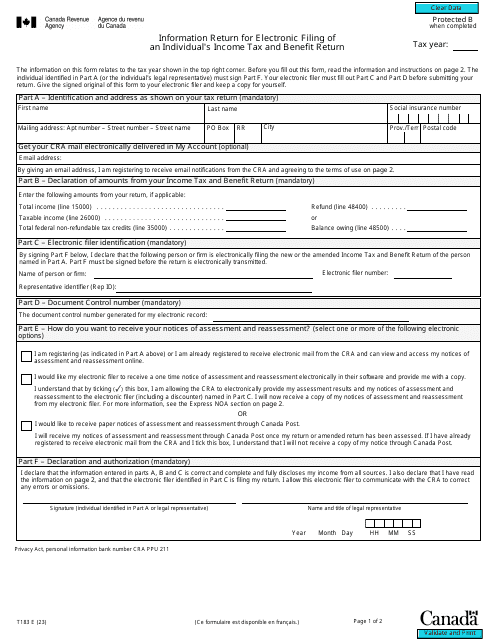

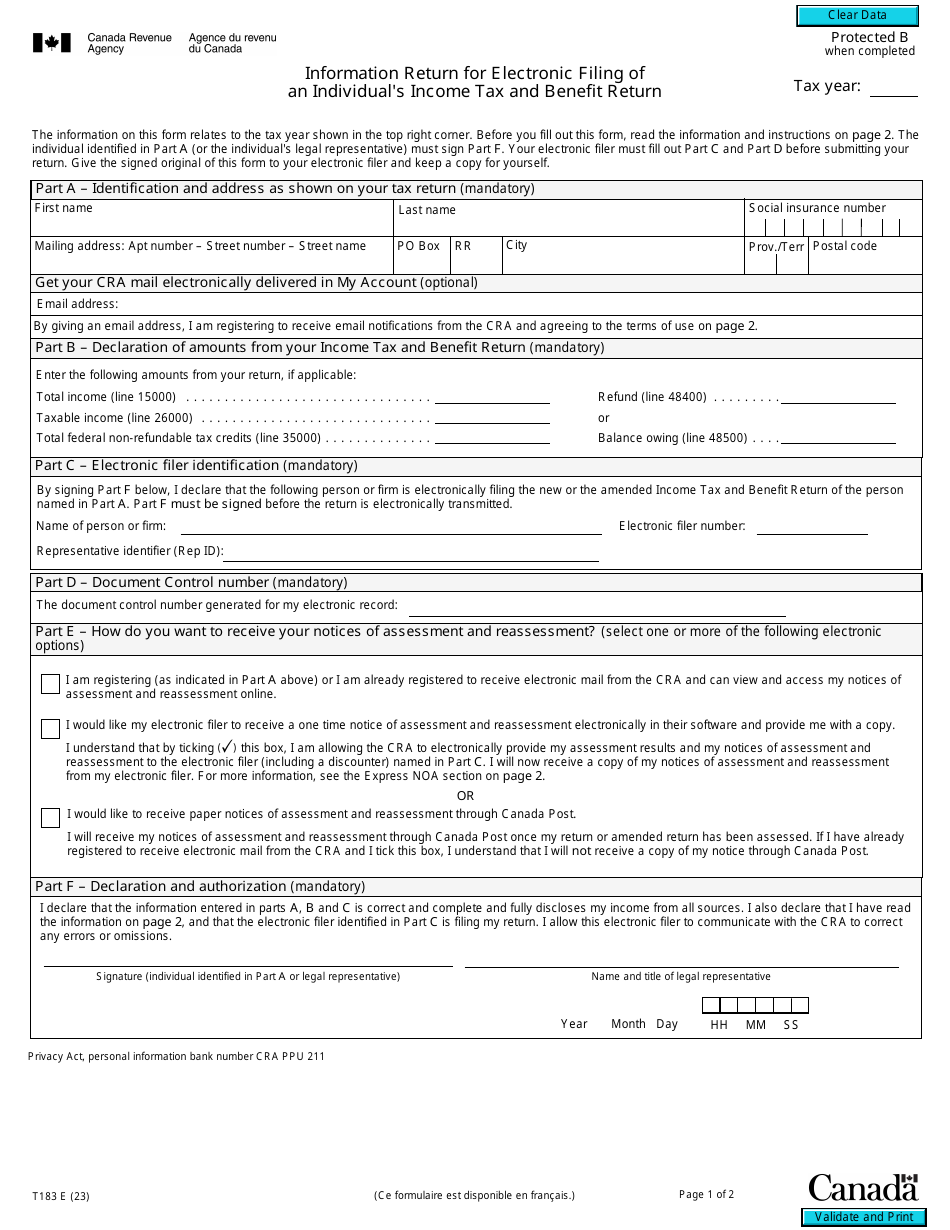

Form T183 Information Return for Electronic Filing of an Individual's Income Tax and Benefit Return - Canada

Form T183 is the information return used for electronic filing of an individual's income tax and benefit return in Canada. It provides the Canada Revenue Agency with important information about the taxpayer's personal and financial situation.

