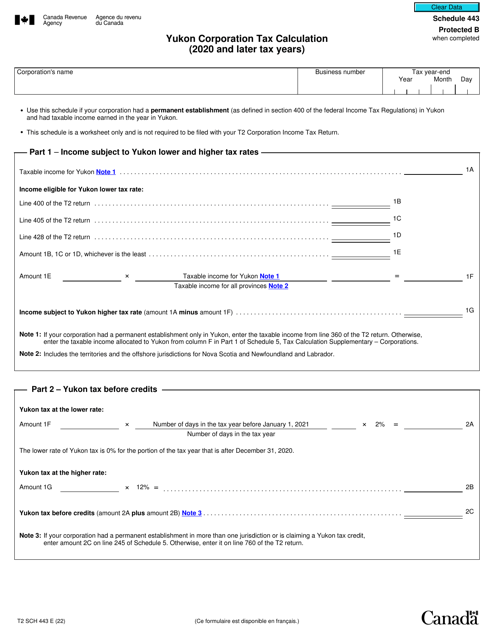

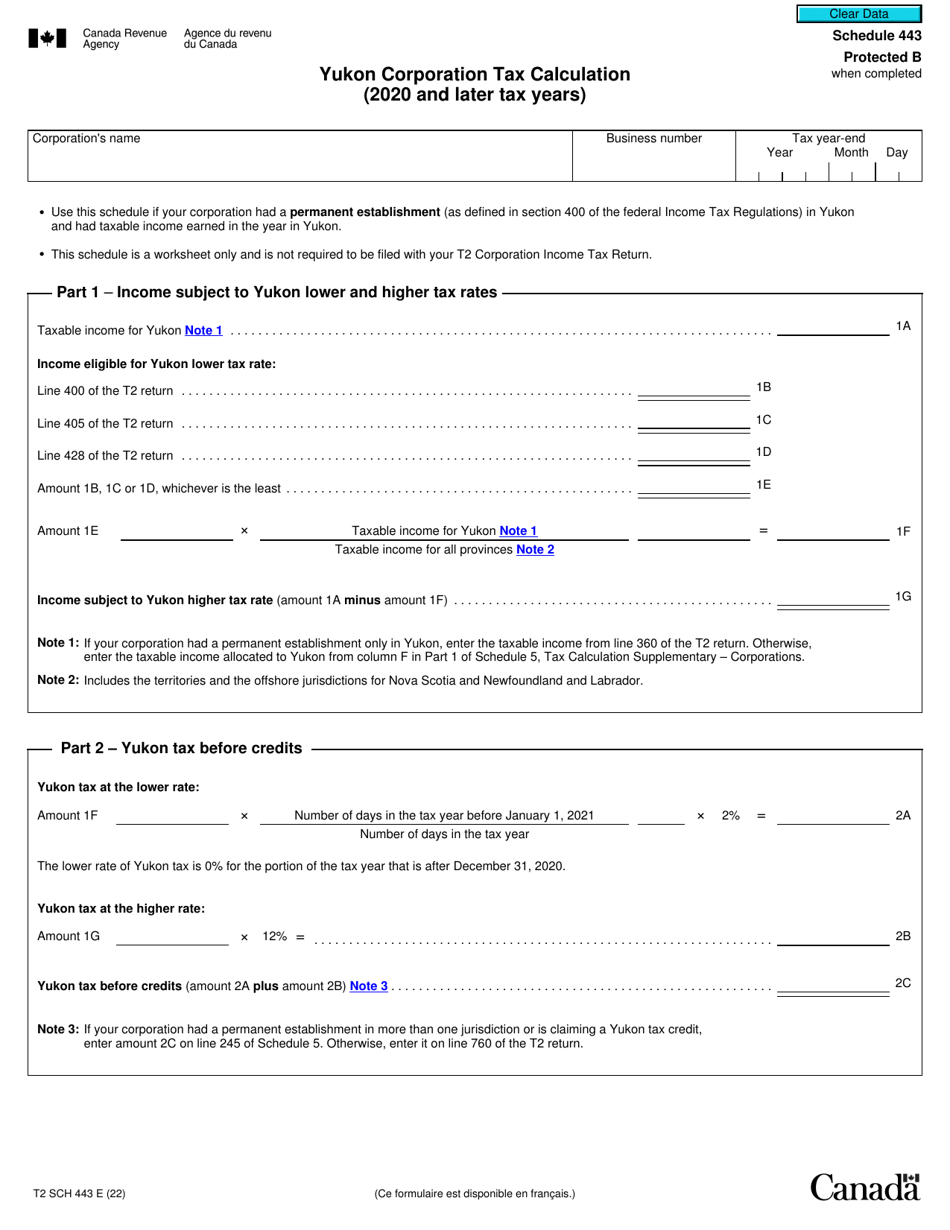

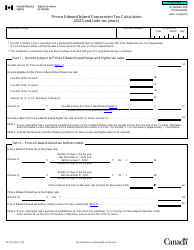

Form T2 Schedule 443 Yukon Corporation Tax Calculation (2020 and Later Tax Years) - Canada

Form T2 Schedule 443 is used by corporations in Yukon, Canada to calculate their corporation tax. It is specifically designed for tax years starting from 2020 onwards.

The Yukon Corporation files the Form T2 Schedule 443 for tax calculation in Canada.

Form T2 Schedule 443 Yukon Corporation Tax Calculation (2020 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 443?

A: Form T2 Schedule 443 is a tax form used by Yukon corporations to calculate their corporation tax liability.

Q: Who should use Form T2 Schedule 443?

A: Yukon corporations should use Form T2 Schedule 443 to calculate their corporation tax.

Q: What tax years does Form T2 Schedule 443 apply to?

A: Form T2 Schedule 443 applies to tax years 2020 and later.

Q: What does Form T2 Schedule 443 calculate?

A: Form T2 Schedule 443 calculates the corporation tax liability for Yukon corporations.