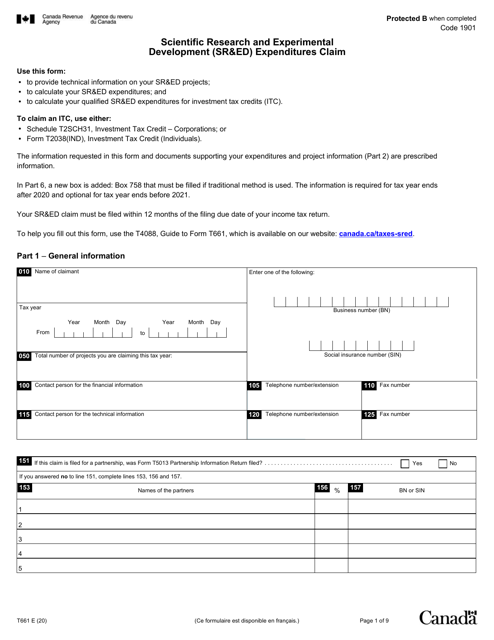

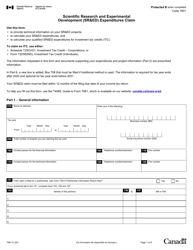

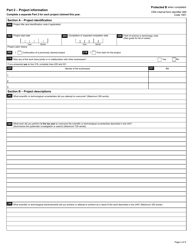

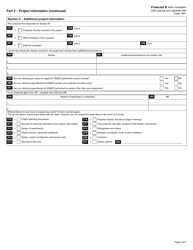

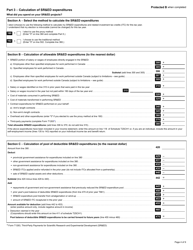

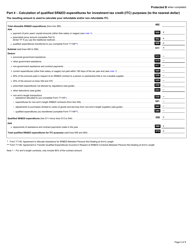

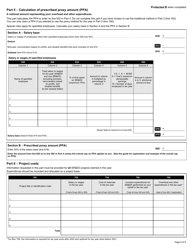