The individual filing their income tax and benefit return files the Form T183 for electronic filing.

Form T183 Information Return for Electronic Filing of an Individual's Income Tax and Benefit Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T183?

A: Form T183 is used for electronic filing of an individual's income tax and benefit return in Canada.

Q: When do I need to use Form T183?

A: You need to use Form T183 when you are filing your income tax and benefit return electronically in Canada.

Q: Is Form T183 specific to Canada?

A: Yes, Form T183 is specific to Canada and is used for filing income tax and benefit returns in Canada.

Q: What information is required on Form T183?

A: Form T183 requires information such as your name, address, social insurance number, and details about your income and deductions.

Q: Can I file my income tax and benefit return using paper forms instead of electronically?

A: Yes, you can file your income tax and benefit return using paper forms instead of electronically. However, using Form T183 is required for electronic filing.

Q: Is electronic filing of income tax and benefit return mandatory in Canada?

A: No, electronic filing of income tax and benefit return is not mandatory in Canada. It is optional, but convenient for many taxpayers.

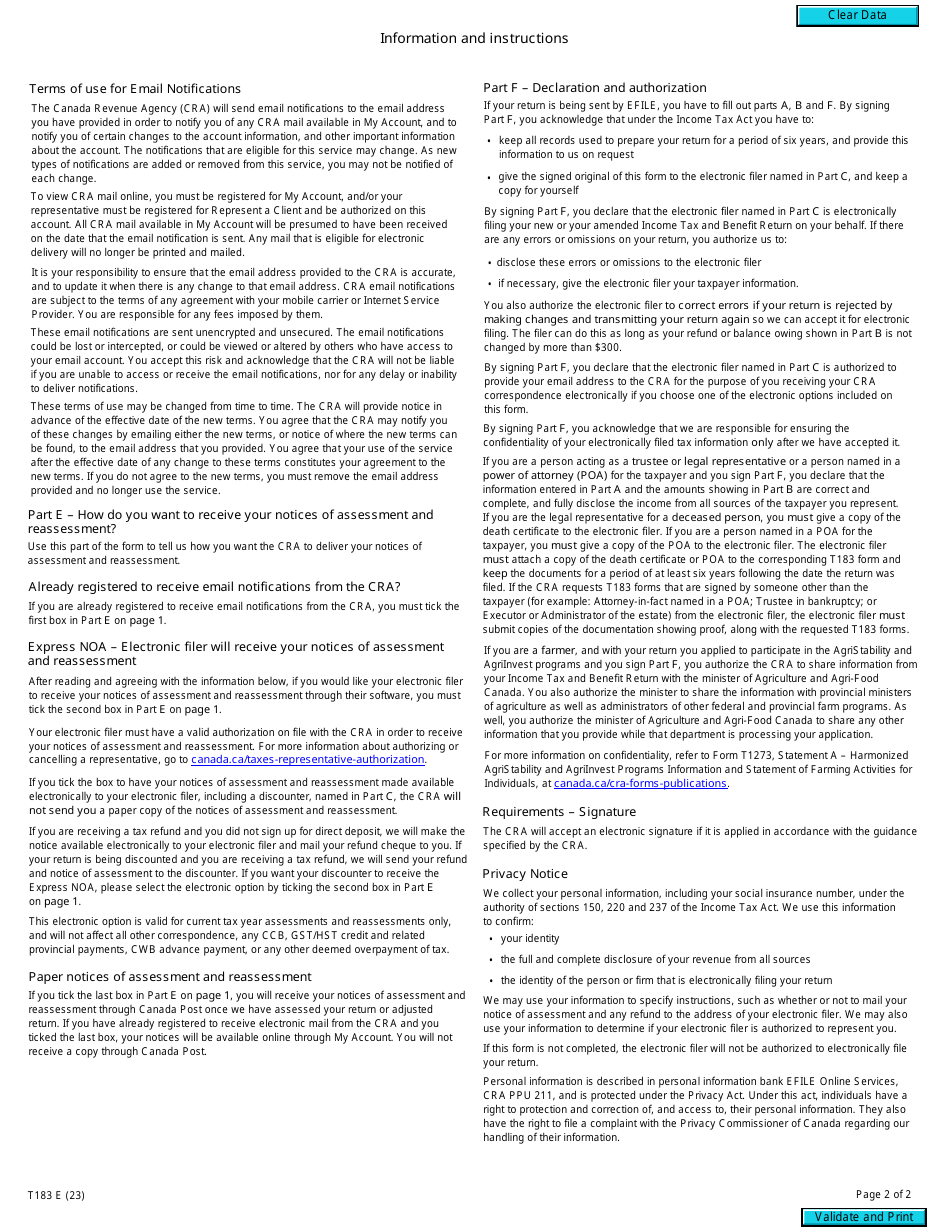

Q: Do I need to keep a copy of Form T183 after filing my income tax and benefit return?

A: Yes, it is recommended to keep a copy of Form T183 and all supporting documents for your records after filing your income tax and benefit return.