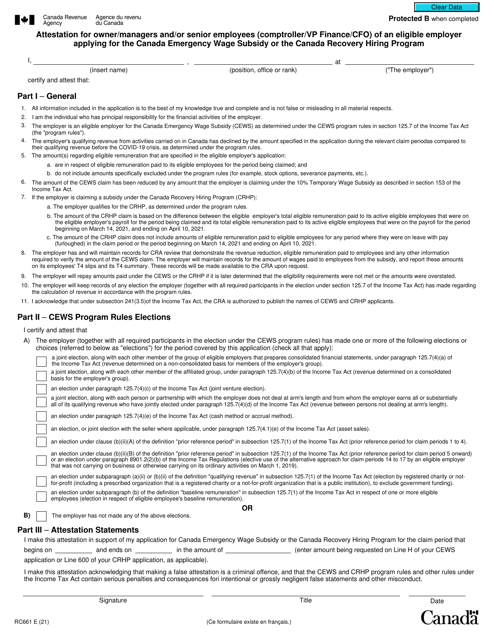

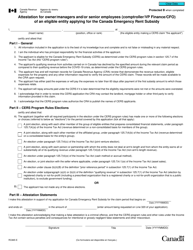

Form RC661 Attestation for Owner / Managers and / or Senior Employees (Comptroller / Vp Finance / Cfo) of an Eligible Employer Applying for the Canada Emergency Wage Subsidy or the Canada Recovery Hiring Program - Canada

