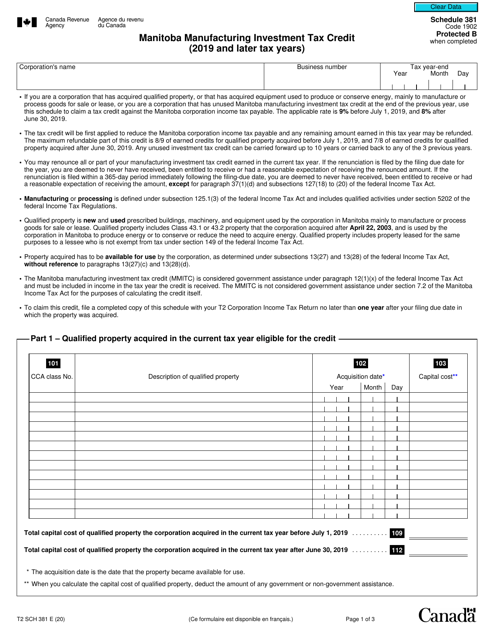

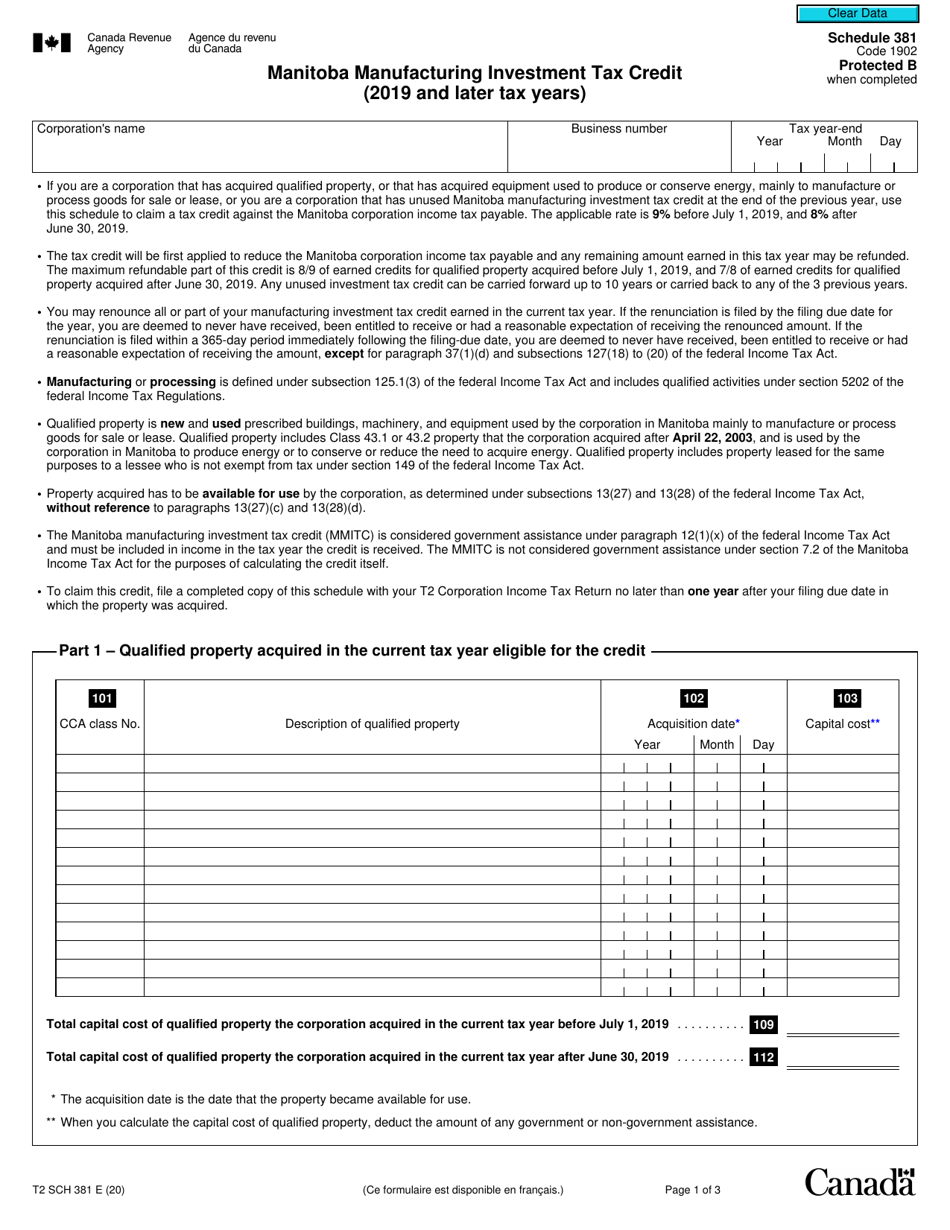

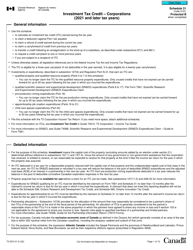

Form T2 Schedule 381 Manitoba Manufacturing Investment Tax Credit (2019 and Later Tax Years) - Canada

This form is used in Manitoba, Canada to claim the Manufacturing Investment Tax Credit for tax years 2019 and later.

