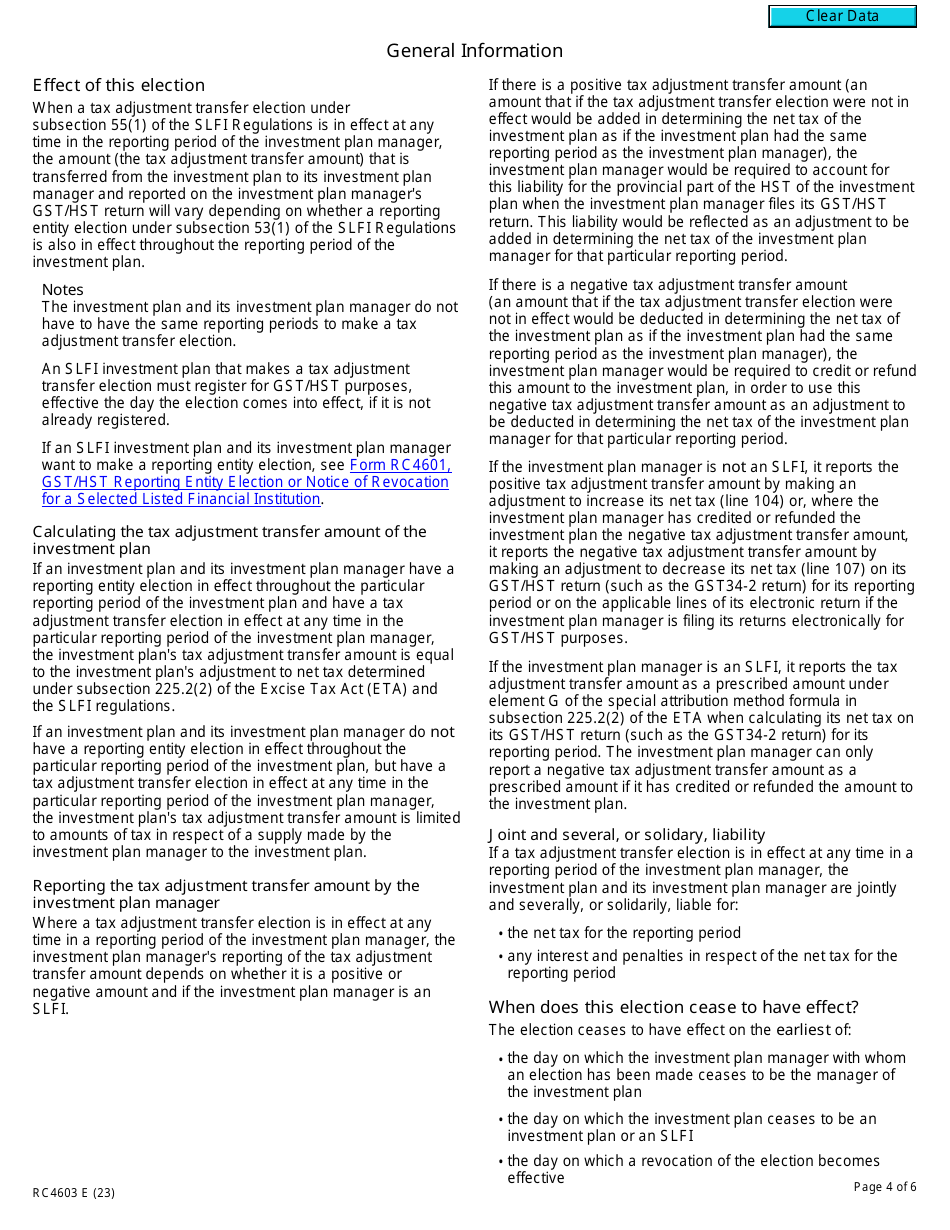

Form RC4603 GST/HST Tax Adjustment Transfer Election or Notice of Revocation for a Selected Listed Financial Institution in Canada is used by financial institutions to elect or revoke their participation in the GST/HST Tax Adjustment Transfer System. This system allows certain financial institutions to transfer unused GST/HST credits or rebates to other financial institutions.

The selected listed financial institution files the Form RC4603 Gst/Hst Tax Adjustment Transfer Election or Notice of Revocation in Canada.

