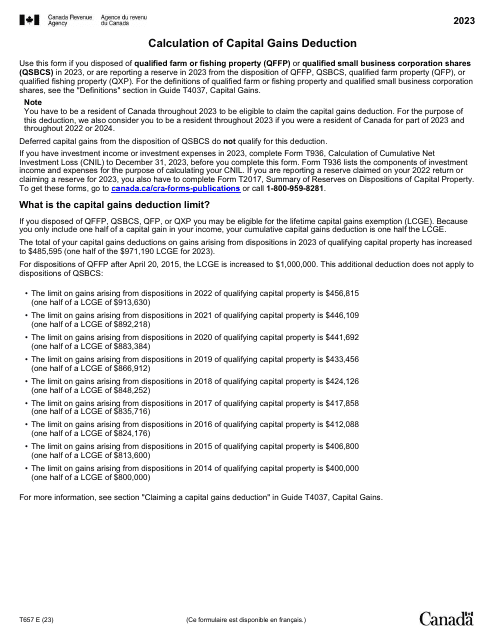

Form T657 Calculation of Capital Gains Deduction - Canada

Form T657 Calculation of Capital Gains Deduction in Canada is used to calculate the capital gains deduction that individuals can claim on the sale of qualifying small business shares or farm or fishing property. The deduction helps reduce the taxable amount of capital gains.

In Canada, individuals who want to claim the capital gains deduction on their tax return are required to file Form T657.

Form T657 Calculation of Capital Gains Deduction - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T657?

A: Form T657 is a form used in Canada to calculate the capital gains deduction.

Q: What is the capital gains deduction?

A: The capital gains deduction is a tax benefit available to Canadian residents on the sale of certain qualified small business shares or qualified farm or fishing property.

Q: Who can claim the capital gains deduction?

A: Canadian residents who meet certain criteria and have disposed of eligible property may be eligible to claim the capital gains deduction.

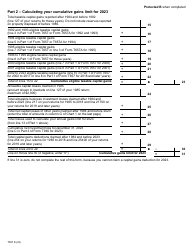

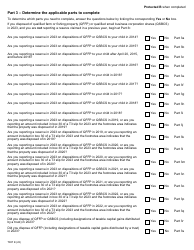

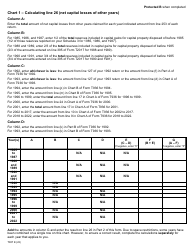

Q: How is the capital gains deduction calculated?

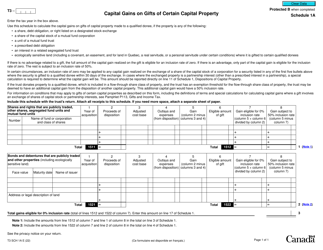

A: The capital gains deduction is calculated using Form T657, where you enter information about the sale of eligible property and determine the allowable amount of the deduction.

Q: What information is required to complete Form T657?

A: To complete Form T657, you will need information about the sale of eligible property, including the proceeds of disposition, the adjusted cost base, and any other related expenses.

Q: Are there any limits to the capital gains deduction?

A: Yes, there are limits to the capital gains deduction. The deduction amount is subject to a lifetime limit, which is adjusted annually. It is important to consult the latest tax regulations or a tax professional for specific details.

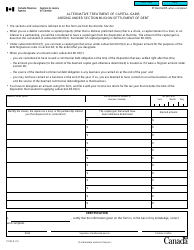

Q: Can I claim the capital gains deduction on multiple properties?

A: Yes, you can claim the capital gains deduction on multiple properties as long as they meet the eligibility criteria.

Q: Do I need to include Form T657 with my tax return?

A: Yes, if you are claiming the capital gains deduction, you should include Form T657 with your tax return to report the calculation of the deduction.

Q: Can I get assistance in completing Form T657?

A: If you require assistance in completing Form T657 or have questions about the capital gains deduction, it is recommended to consult a tax professional or contact the Canada Revenue Agency for guidance.