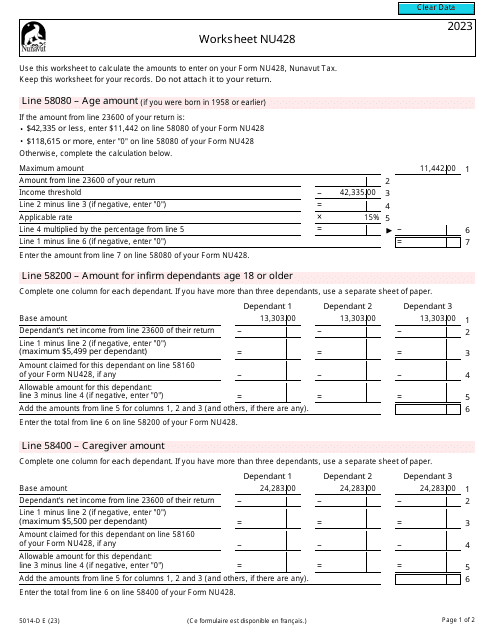

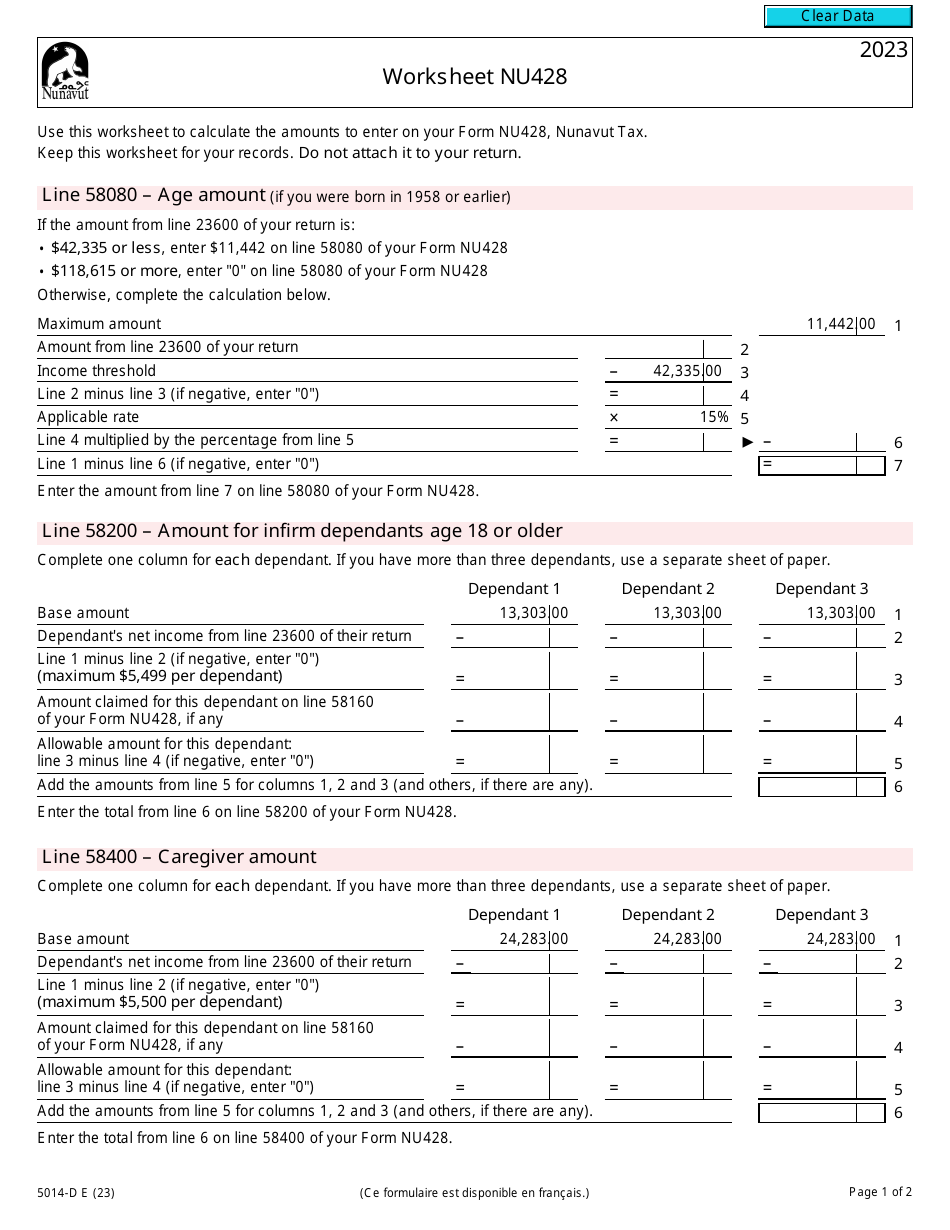

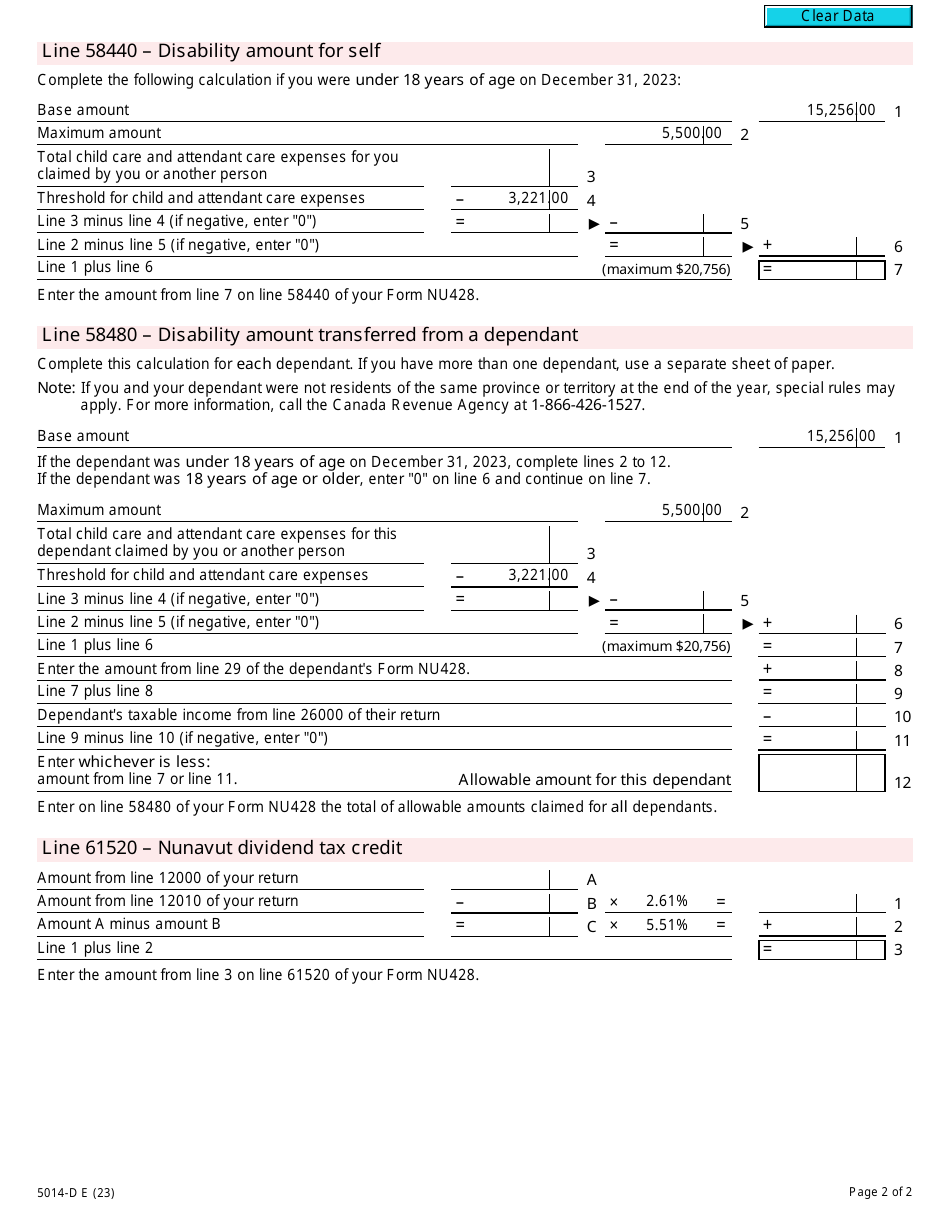

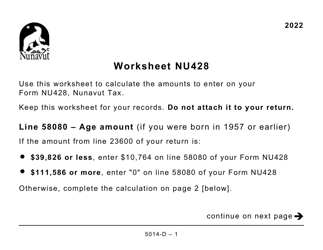

Form 5014-D Worksheet NU428 Nunavut - Canada

Form 5014-D Worksheet NU428 in Nunavut, Canada is used for calculating the Nunavut payroll tax.

Form 5014-D Worksheet NU428 Nunavut - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5014-D Worksheet NU428?

A: Form 5014-D Worksheet NU428 is a tax form used in the Canadian territory of Nunavut.

Q: Who needs to fill out Form 5014-D Worksheet NU428?

A: Residents of Nunavut who need to report their income and deductions for tax purposes need to fill out Form 5014-D Worksheet NU428.

Q: What information is required on Form 5014-D Worksheet NU428?

A: Form 5014-D Worksheet NU428 requires information about your income, deductions, and tax credits.

Q: When is the deadline to submit Form 5014-D Worksheet NU428?

A: The deadline for submitting Form 5014-D Worksheet NU428 is typically April 30 of each year, unless it falls on a weekend or a holiday.

Q: Are there any penalties for late submission of Form 5014-D Worksheet NU428?

A: Yes, there may be penalties for late submission of Form 5014-D Worksheet NU428. It is necessary to consult the official guidelines or contact the Nunavut Department of Finance for specific penalty information.

Q: Can I file Form 5014-D Worksheet NU428 electronically?

A: Yes, you can file Form 5014-D Worksheet NU428 electronically through the NetFile system. However, it is advisable to review the official guidelines or contact the Nunavut Department of Finance for detailed filing instructions.

Q: What should I do if I need help filling out Form 5014-D Worksheet NU428?

A: If you need assistance with filling out Form 5014-D Worksheet NU428, you can contact the Nunavut Department of Finance or consult a tax professional.

Q: Can I claim deductions on Form 5014-D Worksheet NU428?

A: Yes, you can claim deductions on Form 5014-D Worksheet NU428, as long as they are eligible expenses according to the tax laws of Nunavut.

Q: Is Form 5014-D Worksheet NU428 specific to Nunavut?

A: Yes, Form 5014-D Worksheet NU428 is specific to the Canadian territory of Nunavut and is used for reporting income and deductions for tax purposes in that region.