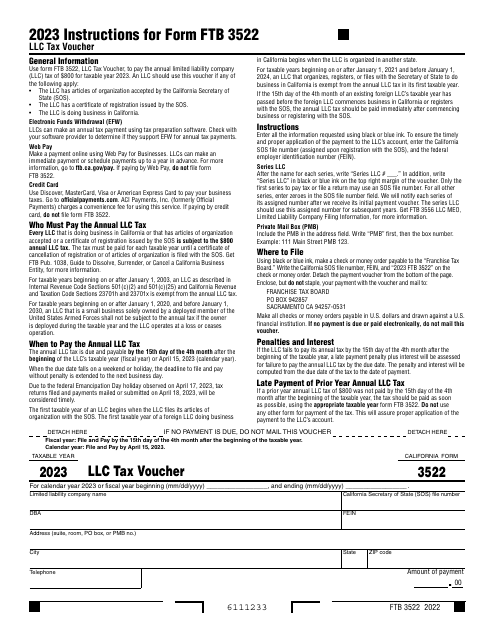

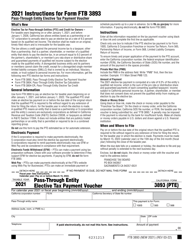

Form FTB3522 LLC Tax Voucher - California

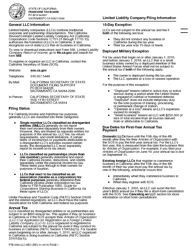

What Is FTB Form 3522?

FTB Form 3522, LLC Tax Voucher , is a legal document every California-based limited liability company (LLC) needs to submit to pay the annual LLC tax of $800. This form is a tax voucher - it details payment information you need to provide with your check or money order. Every new LLC has four months from the date of formation to pay the tax and is subject to this tax until a certificate of cancellation of registration is submitted to the California Secretary of State. You are required to use this form to stay compliant and in good standing if any of the following statements apply to your LLC:

- LLC is doing business in the State of California;

- LLC has a certificate of registration issued by the SOS;

- LLC has articles of organization accepted by the SOS.

This form was released by the California Franchise Tax Board (FTB) . The latest version of the form was issued on January 1, 2022 , with all previous editions obsolete. You can download a fillable FTB 3522 Form through the link below.

