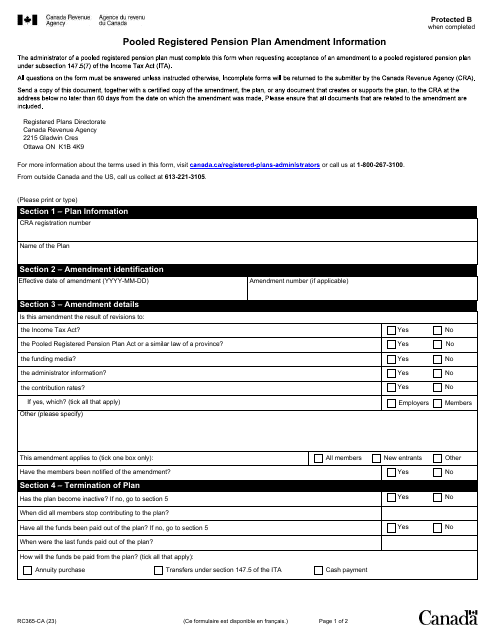

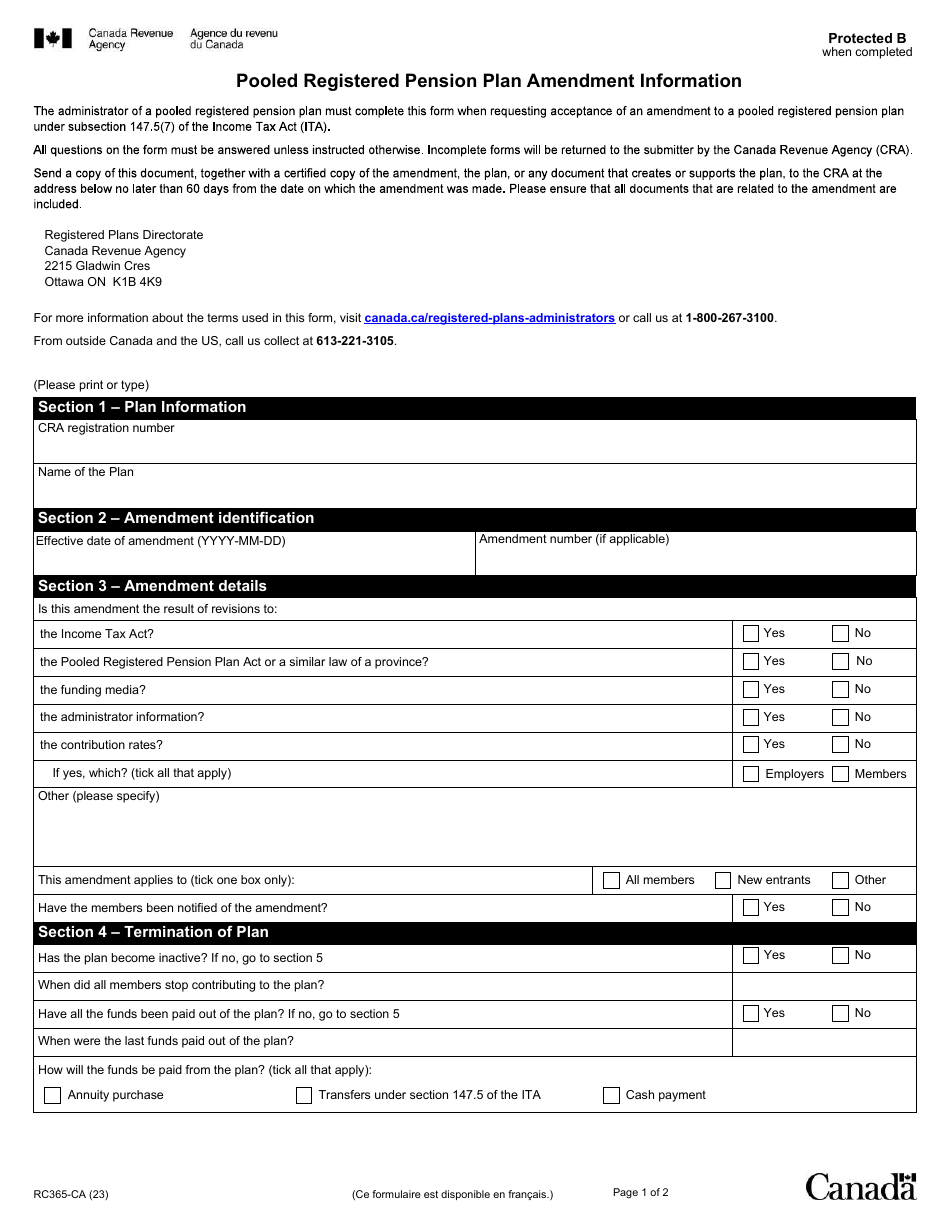

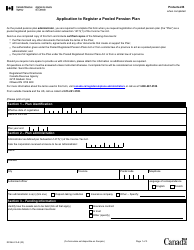

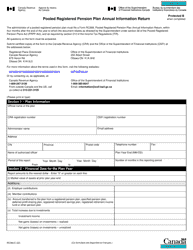

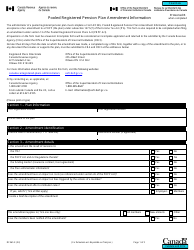

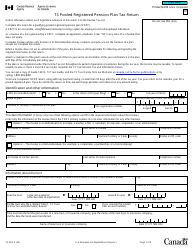

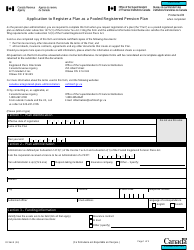

Form RC365-CA Pooled Registered Pension Plan Amendment Information - Canada

Form RC365-CA is used to provide information about amendments made to a Pooled Registered Pension Plan (PRPP) in Canada. It is used to update the Canada Revenue Agency about any changes or modifications to the PRPP.

