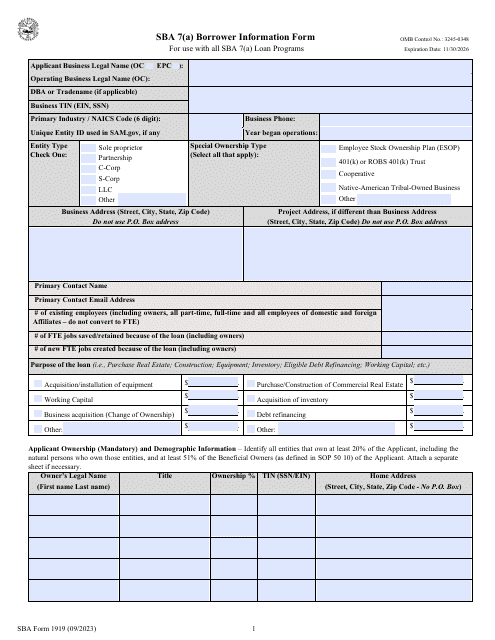

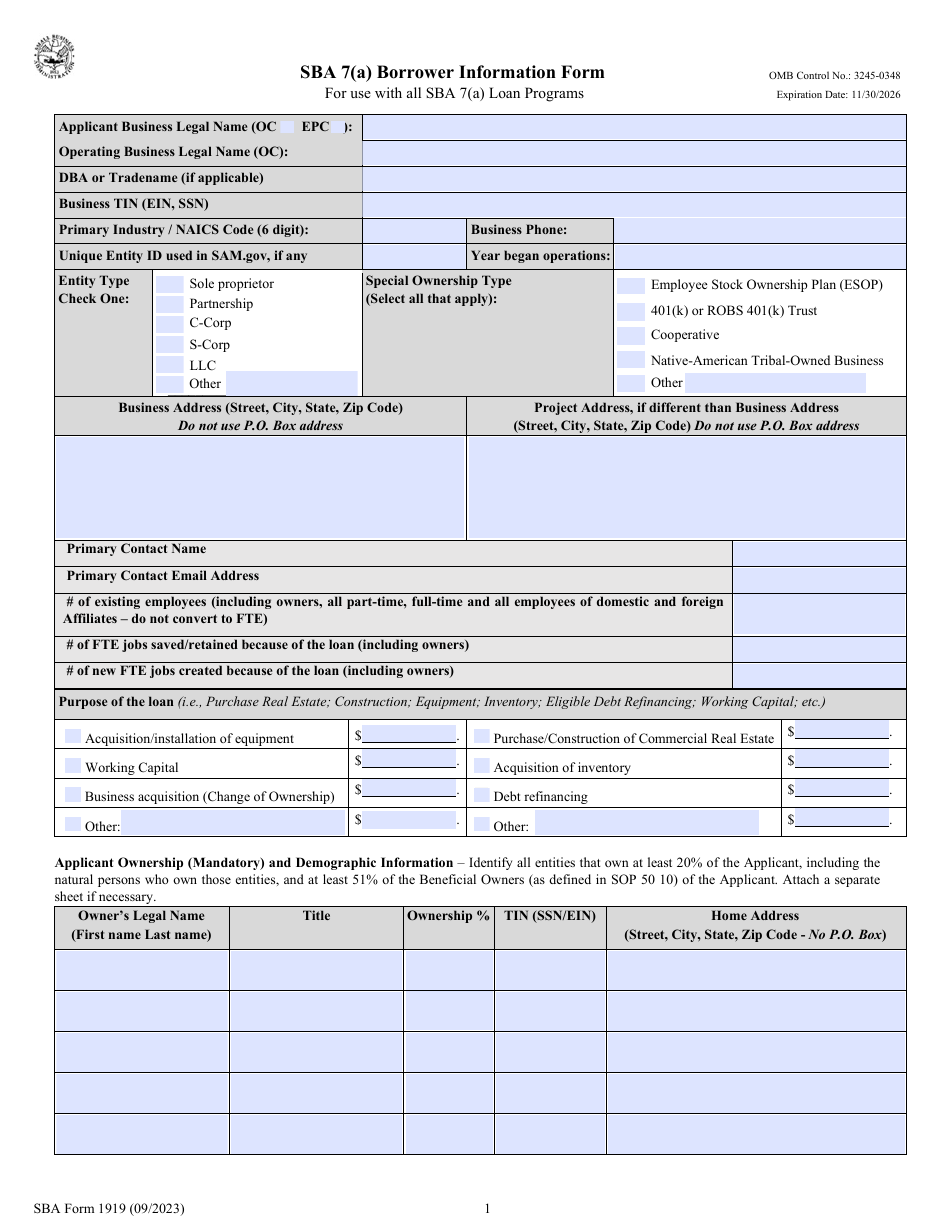

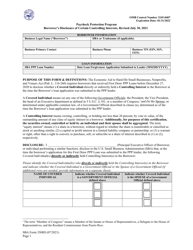

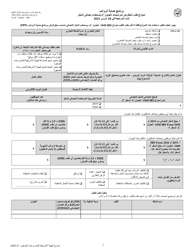

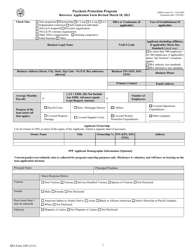

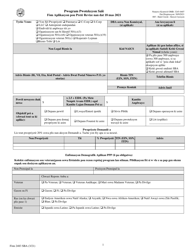

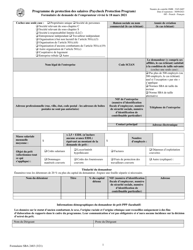

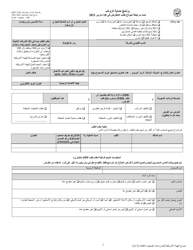

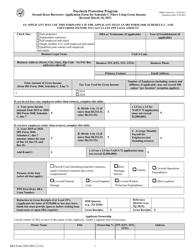

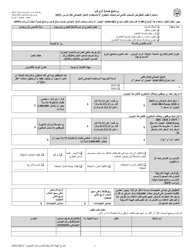

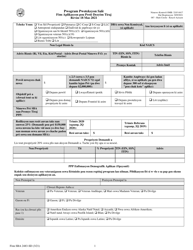

SBA Form 1919 SBA 7(A) Borrower Information Form

What Is the SBA Form 1919?

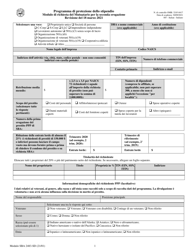

SBA Form 1919, SBA 7(a) Borrower Information Form - also referred to simply as the Borrower Information Form - is a form issued by the Small Business Administration (SBA) and used for collecting information about a 7(a) Borrower. The form reports on the Borrower's indebtedness, their business, and information about any current or previous government financing.

An SBA Form 1919 fillable version is available for download through the link below or can be found through the SBA website. The new SBA Form 1919 was released by the agency on September 1, 2023 , with all previous editions obsolete.

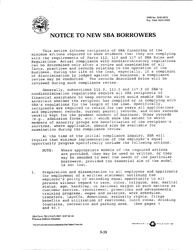

The form is mainly used for determining whether the small business is eligible to be provided with a loan and facilitates a background check on the Borrower. The form is required for all businesses applying for a loan through the SBA 7(a) Program or the Community Advantage (CA) Program.

SBA Form 1919 and SBA Form 1920

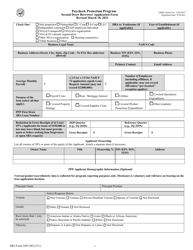

The SBA Form 1920 (Lender's Application for Guaranty) is required to be provided with the Borrower Information Form during the 7(a) loan application process. The SBA 1920 should be filled out by the Lender in order to provide information regarding loan terms, the use of proceeds, and other necessary information to the SBA.

What Are SBA 7(a) Loans?

The SBA 7(a) Loan Guarantee Program is one of the most well-known loan programs offered by the SBA. The program is designed to help small businesses get access to funding. The maximum sum a Borrower may request is a $2 million loan for 25 years for purchasing real estate and equipment for business use or 7 years for working capital.

