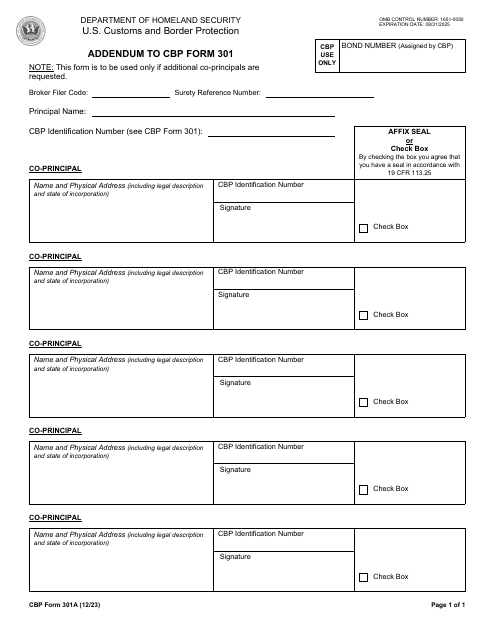

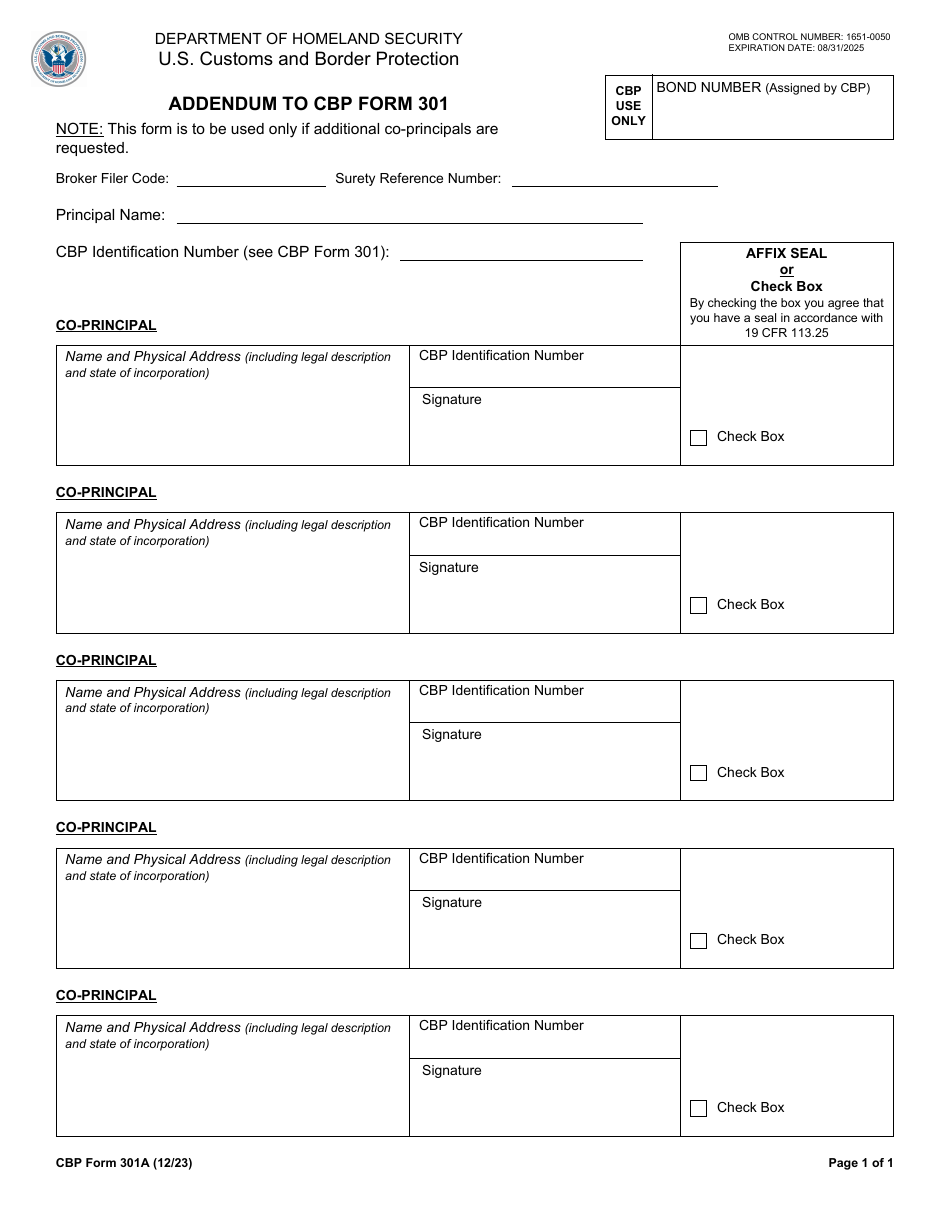

CBP Form 301A Addendum to CBP Form 301

What Is CBP Form 301A?

CBP Form 301A, Addendum to Form 301 , is a form used to provide the Customs and Border Protection (CBP) with information about additional co-principals. This document is an extension of CBP Form 301, Customs Bond, and cannot be submitted separately.

The latest version of the "Customs Bond" CBP Form 301A was issued on December 1, 2023 . At present, the Office of Management and Budget date indicated on the form is expired. However, the document is still valid and can be used. Download a fillable version of the CBP 301A Form through the link below.

The CBP 301 is filled out in order to provide the CBP with a guarantee of payments of taxes, duties, or charges. The CBP wants to make sure that the principals (importers) and sureties (insurance companies) will comply with their laws and regulations. If there are more than two co-principals, the CBP Form 301A must be submitted. The companies that can be registered as co-principals on CBP customs bonds must be related. What is more, they must be of the same business type. At the same time, they are separate legal entities with different tax ID numbers. A customs broker is required to have a separate Power of Attorney for each co-principal.

CBP Form 301A Instructions

Use CBP Form 301A only if additional co-principals are requested. Fill out the form as follows:

- Both the "Broker Filer Code" and "Surety Reference Number" must be the same as indicated on the top of the CBP 301.

- The "CBP Identification Number" must coincide with the number entered in Section II of the CBP 301.

- List up to five co-principals.

- Provide the full legal name of the co-principal including legal description, e.g., partnership, corporation, or individual. The CBP allows using certain abbreviations because the number of characters per box is limited. Indicate the physical address of the co-principals. Do not enter a P.O. Box in this part.

- Provide the identification number filed according to 19 CFR 24.5. If you use the Internal Revenue Service Employer Identification Number, make sure to enter both the two-digit suffix code and an eleven-digit number. Each co-principal will have a separate CBP identification number.

- Provide the signature, name, and title of the authorized individual. If the bond is by the Attorney in Fact, this box must contain the company name of the Attorney in Fact, too. All information you provide must stay within the box margins.

- If the law of the state requires a seal, check the box on the right side of the "Signature" box. It will indicate that your seal is either affixed or electronically submitted to the CBP. If you leave the box unchecked, you acknowledge that no seal is required under the law of the state.