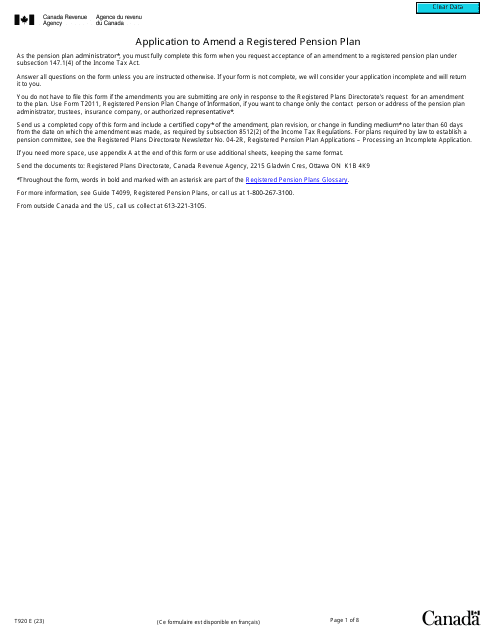

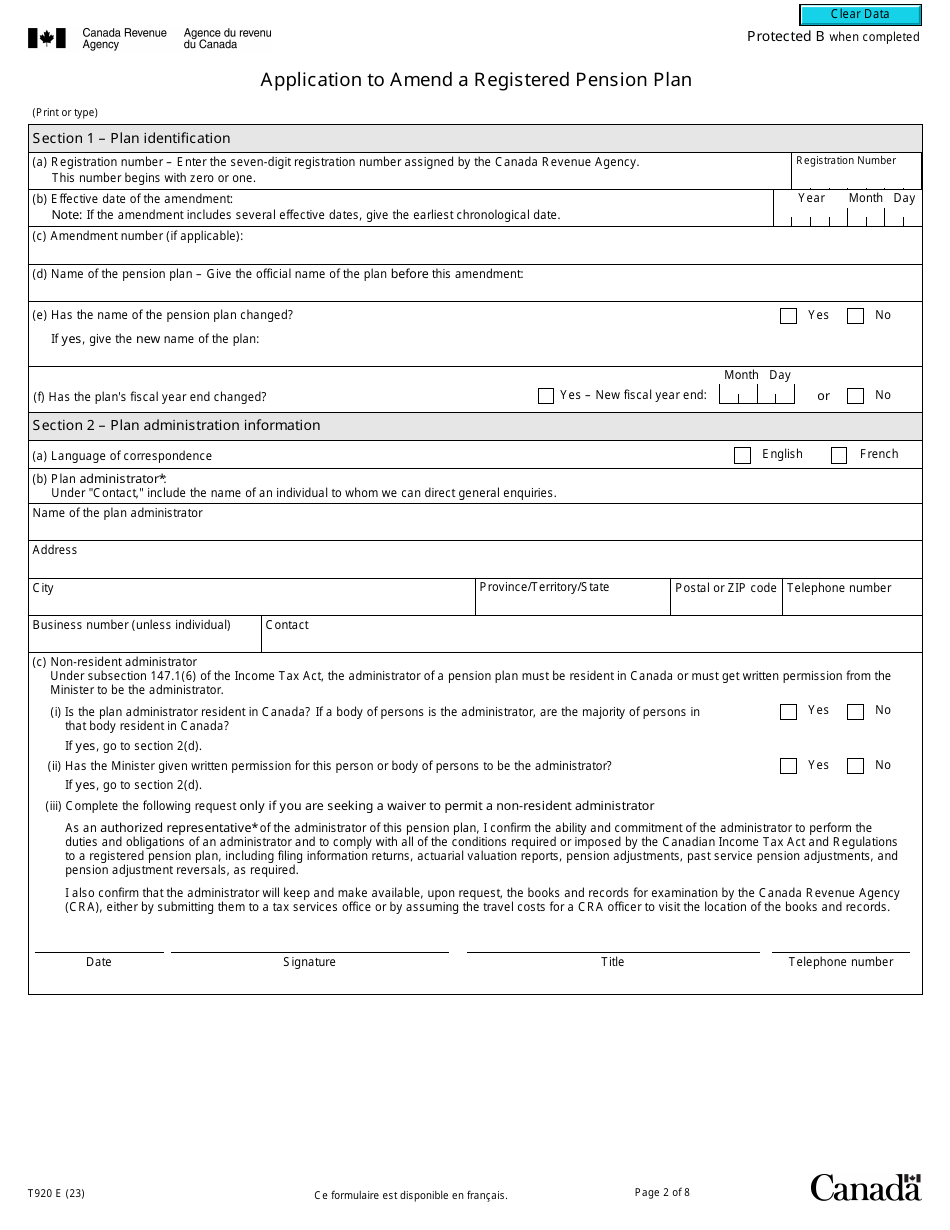

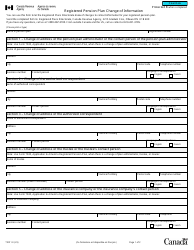

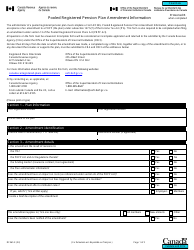

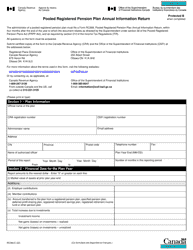

Form T920 Application to Amend a Registered Pension Plan - Canada

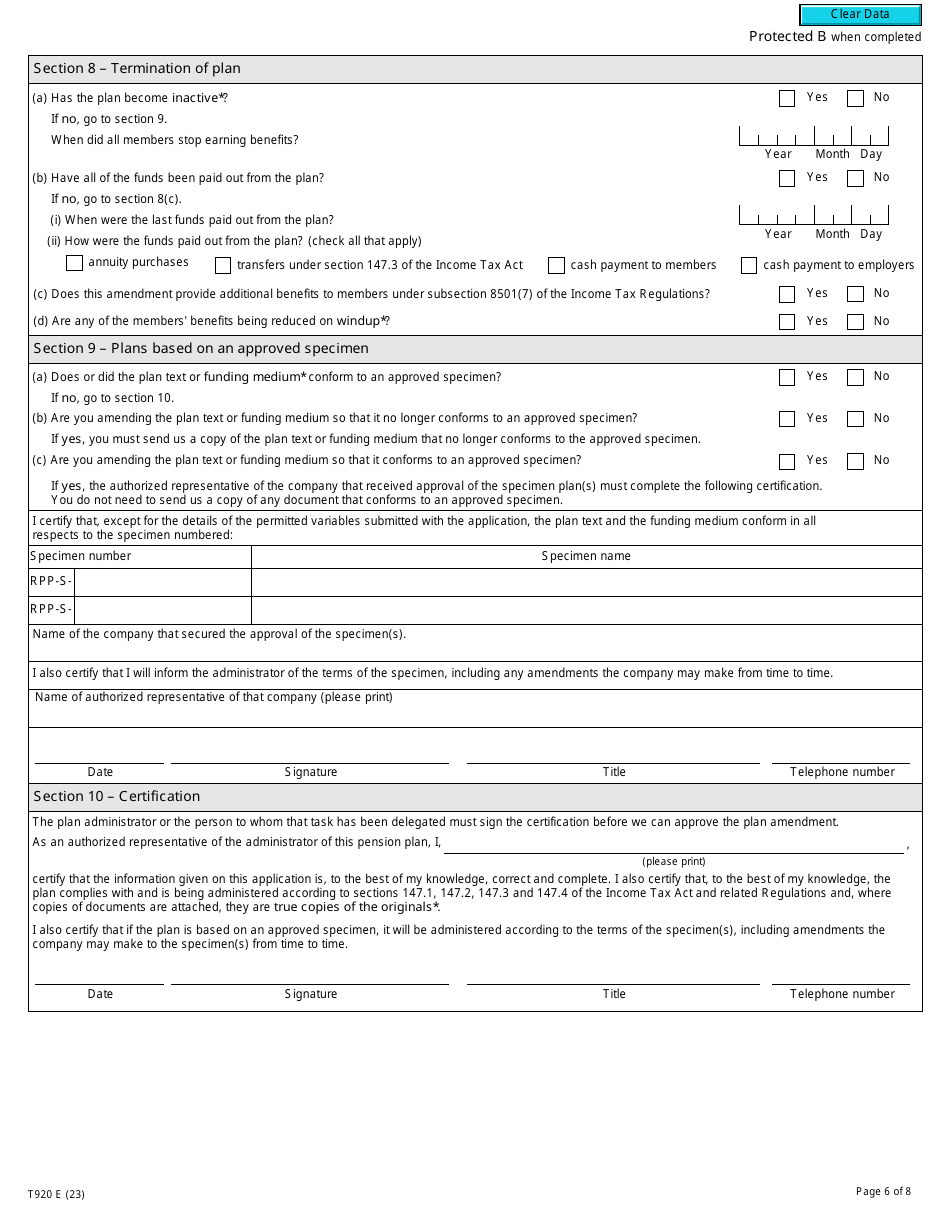

