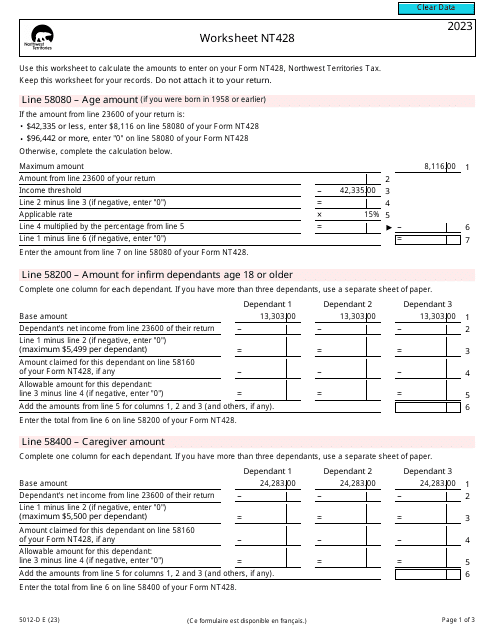

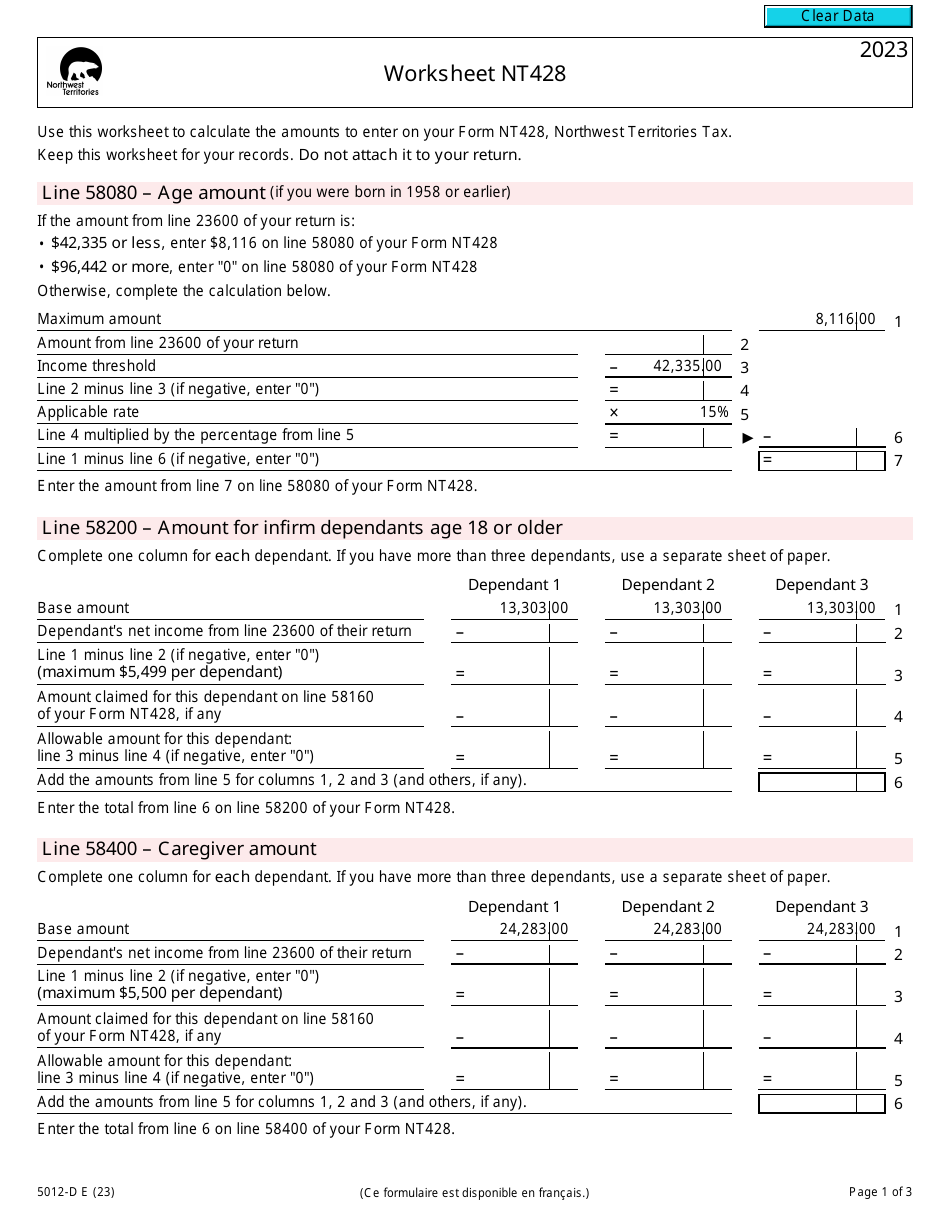

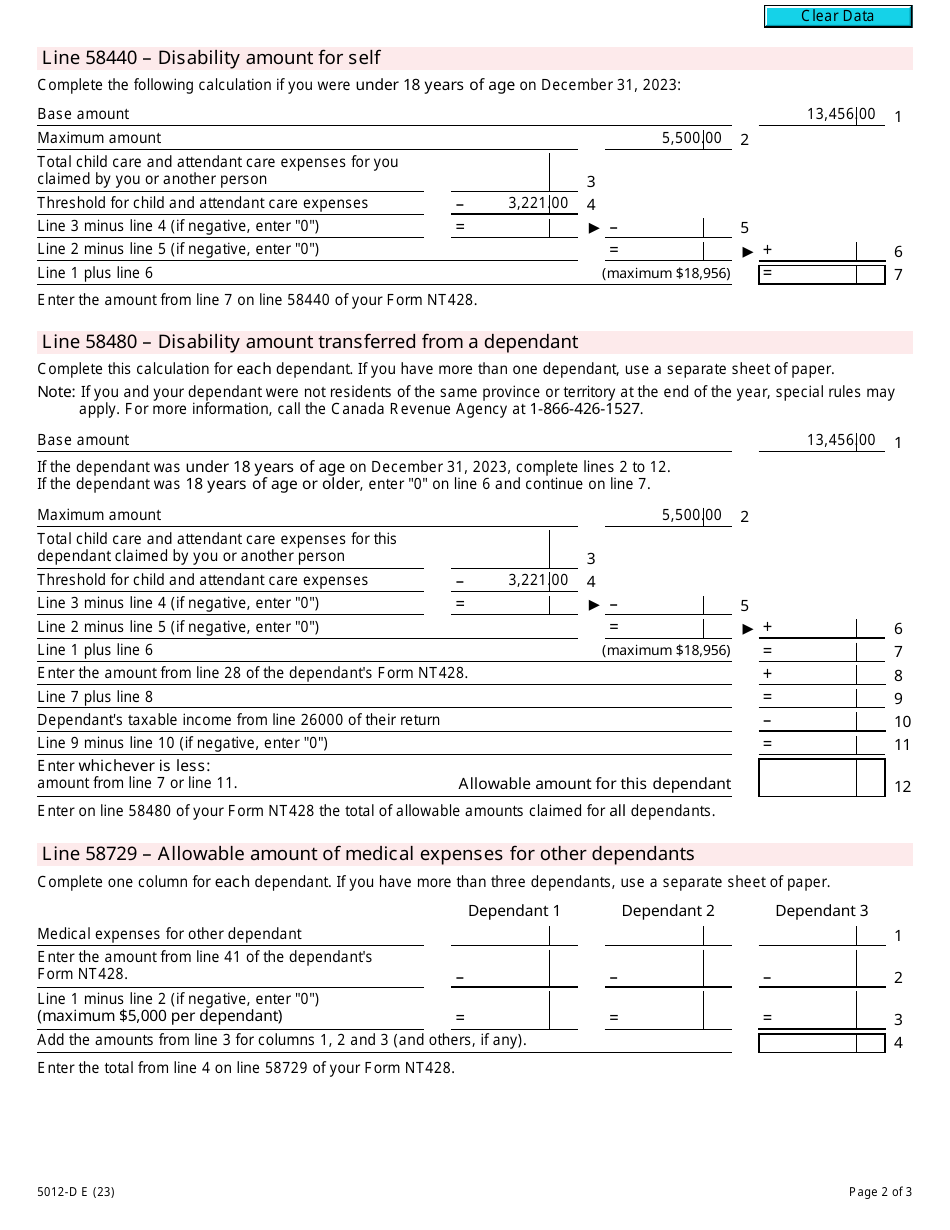

Form 5012-D Worksheet NT428 Northwest Territories - Canada

Form 5012-D Worksheet NT428 is used in the Northwest Territories, Canada for calculating the amount of territorial tax credits that can be claimed on your federal tax return. It helps determine the amount of taxes you owe or the refund you are entitled to.

The Form 5012-D Worksheet NT428 in Northwest Territories, Canada is filed by individuals who are residents of the Northwest Territories and need to calculate their territorial tax-credits for the year.

Form 5012-D Worksheet NT428 Northwest Territories - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5012-D Worksheet NT428?

A: Form 5012-D Worksheet NT428 is a document used in the Northwest Territories in Canada for personal incometax purposes.

Q: Who needs to fill out Form 5012-D Worksheet NT428?

A: Residents of the Northwest Territories who are filing their personal income tax returns need to fill out this form.

Q: What is the purpose of Form 5012-D Worksheet NT428?

A: The purpose of this form is to calculate and report the amount of income tax owed or refundable for residents of the Northwest Territories.

Q: What information is required on Form 5012-D Worksheet NT428?

A: This form requires you to provide details about your income, deductions, and tax credits for the tax year.

Q: When is the deadline to file Form 5012-D Worksheet NT428?

A: The deadline to file this form is usually April 30th of each year.

Q: Are there any penalties for late filing of Form 5012-D Worksheet NT428?

A: Yes, if you file this form after the deadline, you may be subject to penalties and interest charges.

Q: Do I need to keep a copy of Form 5012-D Worksheet NT428 for my records?

A: Yes, it is recommended to keep a copy of this form for your records in case you need to refer to it in the future.