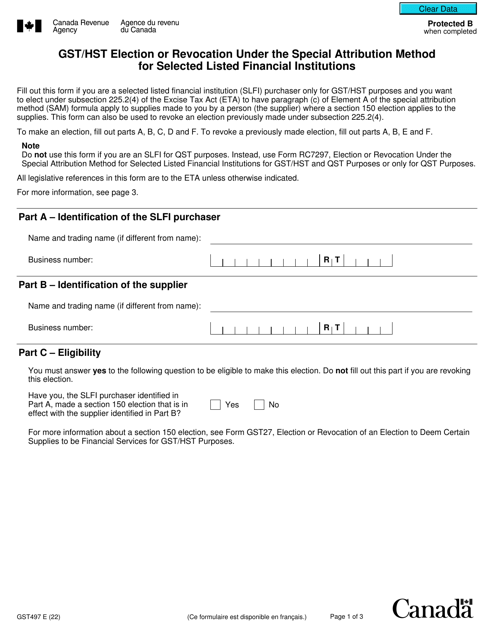

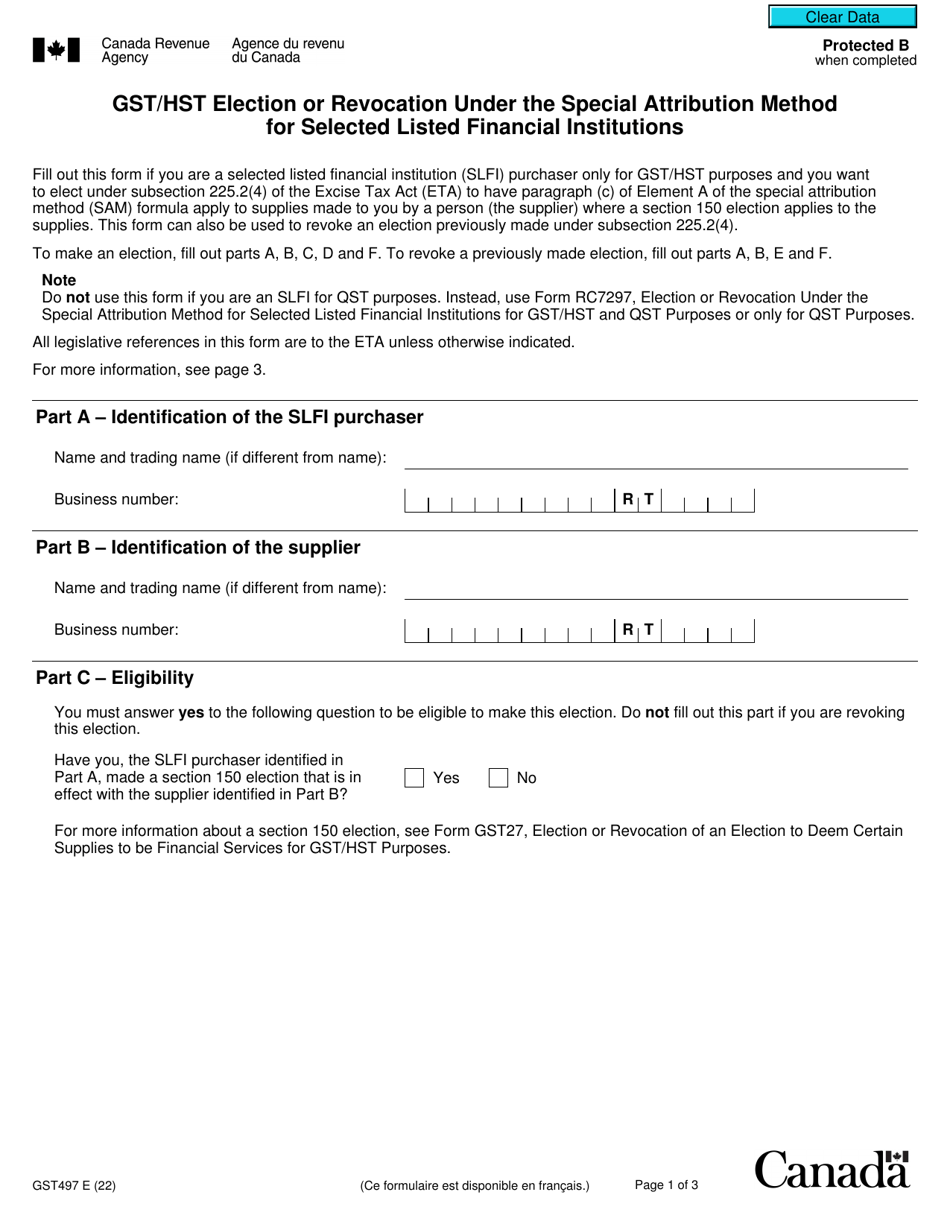

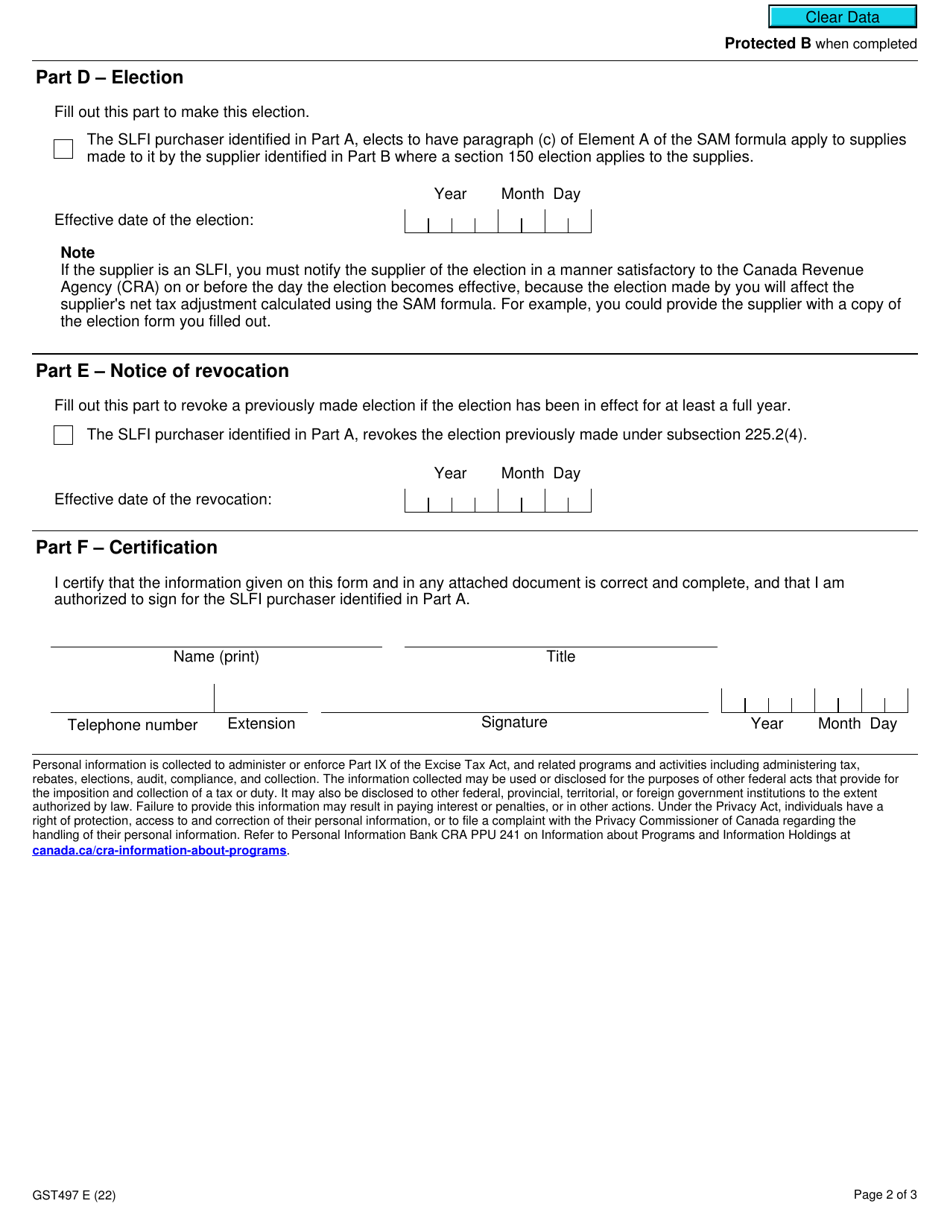

Form GST497 Gst / Hst Election or Revocation Under the Special Attribution Method for Selected Listed Financial Institutions - Canada