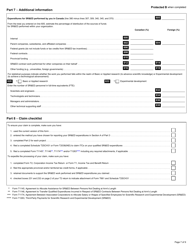

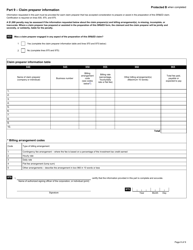

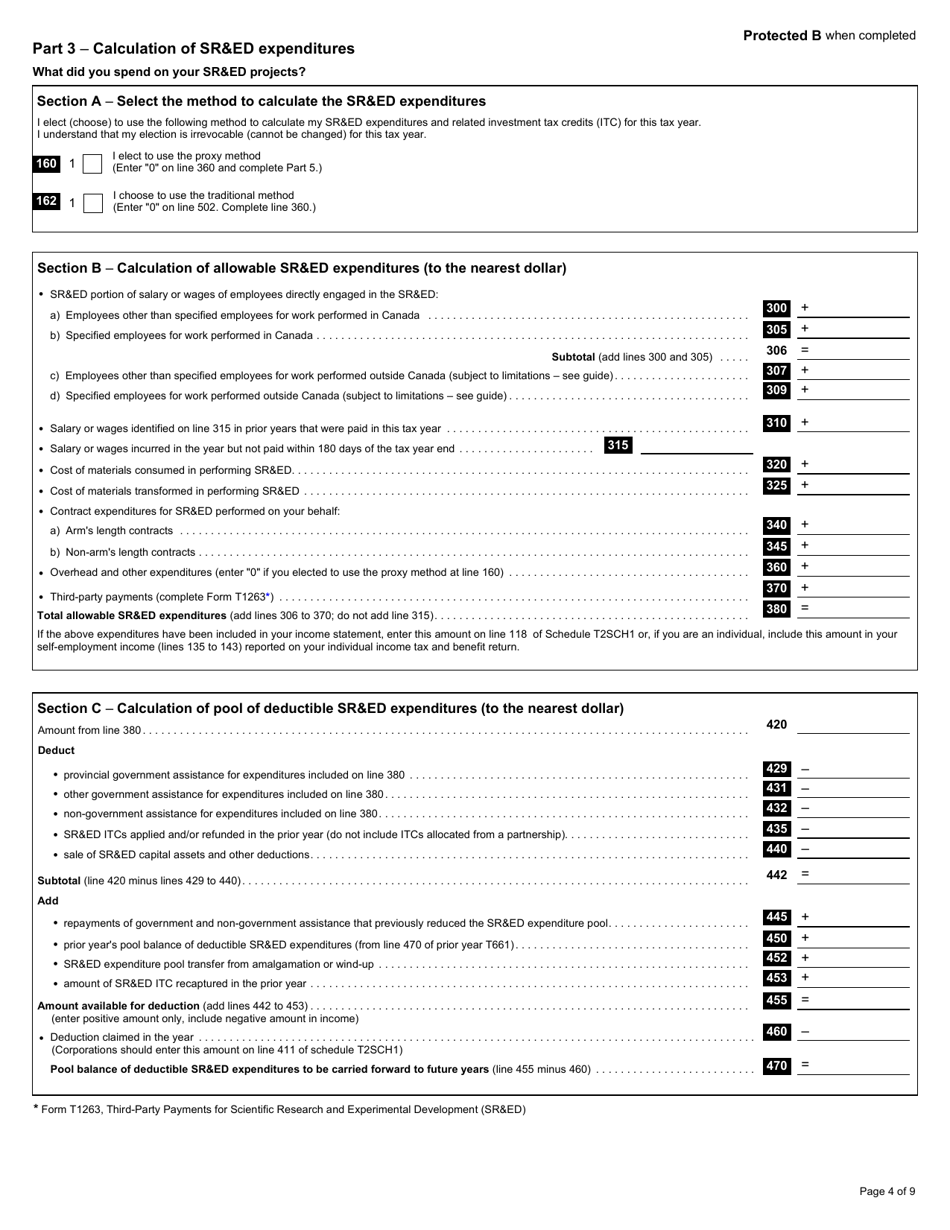

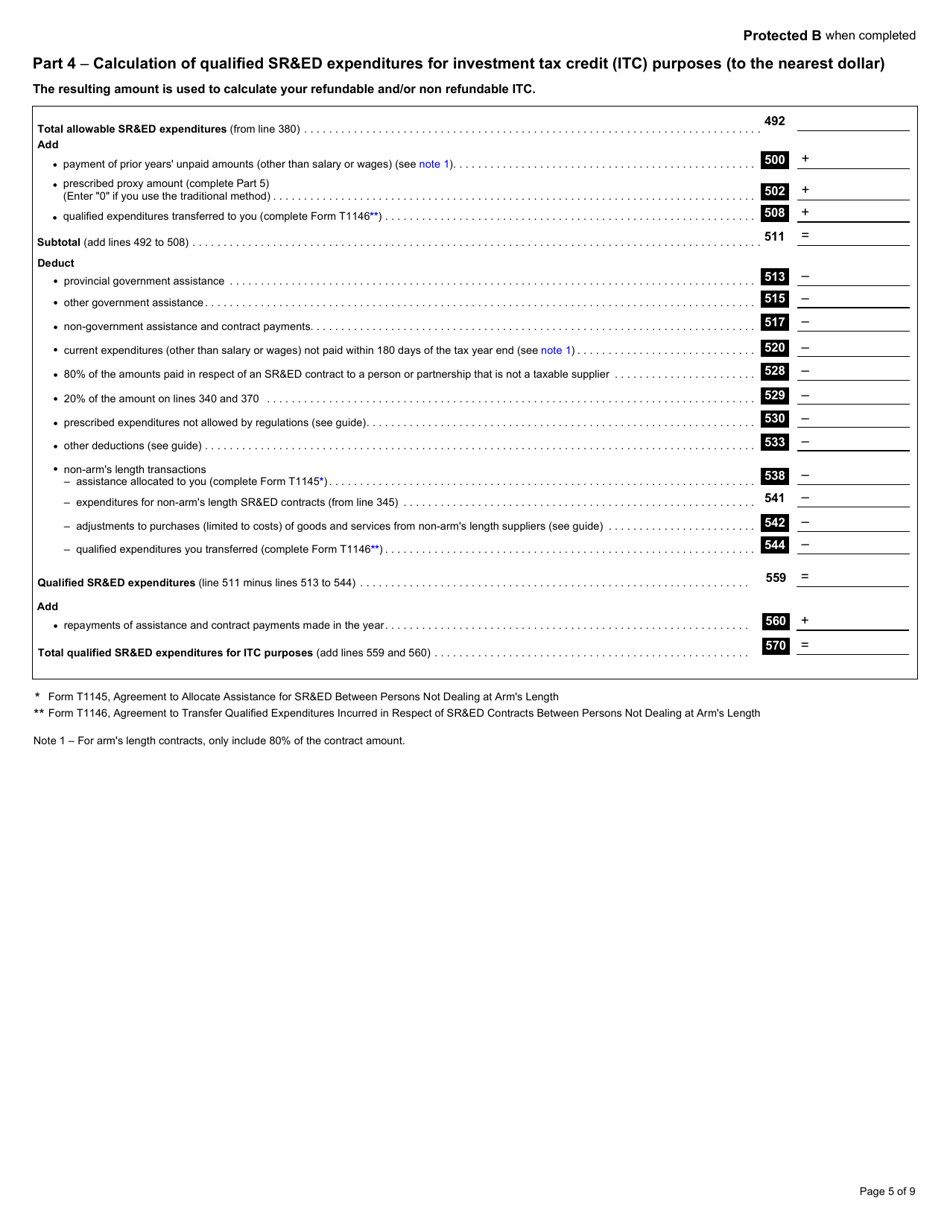

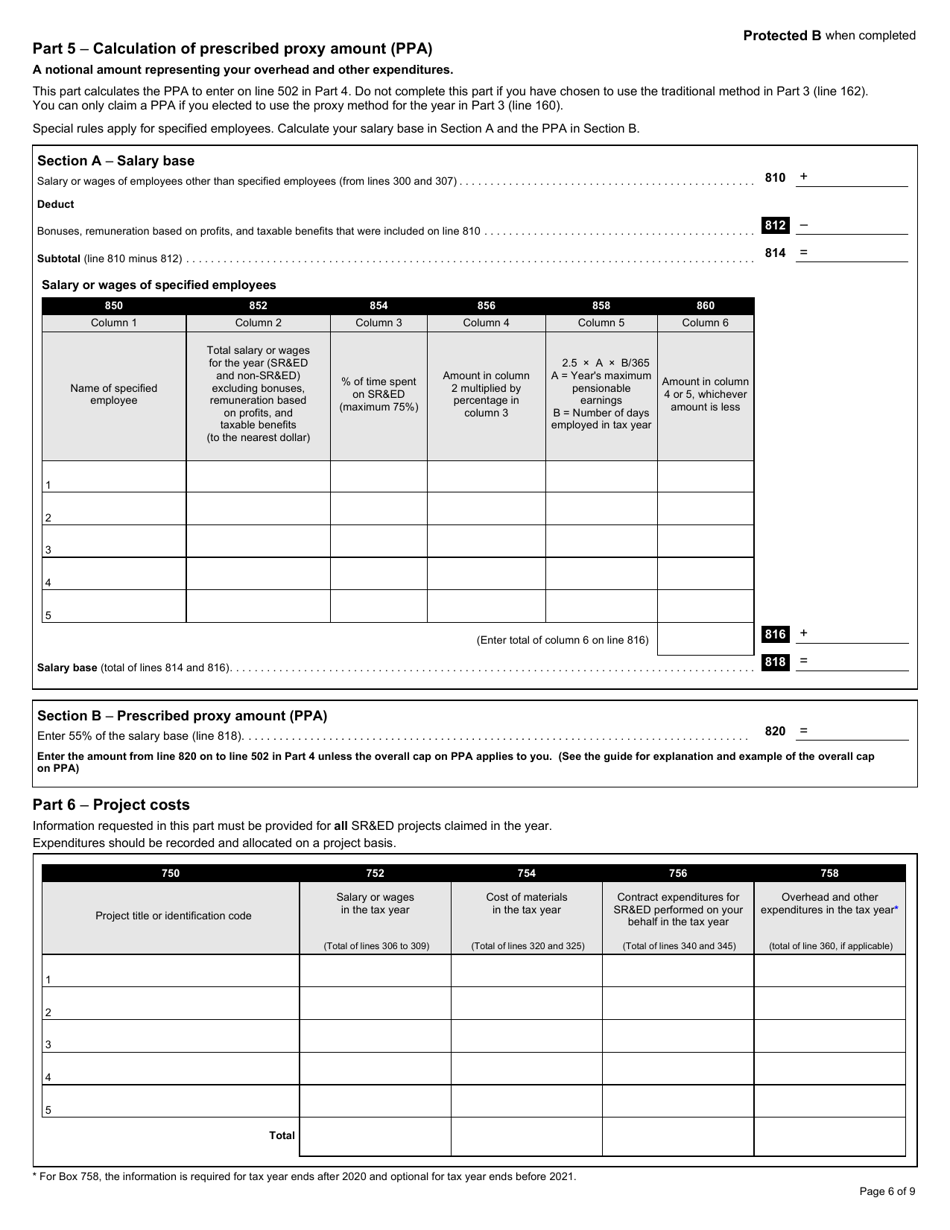

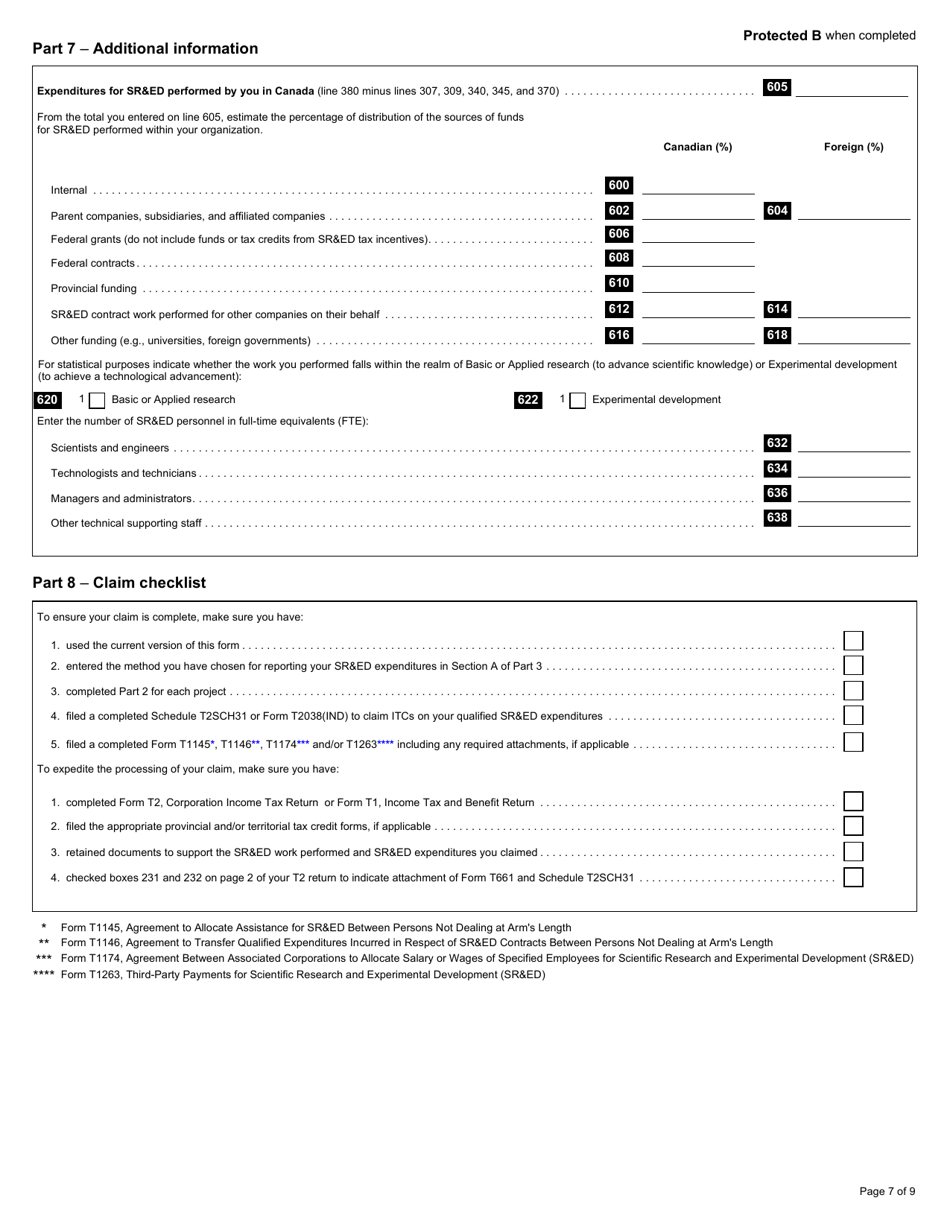

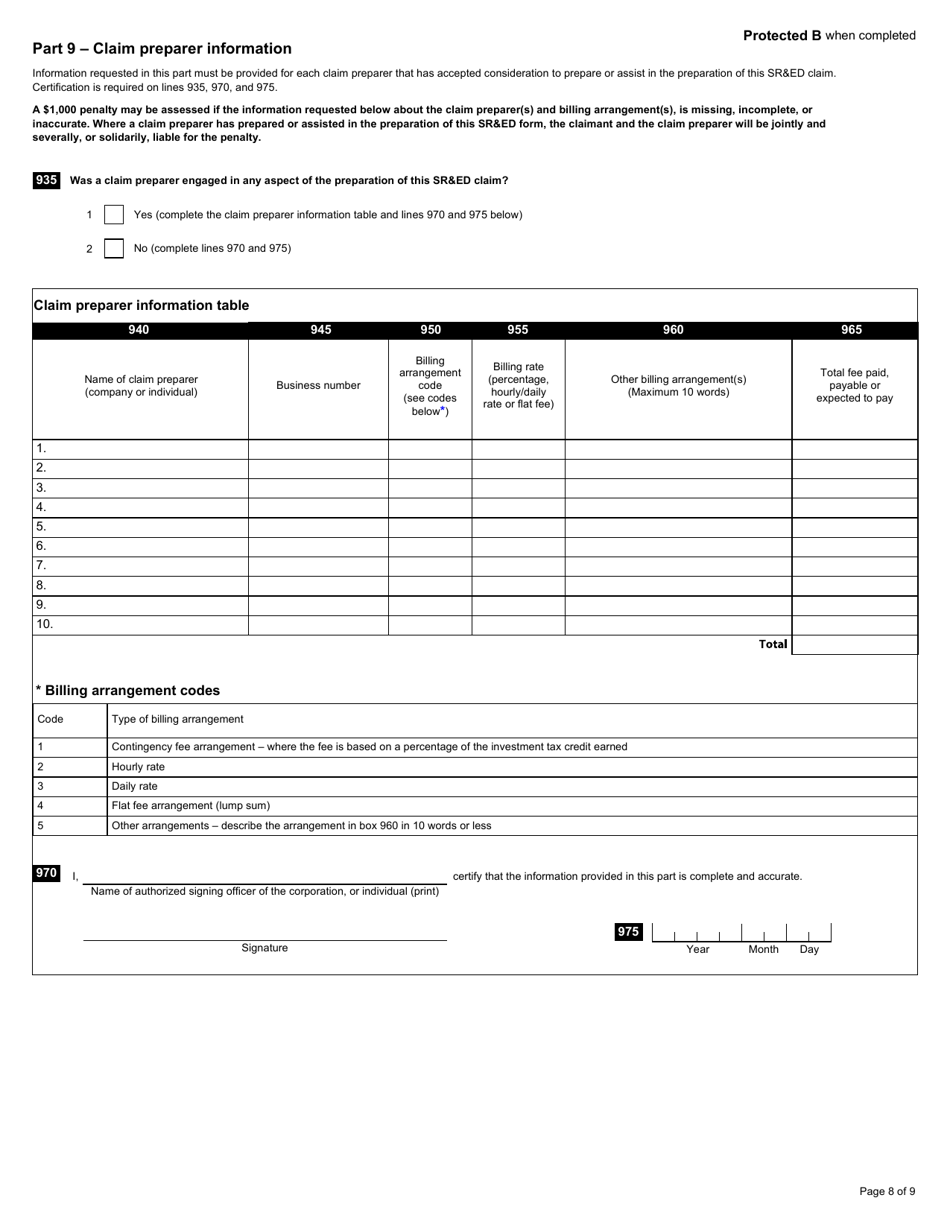

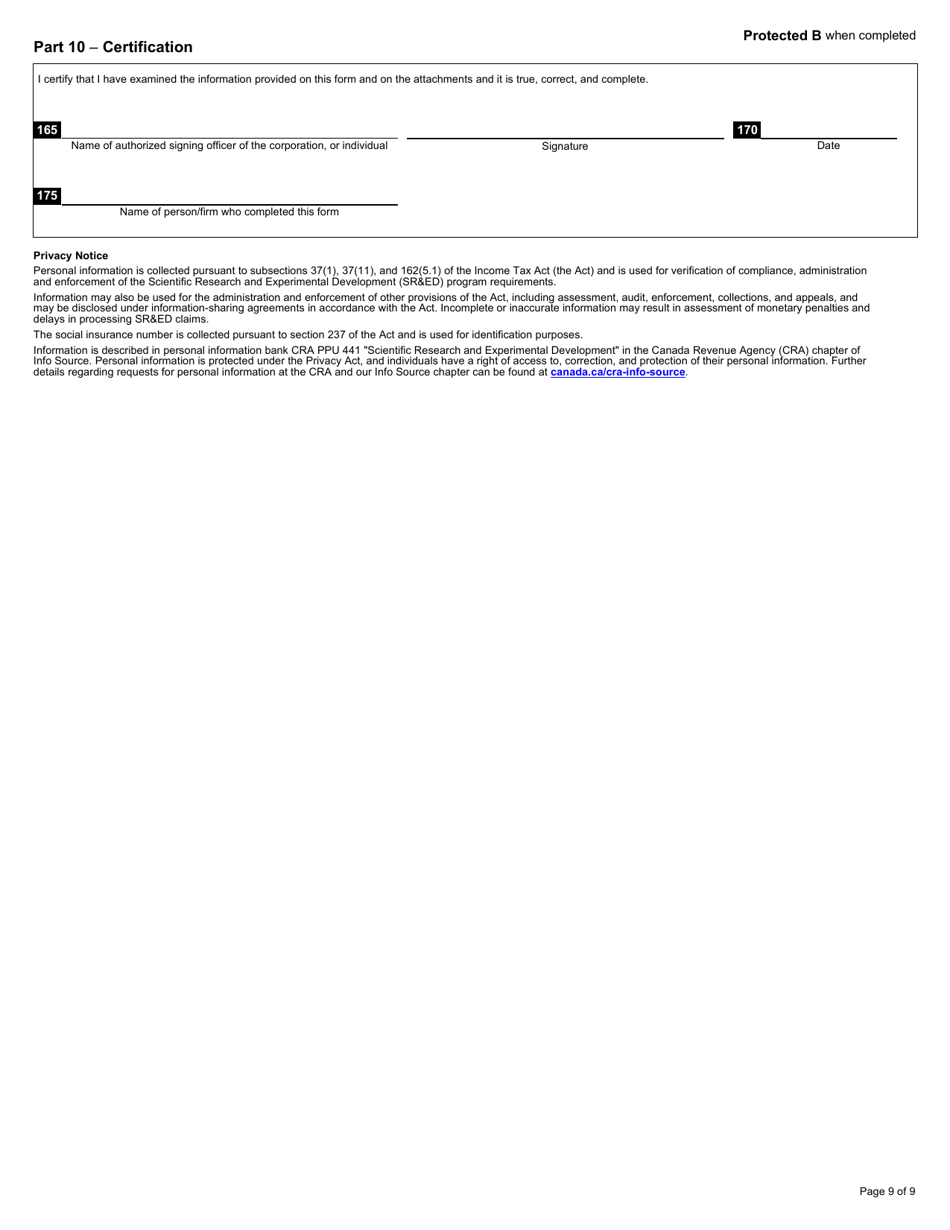

