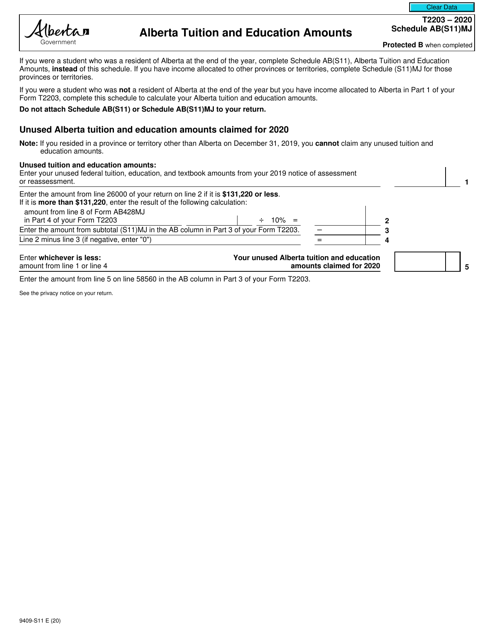

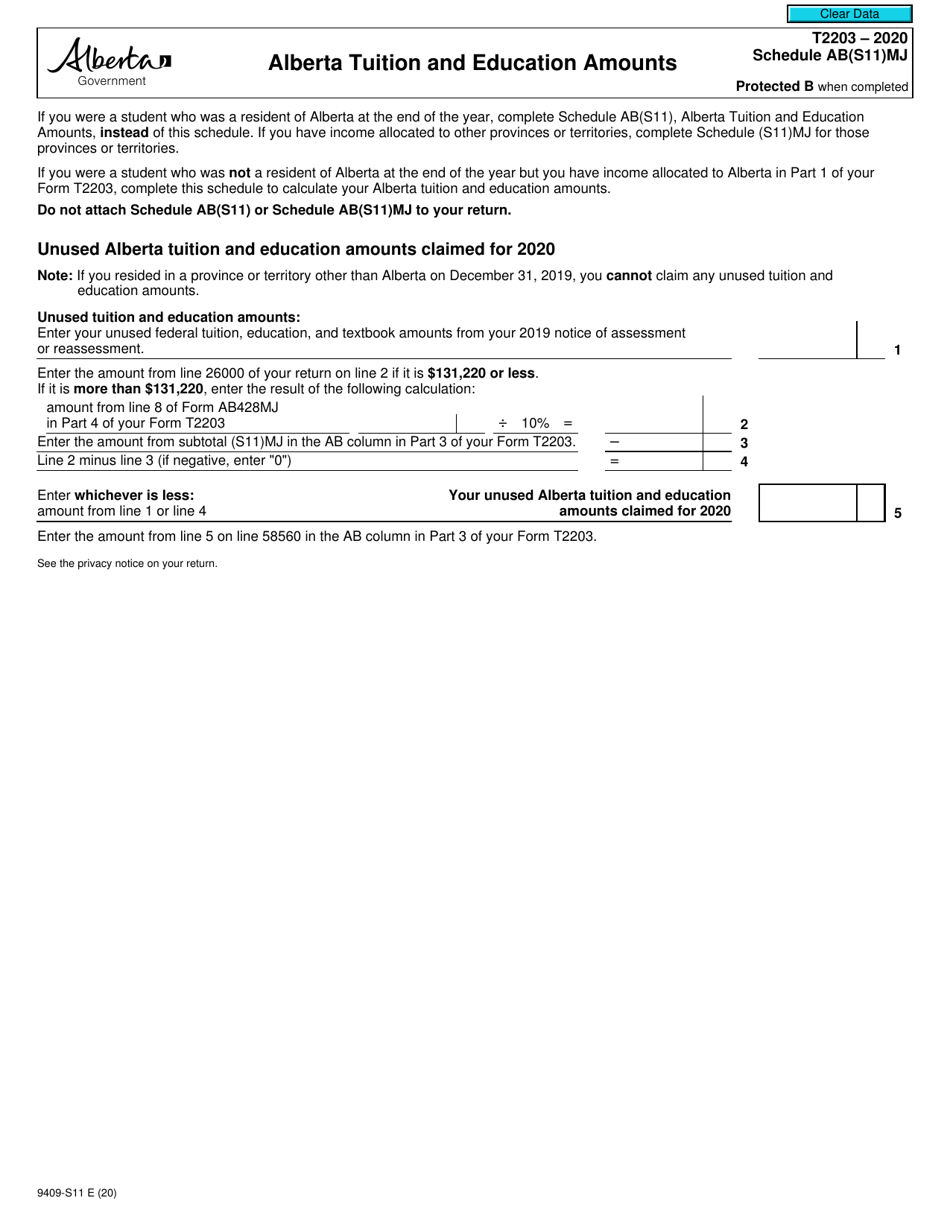

Form T2203 (9409-S11) Schedule AB(S11)MJ Alberta Tuition and Education Amounts - Canada

Form T2203 (9409-S11) Schedule AB(S11)MJ Alberta Tuition and Education Amounts - Canada is used to claim tuition and education amounts for provincial or territorial tax credits in the province of Alberta.

The Form T2203 Schedule AB(S11)MJ Alberta Tuition and Education Amounts is filed by individuals who are claiming tuition and education amounts in the province of Alberta, Canada.

Form T2203 (9409-S11) Schedule AB(S11)MJ Alberta Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What are tuition and education tax credits?

A: Tuition and education tax credits are deductions that students in Canada can claim on their income tax returns to reduce their taxable income.

Q: Who is eligible for tuition and education tax credits?

A: Canadian students who are enrolled in post-secondary education programs such as college, university, or vocational school may be eligible for these tax credits.

Q: How do I claim tuition and education tax credits?

A: To claim the tax credits, you need to enter the appropriate amounts from your tuition tax receipts on your income tax return.

Q: Can I transfer my tuition and education tax credits to someone else?

A: In certain situations, you may be able to transfer a portion of your unused tuition and education tax credits to a parent, grandparent, or spouse.

Q: Are there any limits to the amount I can claim for tuition and education tax credits?

A: Yes, there are limits to the amount you can claim for these tax credits. The limits vary depending on the tax year and province or territory.

Q: Are international students eligible for tuition and education tax credits in Canada?

A: International students may be eligible for tuition and education tax credits if they meet certain criteria, such as having a valid study permit.