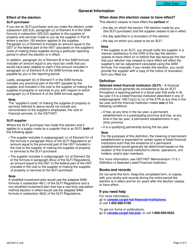

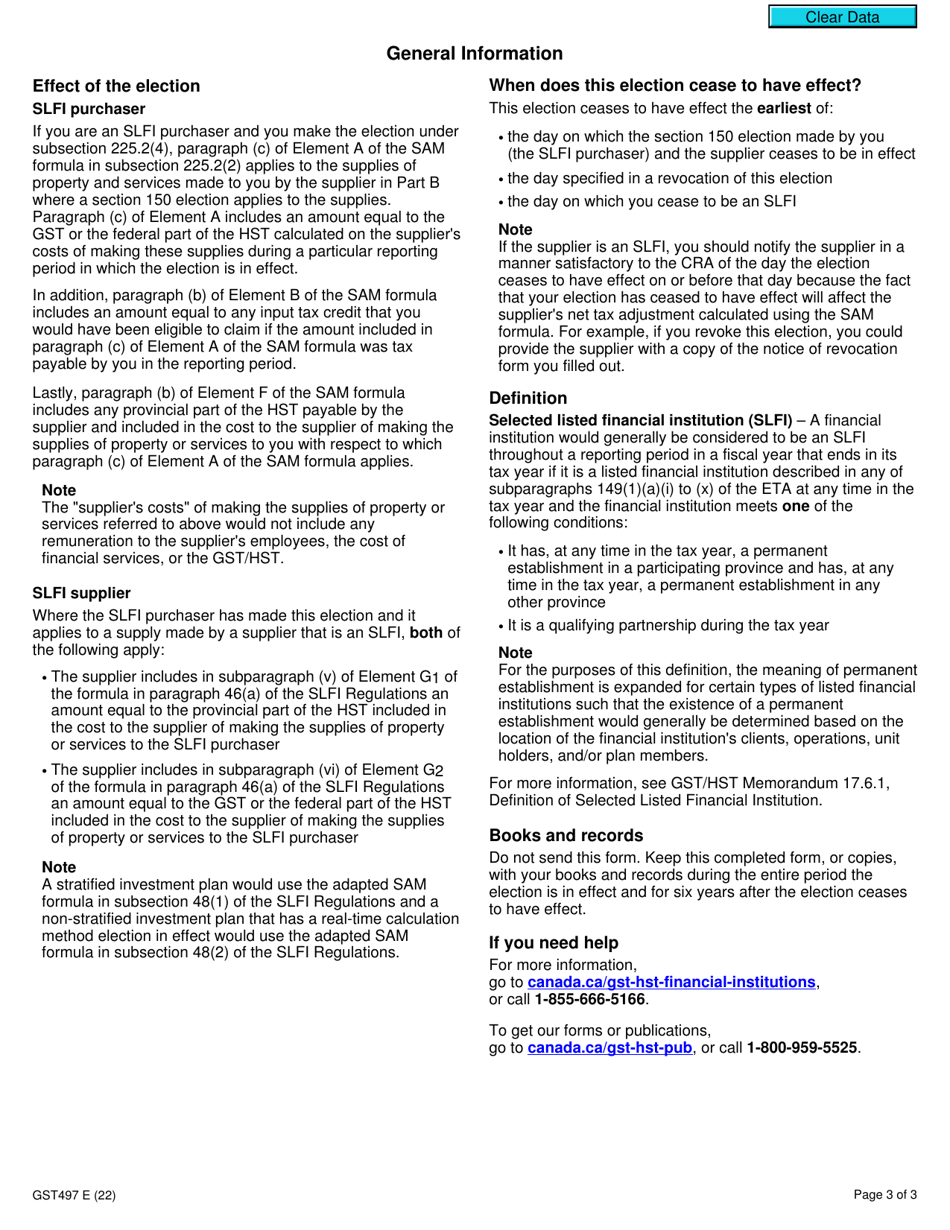

Form GST497 GST/HST Election or Revocation Under the Special Attribution Method for Selected Listed Financial Institutions is used in Canada for making an election or revocation of the special attribution method under the Goods and Services Tax/Harmonized Sales Tax (GST/HST) rules for certain financial institutions. This method allows these institutions to calculate the GST/HST on certain taxable supplies using a special formula, rather than the standard GST/HST rate.

The selected listed financial institutions in Canada file the Form GST497 for GST/HST election or revocation under the special attribution method.

Form GST497 Gst/Hst Election or Revocation Under the Special Attribution Method for Selected Listed Financial Institutions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST497?

A: Form GST497 is a form used in Canada by selected listed financial institutions to elect or revoke the Special Attribution Method for the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

Q: Who uses Form GST497?

A: Selected listed financial institutions in Canada use Form GST497.

Q: What is the Special Attribution Method?

A: The Special Attribution Method is a method used in Canada for determining the GST or HST that applies to financial services provided by selected listed financial institutions.

Q: How do I elect or revoke the Special Attribution Method?

A: You can elect or revoke the Special Attribution Method by completing and filing Form GST497 with the Canada Revenue Agency (CRA).

Q: What is the purpose of the Special Attribution Method?

A: The purpose of the Special Attribution Method is to simplify the calculation of GST or HST for selected listed financial institutions by attributing the tax to various supplies of financial services.

Q: Are there any fees associated with filing Form GST497?

A: No, there are no fees associated with filing Form GST497.

Q: What happens after I file Form GST497?

A: After you file Form GST497, the Canada Revenue Agency (CRA) will review your form and notify you of the acceptance or rejection of your election or revocation.