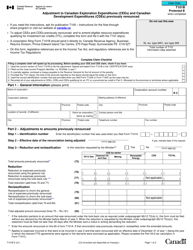

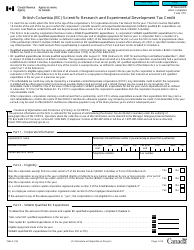

Form T661 Scientific Research and Experimental Development (Sr&ed) Expenditures Claim - Canada

Form T661 is a document used in Canada to claim Scientific Research and Experimental Development (SR&ED) tax credits. It allows individuals or businesses engaged in eligible research or development activities to claim tax incentives for expenditures related to scientific research and experimental development projects. The form helps to determine the amount of eligible expenses that can be claimed for SR&ED tax credits. These tax credits are intended to encourage and support innovation in Canada by providing financial assistance to qualifying individuals and businesses conducting scientific research and experimental development activities.

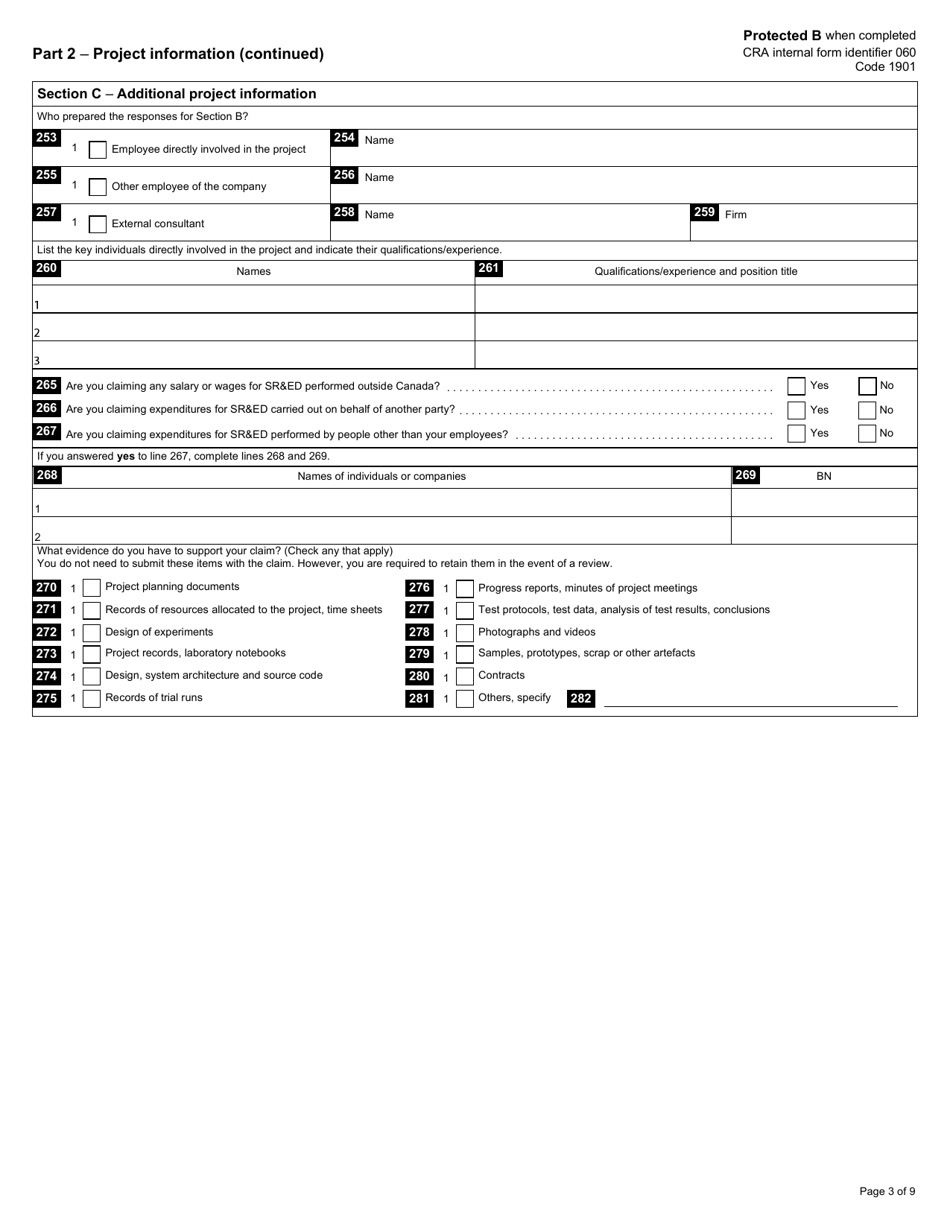

The Form T661 for Scientific Research and Experimental Development (SR&ED) Expenditures Claim in Canada is filed by Canadian corporations or individuals who have incurred eligible expenses related to scientific research and experimental development activities. It is used to claim tax incentives provided by the Canadian government for such research and development work.

