Form SSA-821-BK Work Activity Report - Employee

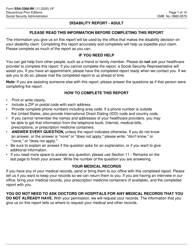

What Is Form SSA-821?

Form SSA-821-BK, Work Activity Report , is a document used for reporting an individual's working activity to the U.S. Social Security Administration (SSA). This form is necessary to determine the individual's eligibility for disability benefits.

Alternate Names:

- SSA Work Activity Report;

- Form SSA-821;

- SSA Form 821-BK.

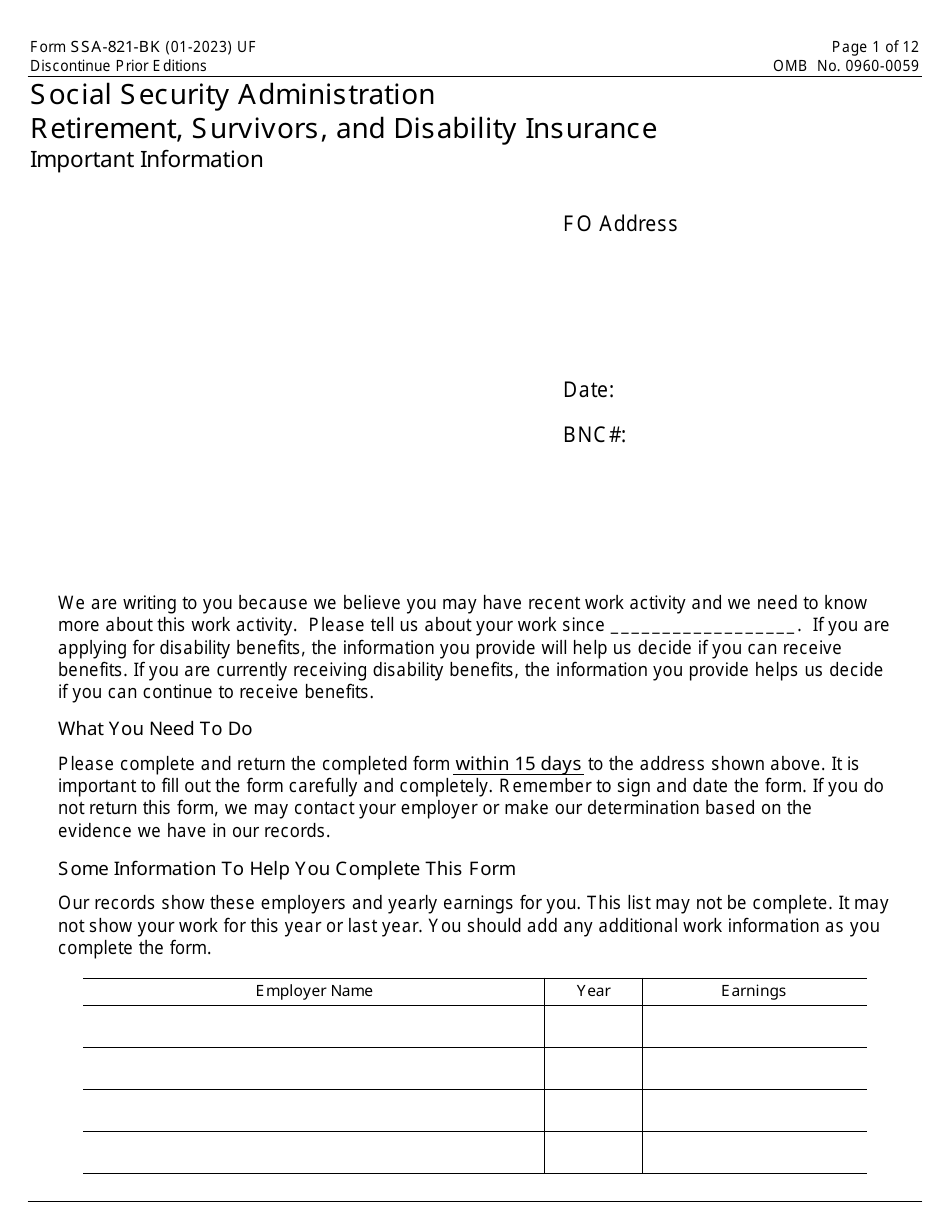

This form requires information only about working activity after the Alleged Onset Date (AOD). AOD is the day the individual claims to be unable to work because of a disability. The latest version of the form was issued on January 1, 2023 . An SSA-821-BK fillable form is available for download and digital filing below.

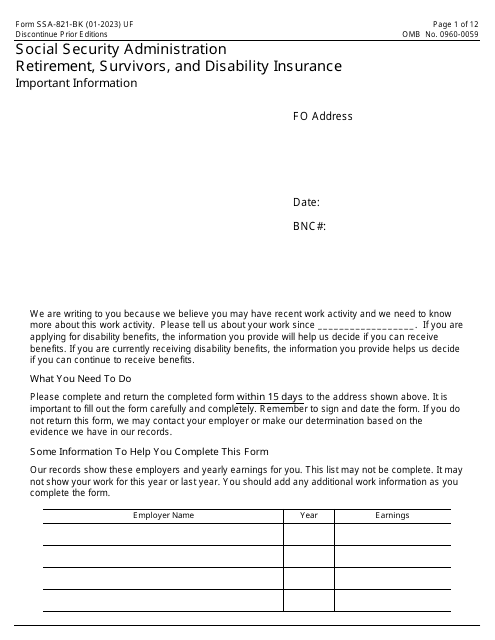

Why Did I Get Form SSA-821-BK?

The SSA mailed you the SSA Work Activity Report because you receive disability insurance benefits. The administration received information about your working activity after the AOD and it requires information about your work to make sure that you are still eligible for the benefits. The cover page of Form SSA-821-BK contains a reason for mailing the form to you. If you have been doing any kind of work and earn any amount of money, you should file the report.

