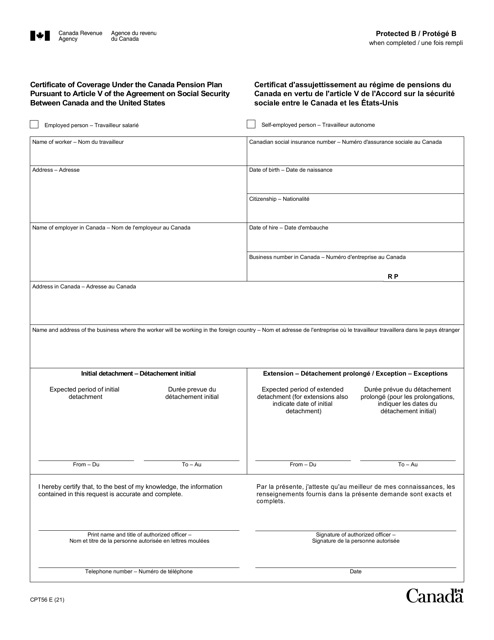

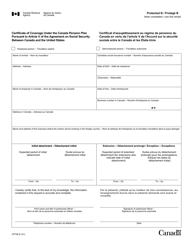

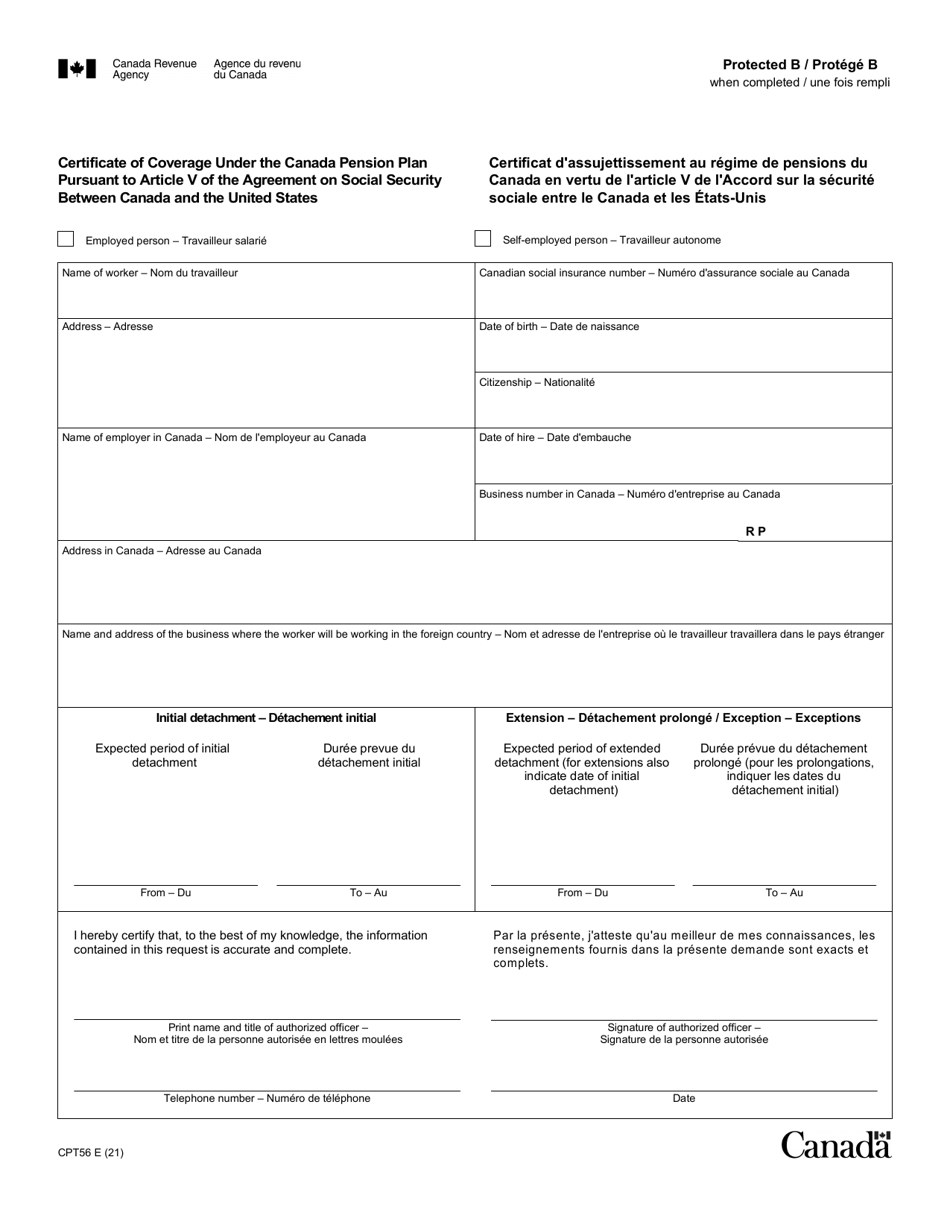

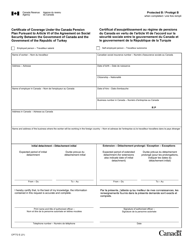

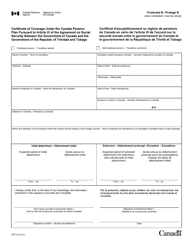

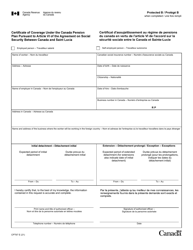

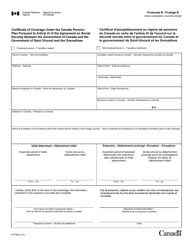

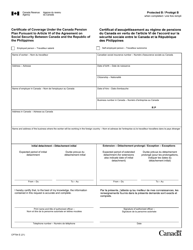

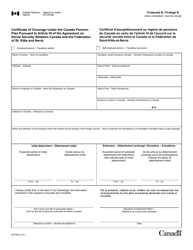

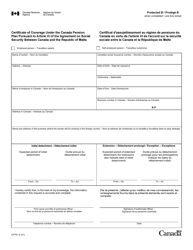

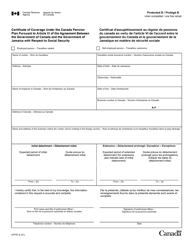

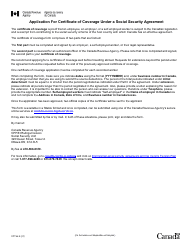

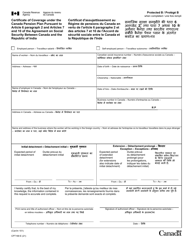

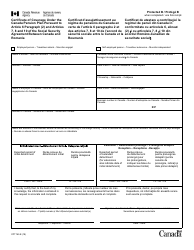

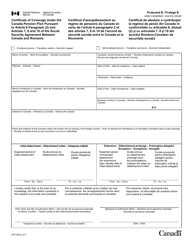

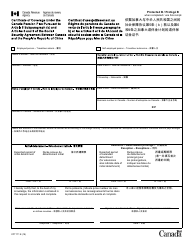

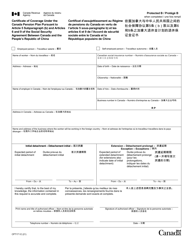

Form CPT56 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article V of the Agreement on Social Security Between Canada and the United States - Canada (English / French)

