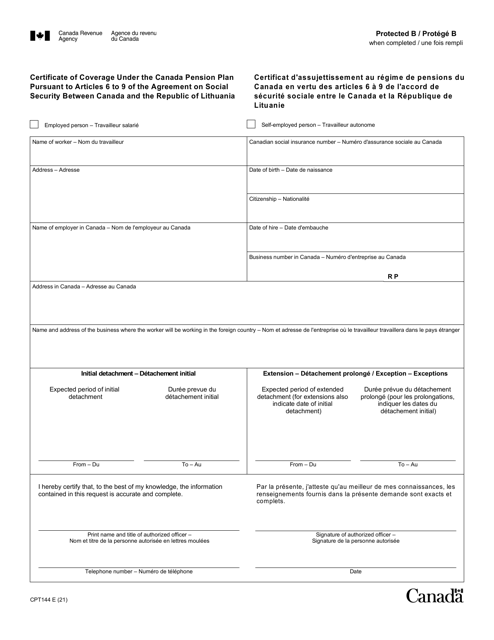

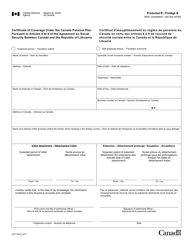

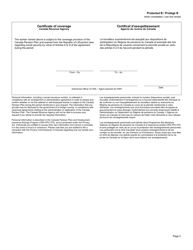

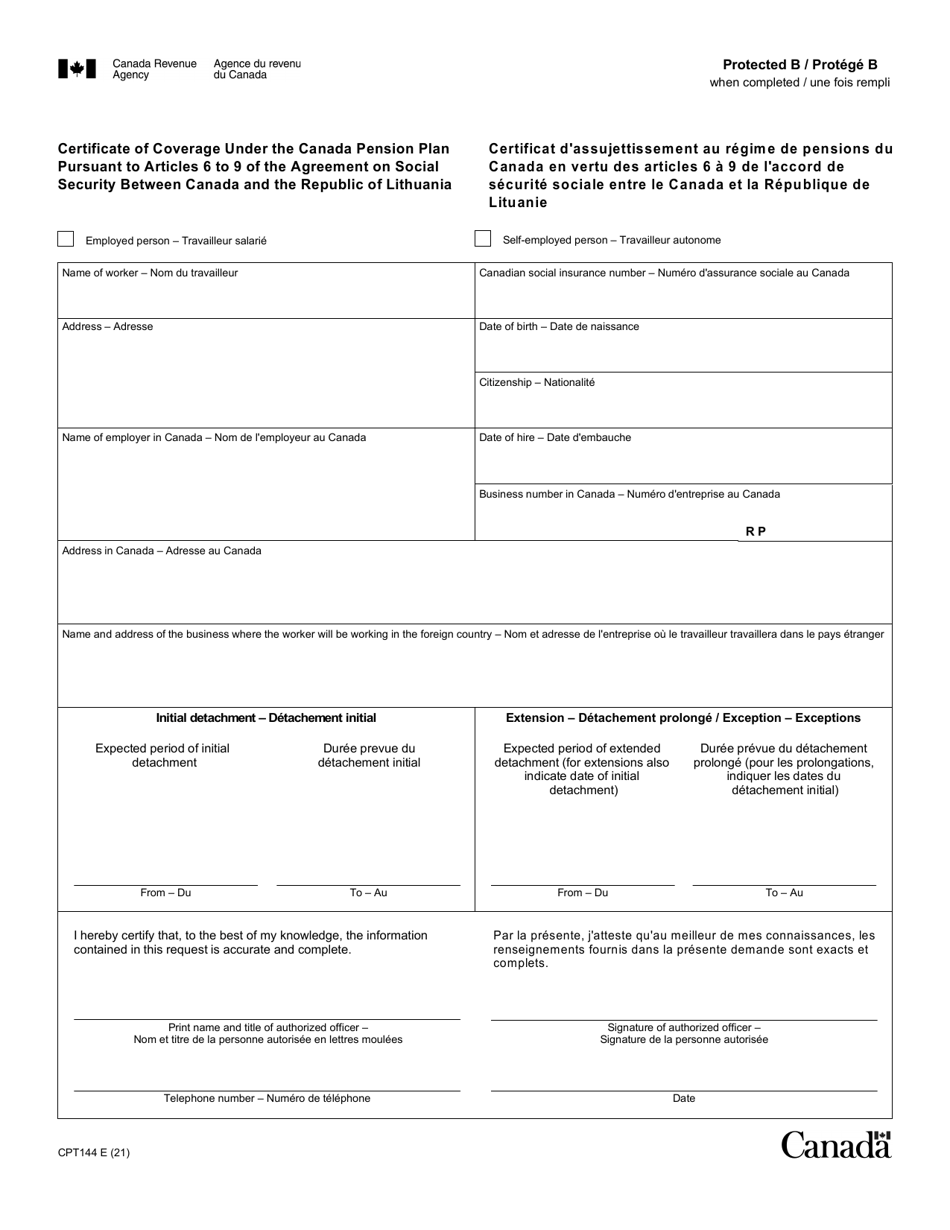

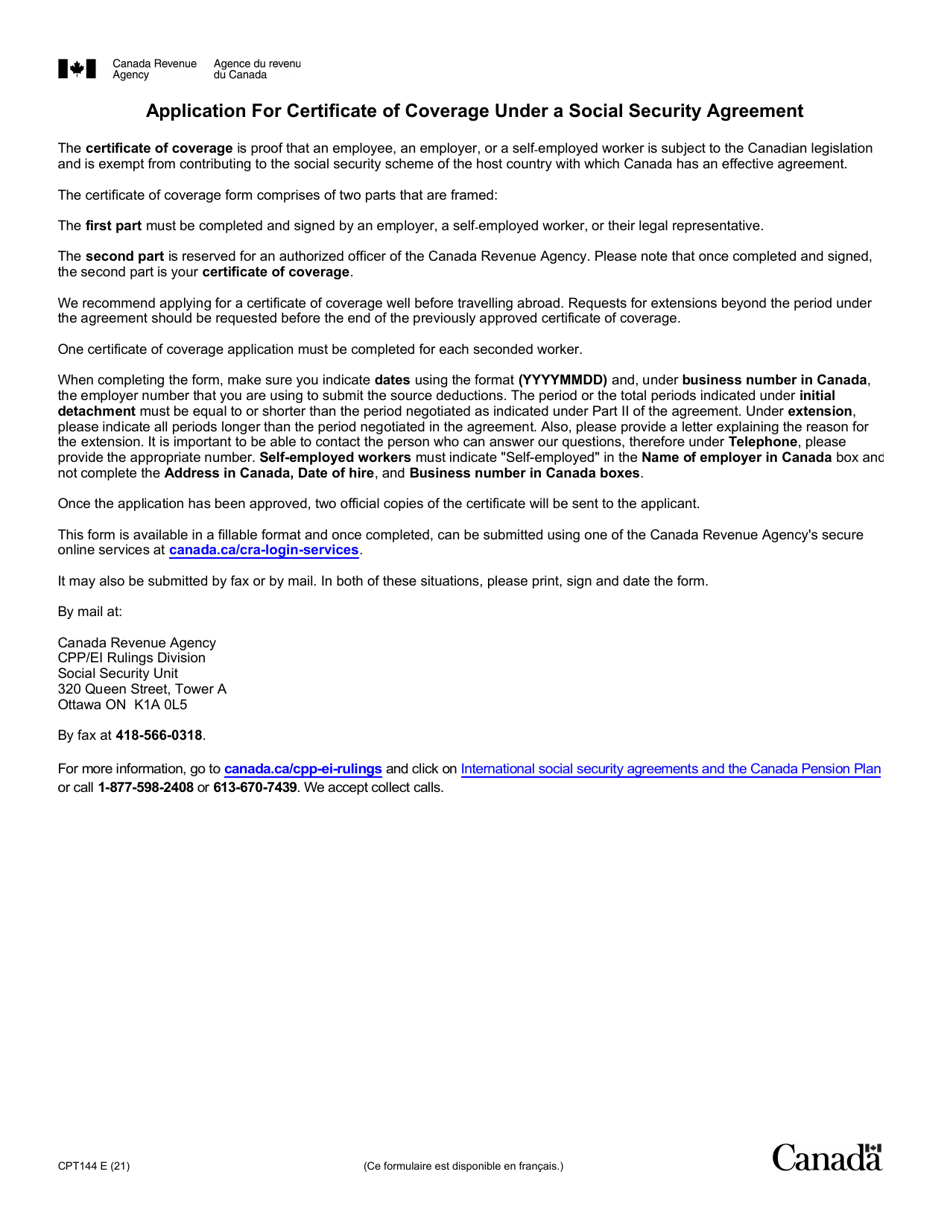

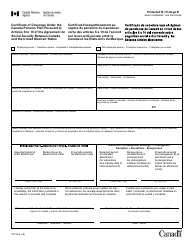

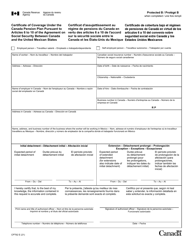

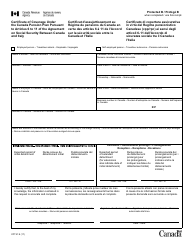