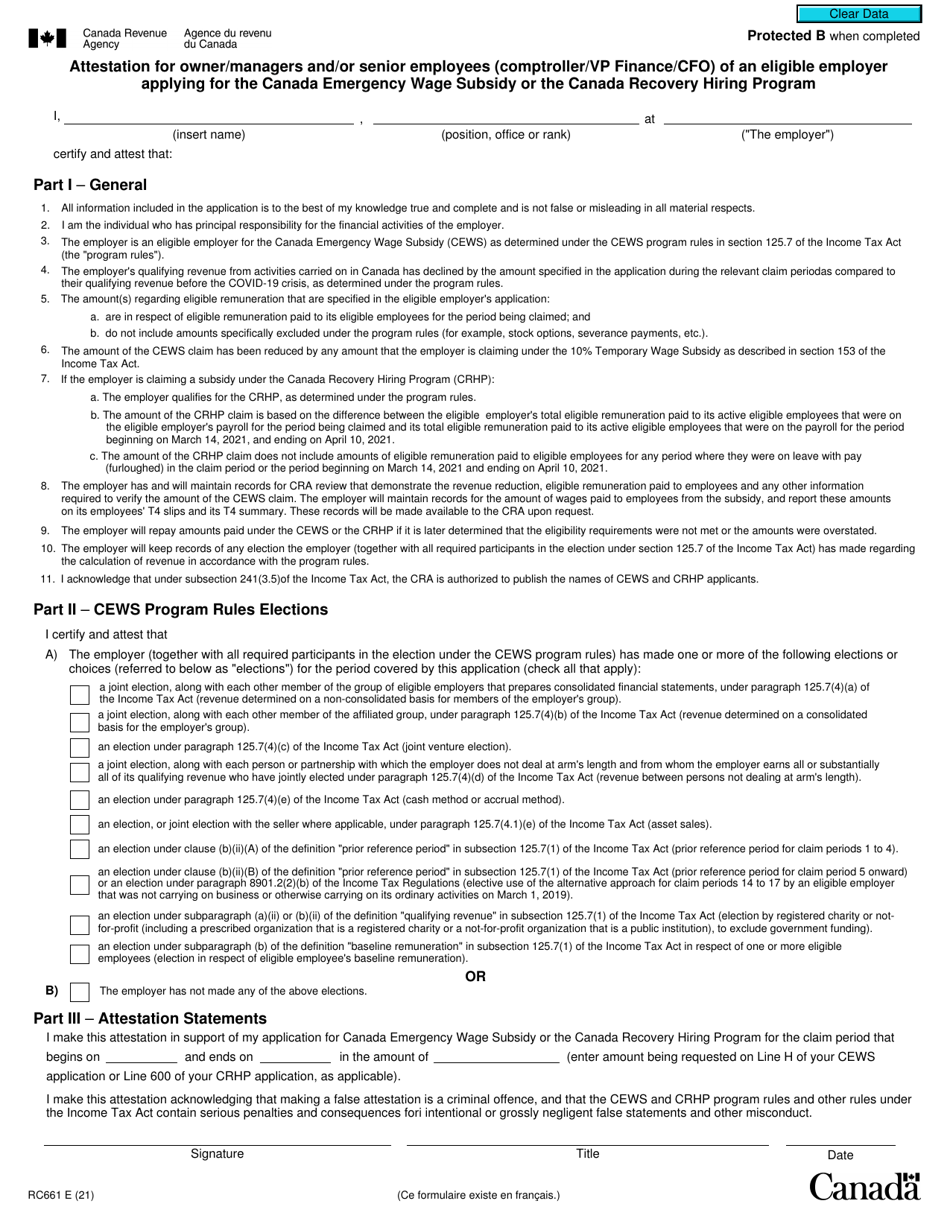

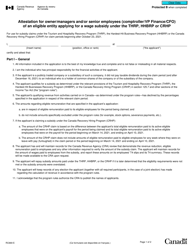

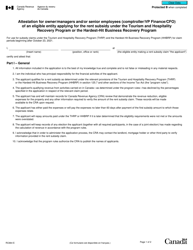

Form RC661 "Attestation for Owner/Managers and/or Senior Employees (Comptroller/VP Finance/CFO) of an Eligible Employer Applying for the Canada Emergency Wage Subsidy or the Canada Recovery Hiring Program" is a document used by eligible employers in Canada who are applying for either the Canada Emergency Wage Subsidy (CEWS) or the Canada Recovery Hiring Program. It is an attestation form that must be completed by the owner/managers and/or specified senior employees of the employer, confirming certain information about the application.

The employer files the Form RC661 Attestation for Owner/Managers and/or Senior Employees (Comptroller/VP Finance/CFO) of an Eligible Employer applying for the Canada Emergency Wage Subsidy or the Canada Recovery Hiring Program in Canada.

Form RC661 Attestation for Owner/Managers and/or Senior Employees (Comptroller/Vp Finance/Cfo) of an Eligible Employer Applying for the Canada Emergency Wage Subsidy or the Canada Recovery Hiring Program - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC661?

A: Form RC661 is an attestation form for owner/managers and/or senior employees of an eligible employer applying for the Canada Emergency Wage Subsidy or the Canada Recovery Hiring Program.

Q: Who needs to fill out Form RC661?

A: Owner/managers and/or senior employees such as Comptroller, VP Finance, or CFO of an eligible employer need to fill out Form RC661.

Q: What is the purpose of Form RC661?

A: The purpose of Form RC661 is to provide attestation from owner/managers and/or senior employees regarding the eligibility criteria for the Canada Emergency Wage Subsidy or the Canada Recovery Hiring Program.

Q: What information is required on Form RC661?

A: Form RC661 requires information such as the name of the employer, the position/role of the employee, the date of attestation, and confirmation of compliance with the eligibility criteria.

Q: Are there any penalties for providing false information on Form RC661?

A: Yes, providing false information on Form RC661 may result in penalties and legal consequences as per the applicable legislation.

Q: Do I need to submit any supporting documents with Form RC661?

A: In certain cases, the CRA may request supporting documents to verify the information provided on Form RC661. It is advisable to keep relevant records and documentation.

Q: How long do I need to keep a copy of Form RC661?

A: It is recommended to keep a copy of Form RC661 and any supporting documentation for a period of six years, as per the CRA's recordkeeping requirements.

Q: Who should I contact if I have questions about Form RC661?

A: If you have questions or need assistance with Form RC661, you can contact the Canada Revenue Agency (CRA) for guidance.