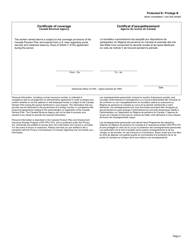

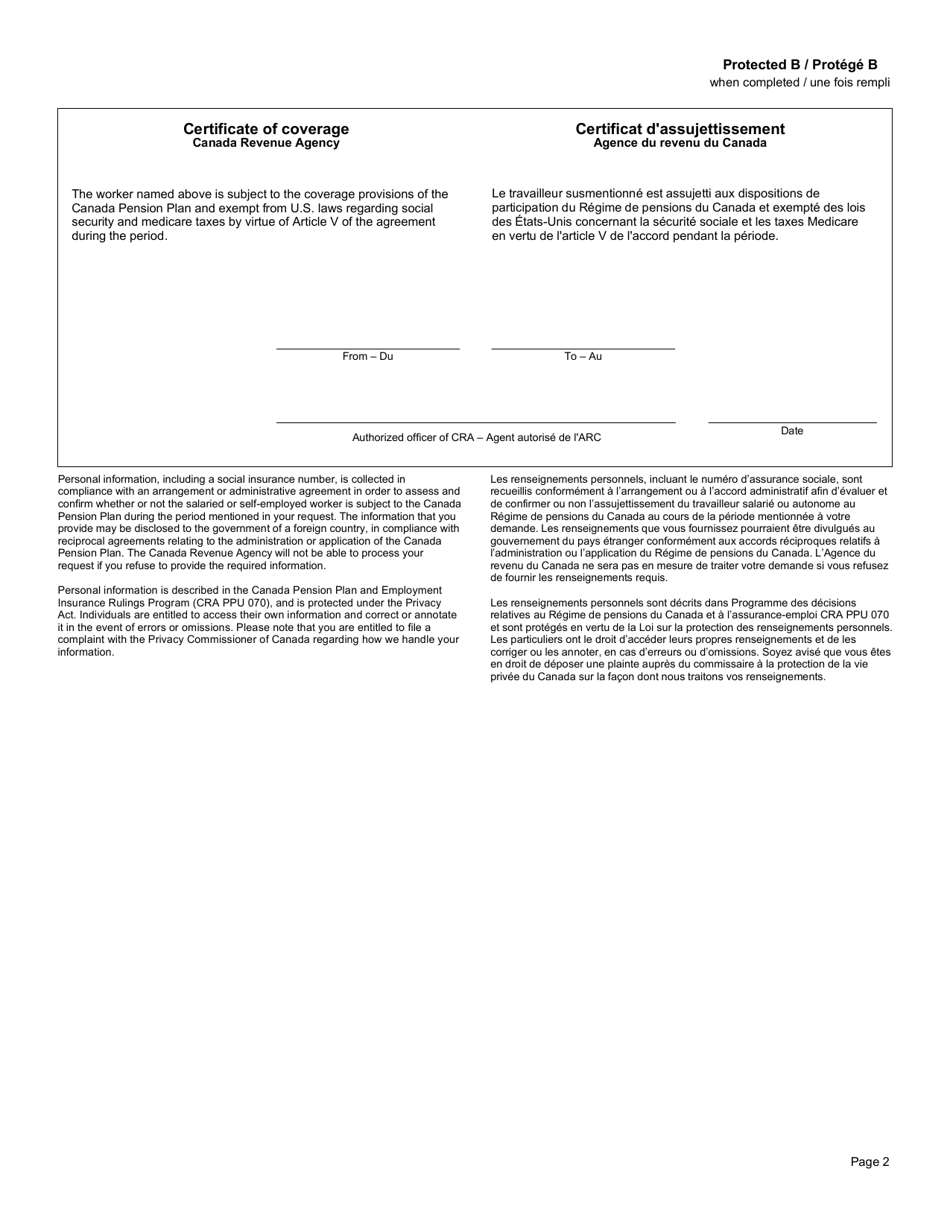

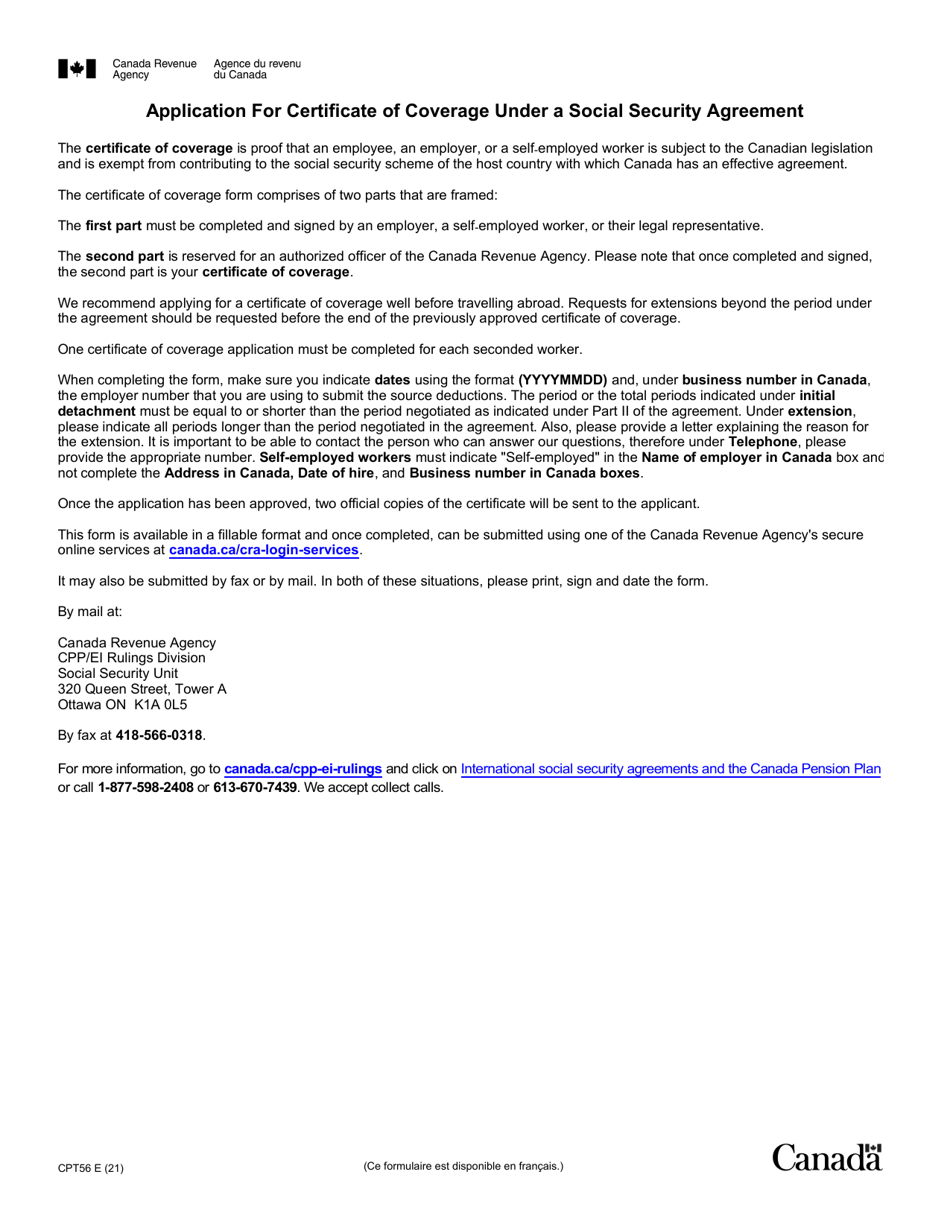

Form CPT56 Certificate of Coverage Under the Canada Pension Plan is used to document an individual's exemption from paying contributions to the Canada Pension Plan while working in the United States, pursuant to the social security agreement between Canada and the United States. This form is important for individuals who are temporarily working in the U.S. and want to avoid paying duplicate social security taxes in both countries.

Form CPT56 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article V of the Agreement on Social Security Between Canada and the United States - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is the Form CPT56?

A: Form CPT56 is a Certificate of Coverage Under the Canada Pension Plan.

Q: What is the purpose of Form CPT56?

A: The purpose of Form CPT56 is to certify coverage under the Canada Pension Plan.

Q: Who is eligible to use Form CPT56?

A: Individuals who are subject to the Canada Pension Plan and covered under the Agreement on Social Security between Canada and the United States are eligible to use Form CPT56.

Q: What is the Agreement on Social Security between Canada and the United States?

A: The Agreement on Social Security is an agreement between Canada and the United States that coordinates the social security programs of both countries.

Q: What information is included in Form CPT56?

A: Form CPT56 includes personal information, employment history, and details about the coverage under the Canada Pension Plan.

Q: Do I need to submit Form CPT56?

A: Yes, if you are subject to the Canada Pension Plan and covered under the Agreement on Social Security between Canada and the United States, you may need to submit Form CPT56 to certify your coverage.

Q: Is Form CPT56 available in both English and French?

A: Yes, Form CPT56 is available in both English and French.

Q: Can I use Form CPT56 for other purposes?

A: No, Form CPT56 is specifically designed for certifying coverage under the Canada Pension Plan.

Q: Is the information on Form CPT56 confidential?

A: Yes, the information on Form CPT56 is confidential and will be used solely for the purpose of administering the Canada Pension Plan and the Agreement on Social Security.