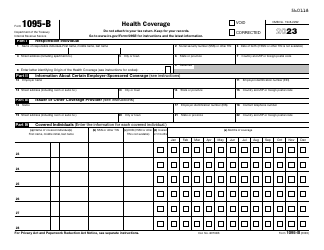

IRS Form 1095-A Health Insurance Marketplace Statement

What Is a Form 1095-A?

IRS Form 1095-A, Health Insurance Marketplace Statement , also known as the healthcare marketplace tax form, is a document used to report information to the Internal Revenue Service (IRS) about the individuals enrolled in a qualified health plan via the Health Insurance Marketplace.

The Health Insurance Marketplace is a platform where people without health care insurance can find necessary information about insurance options and alternatives and obtain health care insurance for themselves, their families, or businesses. Additionally, the health marketplace tax form is used to let the individuals coordinate and adjust the credit on their returns with advance credit payments, to help them claim the premium tax credit - a refundable credit that allows individuals and their families to pay for the premiums on their health insurance, and to complete and submit a correct tax return.

The latest version of the form was released in 2023 . A fillable IRS Form 1095-A form is available for download below.

Where Can I Get a 1095-A Form?

If you, your spouse or dependents are enrolled in the health insurance coverage, the Marketplace will send you this form; however, most individuals do not receive this form. Since the form is completed by the Marketplaces, individuals are not allowed to submit it, but you can use the information on the health marketplace tax form as guidance to aid you in filing an accurate tax return.