Form RC4603 Gst/Hst Tax Adjustment Transfer Election or Notice of Revocation for a Selected Listed Financial Institution - Canada - Frequently Asked Questions (FAQ)

Q: What is the RC4603 form?

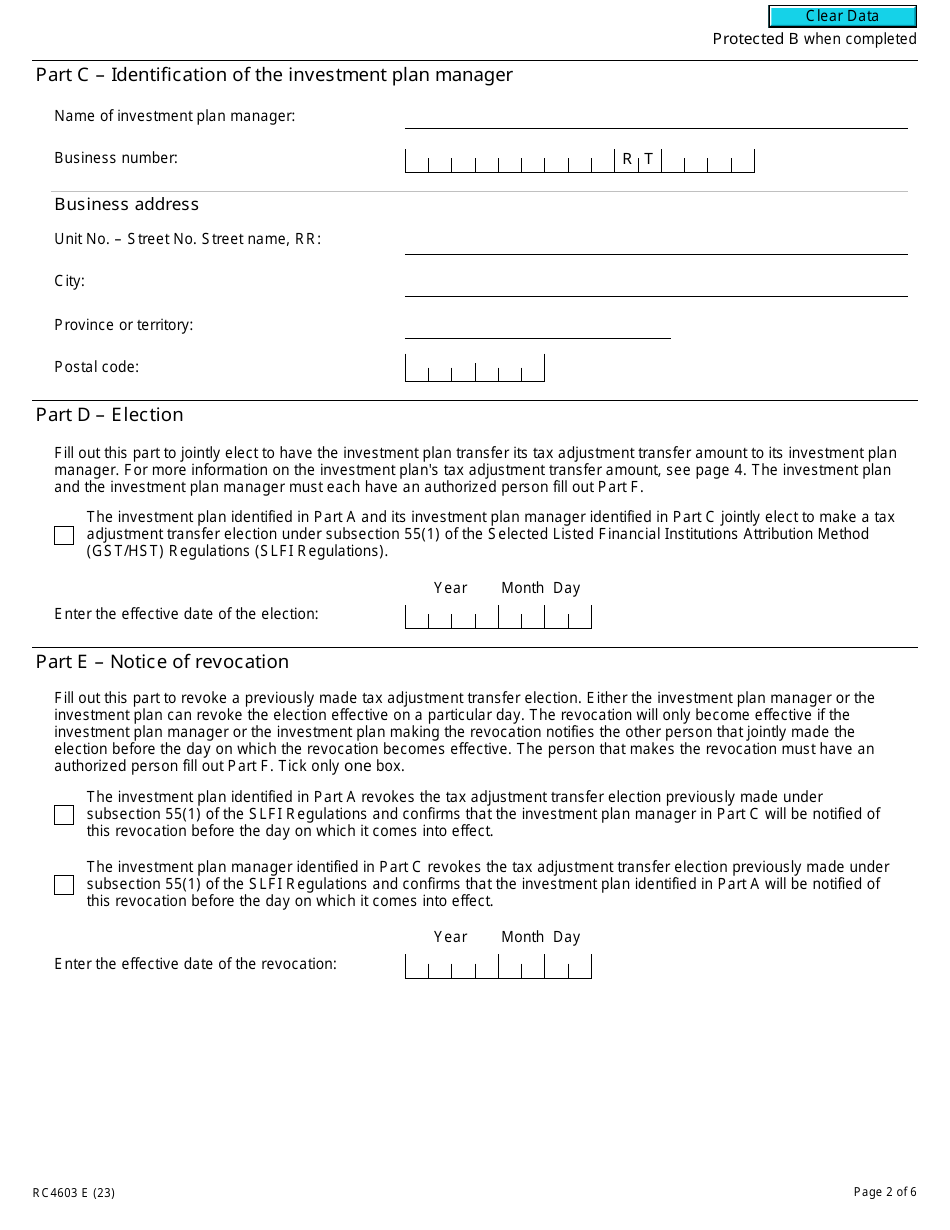

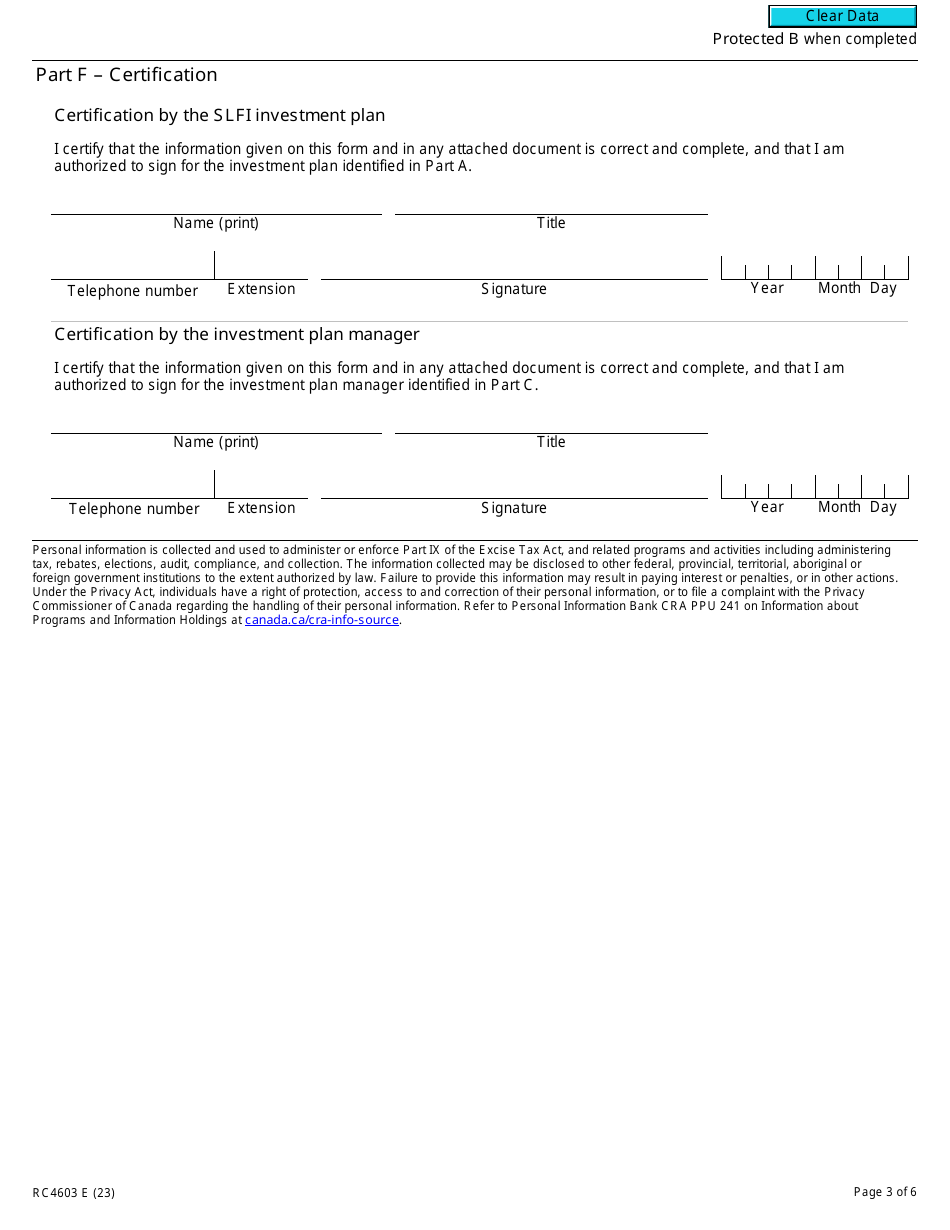

A: The RC4603 form is used to make an election or notice of revocation for a Selected Listed Financial Institution (SLFI) regarding the transfer of GST/HST tax adjustments.

Q: Who needs to file the RC4603 form?

A: SLFIs in Canada who want to make an election or revoke a previously made election for the transfer of GST/HST tax adjustments should file the RC4603 form.

Q: What are GST/HST tax adjustments?

A: GST/HST tax adjustments refer to the adjustments made to the amount of GST/HST that was claimed as an input tax credit, in order to reflect any changes in the inputs used in making taxable supplies.

Q: Why would a Selected Listed Financial Institution make an election or revoke a previous election?

A: SLFIs may make an election or revoke a previous election to transfer GST/HST tax adjustments to another entity within the group or organization, which can help optimize the allocation of these adjustments.

Q: When is the deadline to file the RC4603 form?

A: The deadline to file the RC4603 form depends on various factors, such as the type of election being made or revoked. It is important to consult the CRA guidelines or a tax professional for specific deadlines.