Companies or corporations eligible for the Manitoba Manufacturing Investment Tax Credit (MMITC) in Canada would file the Form T2 Schedule 381 with their corporate tax return.

Form T2 Schedule 381 Manitoba Manufacturing Investment Tax Credit (2019 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 381?

A: Form T2 Schedule 381 is a tax form in Canada that is used to claim the Manitoba Manufacturing Investment Tax Credit.

Q: What is the Manitoba Manufacturing Investment Tax Credit?

A: The Manitoba Manufacturing Investment Tax Credit is a tax incentive provided by the province of Manitoba to encourage investment in manufacturing industries.

Q: Who is eligible for the Manitoba Manufacturing Investment Tax Credit?

A: Canadian corporations that carry on a qualifying manufacturing business in Manitoba are eligible to claim the tax credit.

Q: What is the purpose of the Manitoba Manufacturing Investment Tax Credit?

A: The purpose of the tax credit is to support and stimulate investment in the manufacturing sector in Manitoba.

Q: What expenses qualify for the Manitoba Manufacturing Investment Tax Credit?

A: Expenses related to the acquisition of qualifying property for use in a qualifying manufacturing business in Manitoba may qualify for the tax credit.

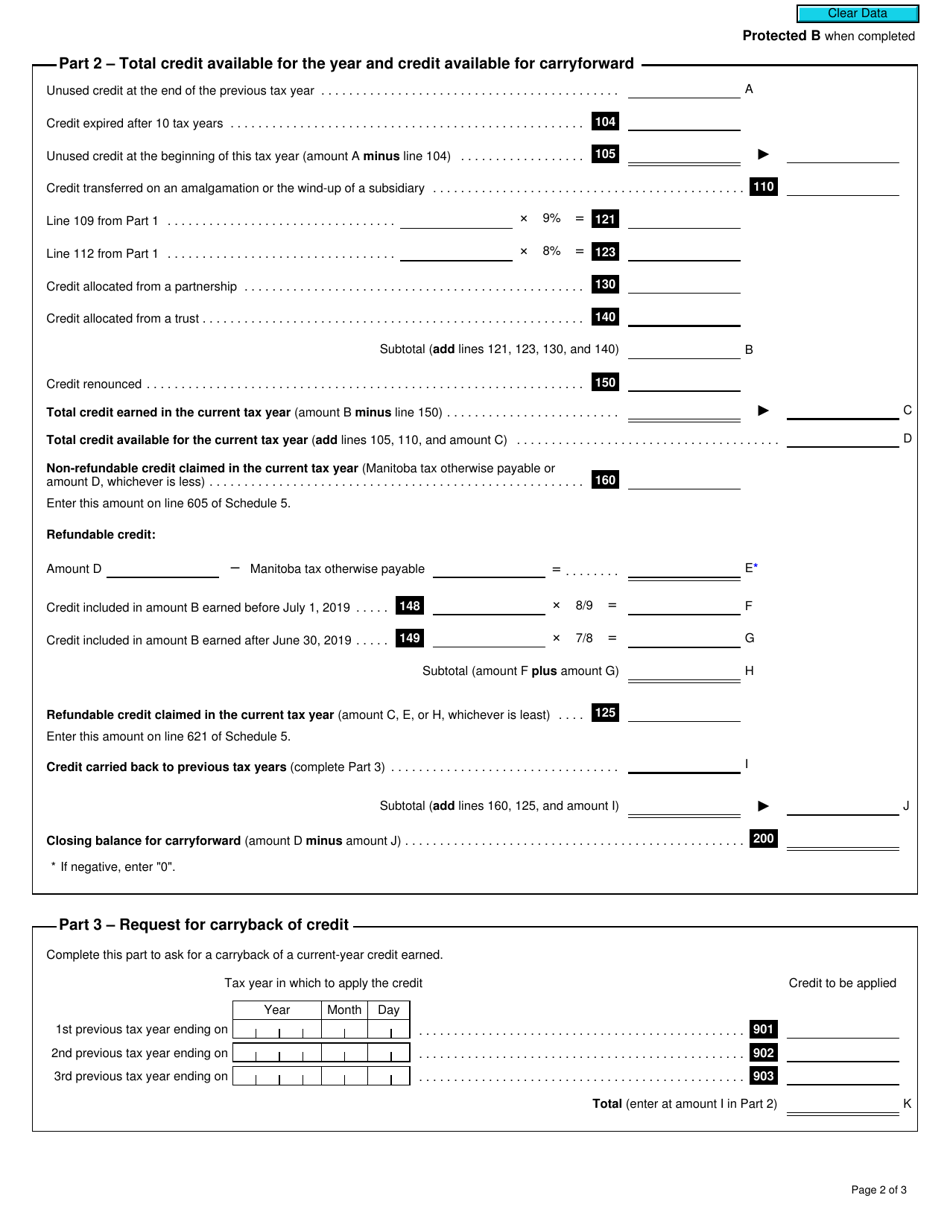

Q: How is the tax credit calculated?

