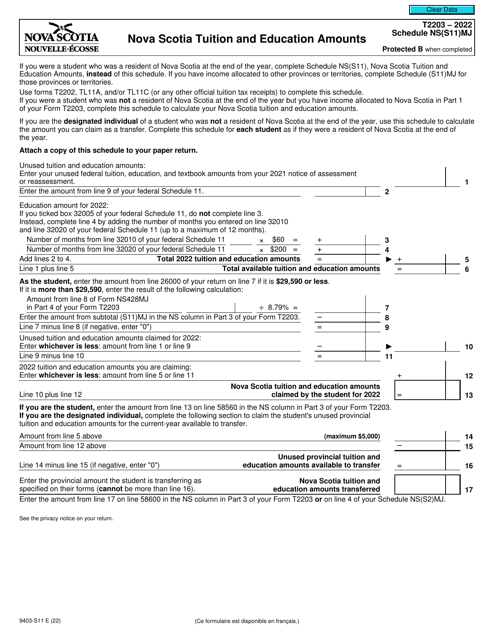

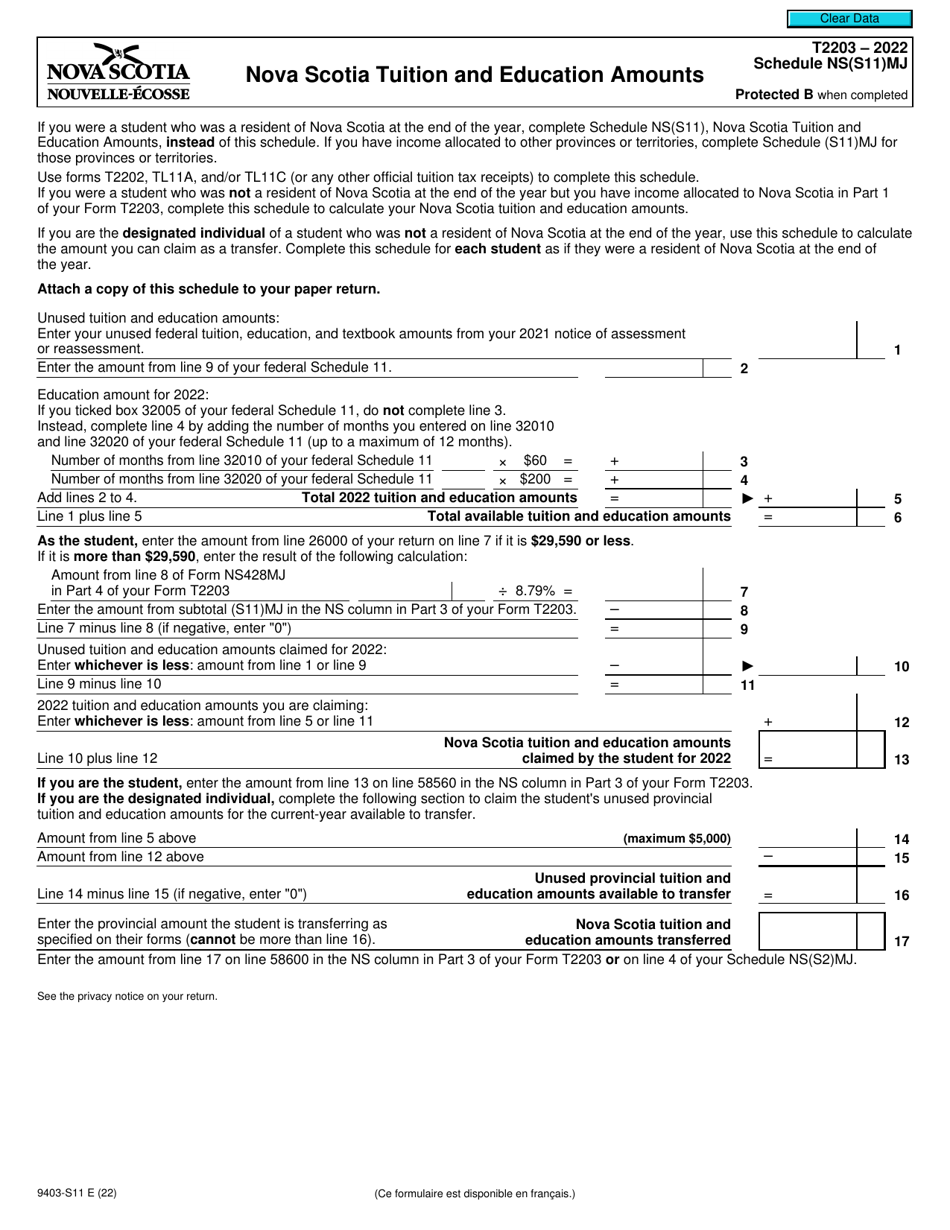

Form T2203 (9403-S11) Schedule NS(S11)MJ Nova Scotia Tuition and Education Amounts - Canada

Form T2203 (9403-S11) Schedule NS(S11)MJ Nova Scotia Tuition and Education Amounts - Canada is used to claim the provincial tuition and education amounts for the province of Nova Scotia. It is for residents of Nova Scotia who have attended a designated post-secondary institution and want to claim the tuition and education amounts on their tax return.

The individual student files the Form T2203 (9403-S11) Schedule NS(S11)MJ Nova Scotia Tuition and Education Amounts in Canada.

Form T2203 (9403-S11) Schedule NS(S11)MJ Nova Scotia Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203 (9403-S11)?

A: Form T2203 (9403-S11) is a schedule used in Canada for claiming Nova Scotia Tuition and Education Amounts.

Q: What is Nova Scotia Tuition and Education Amounts?

A: Nova Scotia Tuition and Education Amounts is a tax credit available to residents of Nova Scotia who have paid fees for post-secondary education.

Q: Who can use Form T2203 (9403-S11)?

A: Residents of Nova Scotia who have paid tuition fees for post-secondary education can use Form T2203 (9403-S11).

Q: What information is required on Form T2203 (9403-S11)?

A: Form T2203 (9403-S11) requires information about the educational institution, the amount of eligible tuition fees paid, and any scholarships or bursaries received.

Q: How do I submit Form T2203 (9403-S11)?

A: Form T2203 (9403-S11) should be completed and submitted with your Canadian income tax return.

Q: Can I claim the Nova Scotia Tuition and Education Amounts if I am not a resident of Nova Scotia?

A: No, the Nova Scotia Tuition and Education Amounts can only be claimed by residents of Nova Scotia.

Q: What other tax credits are available for education expenses in Canada?

A: In addition to the Nova Scotia Tuition and Education Amounts, there are other federal and provincial tax credits available, such as the Canada Education Amount and the Tuition and Education Amounts for other provinces or territories.