Free Connecticut Small Estate Affidavit Forms and Templates

Connecticut Small Estate Affidavit Form: What Is It?

By completing a Connecticut Small Estate Affidavit Form , a person is legally allowed to claim an inherited property and this will give them the legal power to be the new owner of the property. Of course, this applies when the original owner of the property has passed away.

Alternate Name:

- CT Small Estate Affidavit.

By forming a Connecticut Small Estate Affidavit, the new owner of the property avoids the timely probate procedure in court which must go through rigorous checks. There are however some specific pieces of legislation put in place which must be carefully complied with. Otherwise, you risk the document not being recognized from a legal point of view. This legislation includes:

- Although like most states there is no minimum time period only after which you can file the form in Connecticut. However, once the document is received at court, the court should hold this file for a minimum of 30 days after they have received the document;

- This affidavit only concerns personal property which should have a value of no more than forty thousand dollars. Any assets concerning real estate, unfortunately, cannot go through this process;

- The document should be signed appropriately.

Connecticut Small Estate Affidavit Types

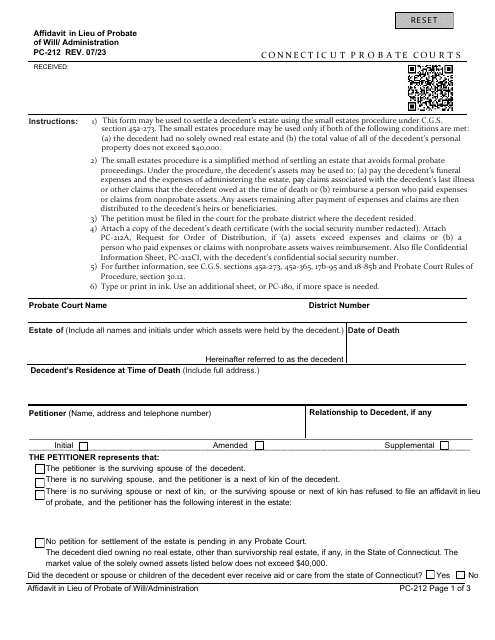

- Form PC-212, Affidavit in Lieu of Probate of Will/Administration – this document is the affidavit which needs to be filled in. It is the main document;

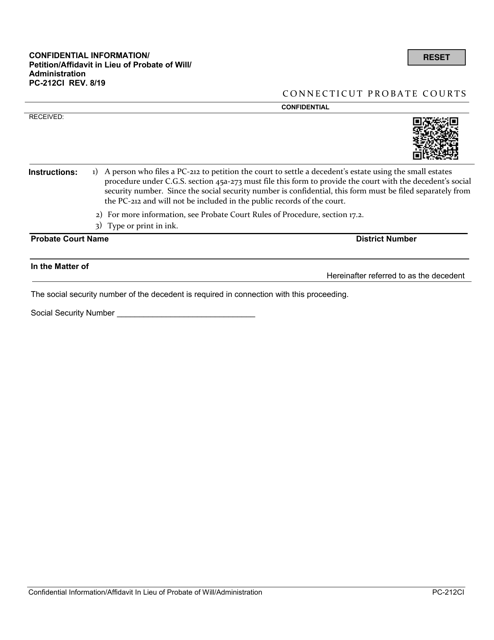

- Form PC-212CI, Confidential Information/Petition/Affidavit in Lieu of Probate of Will/Administration – this is a supplementary document to the main affidavit which is required for gaining confidential information.

How to File a Small Estate Affidavit in Connecticut?

When you come to filing a Small Estate Affidavit in Connecticut, you need to be aware of the various steps that need to be taken to ensure that it is filed correctly and that no issues will be flagged up. The process consists of the following steps:

- Firstly, the person planning to fill in the affidavit needs to ensure that they match the criteria and that no real estate has been left. Otherwise, this form would be inappropriate;

- Once confirming eligibility, all assets should be totaled to ensure they do not go over the threshold;

- Fill in the relevant forms, including both Form PC-212CI and PC-212;

- After everything is filled in correctly and accurately, you need to file the document. This can be done in two ways – either by submitting it online or you can submit the form in court. If you choose to do this through court you would need to hand over two notarized copies;

- After submitting all forms and documents all you need to do is wait. The courts legally cannot start looking at the documents or working with them any less than 30 days after submission;

- If a will was created then the assets should be delegated in accordance with the law. If no will was created, local state laws describe the next course of action;

- The probate court will then make a quick decision and the assets will be divided up as planned originally.

Documents:

2

This form is used for submitting confidential information, petition, and affidavit instead of going through the probate process for a will administration in Connecticut.