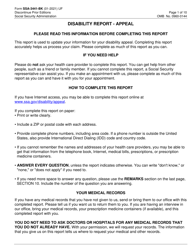

How to Fill Out Form SSA-821-BK?

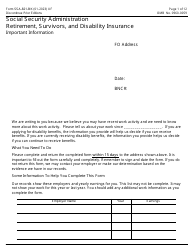

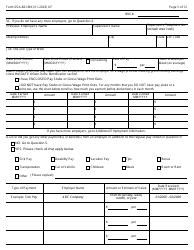

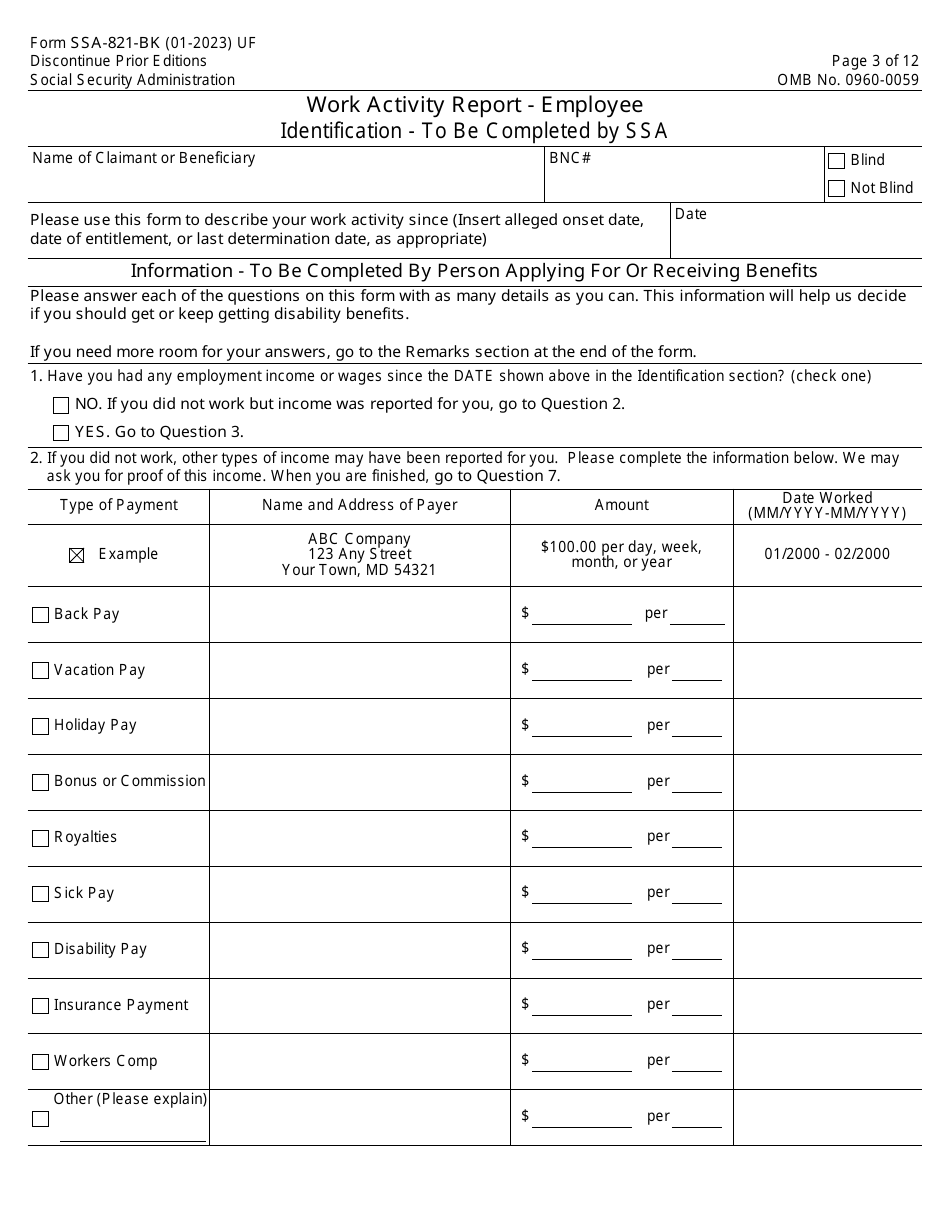

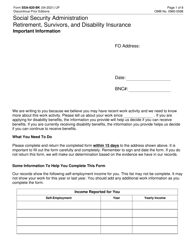

- Provide your name and Social Security Number (SSN). Indicate if you are visually impaired. Enter your claim number and Beneficiary Identification Code (BIC). Enter the date you started your work activity. This may be either the AOD, date of entitlement, or last determination date.

- Indicate whether you received any income or wages since the date stated above in Question 1. If your answer is negative, go to Question 2. If your answer is positive, go to Question 3.

- Report the types of income you received from the stated date in Question 2. If you received any income from the list, check the box, enter the name and the address of the payer, the amount of the payment, and the time period of the payment.