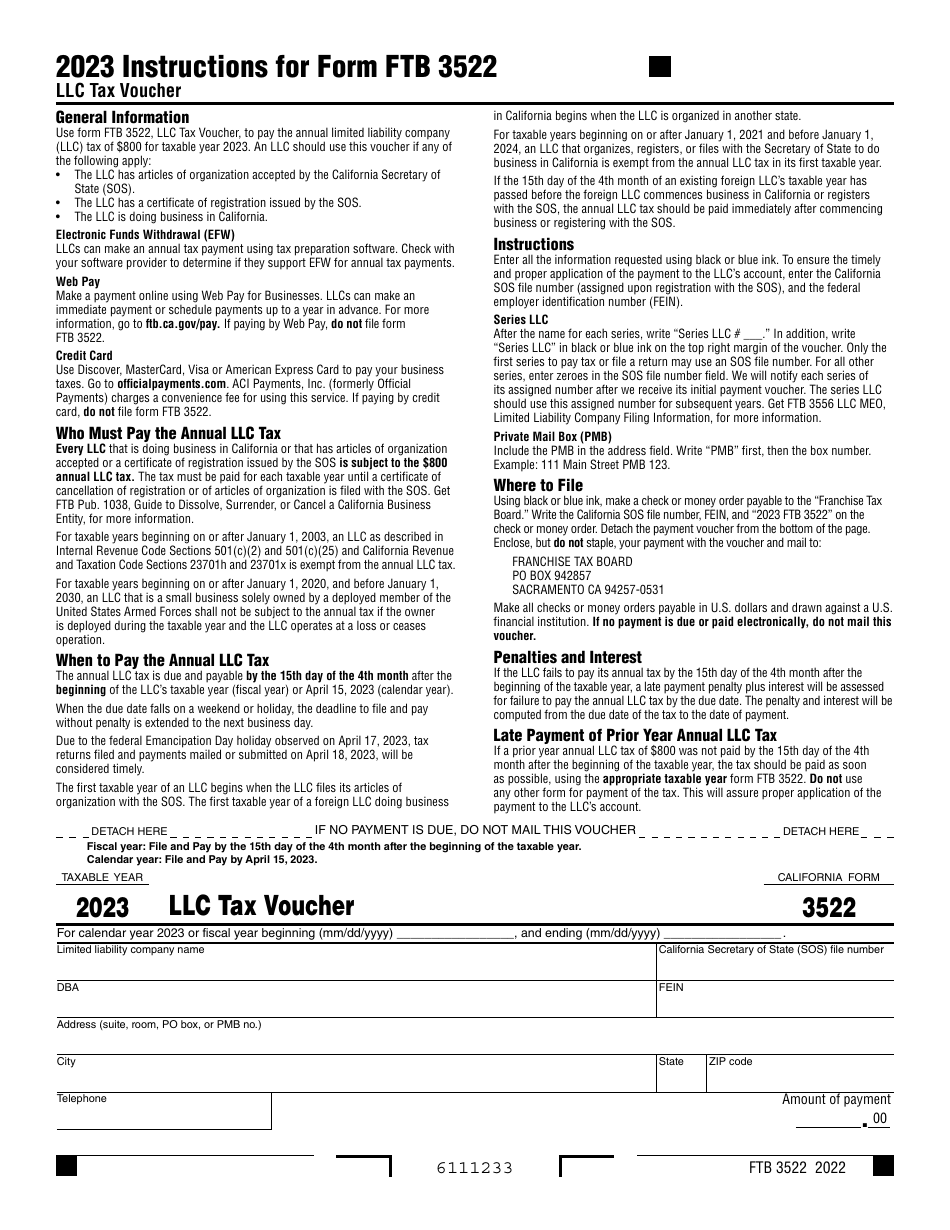

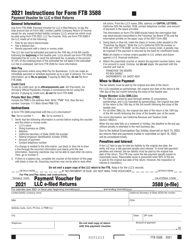

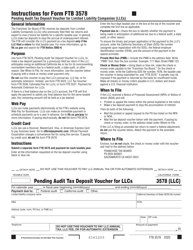

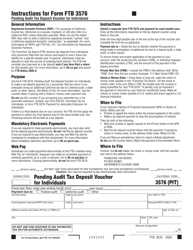

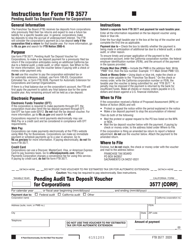

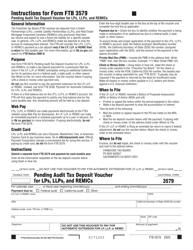

Instructions for Form FTB 3522

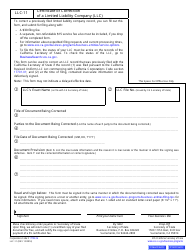

Provide the following details in the LLC Tax Voucher:

- Specify the taxable year you are paying the tax for.

- Name the limited liability company and add its DBA, or trade name.

- Indicate the SOS file number (assigned to the LLC upon registration with the SOS) and Federal Employer Identification Number (FEIN). It ensures the proper and timely application of the payment to the account belonging to the LLC.

- State the company address and telephone number.

- Record the amount of payment.

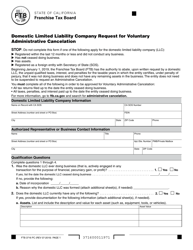

How to File FTB 3522?

Once you complete the form, detach the tax payment voucher from the bottom of the page. Make a check or money order payable to the FTB. Similarly to the IRS Form 1040-V, Payment Voucher, you are required to enclose a check or money order payable in U.S. dollars with the voucher. Note that you are not allowed to staple the documents - simply put them loose in the envelope.

The California Form FTB 3522 due date is the fifteenth day of the fourth month after the beginning of the fiscal year. For calendar year 2020, you must file the voucher and pay the tax by April 15, 2020. Failure to do so will entail a late payment penalty plus interest computed from the due date of the tax to the date of actual payment. However, if you need a six-month extension, beginning with the date of your company's original tax return filing, you may submit Form FTB 3537, Payment for Automatic Extension for LLCs.

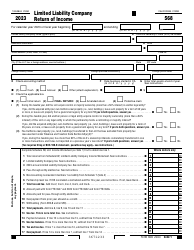

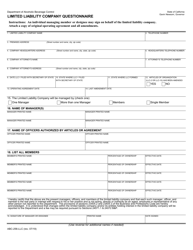

If the business has grossed $250,000 or more during the report year, you also need to file Form FTB 568, Limited Liability Company Return of Income. Additionally, Form FTB 3832, Limited Liability Company Nonresident Members' Consent is submitted if your company has members who are not residents of California.

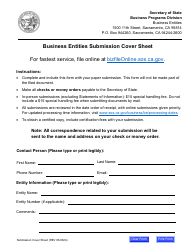

Where to File FTB 3522?

Mail the LLC Tax Voucher to the F ranchise Tax Board, PO Box 942857, Sacramento CA 94257-0531 . If you paid electronically or no payment is due, do not send the form to the FTB.