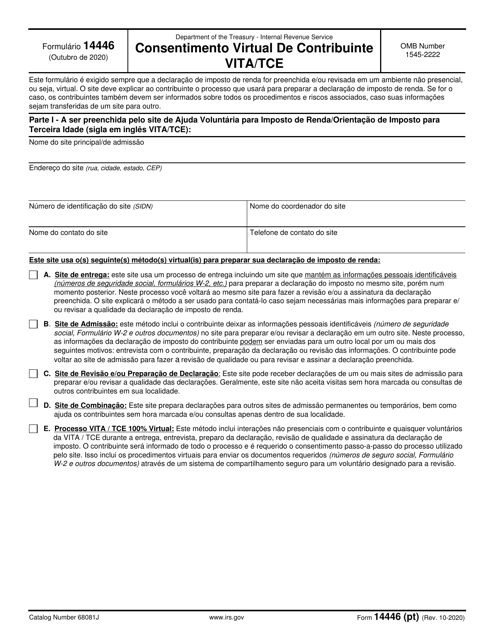

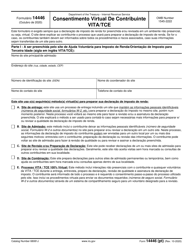

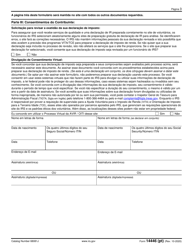

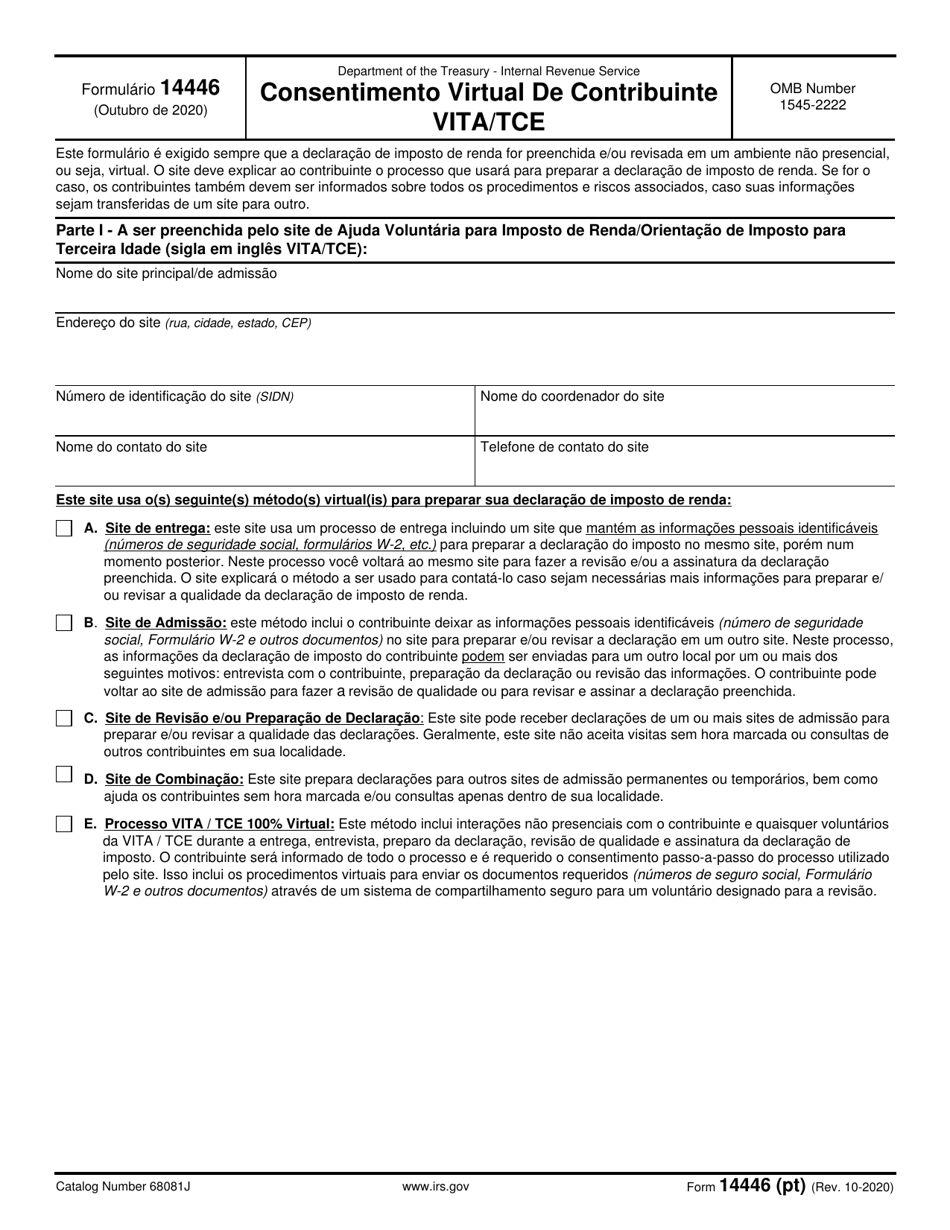

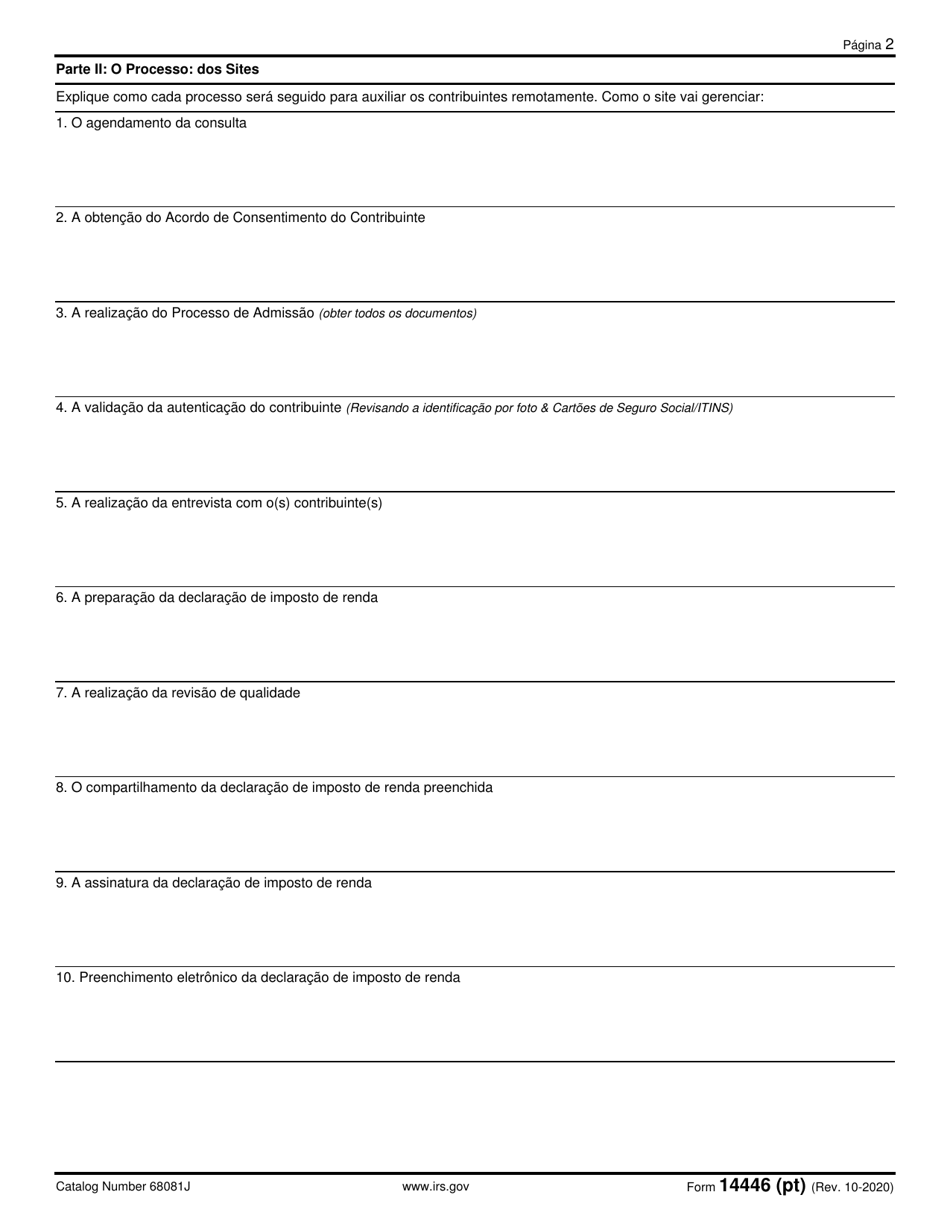

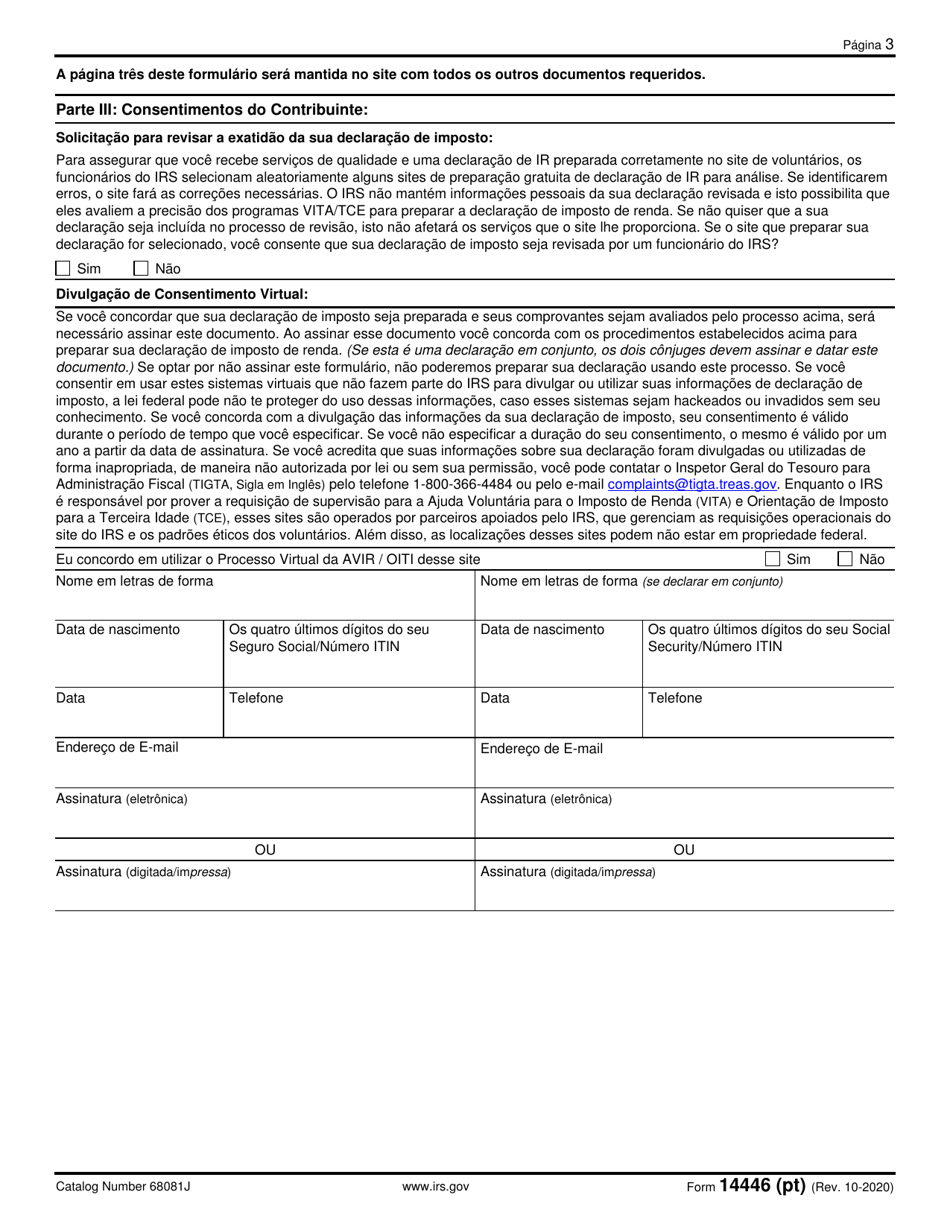

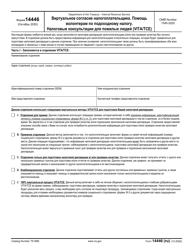

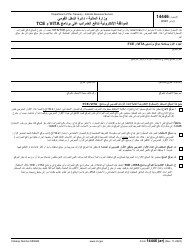

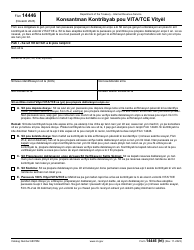

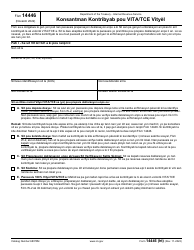

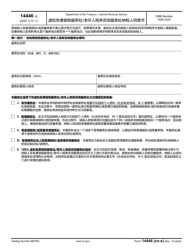

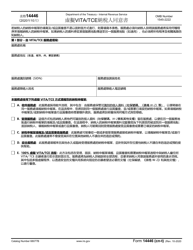

IRS Form 14446(PT) Virtual Vita / Tce Taxpayer Consent (Portuguese)