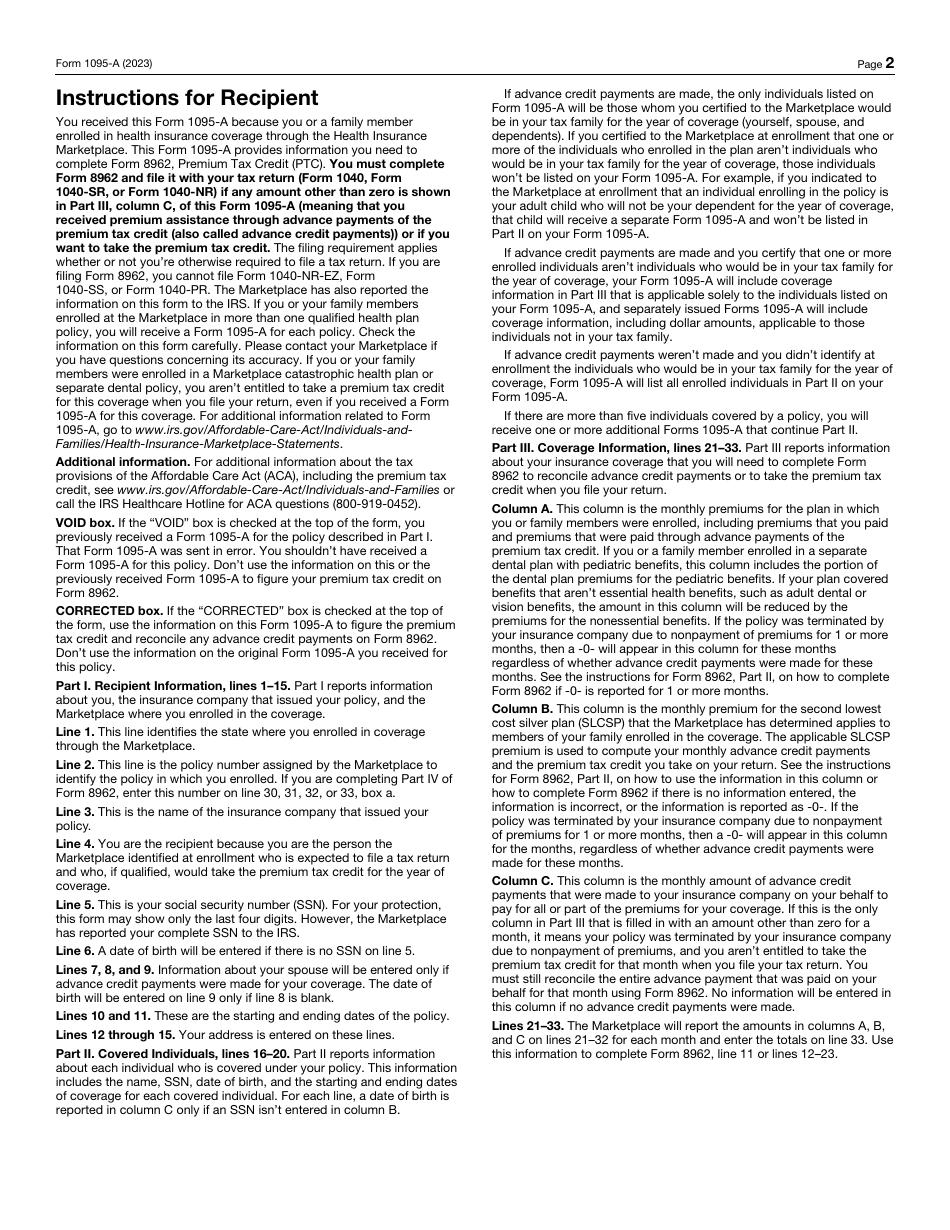

IRS Form 1095-A Instructions

- You can use the information on the form to reconcile the premium tax credit with the advance payments, using Form 8962, Premium Tax Credit, that must be filed with your tax return;

- It is possible to get a copy of the form online from your HealthCare account, if you bought coverage from the federally facilitated Marketplace;

- You can find the form in your state-based Marketplace account if you bought coverage via a state-based Marketplace;

- The form cannot be filed for a stand-alone dental plan or a catastrophic health plan;

- If your policy covers more than five people, you will receive additional forms to list every individual;

- If you have further questions, consult with the official instructions for the form issued by the IRS.

How to Fill out Form 1095-A?

