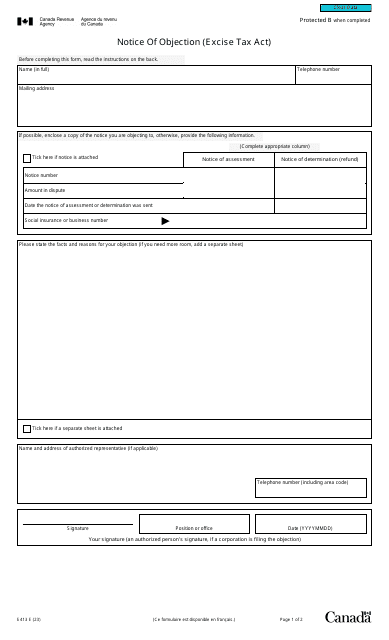

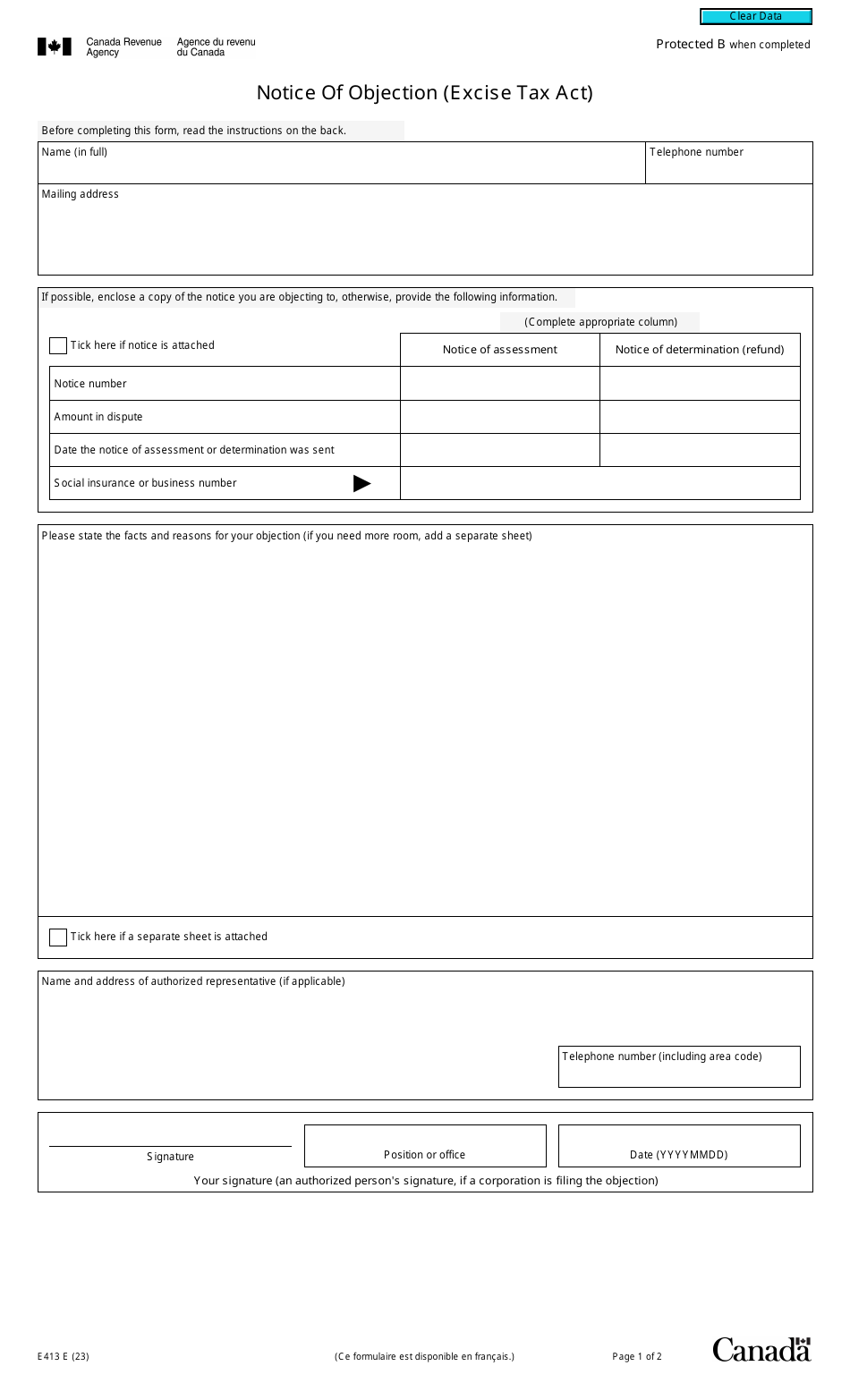

Form E413 Notice of Objection (Excise Tax Act) - Canada

Form E413 Notice of Objection is used in Canada for individuals and businesses to formally object to a decision or assessment made by the Canada Revenue Agency (CRA) regarding excise taxes. It allows taxpayers to challenge the CRA's determination and provide supporting documentation to support their objection.

The person or entity who wishes to object to an assessment made under the Excise Tax Act can file the Form E413 Notice of Objection in Canada.

Form E413 Notice of Objection (Excise Tax Act) - Canada - Frequently Asked Questions (FAQ)

Q: What is a Form E413?