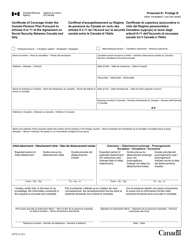

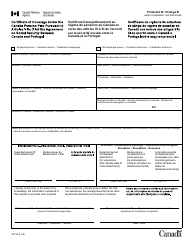

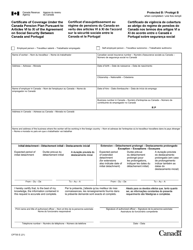

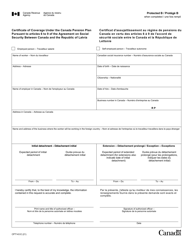

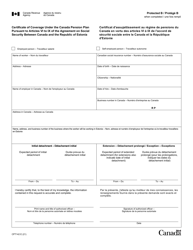

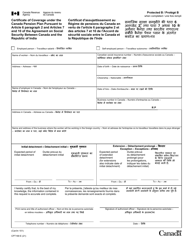

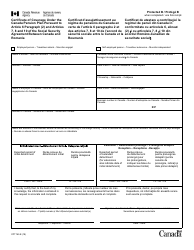

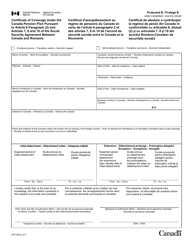

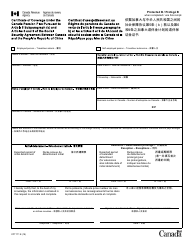

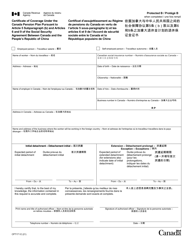

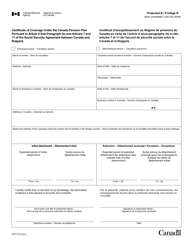

Form CPT144 Certificate of Coverage Under the Cpp Pursuant to Articles 6 to 9 of the Agreement on Social Security Between Canada and the Republic of Lithuania - Canada (English / French)

