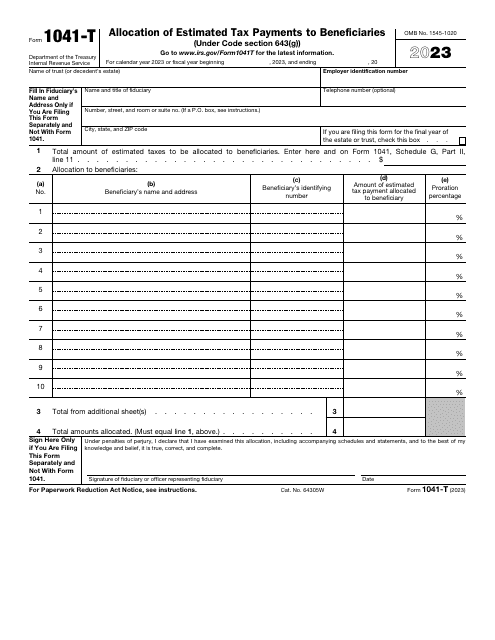

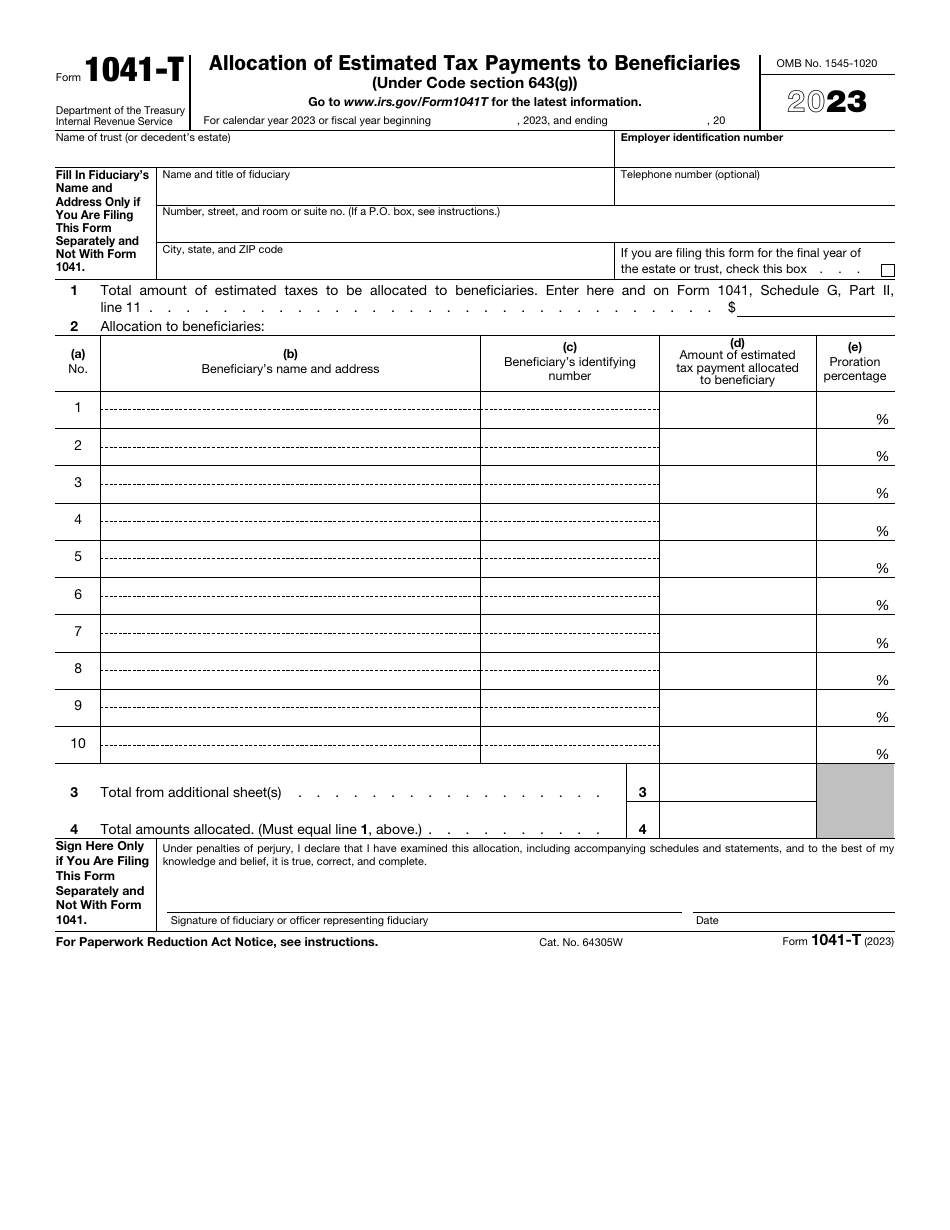

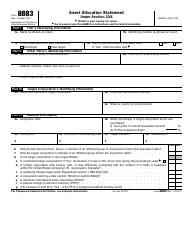

IRS Form 1041-T Allocation of Estimated Tax Payments to Beneficiaries

Fill PDF Online

Fill out online for free

without registration or credit card

What Is IRS Form 1041-T?

