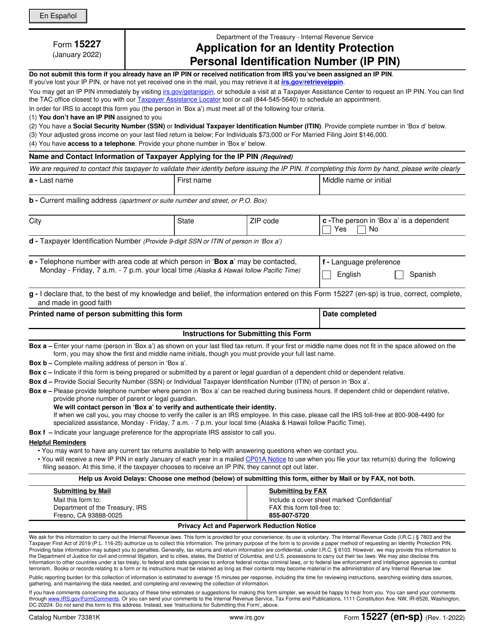

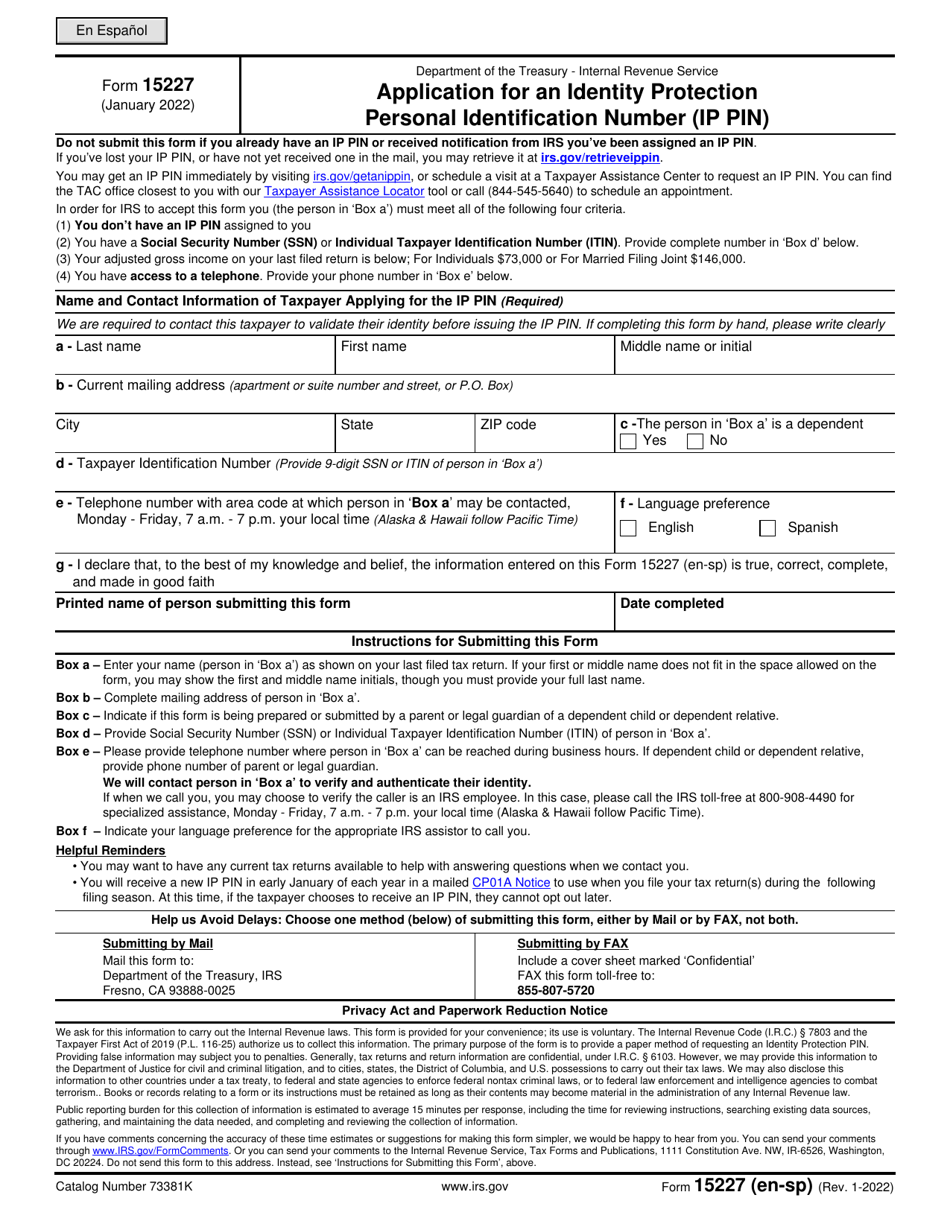

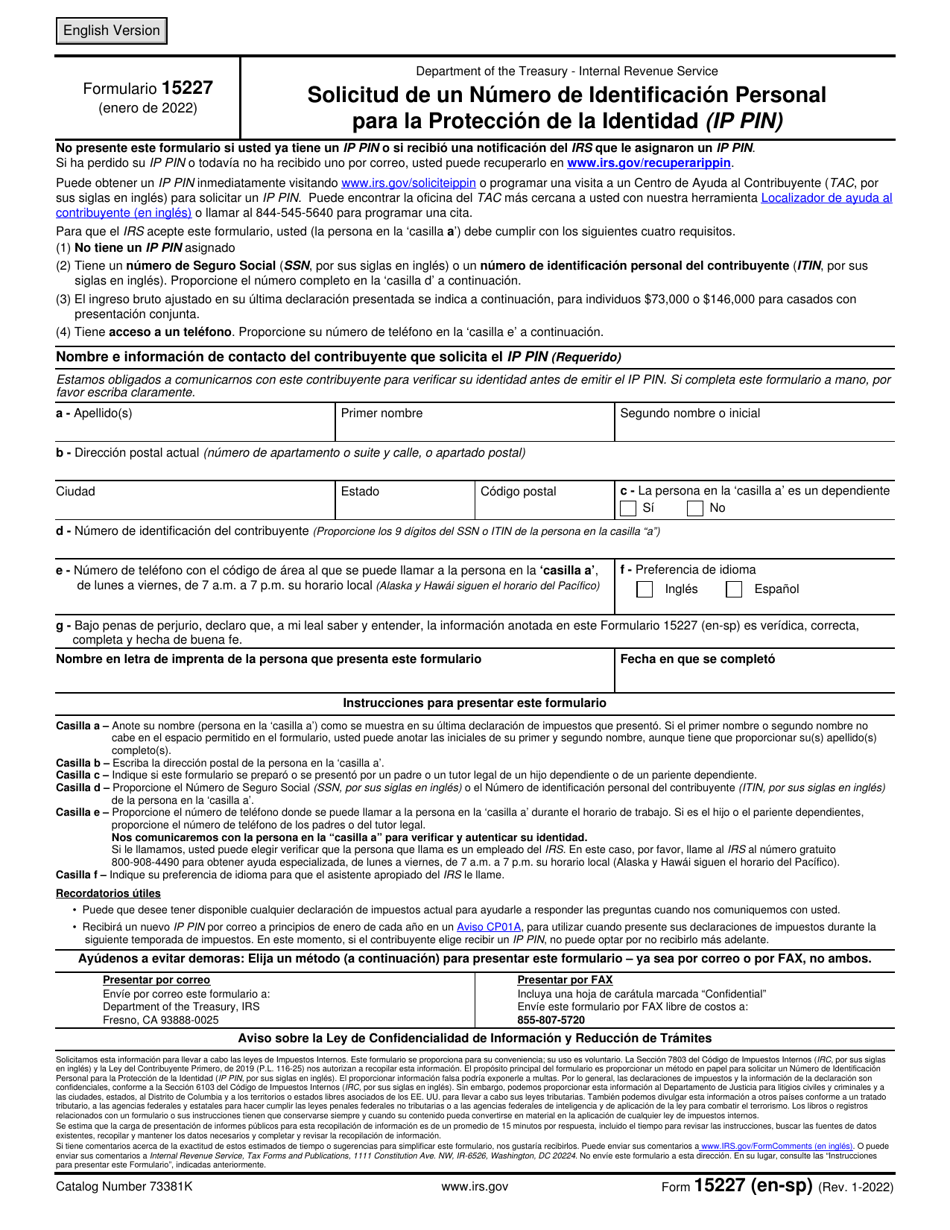

IRS Form 15227 Application for an Identity Protection Personal Identification Number (Ip Pin) (English / Spanish)

What Is IRS Form 15227?