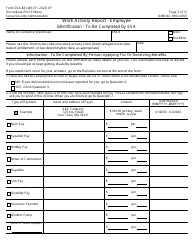

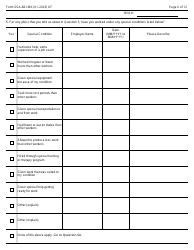

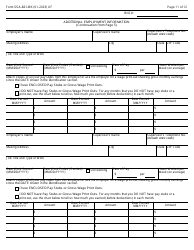

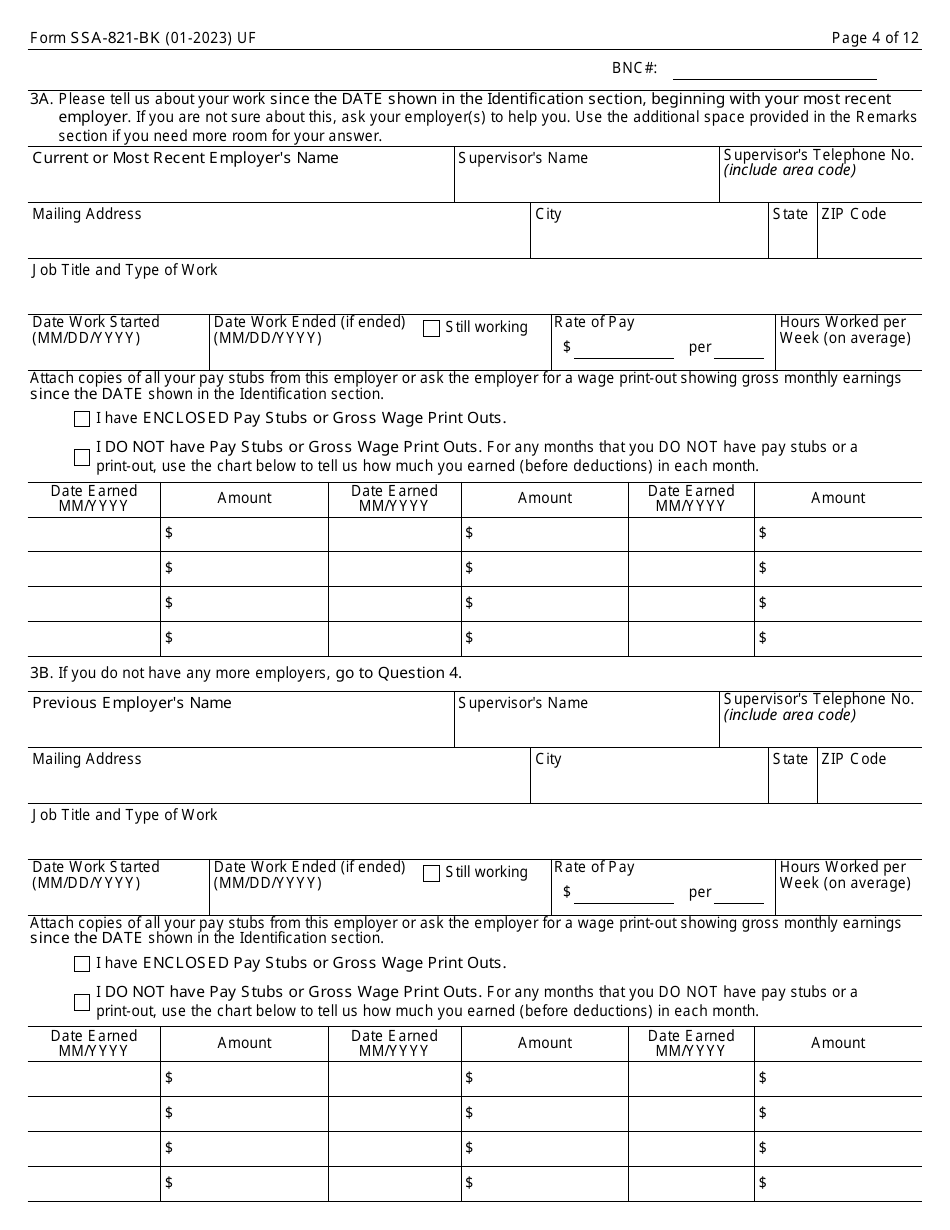

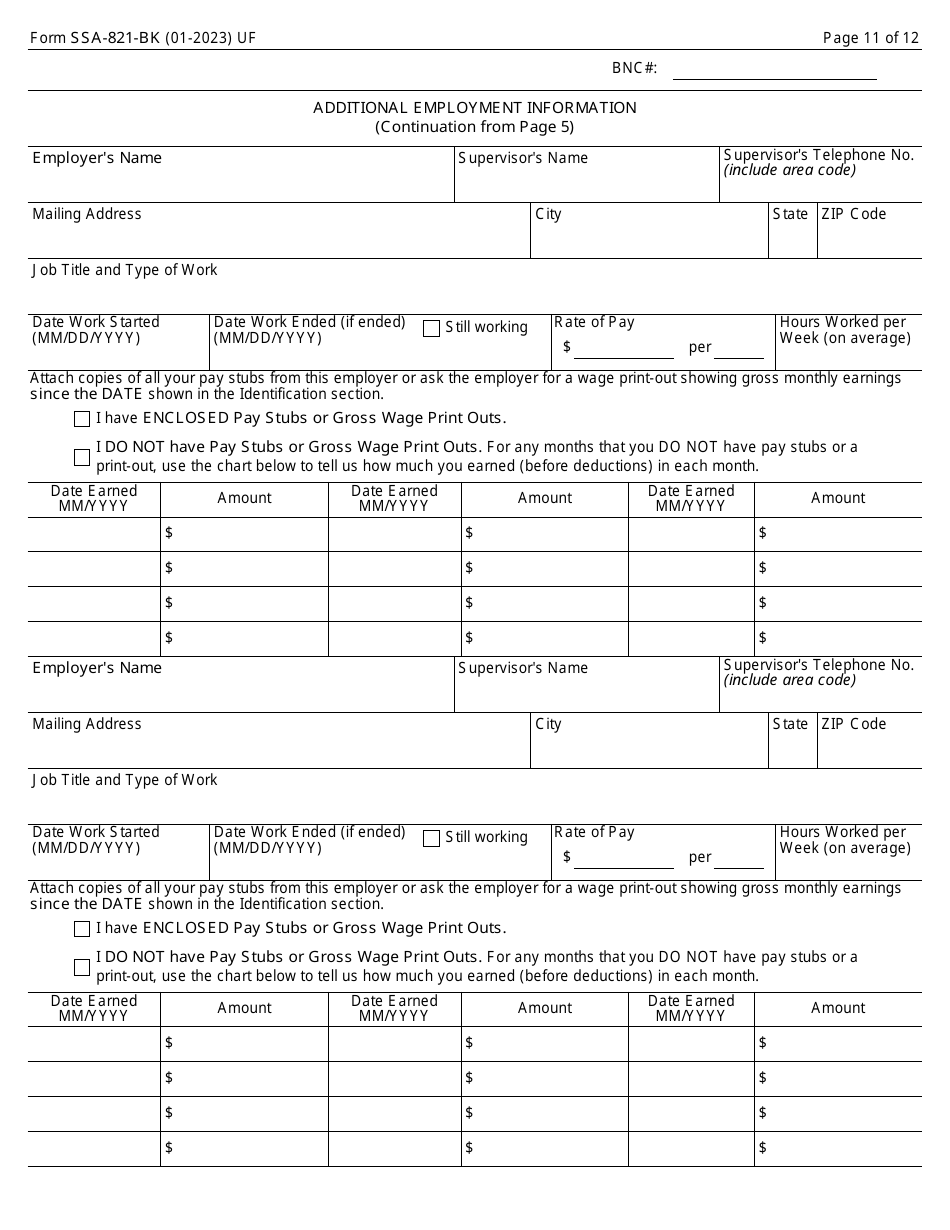

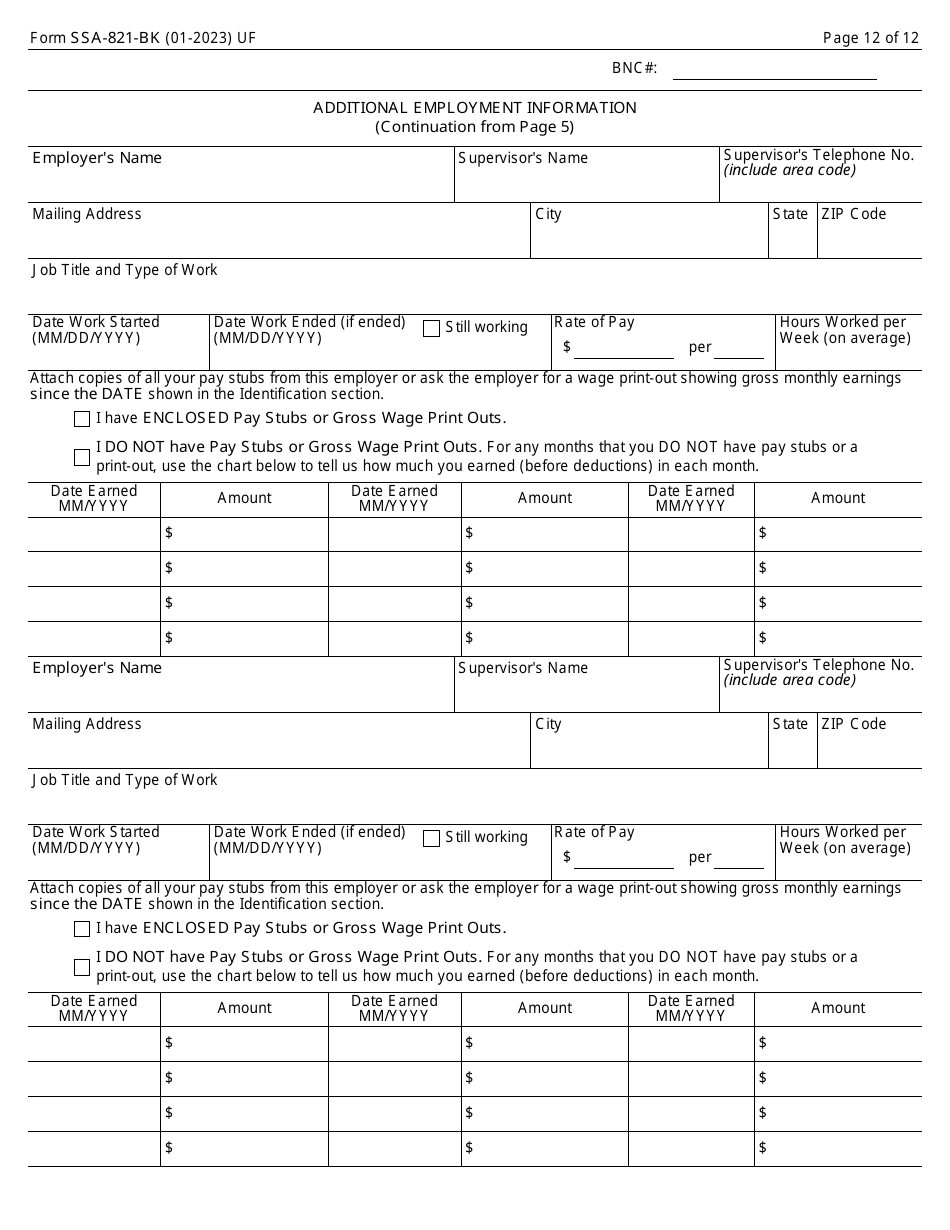

- Provide information about your work activity from the date you stated in the identification section in Question 3A. Enter the name of the current or most recent employer. Provide the name and phone number of the supervisor. Enter the mailing address of your employer. Enter your job title and type of work. State the date your employment started and ended. If you are still working, leave the "Date" box blank and check the box labeled "Still Working." Provide your pay rate and working hours.

- Attach copies of your pay stubs or a wage print. If these papers do not cover the whole employment period, provide information about your income in the table.