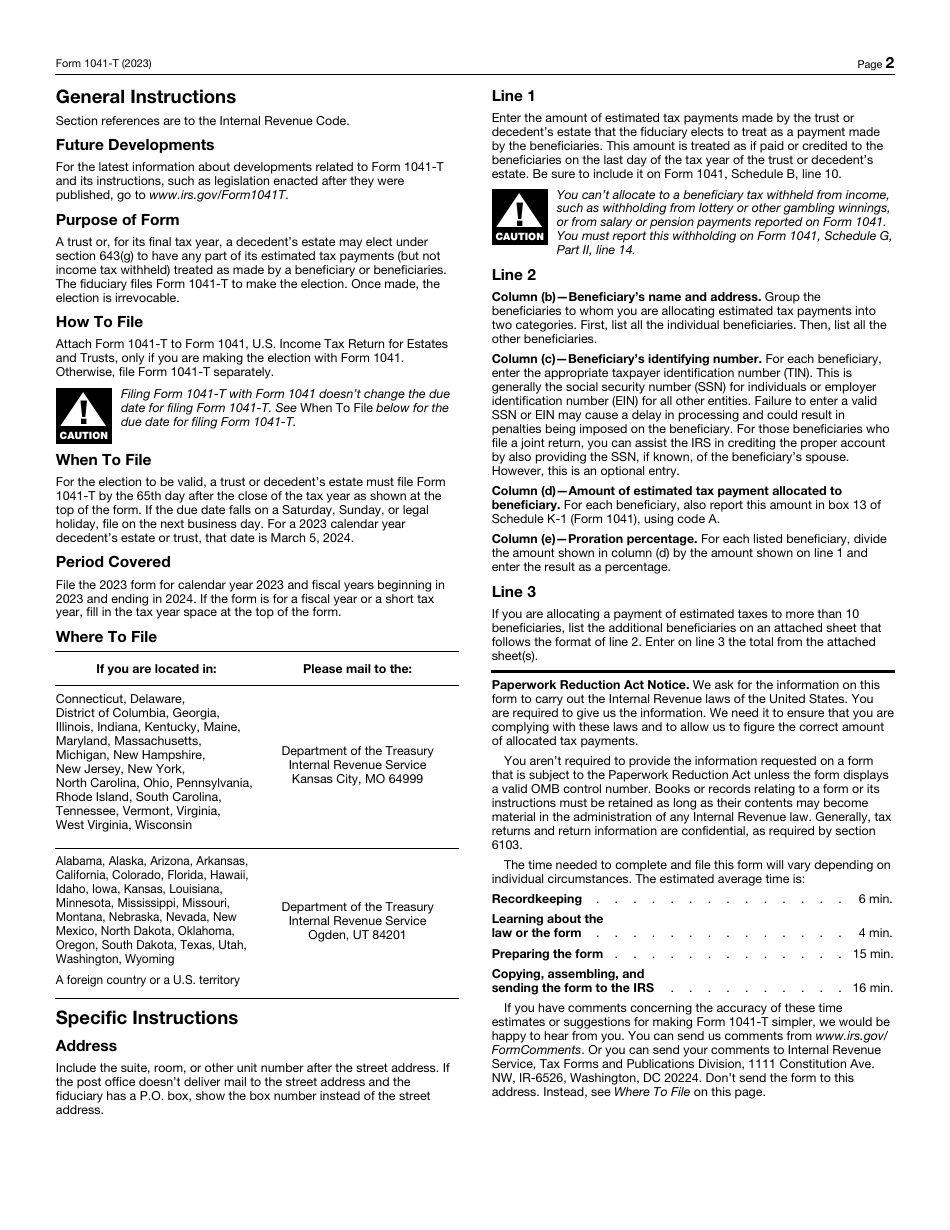

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Additional instructions and information can be found on page 2 of the document;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041-T through the link below or browse more documents in our library of IRS Forms.