IRS Form 15227, Application for an Identity Protection Personal Identification Number (IP PIN), is a formal document used by taxpayers to request the issuance of a unique identification number they will later use to submit income statements.

Alternate Names:

- IP PIN Form;

- IP PIN Form 15227;

- Tax Form 15227.

Anyone can file this document - as long as you have a taxpayer identification number and there are no problems with the verification of your identity, you will be issued a PIN upon request.

This application was released by the Internal Revenue Service (IRS) in - previous editions of the instrument are now outdated. An IRS Form 15227 fillable version is available for download below.

What Is Form 15227 Used For?

Prepare and submit Tax Form 15227 to get a six-digit number from the fiscal authorities - you will use this number every time you file your income statement annually. The number you will be assigned is valid for twelve months - it is generated every year and connected to your tax account.

Usually, tax organs help out identity theft victims with their issues and ensure they no longer have to deal with their problems by sending them annual notices that list new PINs - these taxpayers participate in the PIN program automatically. Alternatively, you can get the PIN even if you never had to deal with identity theft yet you believe your documentation will be safer if you go through this procedure.

Note that you cannot file the form if you already obtained the PIN yet you forgot it or you did not get a formal letter from tax organs - you have an opportunity to retrieve the PIN by reaching out to the IRS. If you got your PIN online, you will be required to check in with the IRS every twelve months to get a new number since notifications are not mailed in this case. Do not disclose the PIN to anyone, even IRS employees - this number will not be used to verify your identity in the future; the only exception is the person you hire to assist you with tax documentation - a paid preparer who fills out the paperwork on your behalf has to know the PIN.

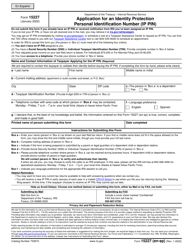

Form 15227 Instructions

Follow these Form 15227 instructions to ask the IRS to issue PIN to safeguard your identity:

-

Identify yourself by stating your full name, current correspondence address, telephone number, and taxpayer identification number . You have to confirm you are listed as a dependent on someone else's tax return by checking the box. Make sure the IRS can call the number you write down during daytime - if you are someone's dependent, enter the telephone number of your legal guardian or parent.

-

Choose whether English or Spanish is the preferred language for you when it comes to fiscal matters . Certify the form by adding your name and actual date of signing - this way, you verify the details you put in writing are true and accurate to the best of your knowledge.

-

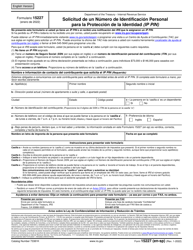

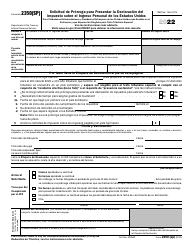

Complete the second page of the form if you are a Spanish-speaking filer and it is more convenient for you to communicate with fiscal authorities in Spanish . The contents of this page are identical to the first one so you may skip the first page in its entirety.

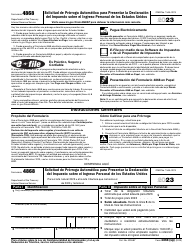

-

Select the filing method that suits you best - you are allowed to file the paperwork via mail or fax . Send the form to the Department of the Treasury, IRS, Fresno, CA 93888-025. The tax number you have to use is 855-807-5720 - if this is how you submit the application, do not forget to attach a cover sheet that says "Confidential" to your documentation. The mailing address and the fax number are the same for English- and Spanish-speaking applicants. You will have to wait around four or six weeks to get a letter from the IRS that indicates your PIN you will have to enter when submitting the next tax return.