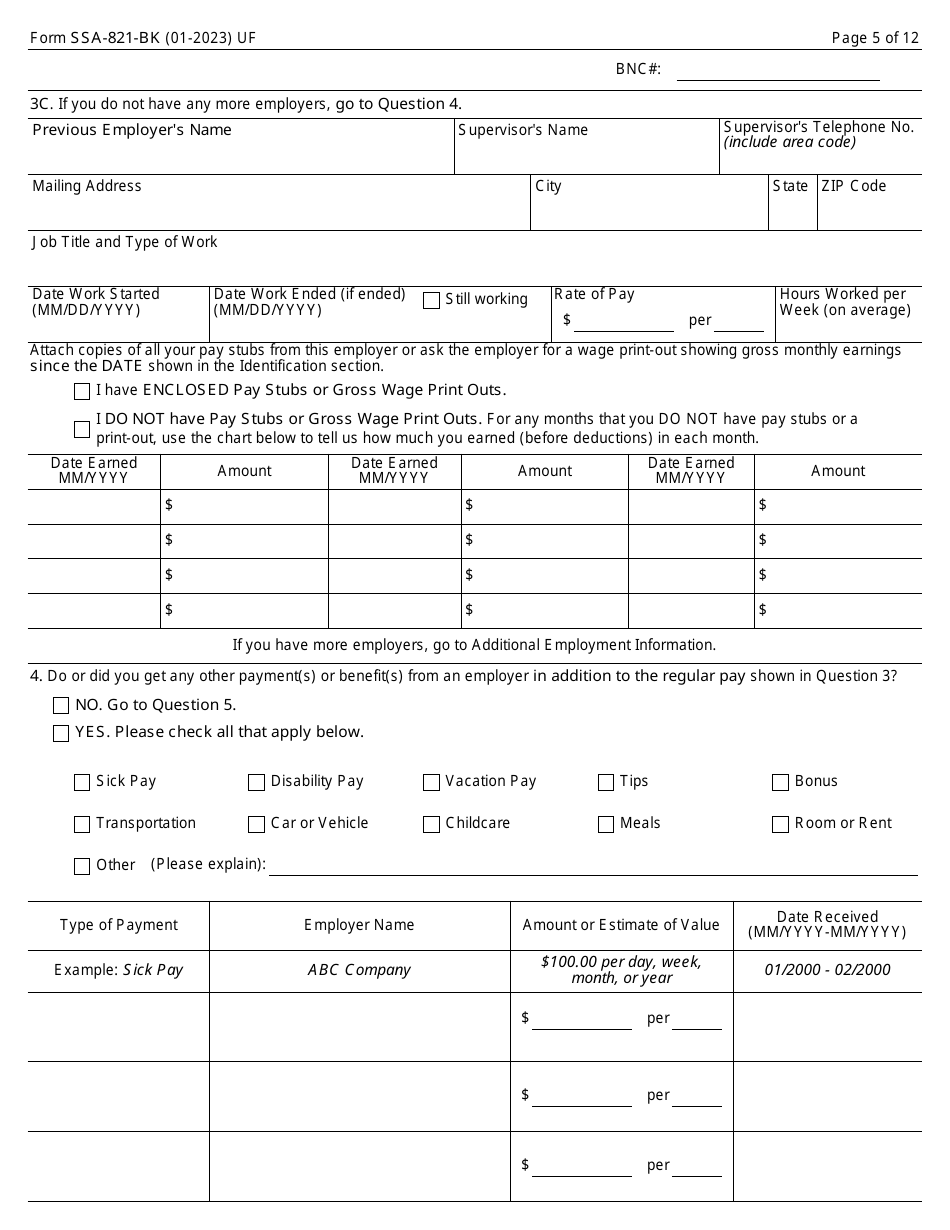

- Provide information about all your employers in Question 3B. If the provided space is not enough, use the "Remarks" section.

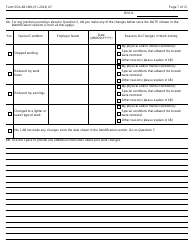

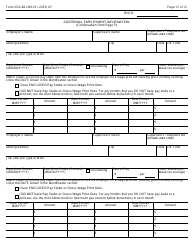

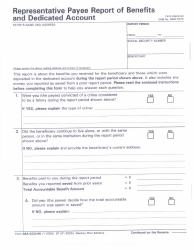

- Indicate whether you received any payment or benefits additional to your wages in Question 4. If you did, specify the type of benefits or payment and provide information about it in the table. Enter the type of payment, the name of the employer, amount of payment, or estimated value of the benefit, and the date it was received.