IRS Form 14446(PT) Virtual Vita/Tce Taxpayer Consent (Portuguese) - Frequently Asked Questions (FAQ)

Q: What is IRS Form 14446(PT)?

A: IRS Form 14446(PT) is a taxpayer consent form for the Virtual Vita/Tce program.

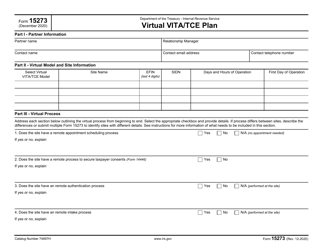

Q: What is the Virtual Vita/Tce program?

A: The Virtual Vita/Tce program provides free tax preparation assistance to taxpayers.

Q: What is the purpose of IRS Form 14446(PT)?

A: The purpose of IRS Form 14446(PT) is to obtain taxpayer consent for the use of their tax information in the Virtual Vita/Tce program.

Q: Is IRS Form 14446(PT) available in Portuguese?

A: Yes, IRS Form 14446(PT) is available in Portuguese.

Q: Do I need to fill out IRS Form 14446(PT) if I want to participate in the Virtual Vita/Tce program?

A: Yes, you need to fill out IRS Form 14446(PT) in order to participate in the Virtual Vita/Tce program.

Q: Is Virtual Vita/Tce available in Portuguese?

A: Yes, Virtual Vita/Tce is available in Portuguese as part of the program's language options.

Q: Is there any cost associated with participating in the Virtual Vita/Tce program?

A: No, the Virtual Vita/Tce program provides free tax preparation assistance to eligible taxpayers.