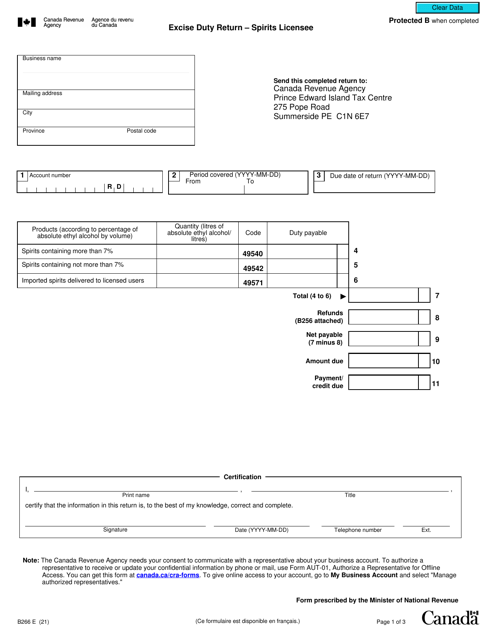

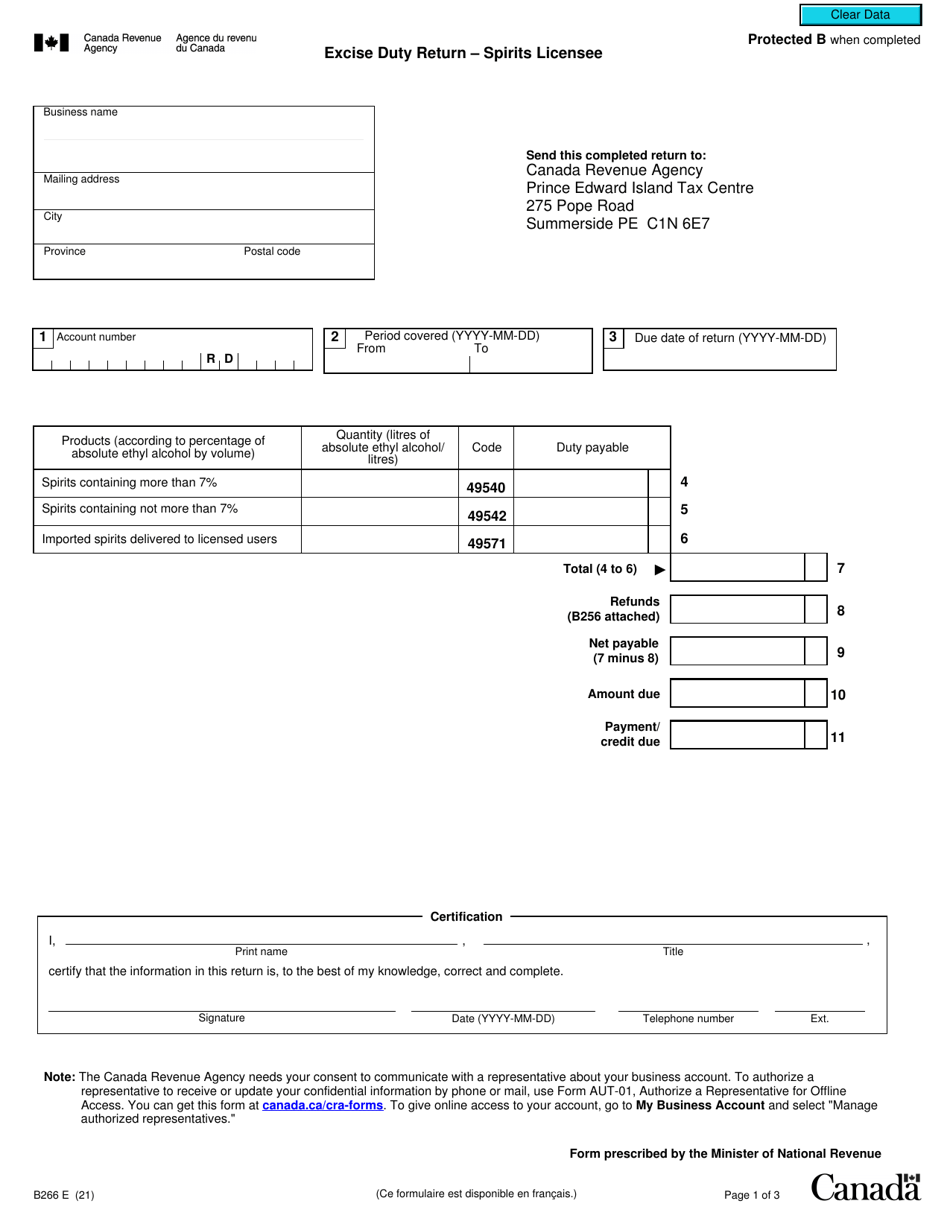

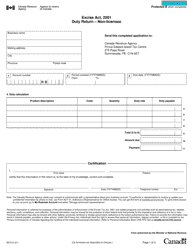

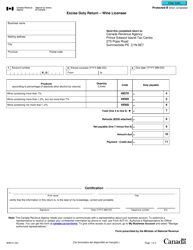

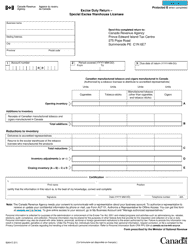

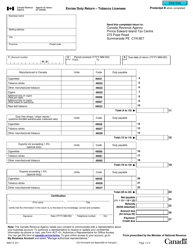

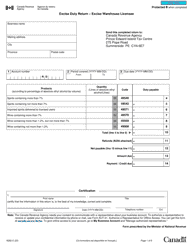

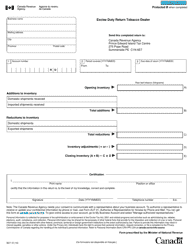

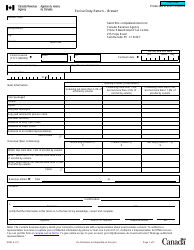

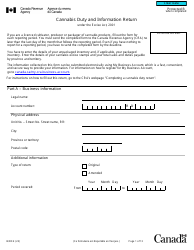

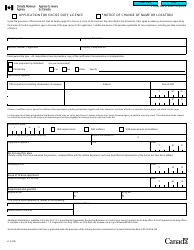

Form B266 Excise Duty Return - Spirits Licensee - Canada

Form B266 Excise Duty Return - Spirits Licensee is used in Canada by businesses that hold a spirits license to report and pay the excise duty on spirits sold or manufactured in the country. It is a way for the Canadian government to monitor and collect taxes on the sale and production of spirits.

The Form B266 Excise Duty Return - Spirits Licensee in Canada is filed by the spirits licensee themselves.

