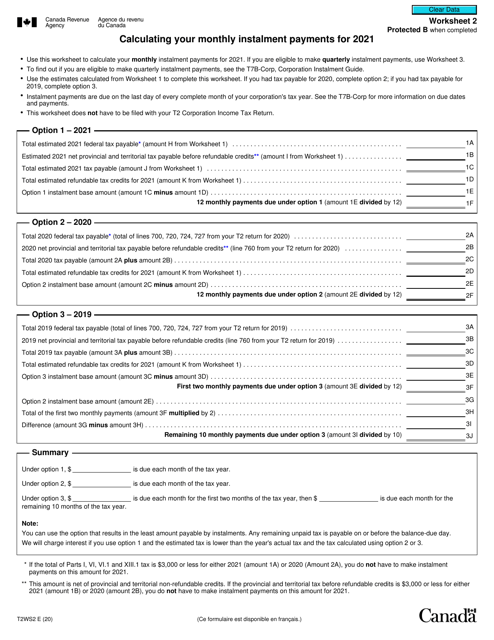

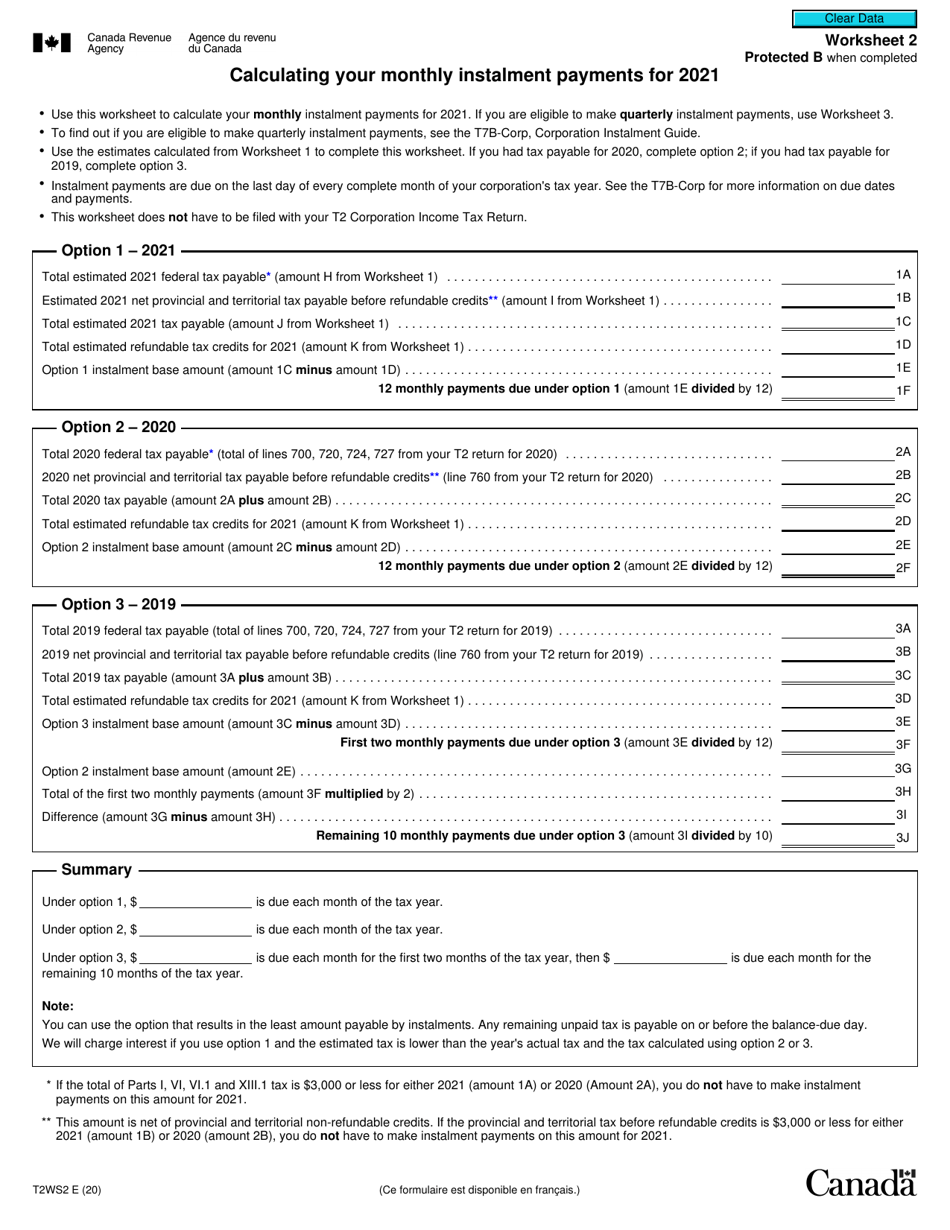

Form T2 Worksheet 2 Calculating Your Monthly Instalment Payments - Canada

Form T2 Worksheet 2 is used by Canadian individuals to calculate their monthly installment payments for income tax purposes. It helps taxpayers estimate the amount they need to pay each month towards their income tax liability.

The Form T2 Worksheet 2 for calculating monthly installment payments in Canada is typically filed by corporations or businesses that are subject to Canadian corporate income tax.

Form T2 Worksheet 2 Calculating Your Monthly Instalment Payments - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Worksheet 2?

A: Form T2 Worksheet 2 is a form used in Canada to calculate monthly installment payments.

Q: What does Form T2 Worksheet 2 calculate?

A: Form T2 Worksheet 2 calculates monthly installment payments.

Q: Why would I need to calculate monthly installment payments?

A: Calculating monthly installment payments is important for budgeting and managing your finances.

Q: How do I use Form T2 Worksheet 2?

A: To use Form T2 Worksheet 2, you need to input the required information as indicated on the form, such as the loan amount and interest rate.

Q: Is Form T2 Worksheet 2 applicable in the United States?

A: No, Form T2 Worksheet 2 is specifically used in Canada.

Q: Can I use Form T2 Worksheet 2 for personal loans?

A: Form T2 Worksheet 2 can be used for personal loans, as well as other types of loans.

Q: What should I do if I have questions about Form T2 Worksheet 2?

A: If you have questions about Form T2 Worksheet 2, you can contact the Canada Revenue Agency (CRA) for assistance.

Q: Are there any other forms I need to complete in addition to Form T2 Worksheet 2?

A: Depending on your financial situation, you may need to complete other forms in addition to Form T2 Worksheet 2. It is best to consult with a tax professional or the Canada Revenue Agency (CRA) for specific guidance.

Q: Can Form T2 Worksheet 2 help me calculate mortgage payments?

A: Yes, Form T2 Worksheet 2 can be used to calculate mortgage payments, as long as you input the correct information relating to your mortgage loan.