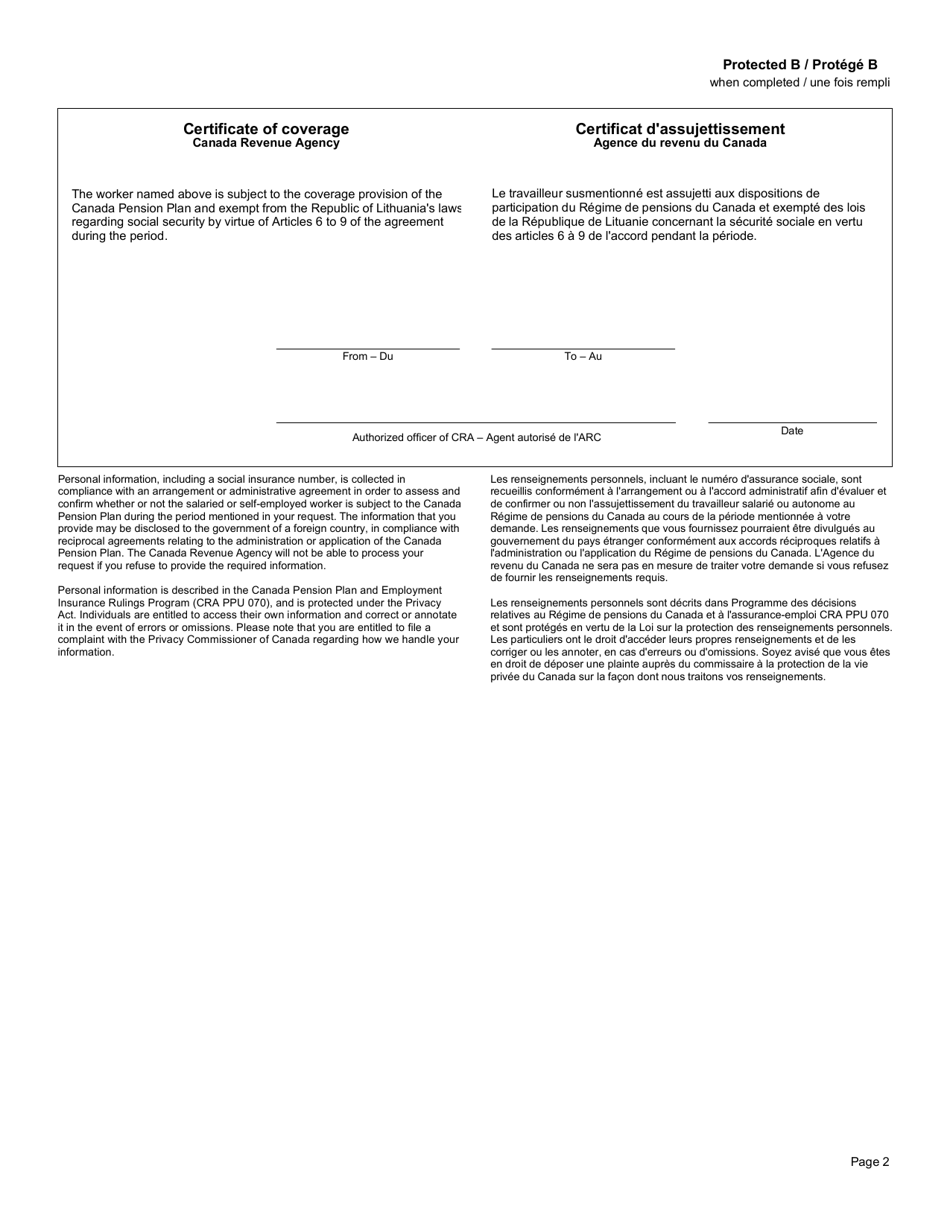

The Form CPT144 Certificate of Coverage is used under the Social Security Agreement between Canada and the Republic of Lithuania. This form certifies that an individual is covered under either the Canadian Pension Plan (CPP) or the social security system of Lithuania. It applies to individuals who are temporarily working or self-employed in one country but are still contributing to the social security system of their home country. In simple terms, it confirms that individuals are exempted from making social security contributions in the host country due to their existing coverage in their home country.

