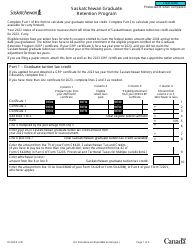

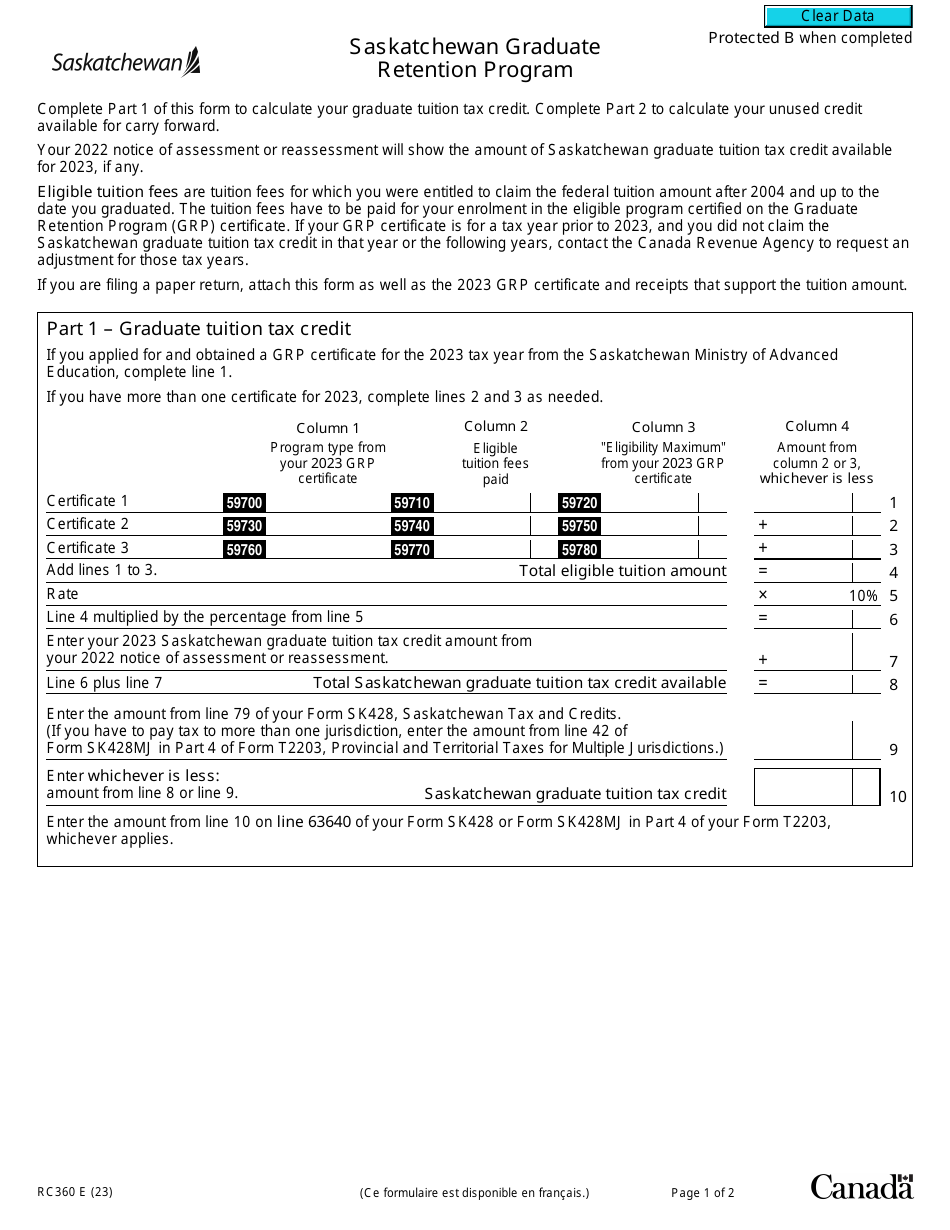

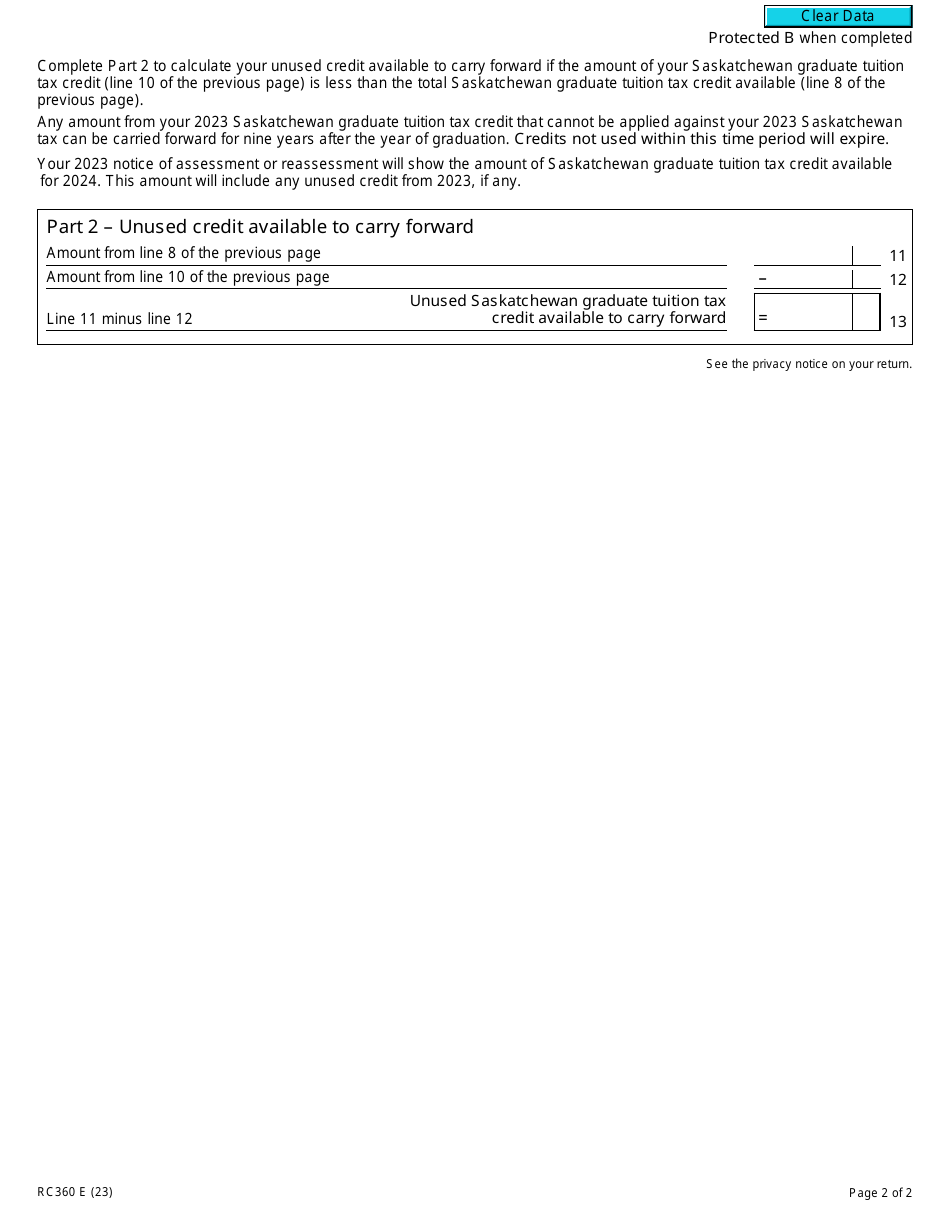

Form RC360 Saskatchewan Graduate Retention Program - Canada

Form RC360 is a tax form used in Saskatchewan, Canada for the Graduate Retention Program. This program provides tax credits to encourage recent graduates to stay and work in Saskatchewan after completing their post-secondary education.

The Form RC360 for the Saskatchewan Graduate Retention Program in Canada is typically filed by the individual who is applying for the program.

Form RC360 Saskatchewan Graduate Retention Program - Canada - Frequently Asked Questions (FAQ)

Q: What is the RC360 Saskatchewan Graduate Retention Program?

A: The RC360 Saskatchewan Graduate Retention Program is a program in Canada that provides tax credits to graduates of eligible educational institutions in Saskatchewan.

Q: Who is eligible for the RC360 Saskatchewan Graduate Retention Program?

A: Graduates who have completed their studies at eligible post-secondary institutions in Saskatchewan are generally eligible for the RC360 Saskatchewan Graduate Retention Program.

Q: How does the RC360 Saskatchewan Graduate Retention Program work?

A: Under the program, eligible graduates may receive a tax credit of up to $20,000 over a period of 7 years, based on their tuition fees and education amount.

Q: What can the tax credits from the RC360 Saskatchewan Graduate Retention Program be used for?

A: The tax credits received through the RC360 Saskatchewan Graduate Retention Program can be used towards paying taxes owed in Saskatchewan.

Q: How can I apply for the RC360 Saskatchewan Graduate Retention Program?

A: To apply for the RC360 Saskatchewan Graduate Retention Program, you can complete and submit Form RC360 to the Canada Revenue Agency (CRA).