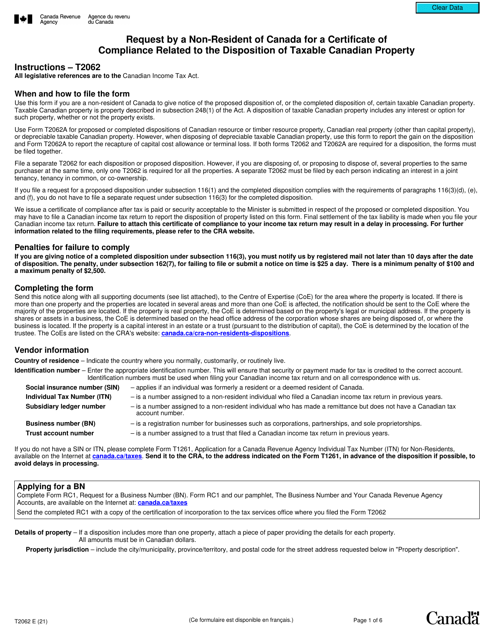

Form T2062 Request by a Non-resident of Canada for a Certificate of Compliance Related to the Disposition of Taxable Canadian Property - Canada

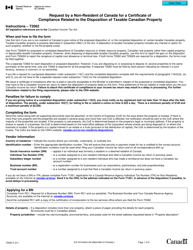

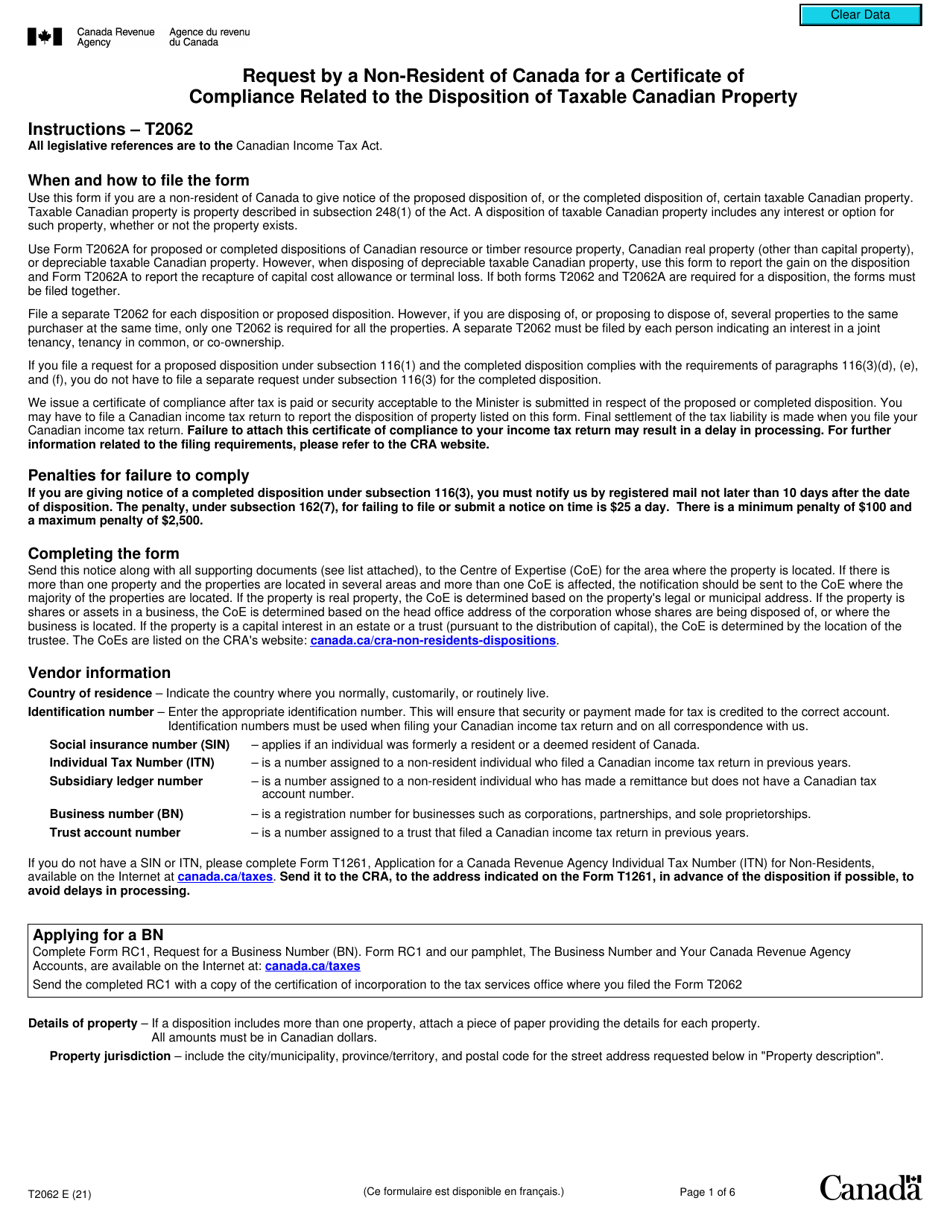

Form T2062 is used by non-residents of Canada to request a certificate of compliance related to the disposition of taxable Canadian property. This form is required by the Canadian tax authorities to ensure that the appropriate taxes have been paid or withheld on the sale or transfer of Canadian property by non-residents. It is designed to ensure that non-residents fulfill their tax obligations in Canada.

The non-resident of Canada files the Form T2062.

Form T2062 Request by a Non-resident of Canada for a Certificate of Compliance Related to the Disposition of Taxable Canadian Property - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2062?

A: Form T2062 is a form used by non-residents of Canada to request a Certificate of Compliance related to the disposition of taxable Canadian property.

Q: What is a Certificate of Compliance?

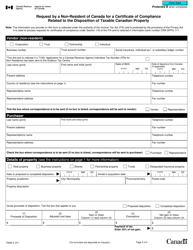

A: A Certificate of Compliance is a document issued by the Canada Revenue Agency (CRA) that confirms that a non-resident has complied with their tax obligations in relation to the disposition of taxable Canadian property.

Q: Who needs to file Form T2062?

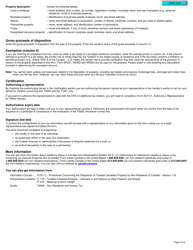

