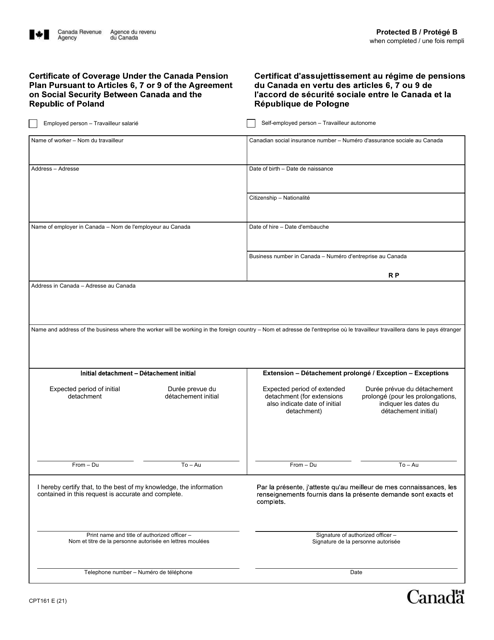

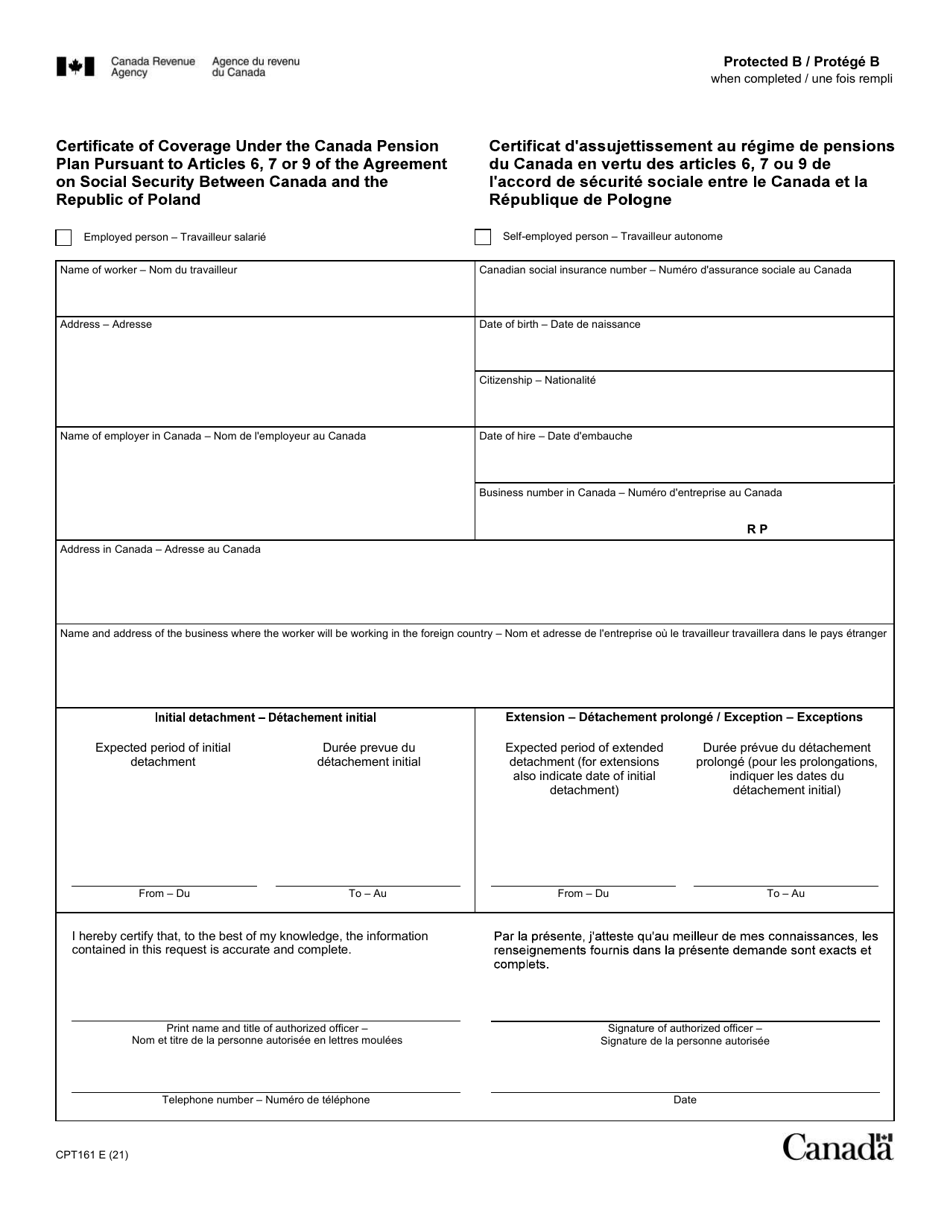

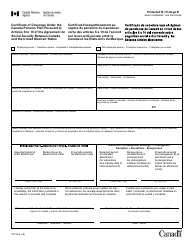

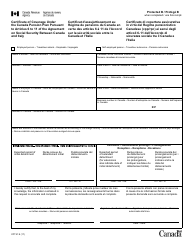

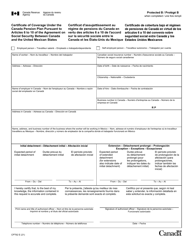

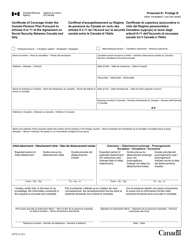

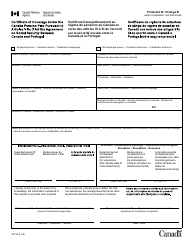

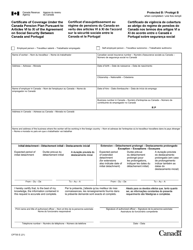

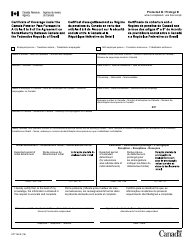

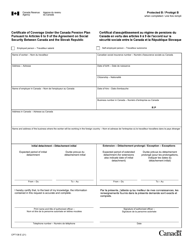

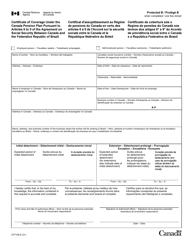

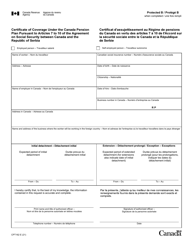

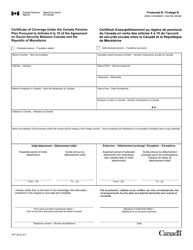

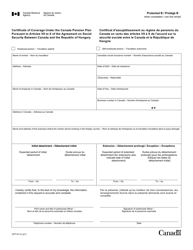

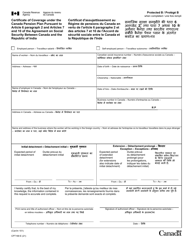

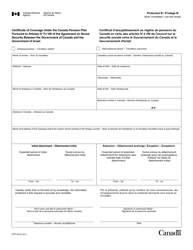

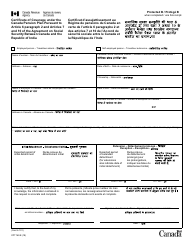

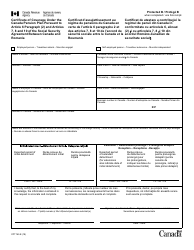

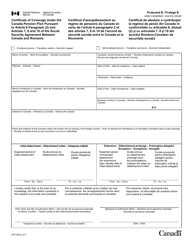

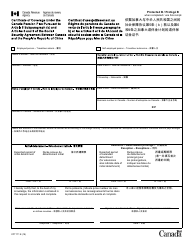

Form CPT161 Certificate of Coverage Under the Canada Pension Plan Pursuant to Articles 6, 7 or 9 of the Agreement on Social Security Between Canada and the Republic of Poland - Canada (English / French)

Form CPT161 Certificate of Coverage Under the Canada Pension Plan pursuant to Articles 6, 7 or 9 of the Agreement on Social Security between Canada and the Republic of Poland - Canada (English/French) is used to confirm an individual's entitlement to benefits under the Canada Pension Plan while they are temporarily working in Poland. It provides proof that the individual is exempt from paying Polish social security contributions during their temporary employment in Poland.

The form CPT161 Certificate of Coverage under the Canada Pension Plan is filed by individuals who are covered under the Canada Pension Plan and are working in Poland under the Agreement on Social Security between Canada and the Republic of Poland.

Form CPT161 Certificate of Coverage Under the Canada Pension Plan Pursuant to Articles 6, 7 or 9 of the Agreement on Social Security Between Canada and the Republic of Poland - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is a Form CPT161?

A: Form CPT161 is a Certificate of Coverage under the Canada Pension Plan.

Q: What is the purpose of Form CPT161?

A: The purpose of Form CPT161 is to certify that an individual is subject to the Canada Pension Plan.

Q: What does Form CPT161 cover?

A: Form CPT161 covers individuals who work in Canada and are subject to the Canada Pension Plan while temporarily working in Poland.

Q: Who is eligible to use Form CPT161?

A: Individuals who work in Canada and are temporarily working in Poland may be eligible to use Form CPT161.

Q: What is the Agreement on Social Security Between Canada and the Republic of Poland?

A: The Agreement on Social Security Between Canada and the Republic of Poland is a bilateral agreement between the two countries that coordinates the social security systems.

Q: Is Form CPT161 available in English and French?

A: Yes, Form CPT161 is available in both English and French.