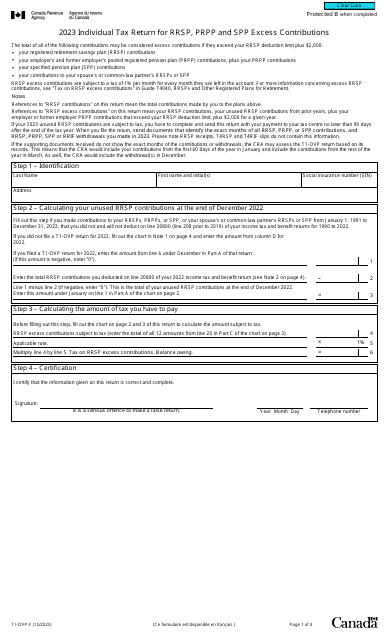

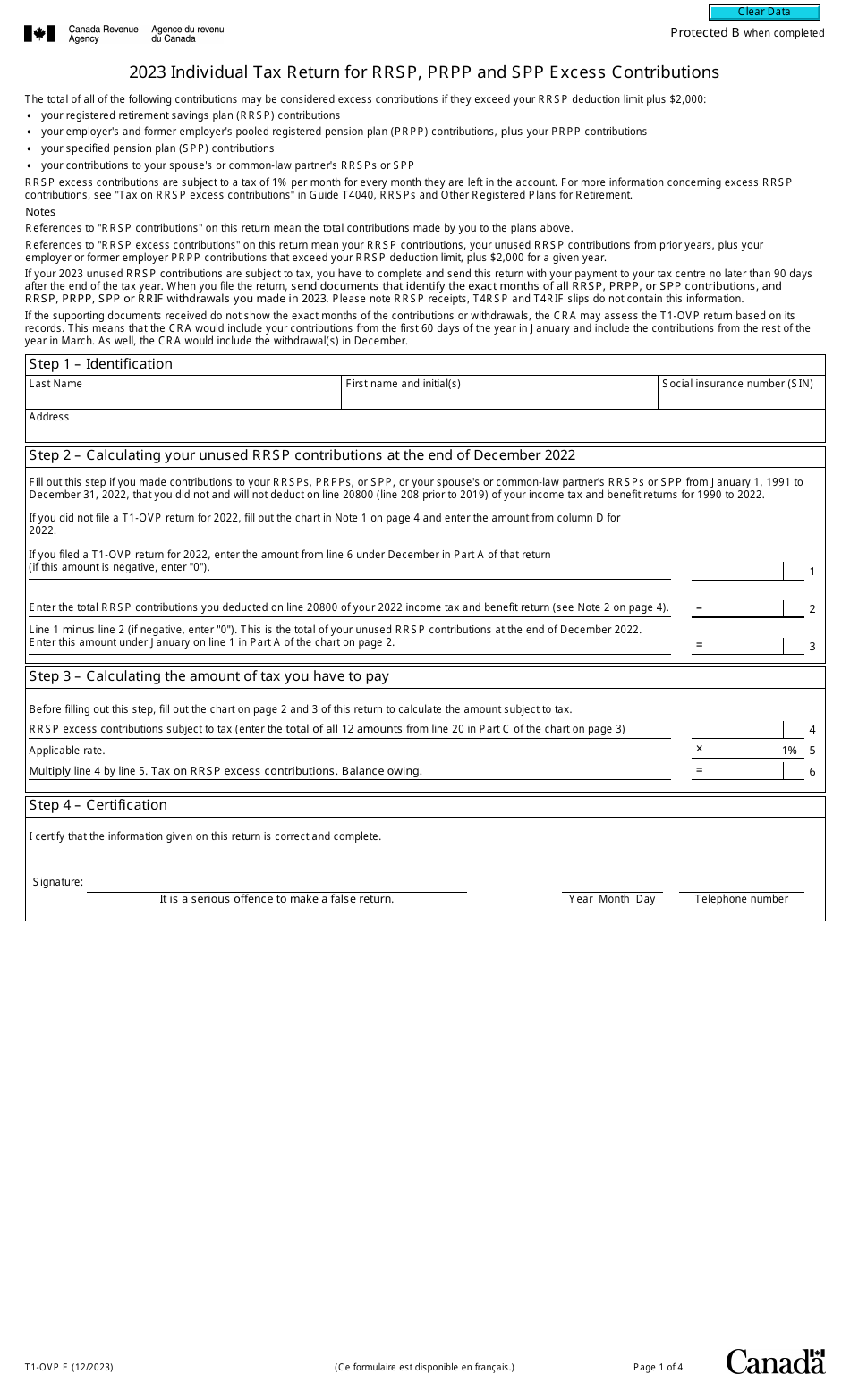

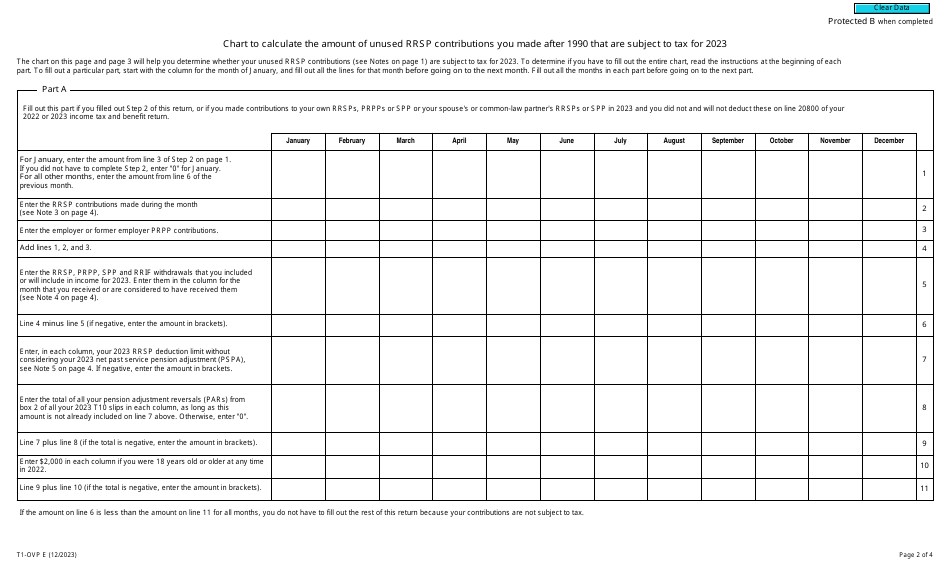

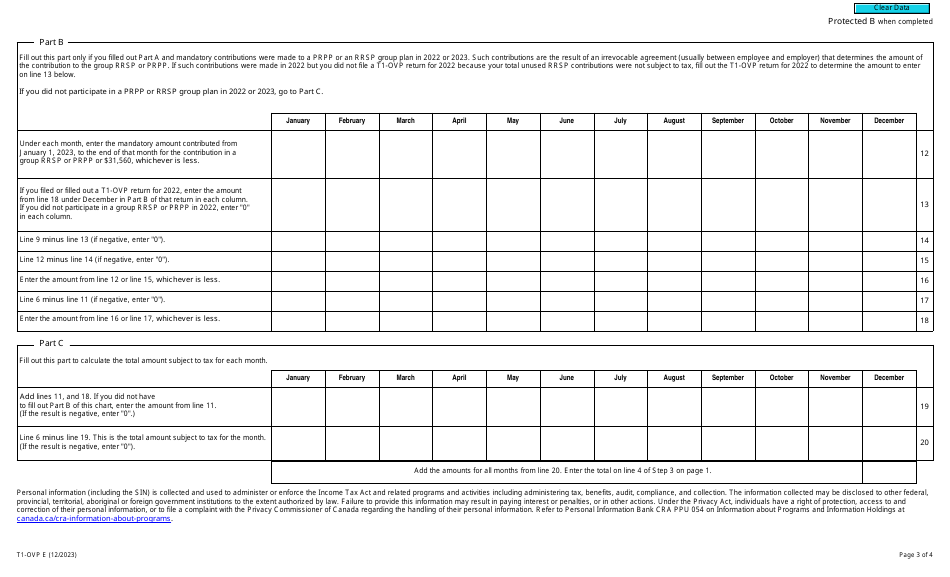

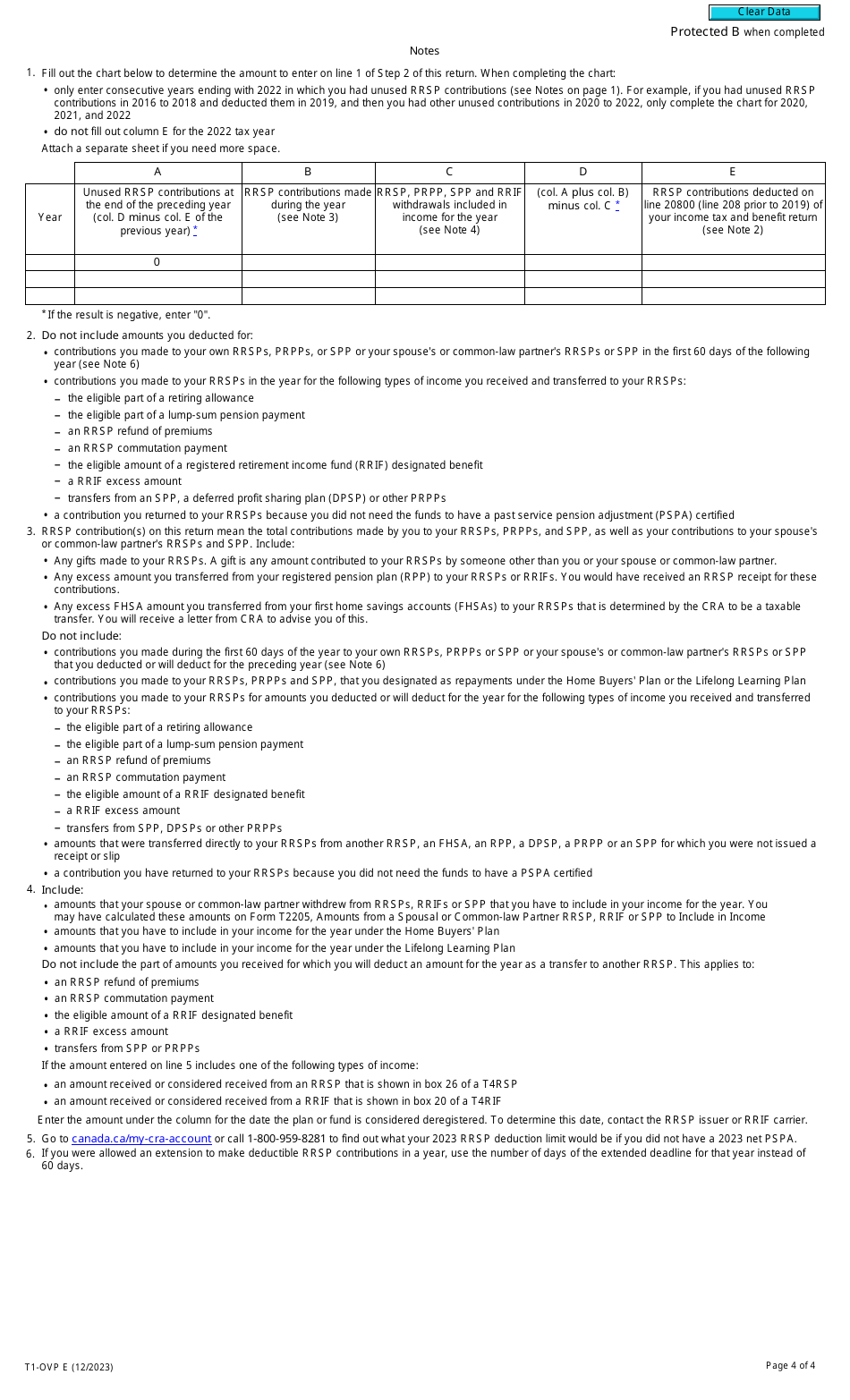

Form T1-OVP Individual Tax Return for Rrsp, Prpp and Spp Excess Contributions - Canada

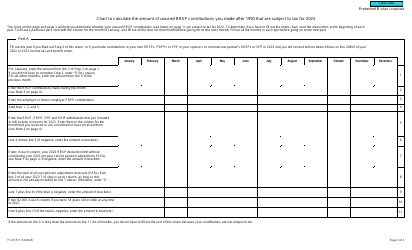

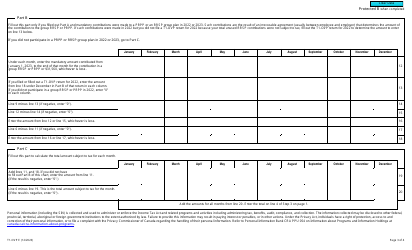

Form T1-OVP is used by individuals in Canada to report excess contributions made to their registered retirement savings plans (RRSPs), pooled registered pension plans (PRPPs), and specified pension plans (SPPs). This form is used to calculate and pay the tax owed on these excess contributions.

The Form T1-OVP Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions in Canada is filed by the individual taxpayer who has made excess contributions to their Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP).