A: Non-residents of Canada who have disposed of taxable Canadian property need to file Form T2062 to request a Certificate of Compliance.

Q: What is taxable Canadian property?

A: Taxable Canadian property refers to certain types of property in Canada, such as real estate, shares of Canadian corporations, and certain business assets, that are subject to tax when sold or disposed of by non-residents.

Q: Why do non-residents need a Certificate of Compliance?

A: Non-residents need a Certificate of Compliance to confirm that they have met their tax obligations and to avoid being subjected to additional taxes or penalties.

Q: Are there any deadlines for filing Form T2062?

A: Yes, Form T2062 should be filed within 10 days after the disposition of the taxable Canadian property.

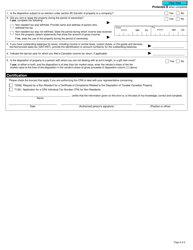

Q: What information is required on Form T2062?

A: Form T2062 requires information about the property being disposed of, the purchase date and cost, the proceeds of disposition, and the non-resident's tax identification number.

Q: What happens after filing Form T2062?

A: After filing Form T2062, the CRA will review the information and issue a Certificate of Compliance if the non-resident is deemed to have complied with their tax obligations.

Q: Can a non-resident sell taxable Canadian property without a Certificate of Compliance?

A: No, a non-resident should not sell taxable Canadian property without first obtaining a Certificate of Compliance from the CRA.