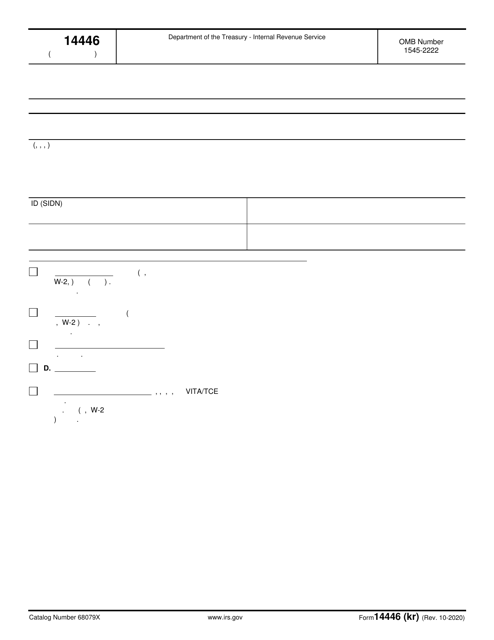

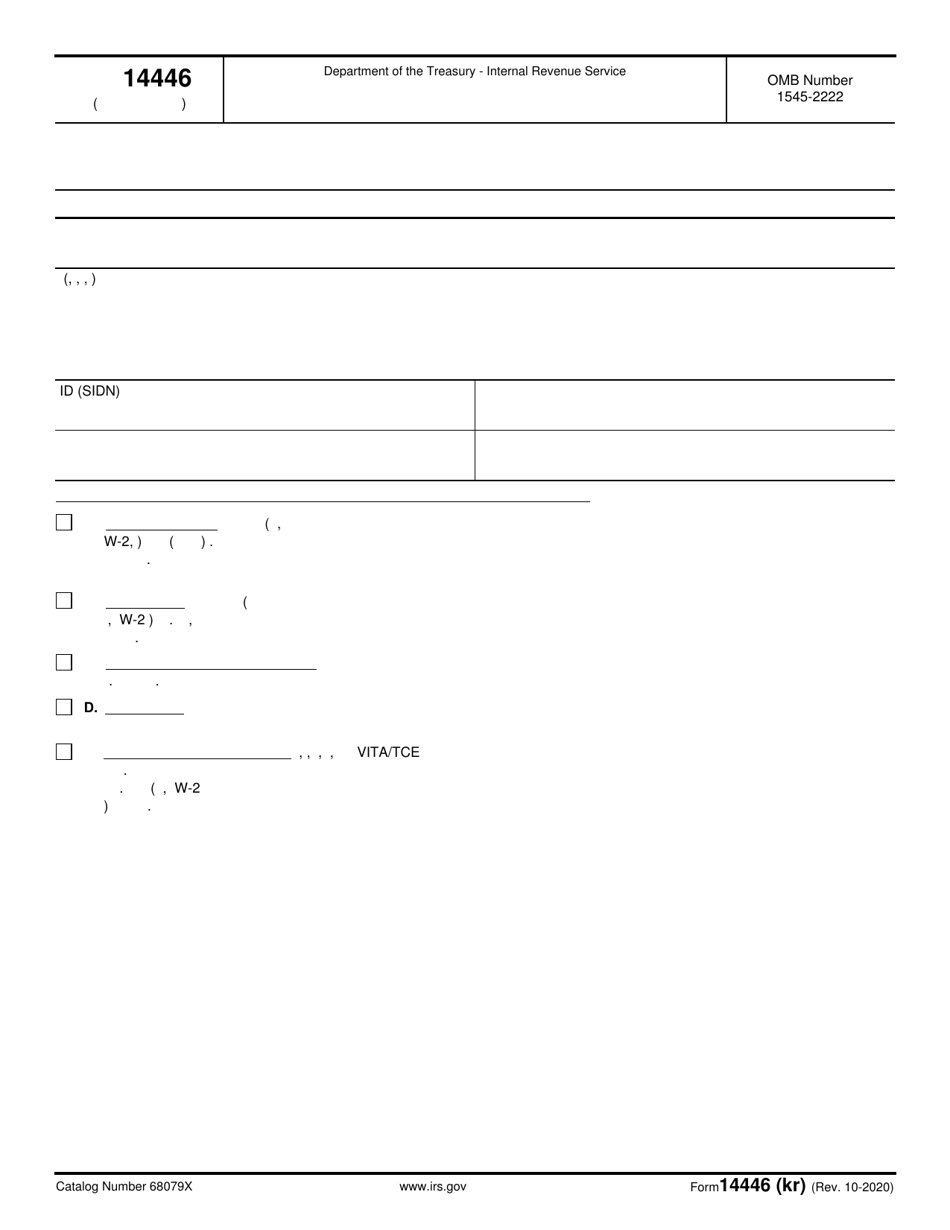

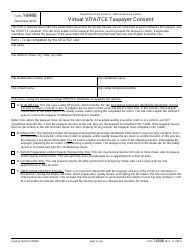

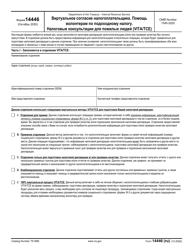

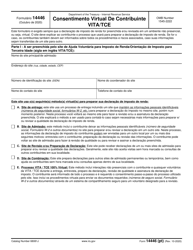

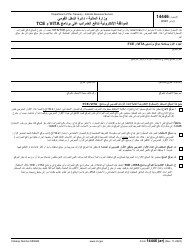

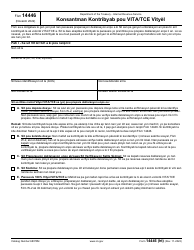

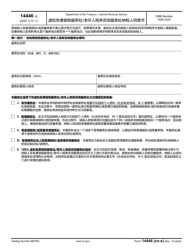

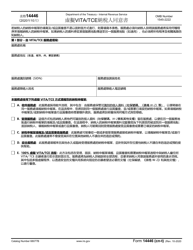

IRS Form 14446 (KR) Virtual Vita / Tce Taxpayer Consent (Korean)

The IRS Form 14446 (KR) Virtual Vita/Tce Taxpayer Consent (Korean) is filed by the taxpayer.

IRS Form 14446 (KR) Virtual Vita/Tce Taxpayer Consent (Korean) - Frequently Asked Questions (FAQ)

Q: What is IRS Form 14446?

A: IRS Form 14446 is a consent form for taxpayers participating in the Virtual VITA/TCE program.

Q: What does IRS Form 14446 (KR) refer to?

A: IRS Form 14446 (KR) specifically refers to the Korean version of the consent form.

Q: What is the purpose of IRS Form 14446?