Form T661 Scientific Research and Experimental Development (Sr&ed) Expenditures Claim - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T661?

A: Form T661 is a form used in Canada to claim Scientific Research and Experimental Development (SR&ED) expenditures.

Q: What is SR&ED?

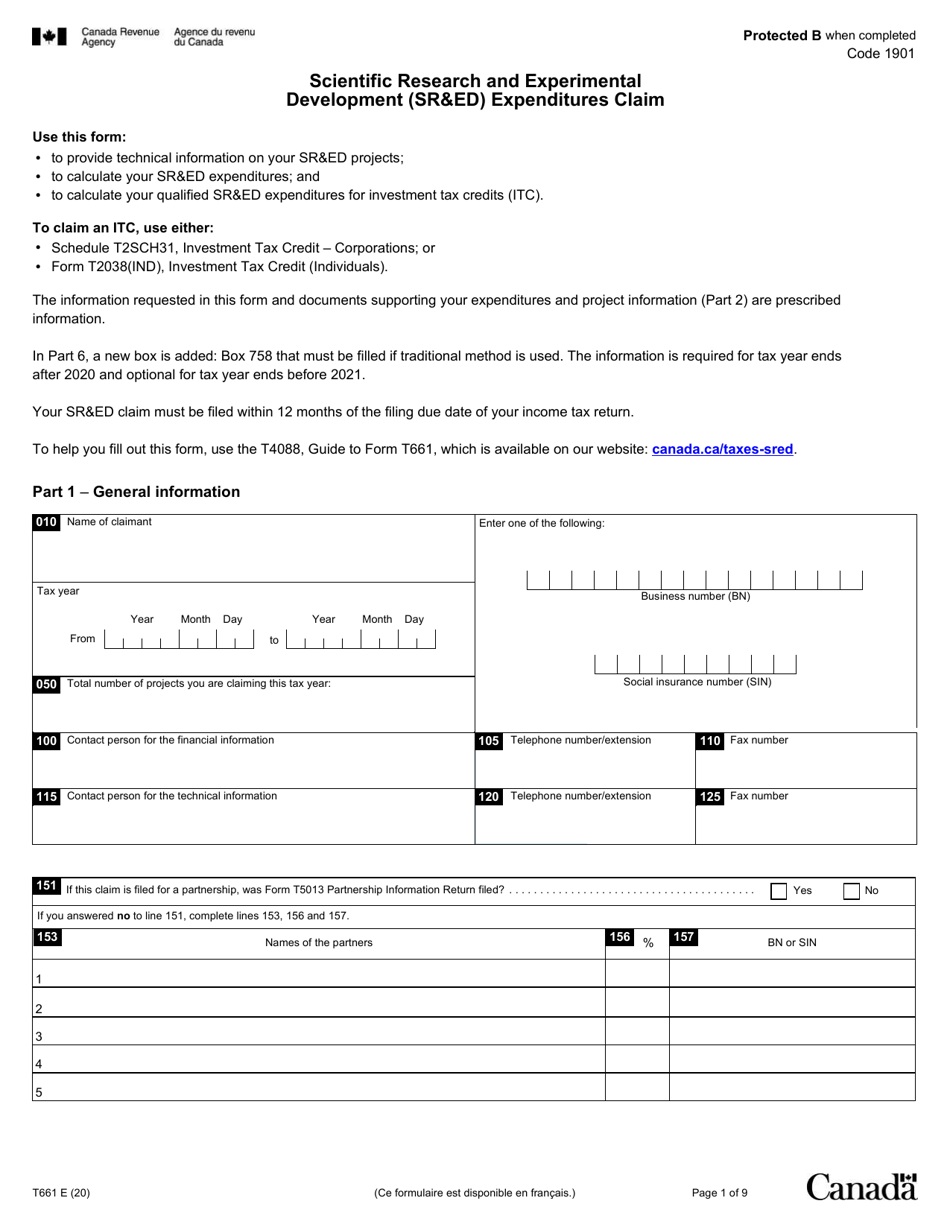

A: SR&ED stands for Scientific Research and Experimental Development. It refers to the work carried out by Canadian businesses to advance knowledge or create new products, processes, or materials.