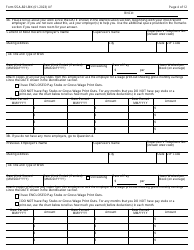

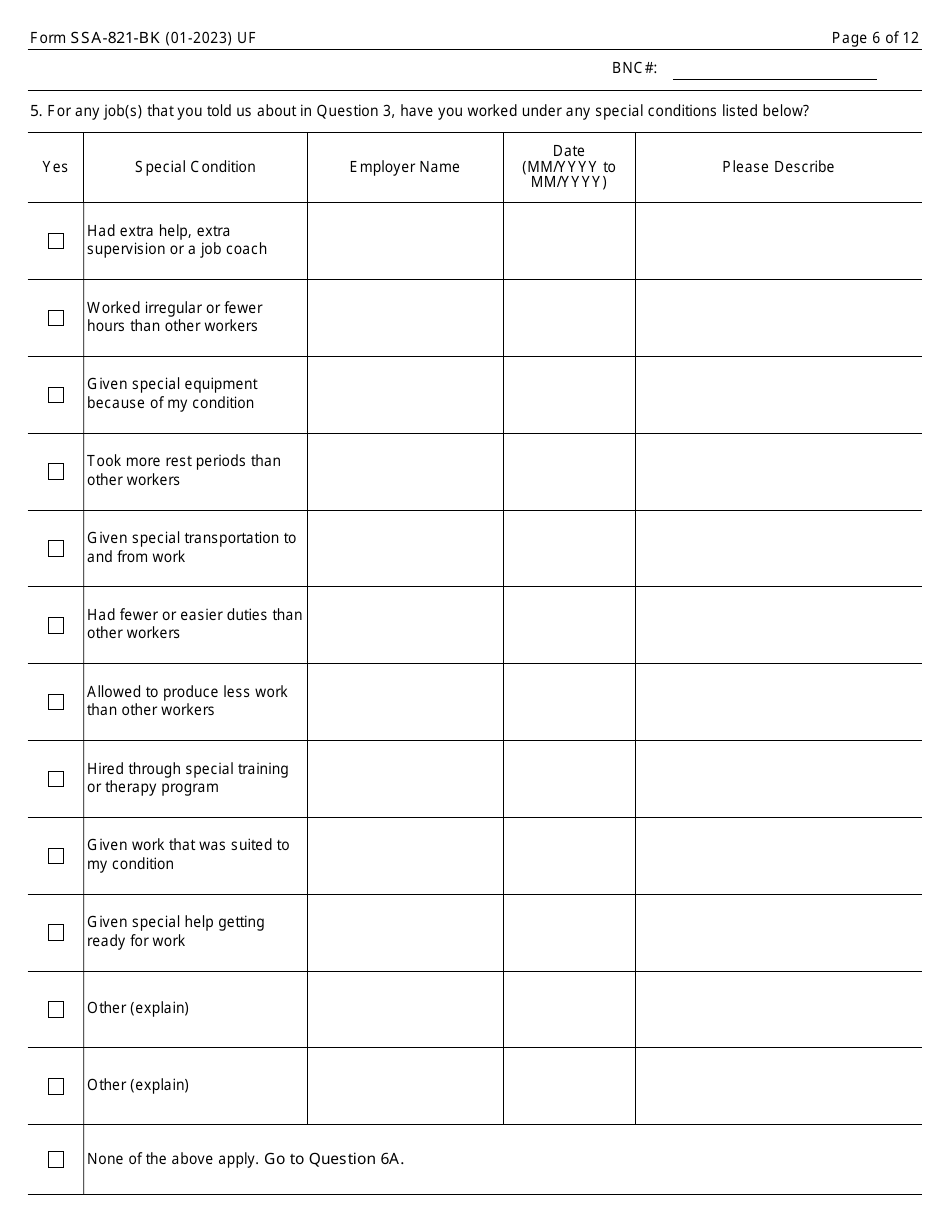

- Indicate whether you worked under special conditions listed in the table in Question 5. If you did, specify the condition, provide the name of the employer, the date these conditions took place, and describe them.

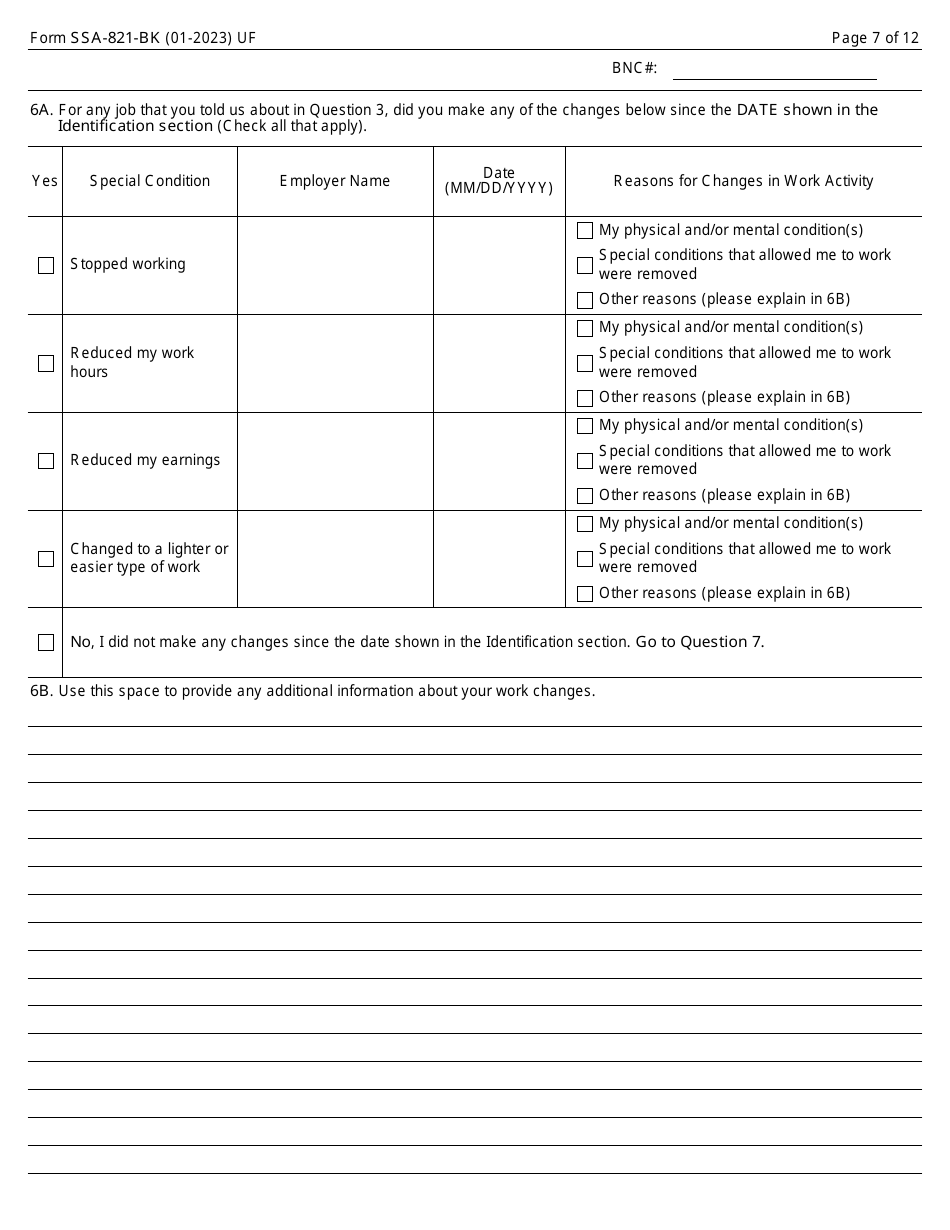

- Indicate if there were changes in your employment in Question 6A. Specify the type of change, name of the employer, date when the change took place, and indicate a reason for that change.

- Provide additional information about the changes listed above (if necessary) in Question 6B.