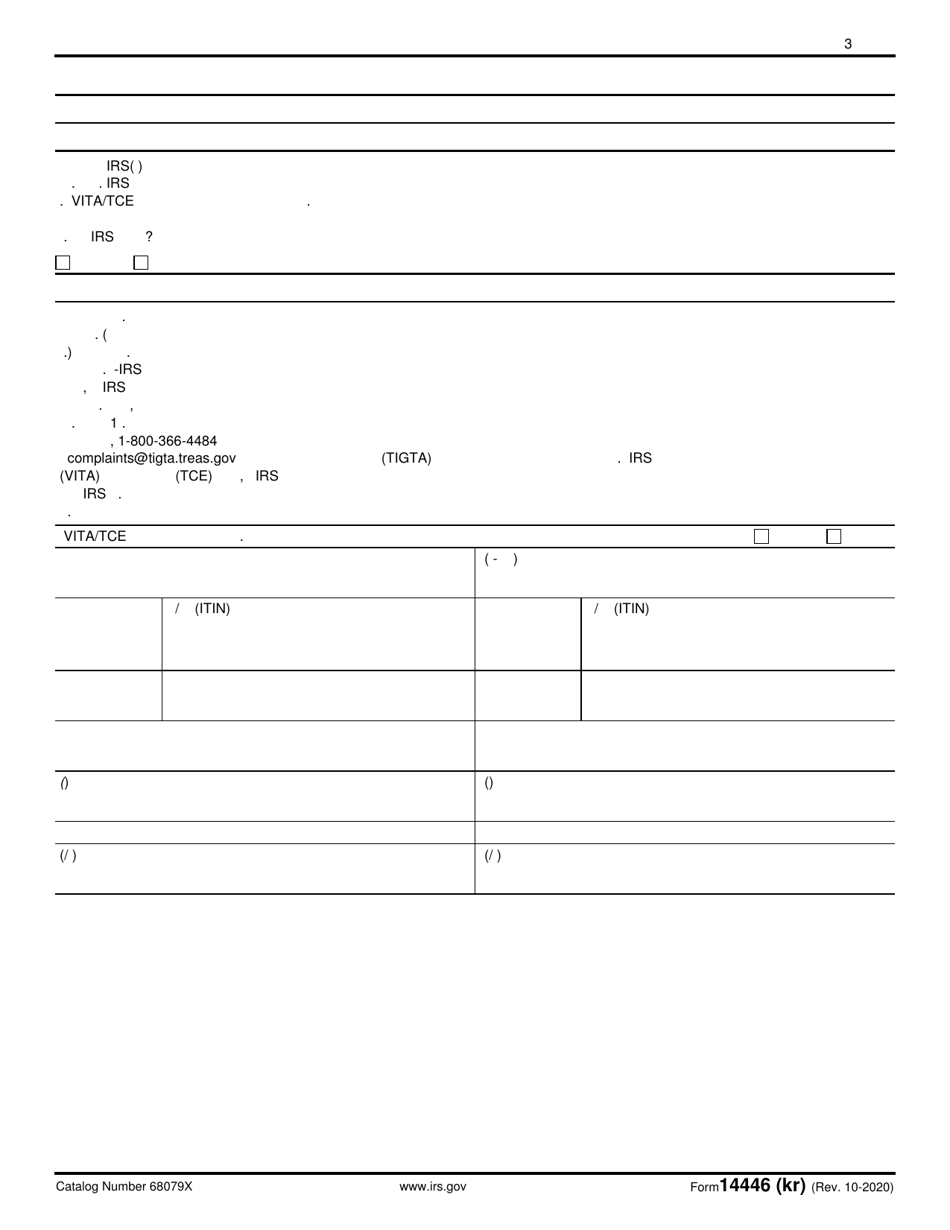

A: The purpose of IRS Form 14446 is to obtain the taxpayer's consent to participate in the Virtual VITA/TCE program and allow the IRS to electronically process their tax return.

Q: Who should use IRS Form 14446?

A: Taxpayers who are participating in the Virtual VITA/TCE program and speak Korean can use IRS Form 14446 (KR) to provide their consent.

Q: Is IRS Form 14446 mandatory?

A: Participation in the Virtual VITA/TCE program is voluntary, so filling out IRS Form 14446 is not mandatory.

Q: Is IRS Form 14446 available in languages other than Korean?

A: Yes, IRS Form 14446 is available in multiple languages to cater to taxpayers who are more comfortable in languages other than English.