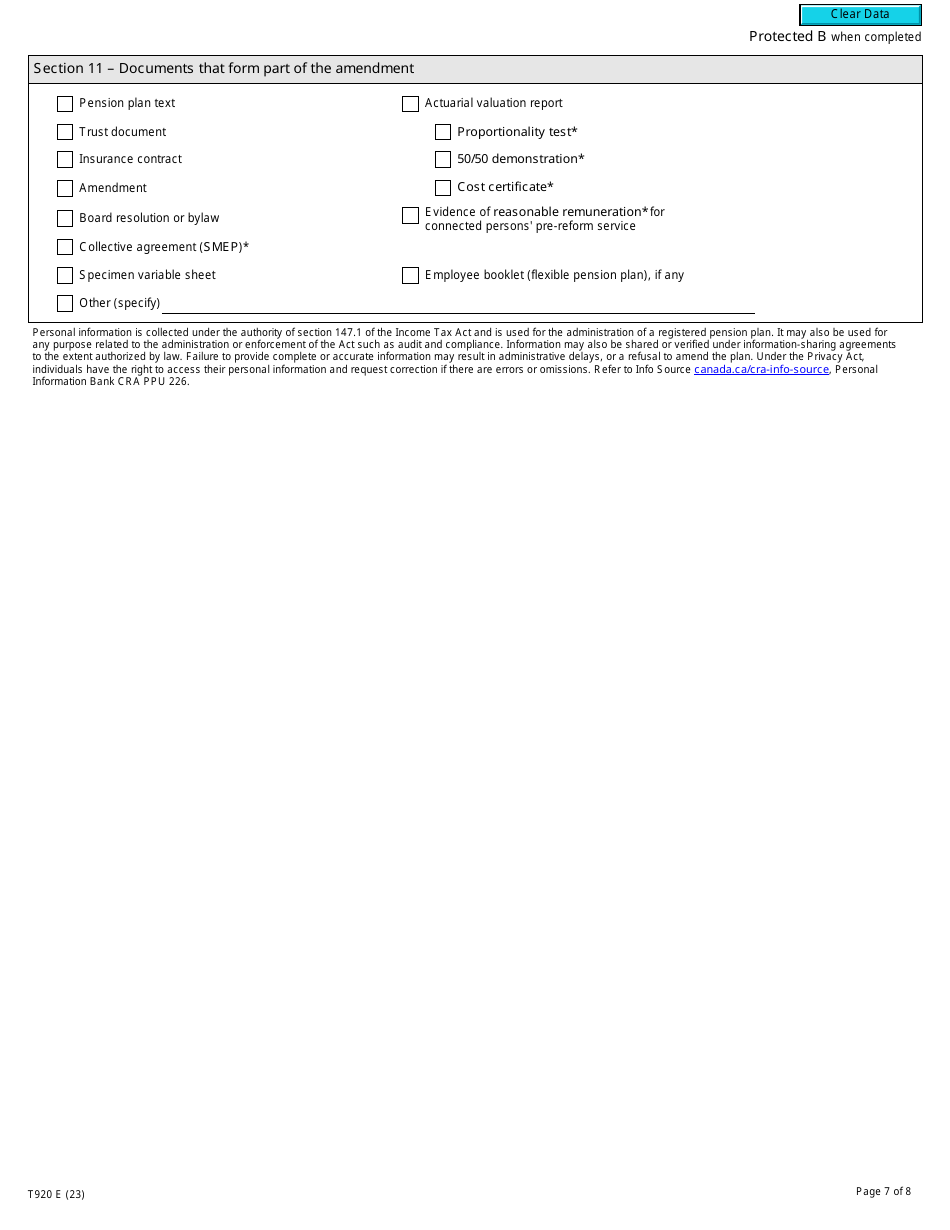

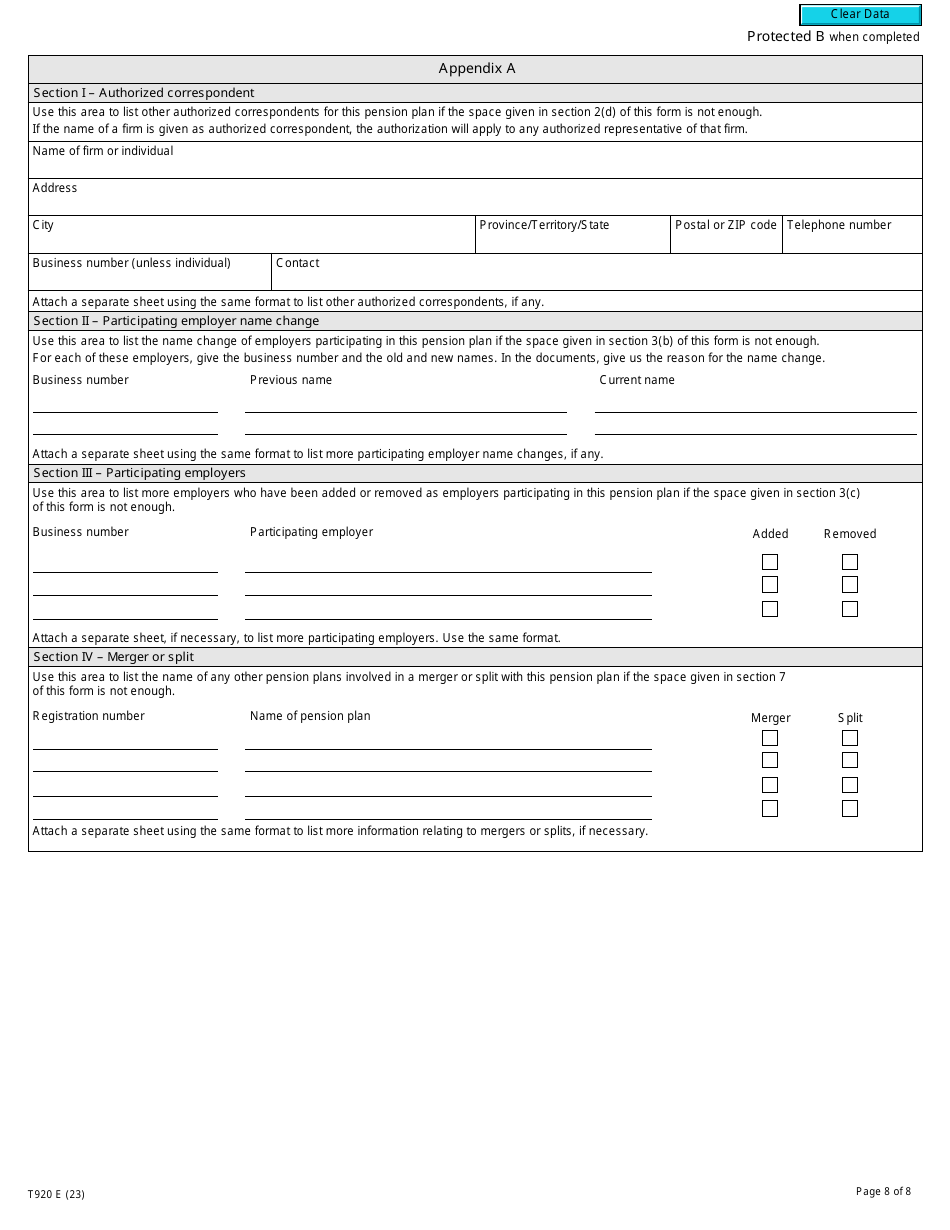

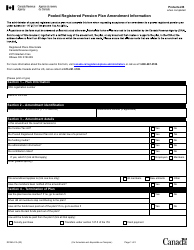

Form T920 is an application that is used in Canada to amend a registered pension plan. It is used to make changes or updates to the existing plan, such as modifying contribution limits, changing plan administrators, or adding new provisions.

The employer or plan administrator usually files the Form T920 to amend a registered pension plan in Canada.

Form T920 Application to Amend a Registered Pension Plan - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T920?

A: Form T920 is an application to amend a registered pension plan in Canada.

Q: Who can use Form T920?

A: Employers and administrators of registered pension plans can use Form T920 to apply for amendments to their plan.

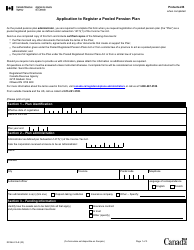

Q: What is a registered pension plan?

A: A registered pension plan is a retirement savings plan set up by an employer for their employees that meets specific requirements set by the government.

Q: Why would someone need to amend a registered pension plan?

A: There are various reasons why someone may need to amend a registered pension plan, such as changes in regulations, plan rules, or organizational needs.