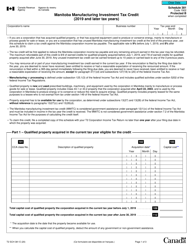

A: The tax credit is calculated as a percentage of the eligible capital expenditure incurred in the tax year.

Q: When is Form T2 Schedule 381 due?

A: Form T2 Schedule 381 is due on the filing date of the corporation's annual income tax return.

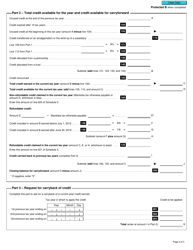

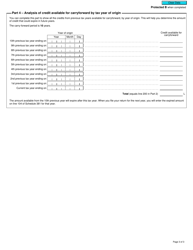

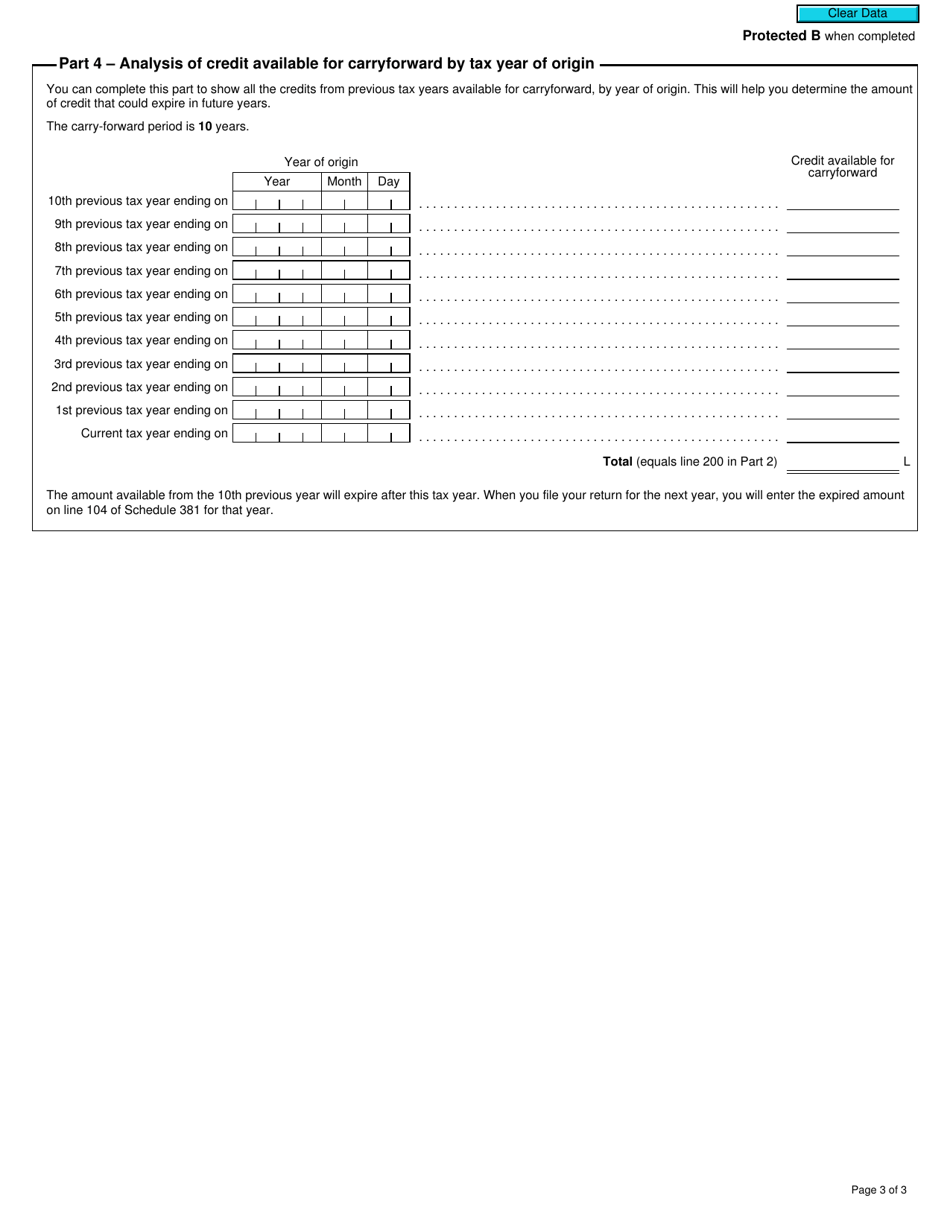

Q: Can the Manitoba Manufacturing Investment Tax Credit be carried forward or back?

A: Yes, any unused tax credit can be carried forward for up to 7 years or carried back for up to 3 years.