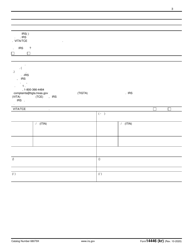

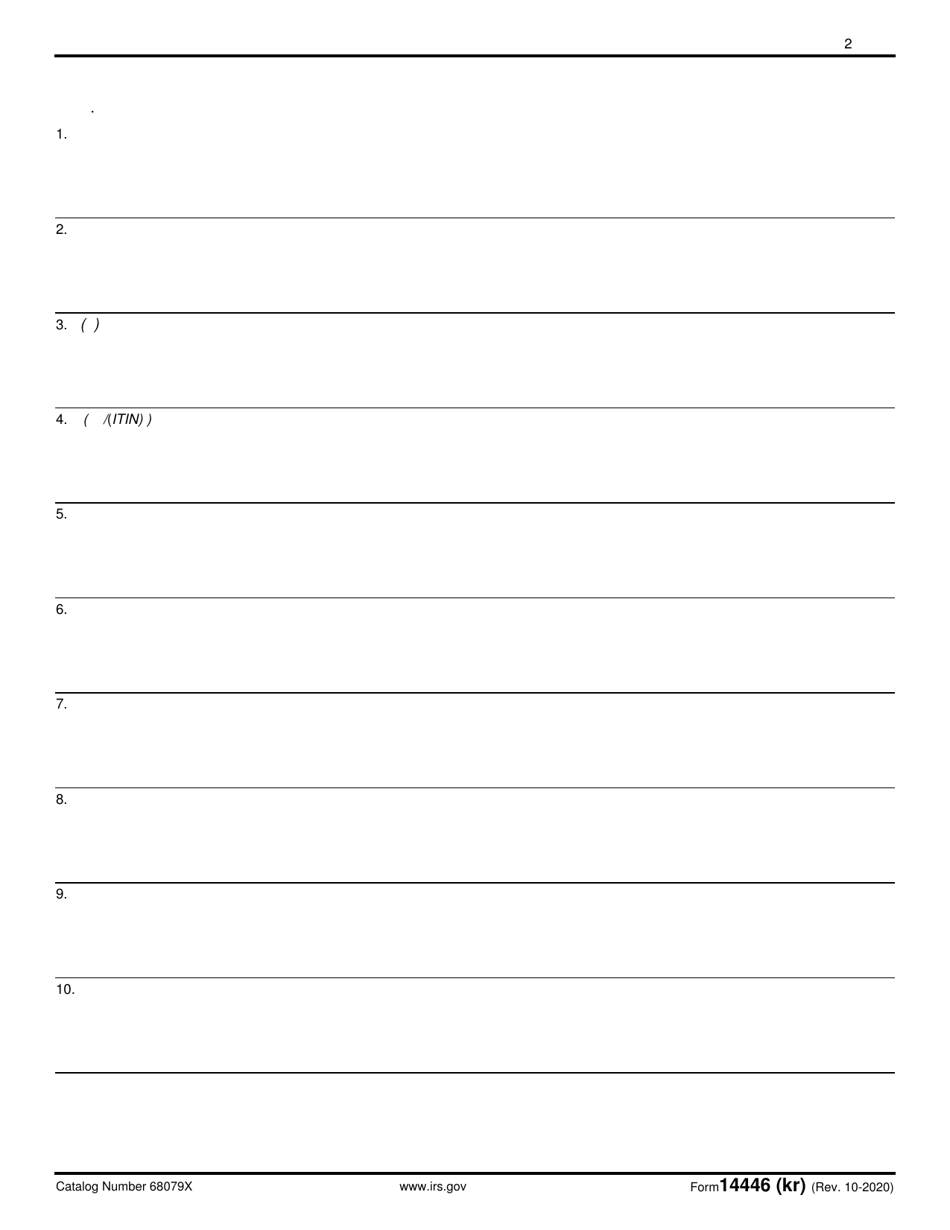

Q: Can I electronically sign IRS Form 14446 (KR)?

A: Yes, you can electronically sign IRS Form 14446 (KR) using a secure electronic signature method specified by the IRS.

Q: Is there a deadline for submitting IRS Form 14446 (KR)?

A: There is no specific deadline for submitting IRS Form 14446 (KR), but it is recommended to submit it before the tax filing deadline to ensure timely processing of your return.

Q: Can I make changes to IRS Form 14446 (KR) after submitting it?

A: Once you have submitted IRS Form 14446 (KR), you cannot make changes to it. Make sure to review the form carefully before submitting.