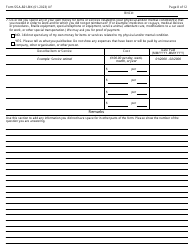

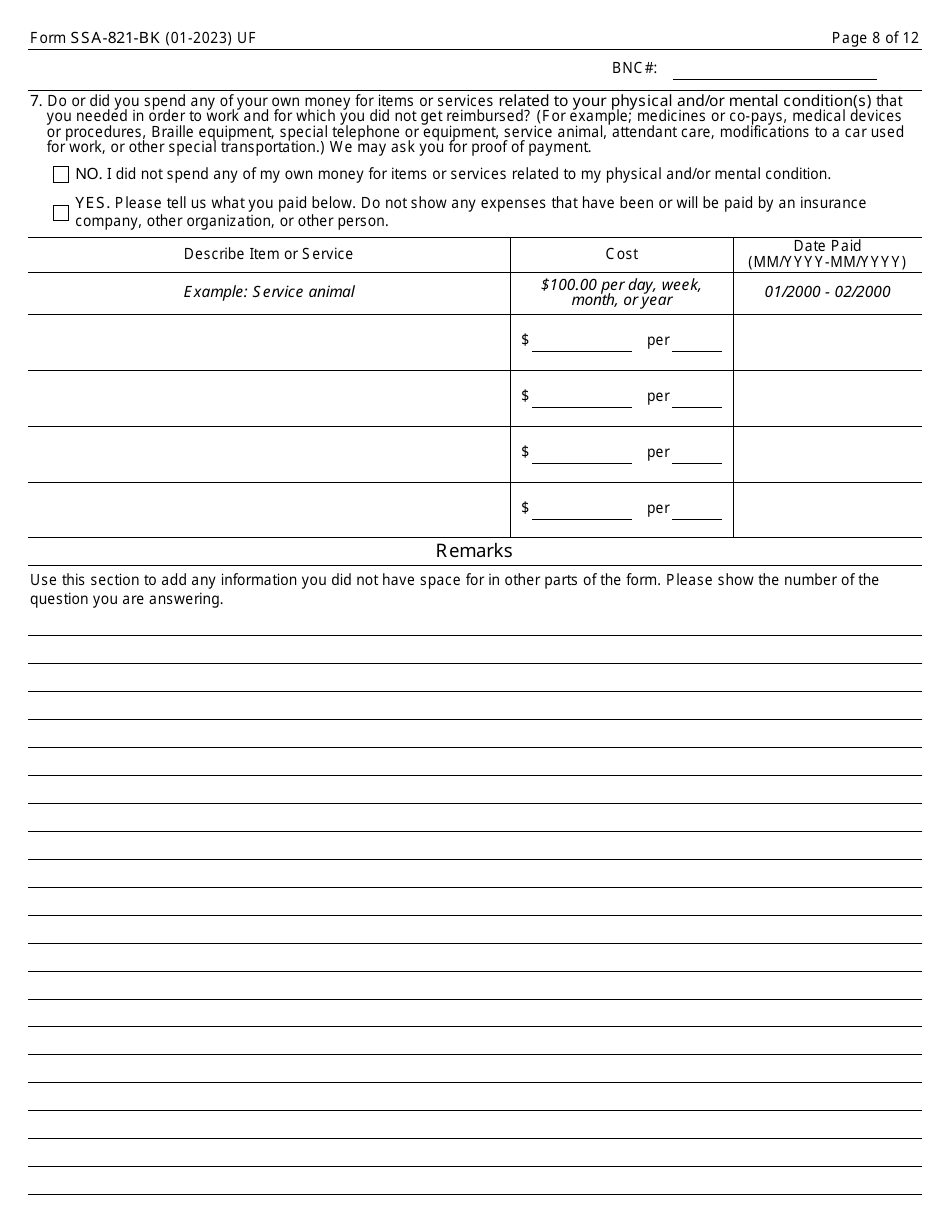

- Indicate whether you covered the cost of items or services related to your condition from our own funds and if you were not reimbursed in Question 7. If you did, specify, what you paid for, the amount you paid, and the date you made this payment.

