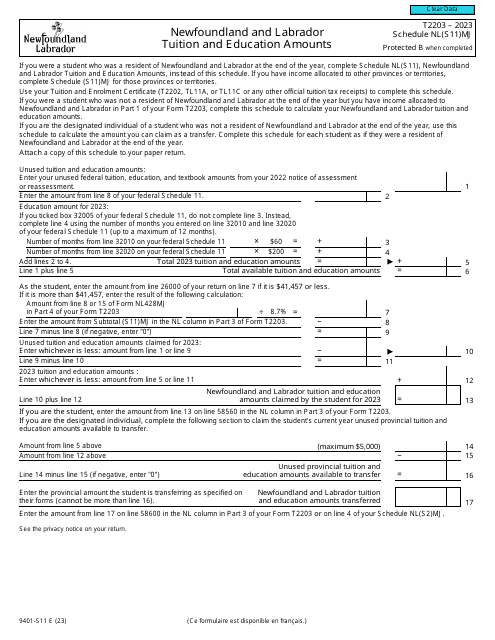

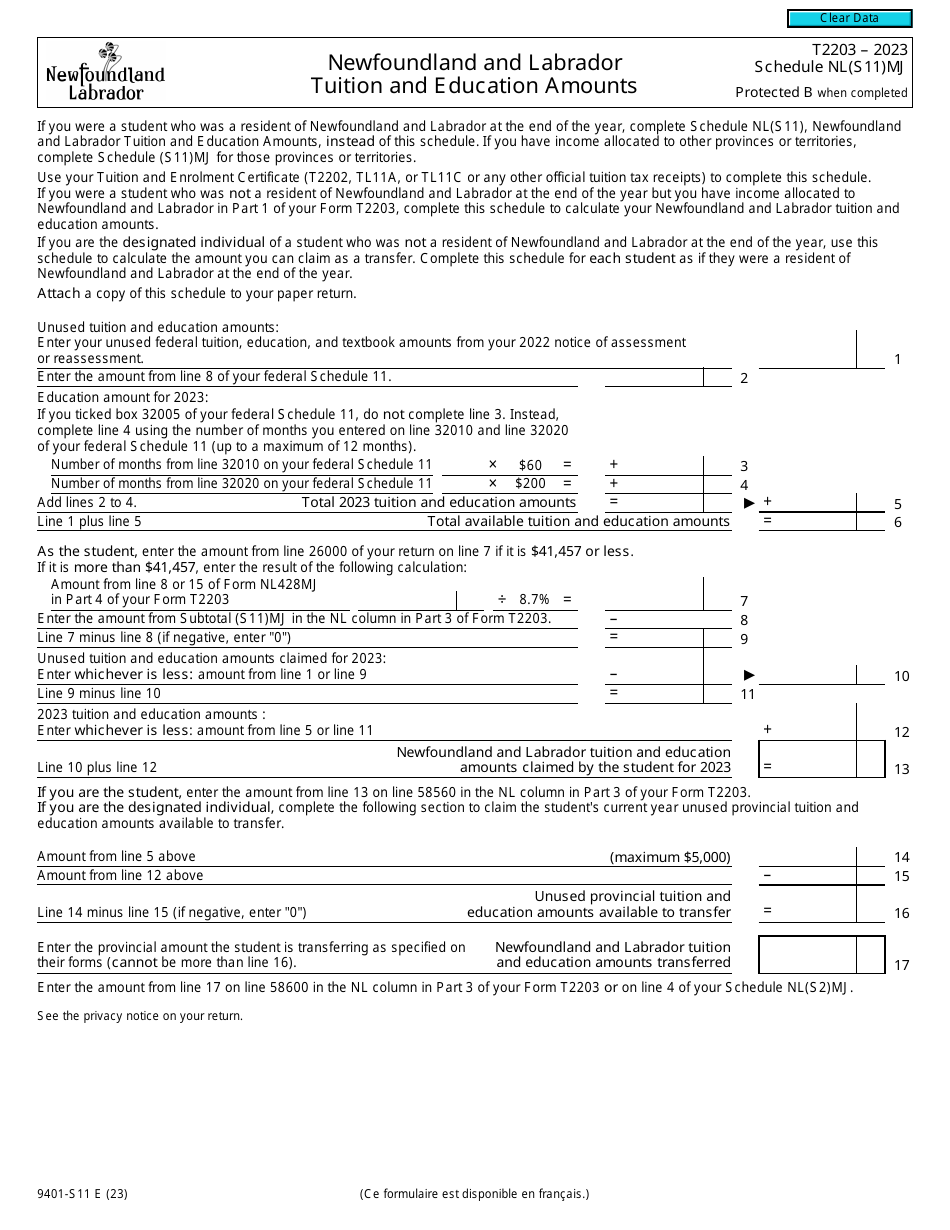

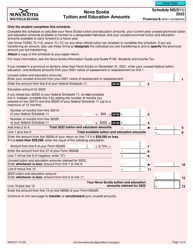

Form T2203 (9401-S11) Schedule NL(S11)MJ Newfoundland and Labrador Tuition and Education Amounts - Canada

Form T2203 (9401-S11) Schedule NL(S11)MJ Newfoundland and Labrador Tuition and Education Amounts is used by residents of Newfoundland and Labrador in Canada to claim tuition and education amounts for provincial tax credits. It is used to calculate the amount of tax credit that can be claimed for eligible education expenses incurred by residents of Newfoundland and Labrador.

The Form T2203 (9401-S11) Schedule NL(S11)MJ Newfoundland and Labrador Tuition and Education Amounts is filed by individuals who are claiming tuition and education amounts in the province of Newfoundland and Labrador, Canada.

Form T2203 (9401-S11) Schedule NL(S11)MJ Newfoundland and Labrador Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada.

Q: What is Schedule NL(S11)MJ?

A: Schedule NL(S11)MJ is a specific schedule within Form T2203.

Q: What are Newfoundland and Labrador Tuition and Education Amounts?

A: Newfoundland and Labrador Tuition and Education Amounts are tax credits and benefits specific to the province of Newfoundland and Labrador.

Q: Who can claim Newfoundland and Labrador Tuition and Education Amounts?

A: Residents of Newfoundland and Labrador who incurred eligible education expenses can claim these amounts.

Q: Do I need to file Form T2203 and Schedule NL(S11)MJ?

A: You only need to file Form T2203 and Schedule NL(S11)MJ if you are a resident of Newfoundland and Labrador and want to claim the provincial Tuition and Education Amounts.

Q: Are there any deadlines for filing Form T2203 and Schedule NL(S11)MJ?

A: The deadlines for filing Form T2203 and Schedule NL(S11)MJ are typically the same as the deadlines for filing your income tax return in Canada.

Q: Can I claim Newfoundland and Labrador Tuition and Education Amounts if I am not a resident of the province?

A: No, these tax credits and benefits are specific to residents of Newfoundland and Labrador.