The Form CPT144 Certificate of Coverage under the CPP pursuant to articles 6 to 9 of the Agreement on Social Security between Canada and the Republic of Lithuania is typically filed by individuals who are subject to both Canadian and Lithuanian social security laws. This form is used to certify that the individual is covered under the Canada Pension Plan (CPP) and exempt from paying social security contributions in Lithuania. The form can be filled out in both English and French.

Form CPT144 Certificate of Coverage Under the Cpp Pursuant to Articles 6 to 9 of the Agreement on Social Security Between Canada and the Republic of Lithuania - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is the CPT144 Certificate of Coverage under the CPP?

A: The CPT144 Certificate of Coverage under the CPP stands for Canada Pension Plan. It is a document that provides coverage and exemption from certain social security taxes for individuals who work in both Canada and the Republic of Lithuania.

Q: What is the Agreement on Social Security between Canada and the Republic of Lithuania?

A: The Agreement on Social Security between Canada and the Republic of Lithuania is a treaty that establishes cooperation and coordination in social security between the two countries. It ensures that individuals who have lived or worked in both countries can benefit from the social security systems of both countries.

Q: What are Articles 6 to 9 of the Agreement on Social Security?

A: Articles 6 to 9 of the Agreement on Social Security between Canada and the Republic of Lithuania outline the provisions related to coverage and exemption from social security taxes for individuals who work in both countries. These articles detail the rules and procedures for obtaining the CPT144 Certificate of Coverage under the CPP.

Q: How does the CPT144 Certificate of Coverage under the CPP benefit individuals?

A: The CPT144 Certificate of Coverage under the CPP benefits individuals by providing coverage and exemption from social security taxes in both Canada and the Republic of Lithuania. This means that individuals will not have to pay duplicate social security taxes and can access social security benefits in both countries.

Q: Who is eligible to apply for the CPT144 Certificate of Coverage under the CPP?

A: Individuals who work or have worked in Canada and the Republic of Lithuania may be eligible to apply for the CPT144 Certificate of Coverage under the CPP. The exact eligibility requirements can be found in the Agreement on Social Security between Canada and the Republic of Lithuania.

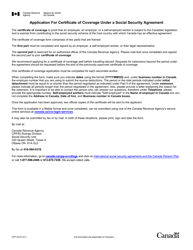

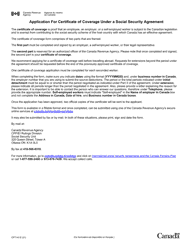

Q: How can individuals apply for the CPT144 Certificate of Coverage under the CPP?

A: Individuals who wish to apply for the CPT144 Certificate of Coverage under the CPP can do so by contacting the relevant social security authorities in Canada or the Republic of Lithuania. These authorities will provide the necessary application forms and guidance on the application process.

Q: Is the CPT144 Certificate of Coverage under the CPP mandatory?

A: The CPT144 Certificate of Coverage under the CPP is not mandatory, but it is highly recommended for individuals who work in both Canada and the Republic of Lithuania. It ensures that individuals are properly covered and exempted from social security taxes in both countries.

Q: How long is the CPT144 Certificate of Coverage under the CPP valid for?

A: The validity period of the CPT144 Certificate of Coverage under the CPP can vary depending on the specific circumstances of the individual. It is recommended to contact the relevant social security authorities in Canada or the Republic of Lithuania for information on the validity period.

Q: Are there any fees associated with the CPT144 Certificate of Coverage under the CPP?

A: There may be administrative fees associated with the application for the CPT144 Certificate of Coverage under the CPP. The exact fees and payment methods will be provided by the relevant social security authorities in Canada or the Republic of Lithuania.

Q: What should individuals do if they have further questions about the CPT144 Certificate of Coverage under the CPP?

A: If individuals have further questions about the CPT144 Certificate of Coverage under the CPP, they can contact the relevant social security authorities in Canada or the Republic of Lithuania. These authorities will be able to provide more information and guidance on the specific situation.