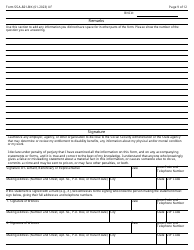

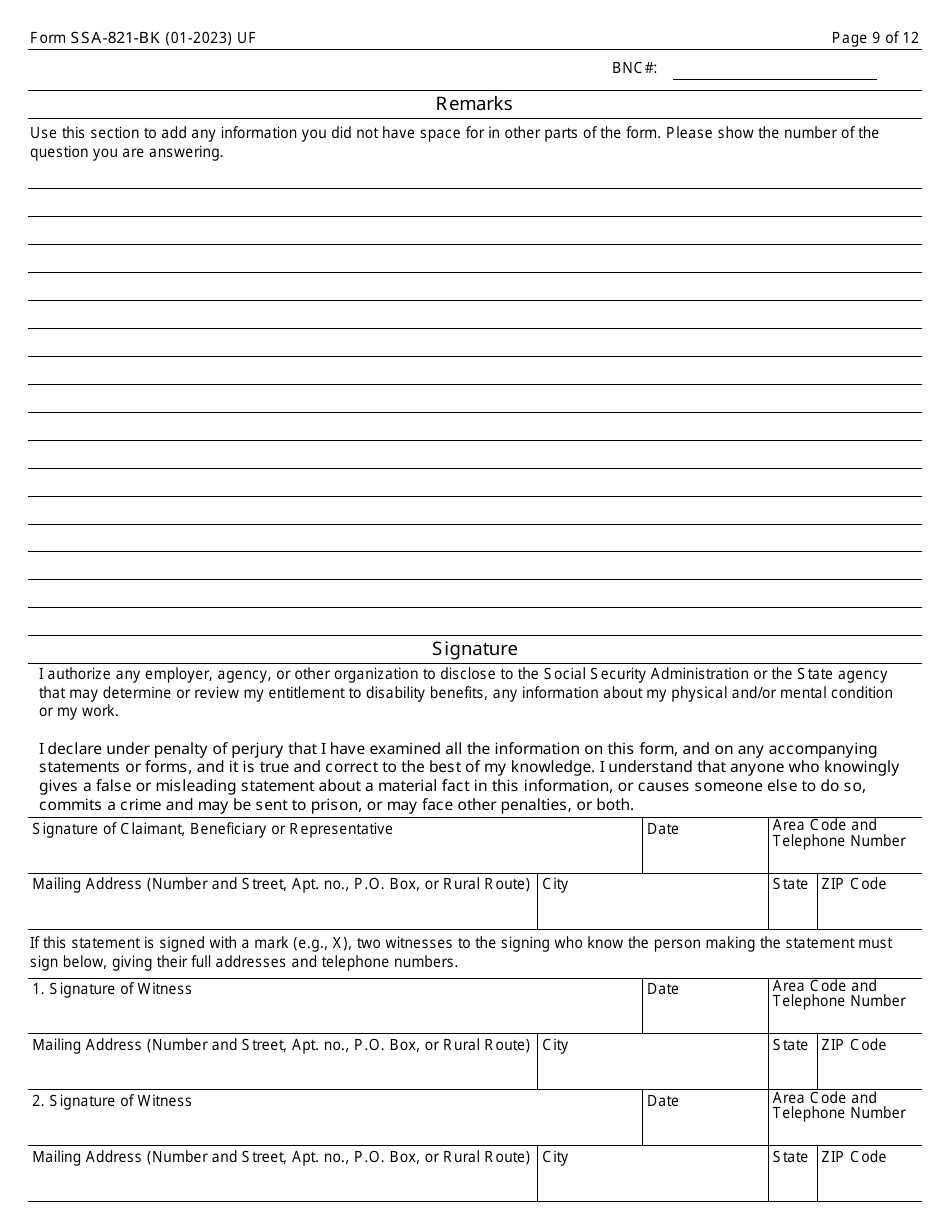

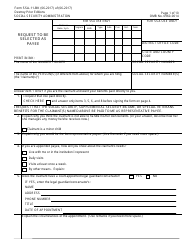

- Sign and date the form. Provide your mailing address. If the form is signed by the X mark, it must contain two signatures of witnesses.

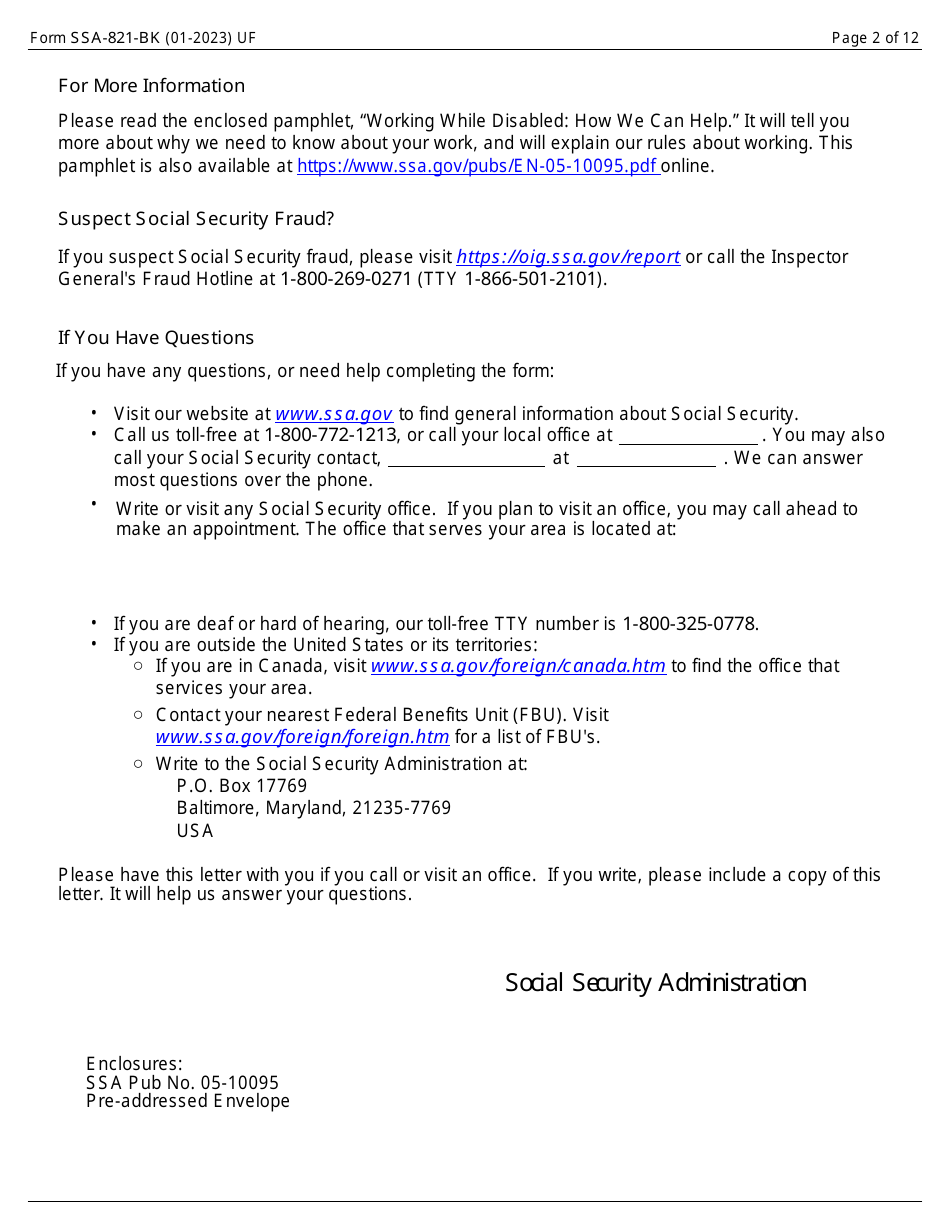

Where to Send Form SSA Form 821-BK?

If the SSA mailed the form to you, return the completed form to the address shown on the envelope. If you are filing the form yourself, send it to your local SSA office after you received a payment. The mailing address of the office can be found on the SSA website. You should do this within 15 days after receiving the form.

What Happens if My SSA-821 Form Is a Couple of Days Late?

If the SSA does not receive Form SSA-821-BK on time, it will make a decision regarding your eligibility based on the information it has. It may also contact your employer and receive the information from them.