A: Form E413 is a Notice of Objection used for objecting to assessments or decisions under the Excise Tax Act in Canada.

Q: When is Form E413 used?

A: Form E413 is used when you want to object to assessments or decisions made by the Canada Revenue Agency (CRA) regarding excise taxes.

Q: How do I file a Form E413?

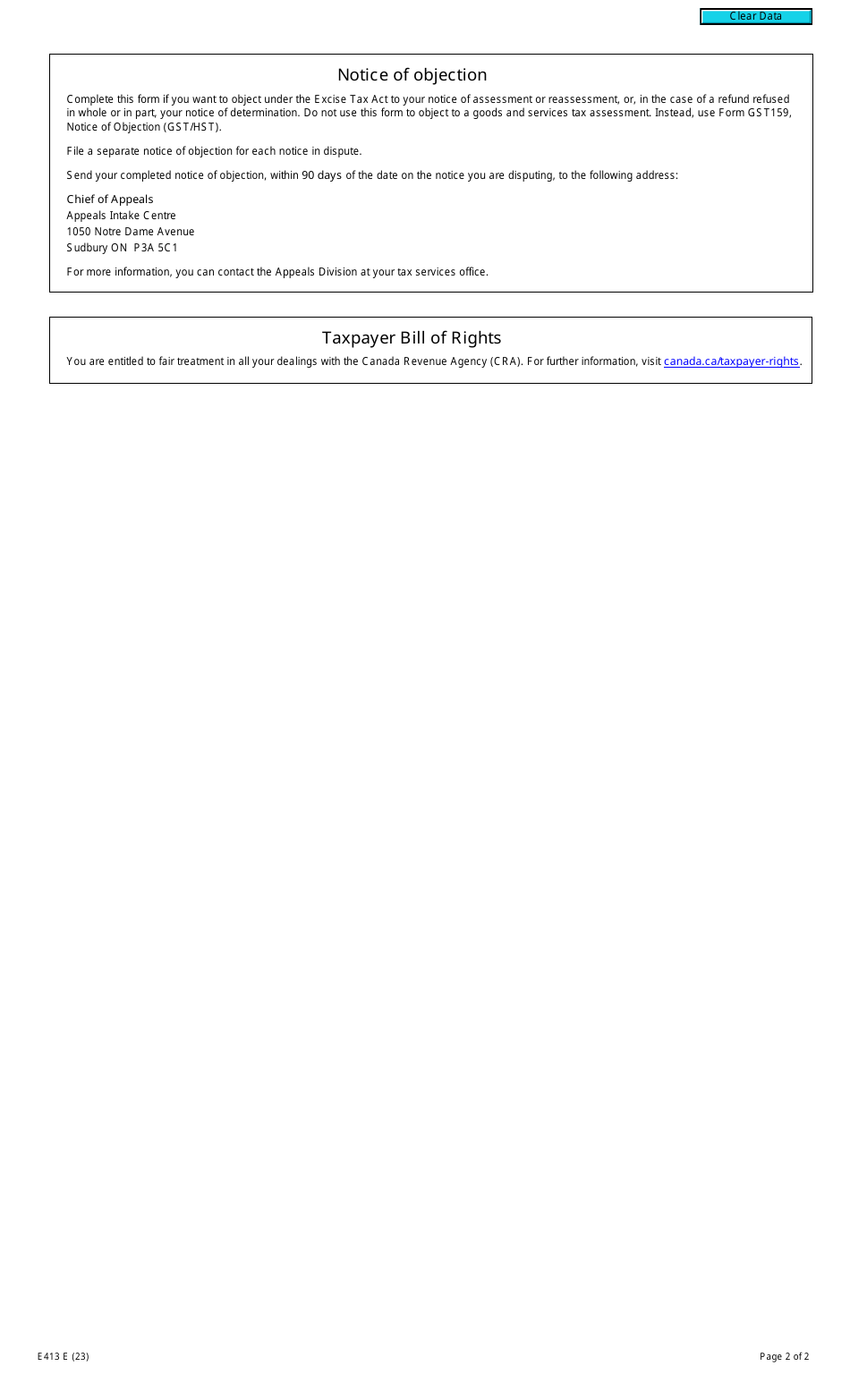

A: To file a Form E413, you need to complete the form and submit it to the Taxpayer Relief Program of the CRA.

Q: What information is required on Form E413?

A: Form E413 requires information such as your personal details, the date of the assessment or decision you are objecting to, the grounds for objection, and any supporting documents.

Q: Is there a deadline for filing Form E413?

A: Yes, there is a deadline for filing Form E413. It must be filed within 90 days of the date of the assessment or decision you are objecting to.

Q: What happens after I file Form E413?

A: After you file Form E413, the CRA will review your objection and may request additional information or documentation. They will then make a decision on the objection.

Q: Can I appeal the CRA's decision after filing Form E413?

A: Yes, if you are not satisfied with the CRA's decision on your objection, you can appeal it to the Tax Court of Canada within 90 days of receiving the decision.

Q: Is there a fee to file Form E413?

A: No, there is no fee to file Form E413.

Q: Can I get legal assistance when filing Form E413?

A: Yes, you can seek legal assistance or advice when filing Form E413, although it is not mandatory.