Form B266 Excise Duty Return - Spirits Licensee - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B266?

A: Form B266 is an Excise Duty Return for Spirits Licensees in Canada.

Q: Who is required to file Form B266?

A: Spirits licensees in Canada are required to file Form B266.

Q: What is the purpose of Form B266?

A: The purpose of Form B266 is to report and pay excise duty on spirits produced in Canada or imported for sale in Canada.

Q: How often is Form B266 filed?

A: Form B266 is filed on a monthly basis.

Q: What information is required to complete Form B266?

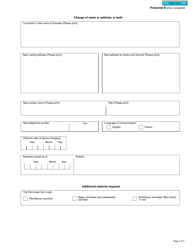

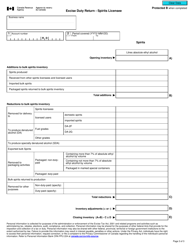

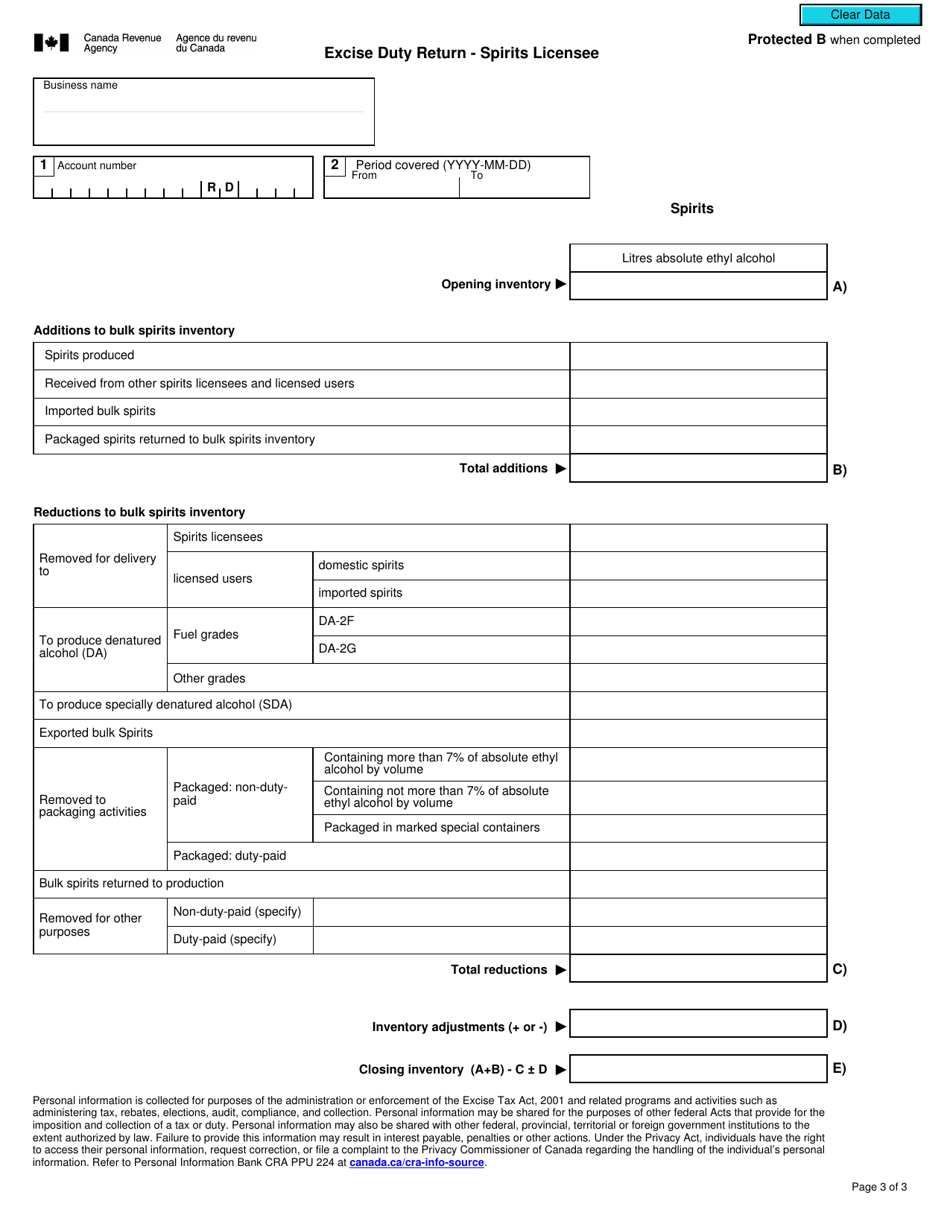

A: Form B266 requires information on the quantity of spirits produced, imported, and sold, as well as the applicable excise duty rates.