Form T1-OVP Individual Tax Return for Rrsp, Prpp and Spp Excess Contributions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1-OVP?

A: Form T1-OVP is the Canadian tax form used to report excess contributions to RRSP, PRPP, and SPP.

Q: What are RRSP, PRPP, and SPP?

A: RRSP stands for Registered Retirement Savings Plan, PRPP stands for Pooled Registered Pension Plan, and SPP stands for Specified Pension Plan.

Q: What are excess contributions?

A: Excess contributions are contributions made to RRSP, PRPP, or SPP that exceed the allowable limits.

Q: Why do I need to report excess contributions?

A: Reporting excess contributions ensures that you are not subject to additional taxes or penalties.

Q: When do I need to file Form T1-OVP?

A: You need to file Form T1-OVP if you have made excess contributions in a tax year.

Q: Are there any penalties for failing to report excess contributions?

A: Yes, failing to report excess contributions may result in additional taxes and penalties.

Q: Is there a deadline for filing Form T1-OVP?

A: The deadline for filing Form T1-OVP is the same as the deadline for filing your income tax return, which is typically April 30th.

Q: Can I amend my Form T1-OVP if I made a mistake?

A: Yes, if you made a mistake on your Form T1-OVP, you can file an amended form to correct it.

Q: Do I need to submit any supporting documents with Form T1-OVP?

A: You may need to provide supporting documents, such as receipts or statements, to substantiate your excess contributions.