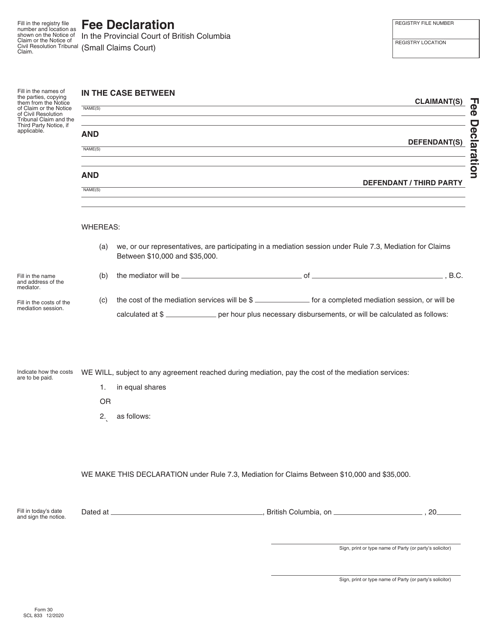

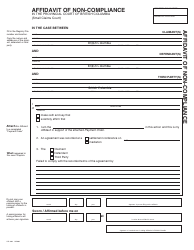

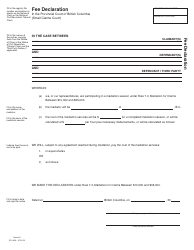

SCR Form 30 (SCL833) Fee Declaration - British Columbia, Canada

The SCR Form 30 (SCL833) Fee Declaration is used in British Columbia, Canada to declare the fees associated with a specific type of application or transaction. It is a document that helps determine and disclose the fees required for the particular process.

The SCR Form 30 (SCL833) Fee Declaration is typically filed by the registered owner of the vehicle in British Columbia, Canada.

SCR Form 30 (SCL833) Fee Declaration - British Columbia, Canada - Frequently Asked Questions (FAQ)

Q: What is SCR Form 30?

A: SCR Form 30 is a Fee Declaration form in British Columbia, Canada.

Q: Who is required to submit SCR Form 30?

A: Individuals in British Columbia, Canada who are applying for a specific license or permit may be required to submit SCR Form 30.

Q: What is the purpose of SCR Form 30?

A: The purpose of SCR Form 30 is to declare the fees associated with the license or permit being applied for.

Q: Are there any fees associated with submitting SCR Form 30?

A: Yes, there may be fees associated with submitting SCR Form 30. The specific amount will depend on the type of license or permit being applied for.

Q: Is SCR Form 30 specific to British Columbia?

A: Yes, SCR Form 30 is specific to British Columbia, Canada.

Q: Can SCR Form 30 be used for any type of license or permit?

A: SCR Form 30 is designed to declare fees for specific licenses or permits in British Columbia, Canada. It may not be applicable to all types of licenses or permits.