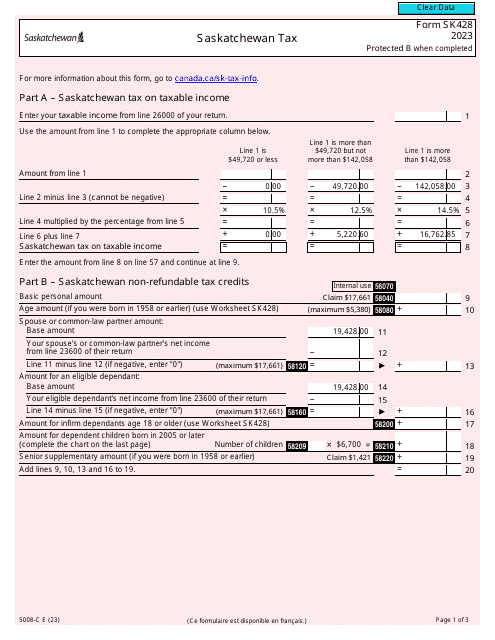

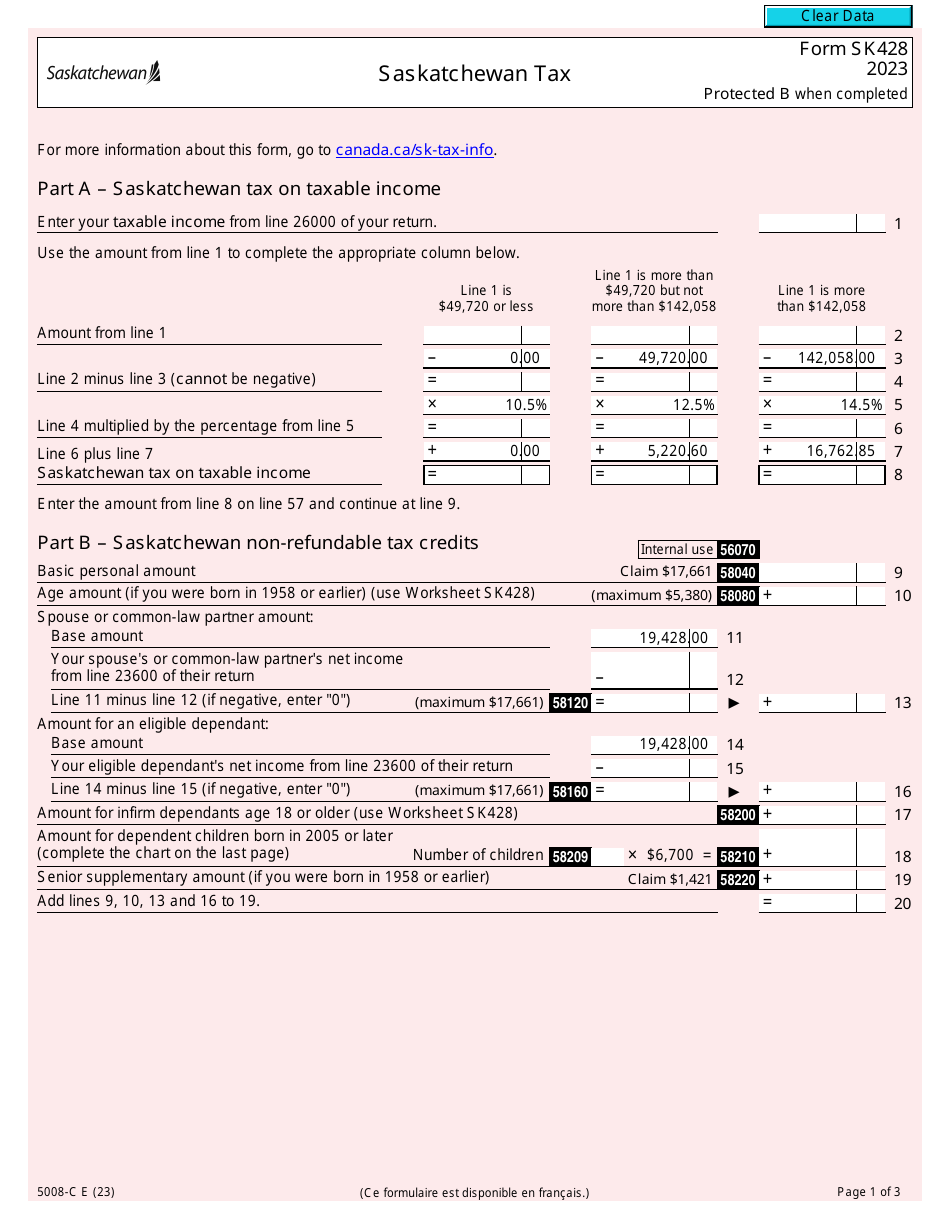

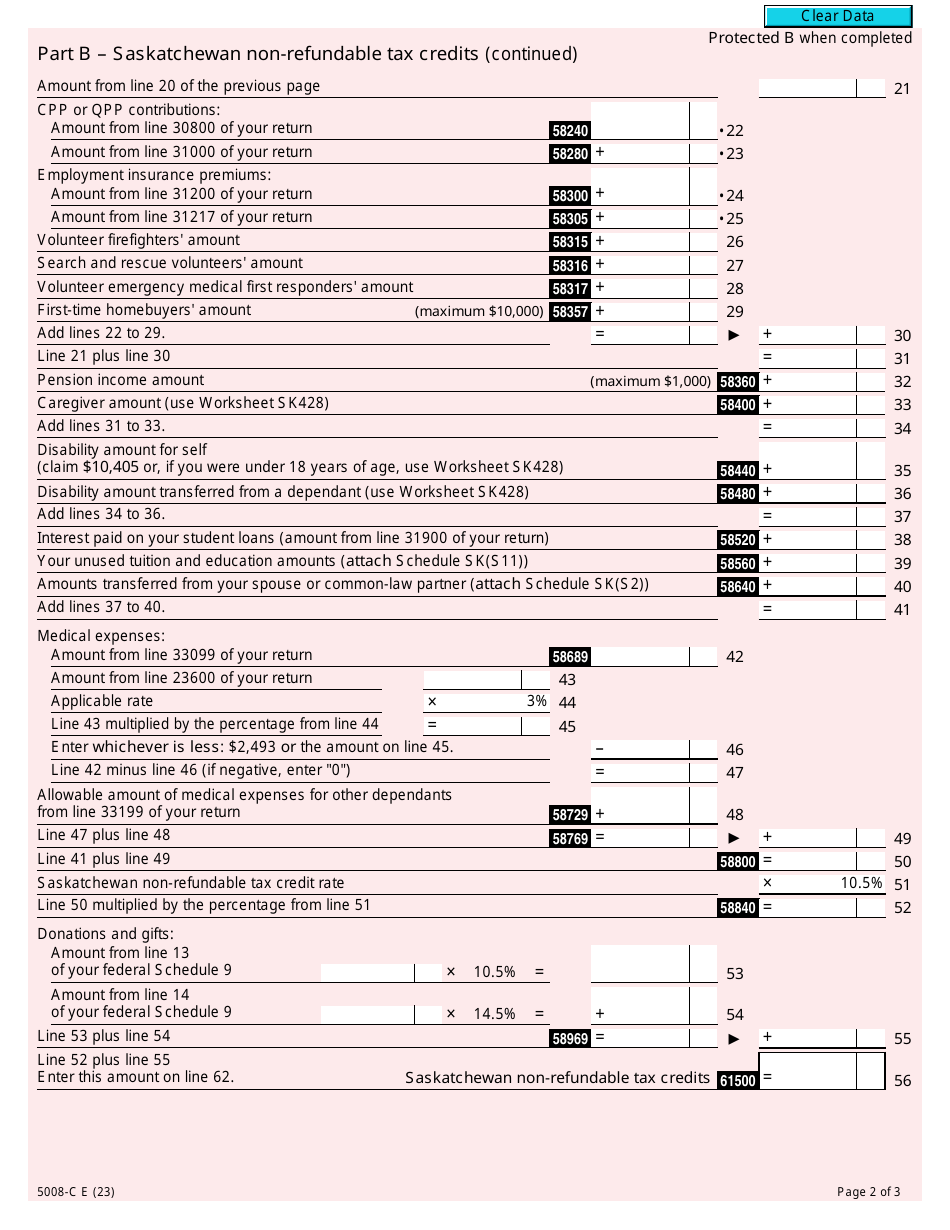

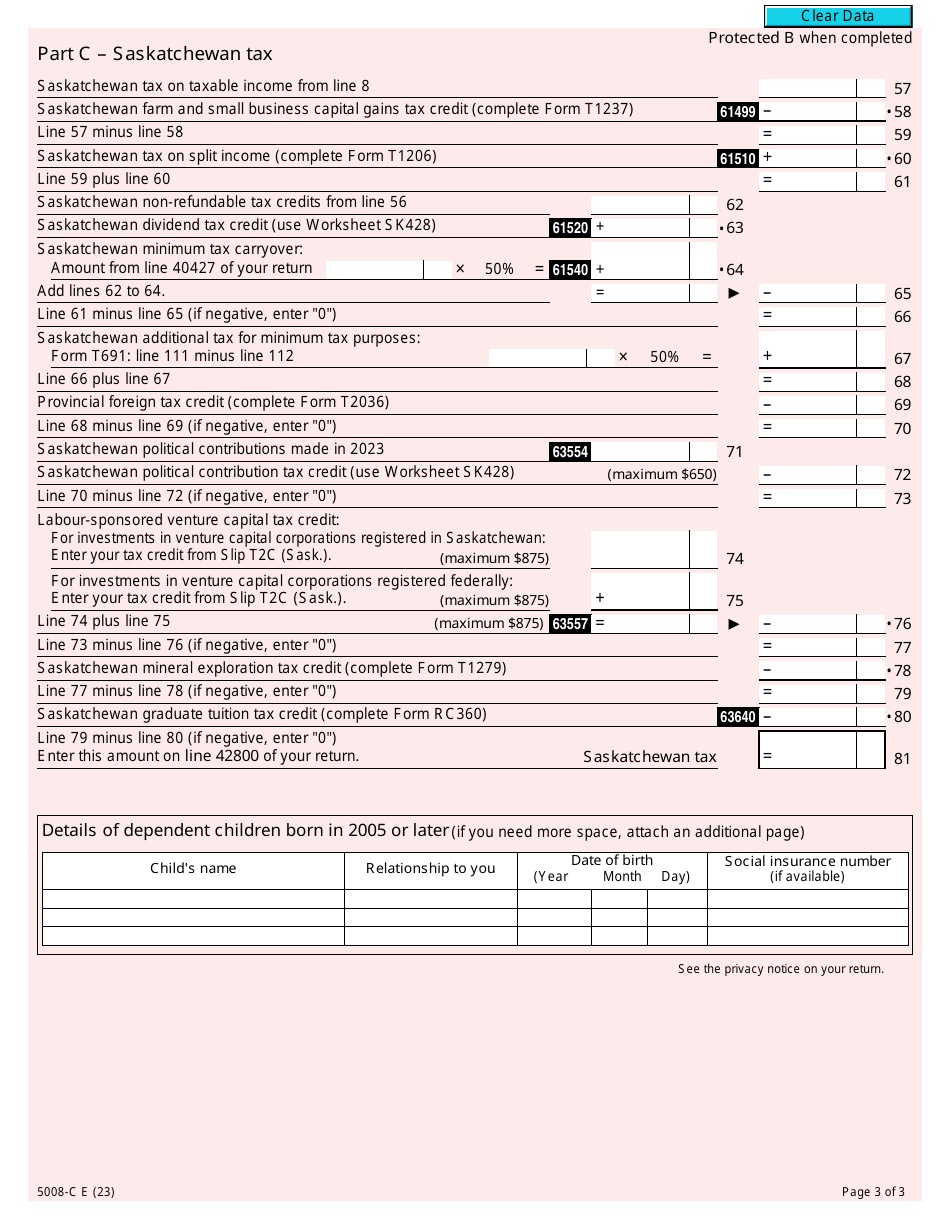

Form 5008-C (SK428) Saskatchewan Tax - Canada

Form 5008-C (SK428) is the Saskatchewan Tax Form for individuals living in Saskatchewan, Canada. It is used to report and calculate provincial income tax owed by residents of Saskatchewan.

The Form 5008-C (SK428) for Saskatchewan Tax in Canada is filed by individual taxpayers who are residents of Saskatchewan and have income to report for that province.

Form 5008-C (SK428) Saskatchewan Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5008-C?

A: Form 5008-C is the Saskatchewan Tax form for residents of Saskatchewan, Canada.

Q: What is the purpose of Form 5008-C?

A: Form 5008-C is used to report and pay provincial taxes owed to the government of Saskatchewan.

Q: Who needs to file Form 5008-C?

A: Residents of Saskatchewan who have a tax liability to the Saskatchewan government need to file Form 5008-C.

Q: When is Form 5008-C due?

A: The due date for filing Form 5008-C is usually April 30th of the following year, the same as the federal tax return.

Q: What happens if I don't file Form 5008-C?

A: If you fail to file Form 5008-C or pay the taxes owed, you may be subject to penalties and interest charges.

Q: Can I file Form 5008-C electronically?

A: Yes, you can file Form 5008-C electronically using the internet filing system approved by the Saskatchewan government.

Q: What if I need assistance with Form 5008-C?

A: If you need help with Form 5008-C or have questions, you can contact the Saskatchewan Ministry of Finance or seek assistance from a tax professional.