The employer who offers the Pooled Registered Pension Plan (PRPP) in Canada files the Form RC365-CA for amendment information.

Form RC365-CA Pooled Registered Pension Plan Amendment Information - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC365-CA?

A: Form RC365-CA is a document related to Pooled Registered Pension Plan (PRPP) amendment information in Canada.

Q: What is a Pooled Registered Pension Plan (PRPP)?

A: A Pooled Registered Pension Plan (PRPP) is a type of retirement savings plan in Canada.

Q: Who should use Form RC365-CA?

A: Form RC365-CA should be used by individuals or organizations who need to provide amendment information for a Pooled Registered Pension Plan (PRPP).

Q: What information is required on Form RC365-CA?

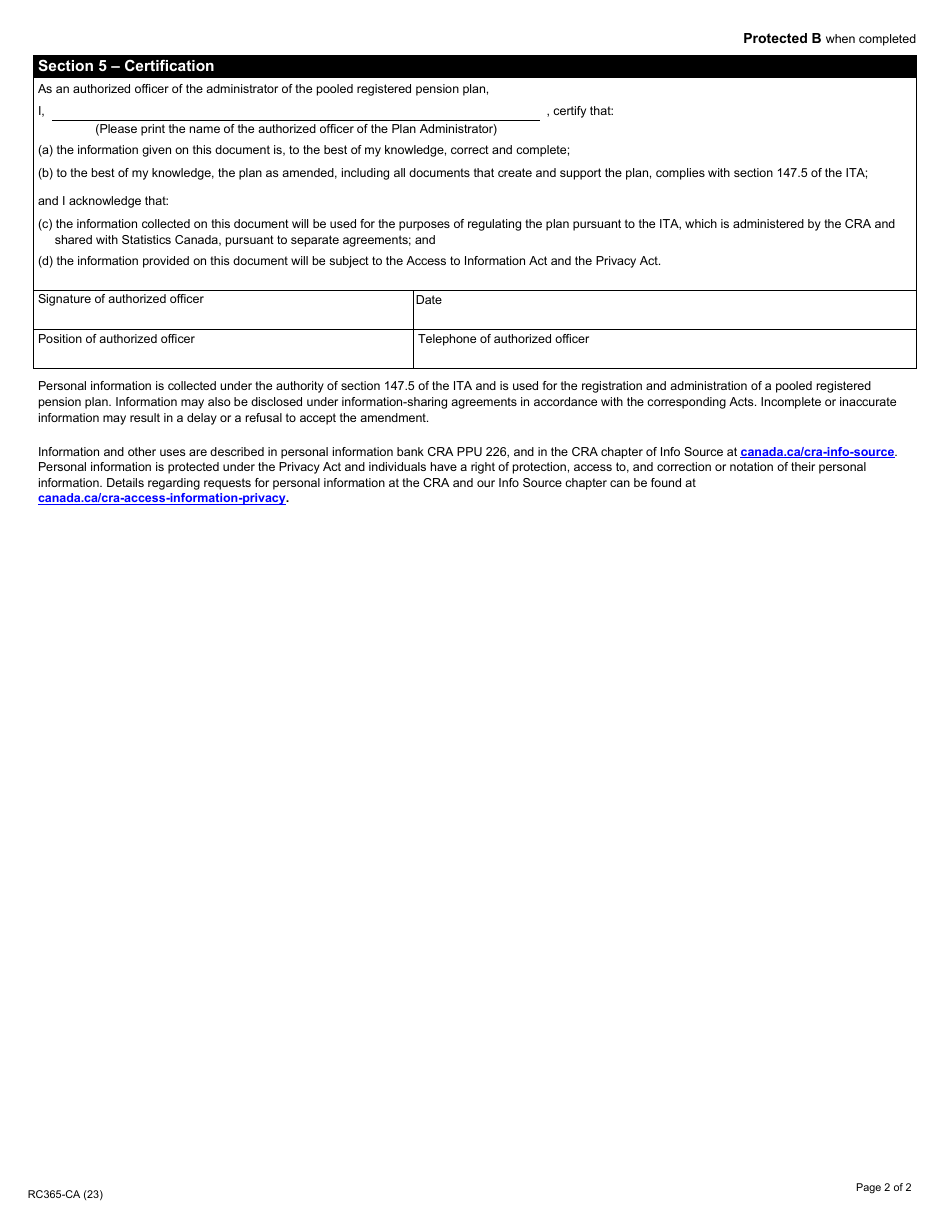

A: Form RC365-CA requires information about the plan administrator, the plan number, and details of the proposed amendment.

Q: Are there any fees associated with using Form RC365-CA?

A: There are no fees associated with using Form RC365-CA.

Q: How should I submit Form RC365-CA?

A: Form RC365-CA can be submitted by mail or by electronic means, as specified by the CRA.

Q: Is Form RC365-CA mandatory?

A: Form RC365-CA is mandatory for individuals or organizations who need to provide amendment information for a Pooled Registered Pension Plan (PRPP).

Q: What should I do if I have additional questions about Form RC365-CA?

A: If you have additional questions about Form RC365-CA, you should contact the Canada Revenue Agency (CRA) for assistance.