Q: Who is eligible to file Form T661?

A: Canadian corporations and individuals who have conducted SR&ED activities may be eligible to file Form T661.

Q: What kind of expenditures can be claimed using Form T661?

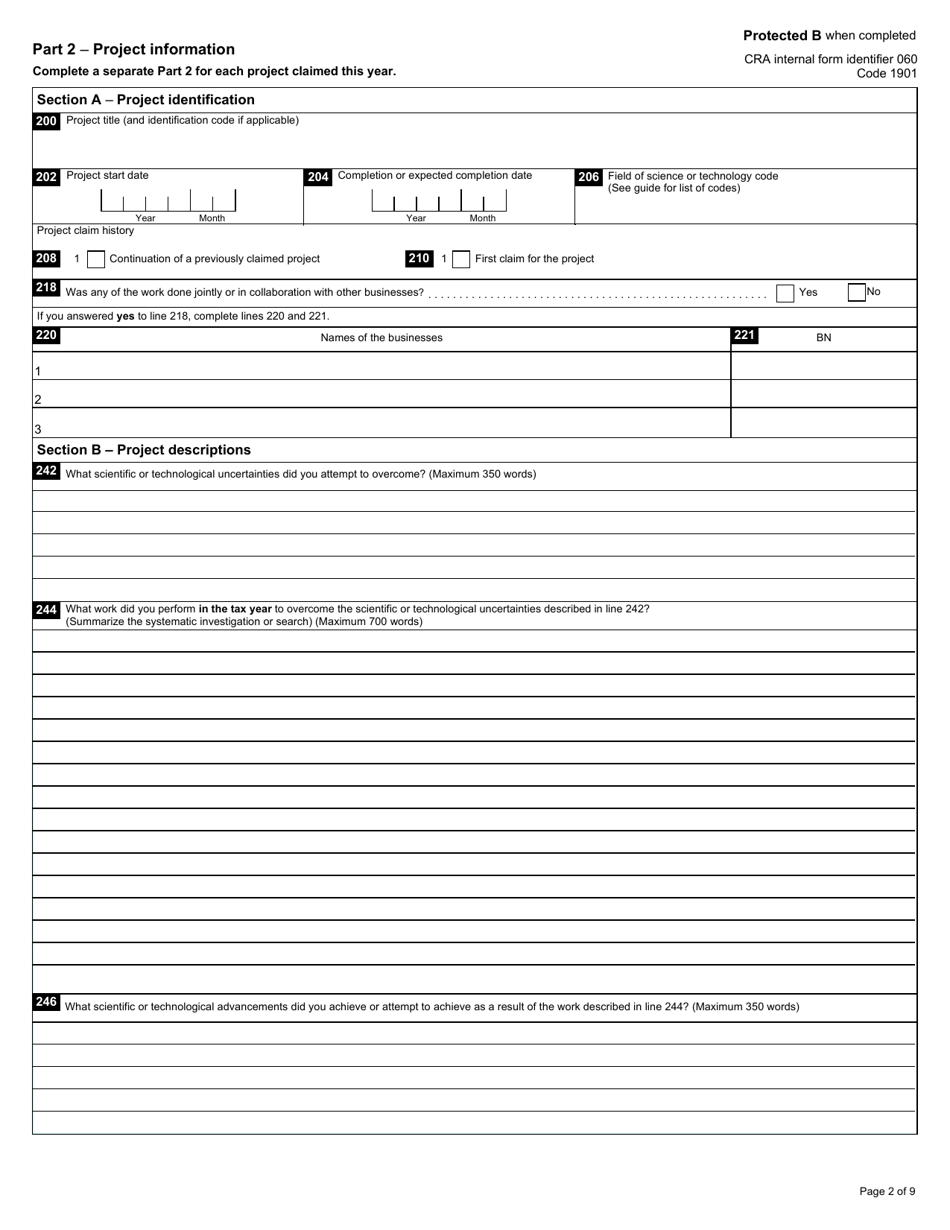

A: Expenses related to salaries, materials, subcontractors, capital expenditures, and overhead costs incurred during SR&ED activities can be claimed using Form T661.

Q: What is the purpose of filing Form T661?

A: The purpose of filing Form T661 is to claim eligible SR&ED expenditures and potentially receive tax incentives or credits from the Canadian government.

Q: Are there any specific rules or requirements for filing Form T661?

A: Yes, there are specific rules and requirements for filing Form T661. These include providing detailed information about the SR&ED activities, supporting documentation, and meeting certain eligibility criteria.

Q: When should I file Form T661?

A: Form T661 should be filed along with your corporate income tax return within 18 months after the end of the tax year in which the SR&ED expenditures were incurred.

Q: What should I do if I need help with filing Form T661?

A: If you need assistance with filing Form T661 or have questions about the SR&ED program, you can contact the CRA or consult with a tax professional who specializes in SR&ED claims.