-

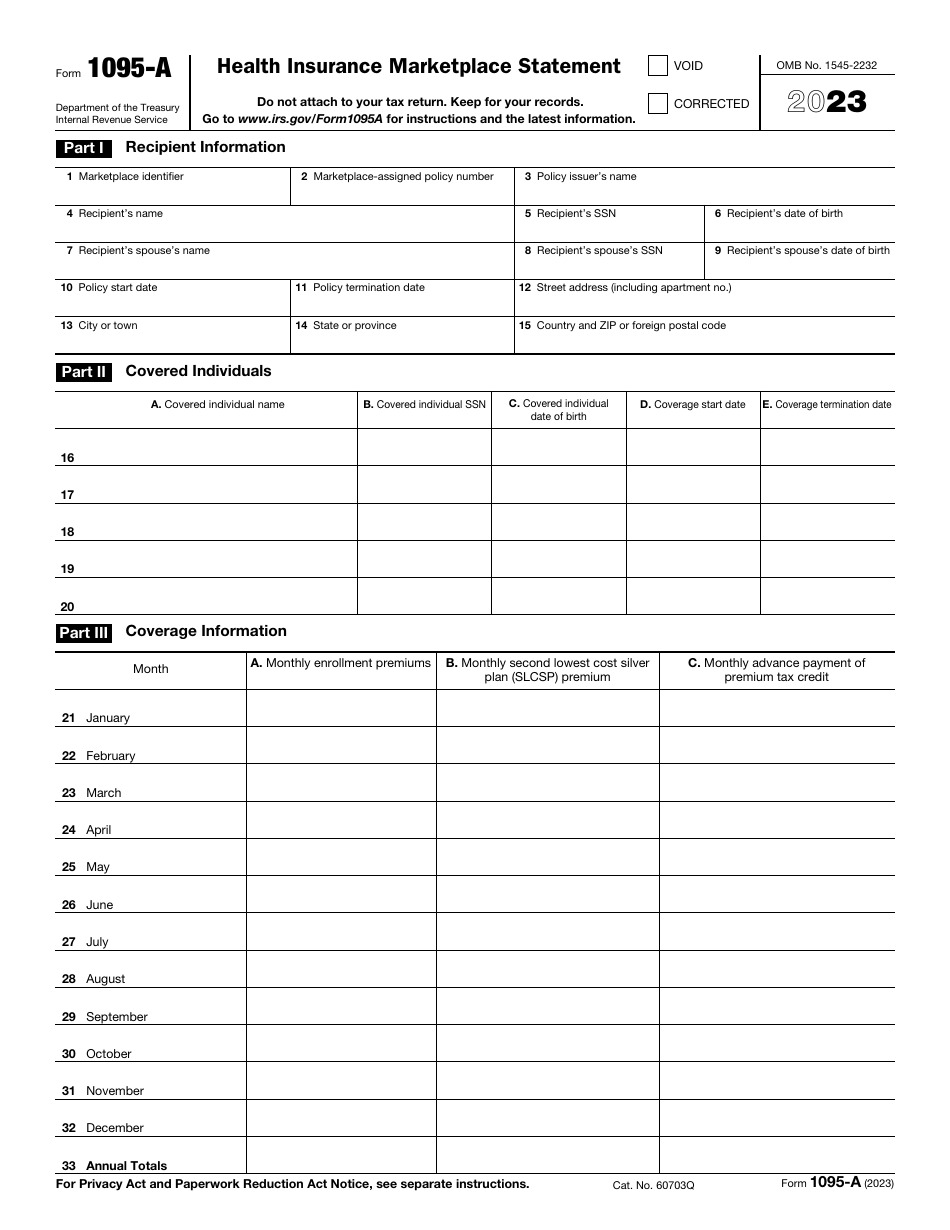

Part I - Recipient Information :

- Submit the Marketplace identifier - a state name or an abbreviation;

- Enter the number assigned to the policy by the Marketplace;

- Write down the name of the policy issuer;

- Identify the recipient of the statement using the full name. This must be the person identified as the tax filer at the time of enrollment. If the tax filer cannot be identified, enter the full name of the primary applicant for the health insurance coverage;

- Write down the recipient's social security number; if you do not have that information, write down the date of birth;

- If advance credit payments were made for the health insurance coverage, enter information about the recipient's spouse - the full name, the social security number, and the date of birth;

- State the dates when the coverage under the policy began and when it was terminated;

- Provide the address of the recipient.

-

Part II - Covered Individuals . This section identifies all the people covered under the policy. State the covered individual's full name, the social security number or the date of birth, the starting and ending dates of coverage;

-

Part III - Coverage Information . There are 12 lines for each month of the year. Enter the monthly enrollment premiums, monthly second lowest cost silver plan (one of the Health Insurance Marketplace «metal levels» that allows you to pay moderate monthly premiums and costs when you require care) premium, and monthly advance payment of premium tax credit.

Where to Send Form 1095-A?

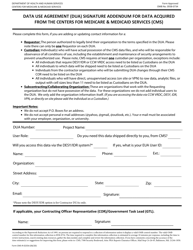

Only electronic filing is available for IRS 1095-A Form. It does not exist in paper form and can only be filled out and submitted online. Health Insurance Marketplaces must submit the 1095-A statement through the Department of Health and Human Services Data Services Hub in order to report information on all enrollments in qualified health plans. IRS Form 1095-A due date is the last day of the first calendar month of the year . If the due date falls on a Saturday, Sunday, or a legal holiday, the statement must be submitted by the next business day. The annual report must be filed with the IRS on or before that date for coverage in the previous calendar year. The penalty for failing to provide this form to individuals or for providing incorrect forms is $250 for each document, the total annual amount of penalties cannot exceed $3,000,000.

IRS 1095-A Related Forms:

- IRS Form 1095-B, Health Coverage is a related document used to inform the IRS and the taxpayers about people that have minimum essential coverage (individual market plans, plans sponsored by eligible employers, and programs sponsored by the government) and consequently are not liable for the individual shared responsibility payment;

- IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage is a form used by the employers that have fifty or more full-time employees to send the required information about enrollment in health coverage and health coverage offers for these employees.