The SBA does not lend money directly to the small businesses, it only guarantees the loan for the bank, acting as a co-signer. The Borrower can choose the Lender that best suits their demand. All paperwork required by the SBA is completed through the Lender. To be considered eligible for the SBA 7(a) Loan Program, the business has to operate for profit within the United States and meet SBA's small size standards. The size of the business is determined by the number of employed personnel and the average loan receipts. Non-eligible businesses include lending companies, companies that engage in illegal or speculative activities and non-profit organizations.

SBA Form 1919 Instructions

All small business owners who proceed with the 7(a) application are required to complete the SBA Borrower Information Form. The following categories of Borrowers are required to file the SBA 1919:

- Sole proprietors,

- All general partners and all limited partners who own 20% of the business or more;

- All individuals who own 20% or more of a corporation;

- All directors, managers or members of staff owning 20% or more of an LLC;

- Any individual hired by the small business to manage day-to-day operations.

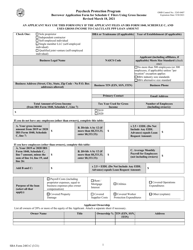

How to Fill out SBA Form 1919?

- Section I requires the information about the small Borrower's lending history and needs to be filled out by an authorized representative of the applicant business (in most cases - the president or the majority owner of a business). This section also requires the requested loan amount, its purpose, and the amount of the last tax return. Section I should also contain information about the operating licenses, agreements, and branch offices of the applicant business, the ownership stake and contact information of all equity owners and the staff headcount.

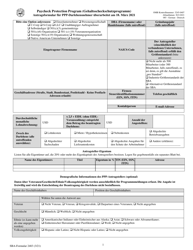

- Section II requires information related to the principals of a business and includes questions about the Borrower's criminal and professional records, personal obligations, citizenship, and business history.

- The final part of the form verifies all of the information provided above. The completed SBA Form 1919 should be submitted to the Lender who will forward all paperwork to the SBA.