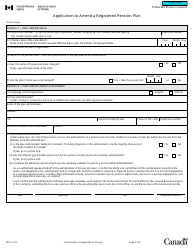

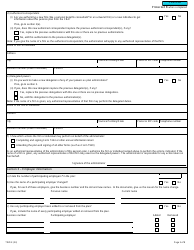

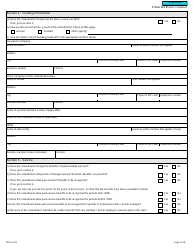

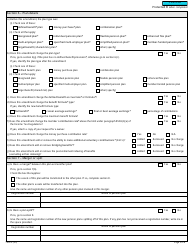

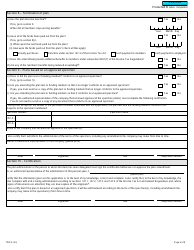

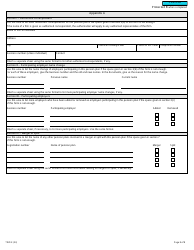

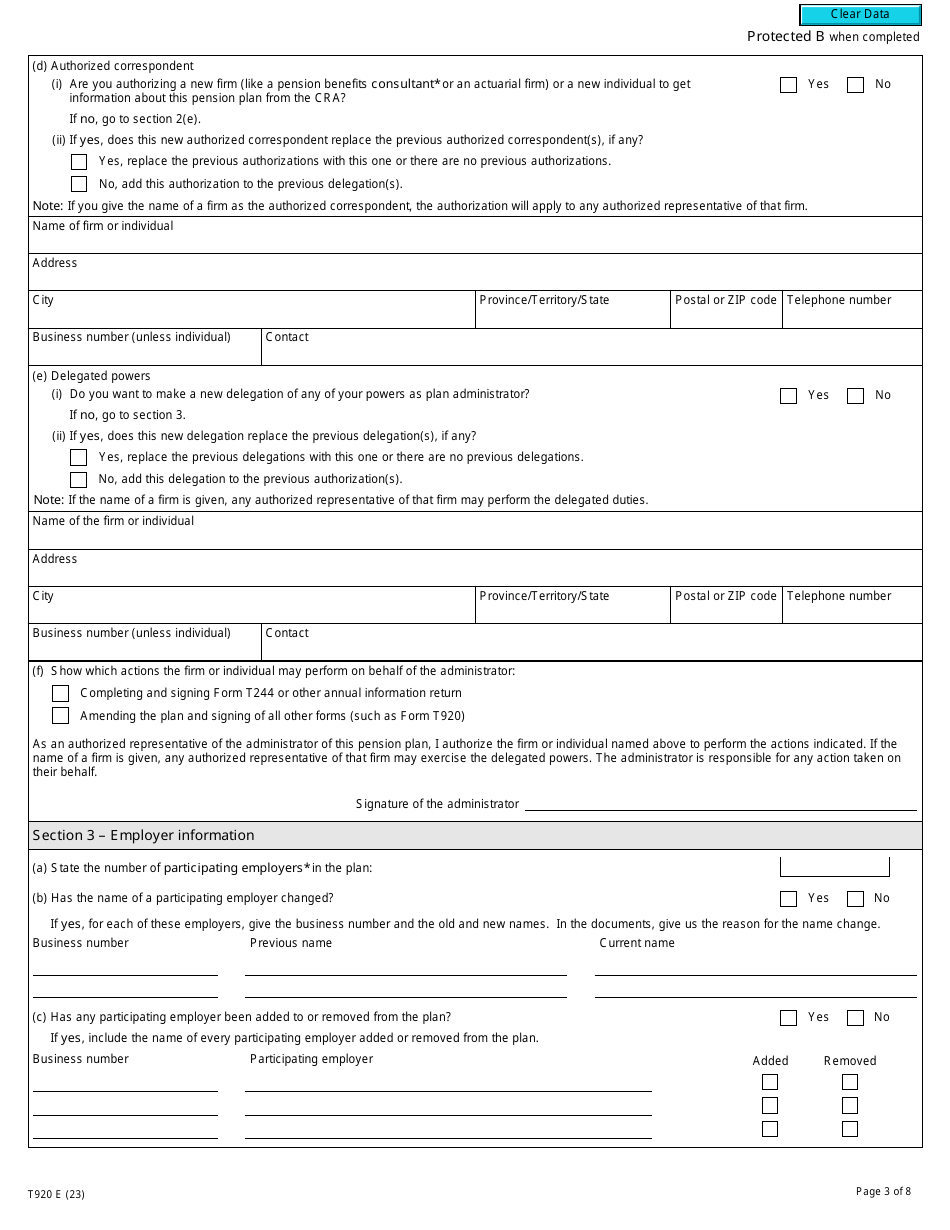

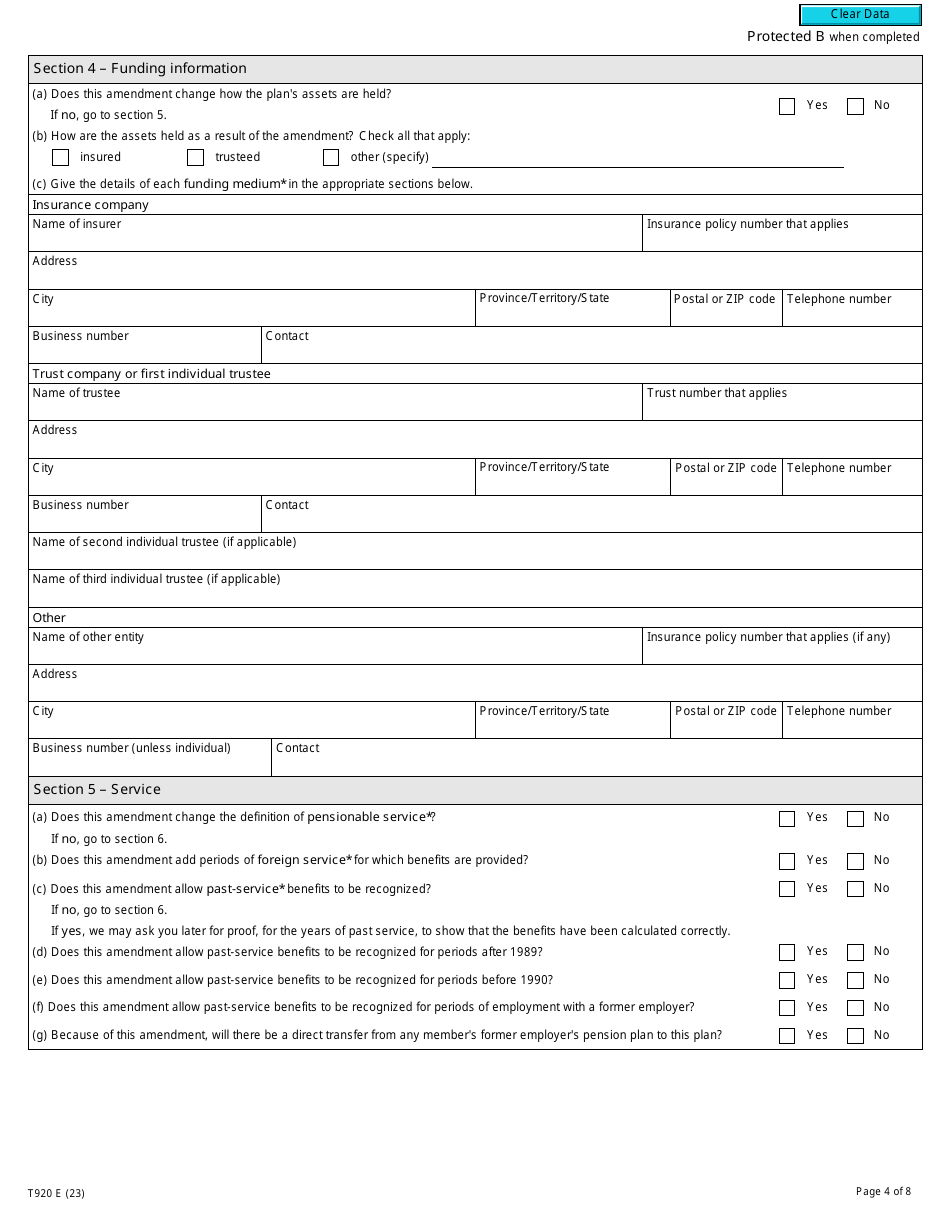

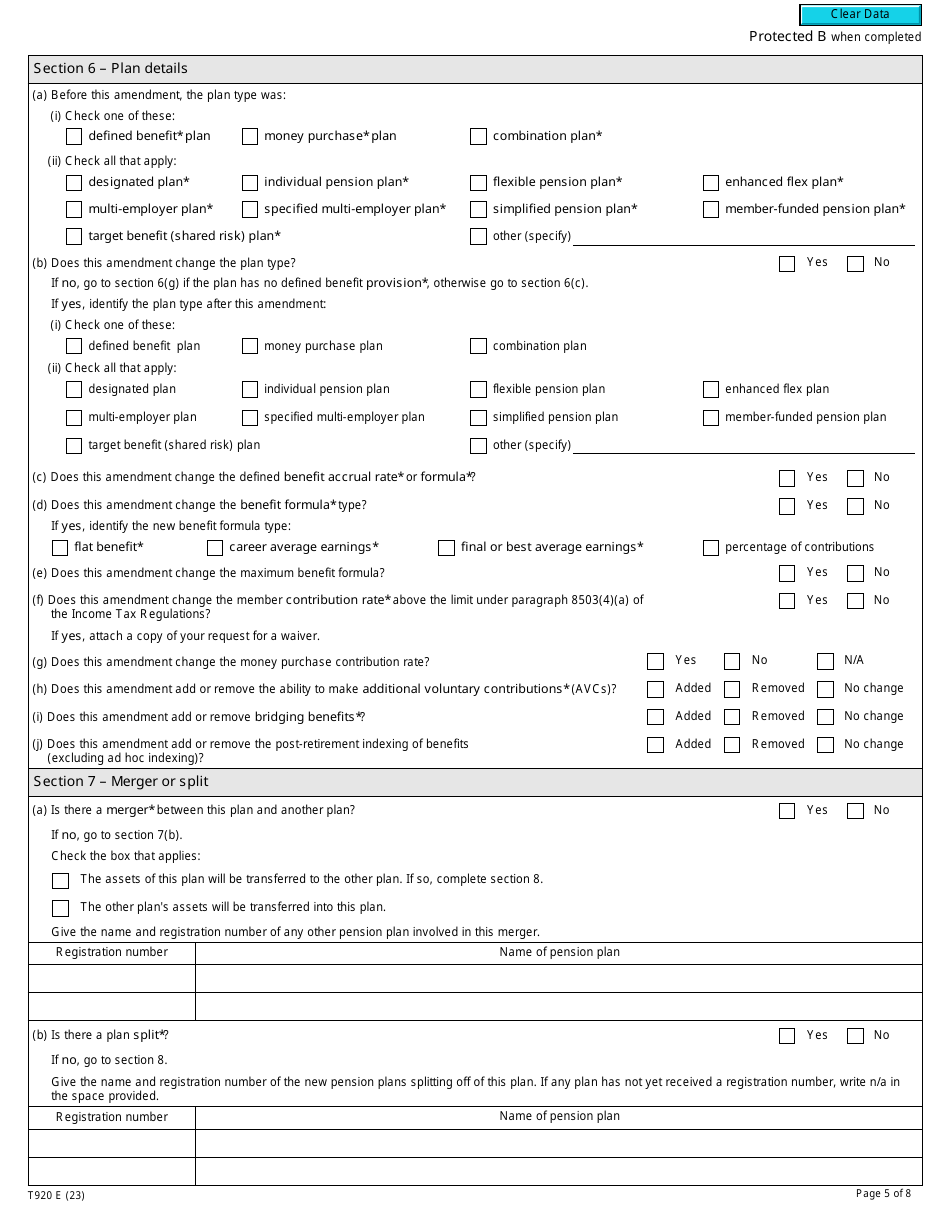

Q: What information is required in Form T920?

A: Form T920 requires information about the plan, proposed amendments, and the reasons for the amendments.

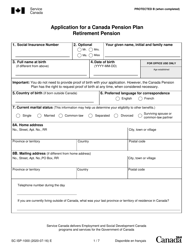

Q: Are there any fees associated with submitting Form T920?

A: There are no fees required to submit Form T920.

Q: How long does it take to process Form T920?

A: The processing time for Form T920 can vary, but it is typically several weeks.

Q: Who should I contact for assistance with Form T920?

A: For assistance with Form T920, you can contact the Canada Revenue Agency or consult with a pension plan professional.

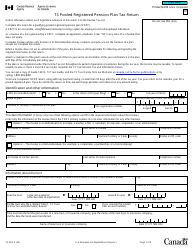

Q: Can I submit Form T920 electronically?

A: No, Form T920 cannot be submitted electronically. It must be printed, signed, and mailed or faxed to the appropriate tax services office.