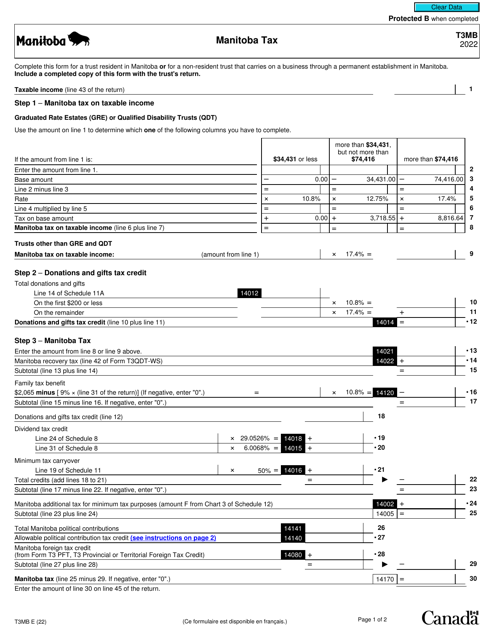

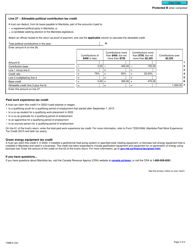

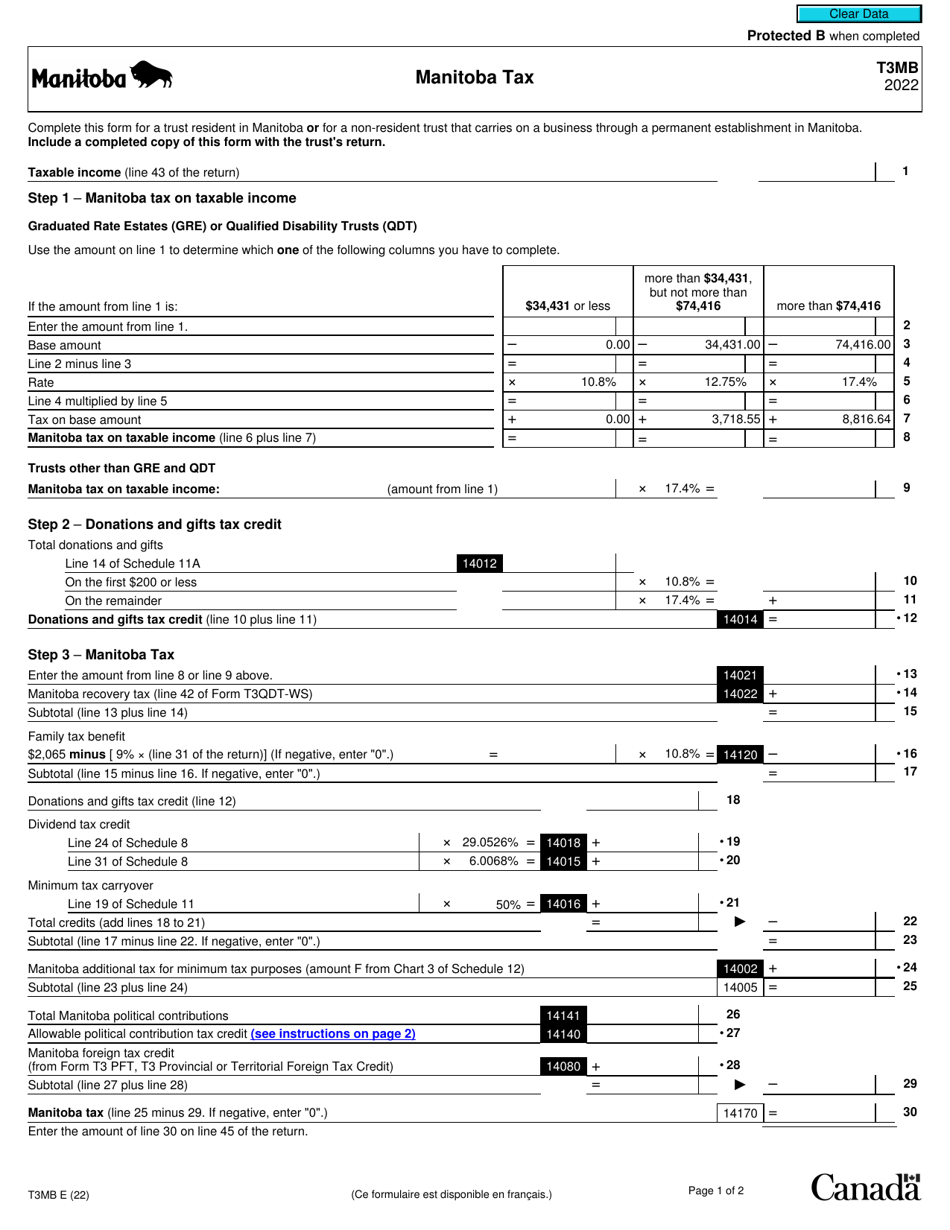

Form T3MB Manitoba Tax - Canada

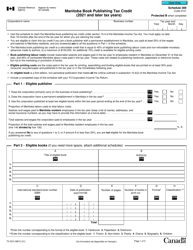

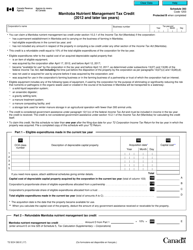

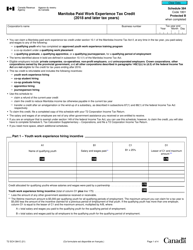

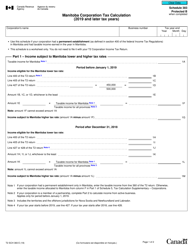

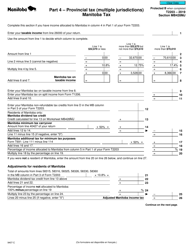

Form T3MB, also known as Manitoba Tax – Canada, is a personal income tax form used by residents of Manitoba, Canada to report and calculate their provincial taxes. It is specifically designed for individuals who reside in Manitoba and have income from various sources, including employment, self-employment, investments, and rental properties. Form T3MB is filed in addition to the federal income tax return (T1) and helps determine the amount of provincial tax owed or the refund to be claimed.

The Form T3MB Manitoba Tax in Canada is filed by residents of the province of Manitoba who have taxable income to report.

Form T3MB Manitoba Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3MB?

A: Form T3MB is a tax form specific to the province of Manitoba in Canada.

Q: Who needs to file Form T3MB?

A: Anyone who is a resident of Manitoba and has taxable income or is eligible for tax credits in the province needs to file Form T3MB.

Q: What is the purpose of Form T3MB?

A: The purpose of Form T3MB is to calculate and report your provincial tax liability in Manitoba.

Q: When is the deadline to file Form T3MB?

A: The deadline to file Form T3MB is usually April 30th of the following year, just like the federal tax return.

Q: What should I do if I have questions about filling out Form T3MB?

A: If you have questions about filling out Form T3MB, you can contact the Manitoba Taxation office or consult a tax professional.

Q: Are there any penalties for not filing Form T3MB?

A: Yes, there can be penalties for not filing Form T3MB, including late filing penalties and interest charges on any taxes owed.

Q: Can I file Form T3MB electronically?

A: Yes, you can file Form T3MB electronically through the NetFile Manitoba system.

Q: What if I move from Manitoba during the tax year?

A: If you move from Manitoba during the tax year, you may need to file both a Manitoba tax return and a tax return for your new province of residence.

Q: Is Form T3MB only for individuals or can businesses file it too?

A: Form T3MB is primarily for individuals, but certain types of businesses can also be required to file it if they have taxable income in Manitoba.