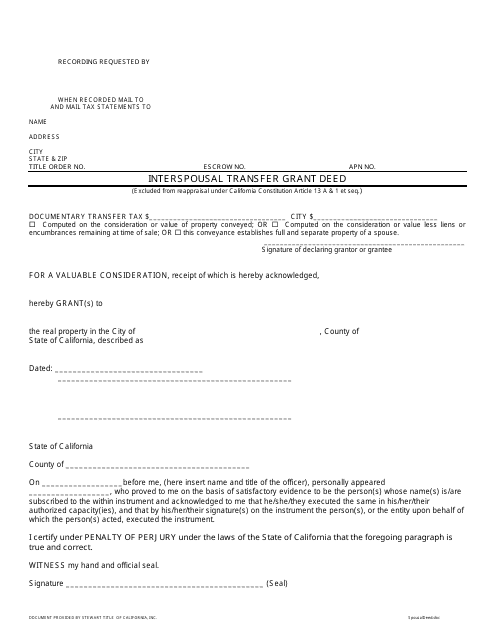

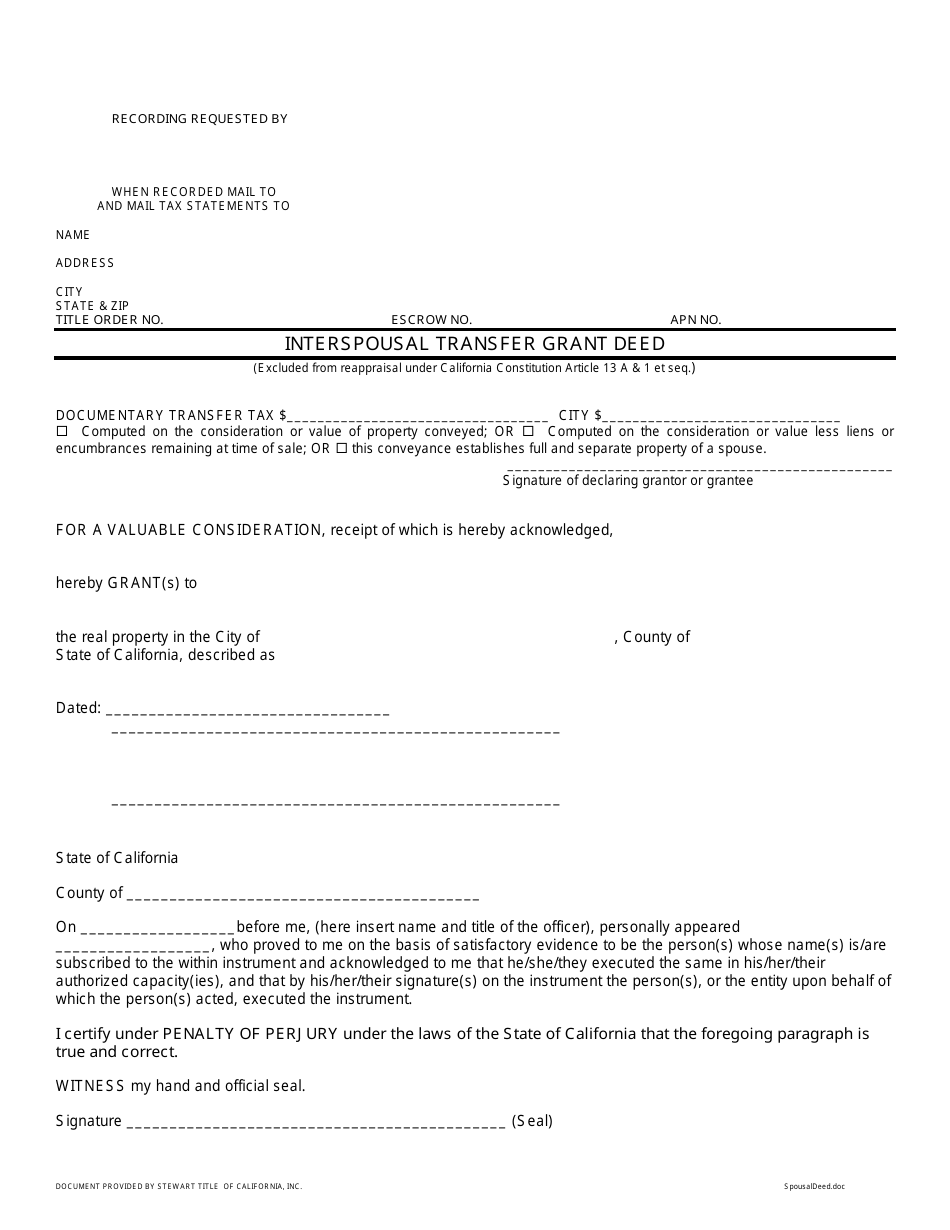

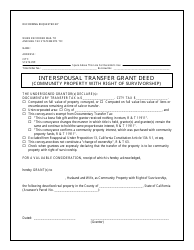

Interspousal Transfer Grant Deed Form - California

The Interspousal Transfer Grant Deed Form in California is used to transfer property between spouses. It allows one spouse to transfer their interest in the property to the other spouse without triggering reassessment for property tax purposes.

The Interspousal Transfer Grant Deed form in California is typically filed by married couples who wish to transfer real property between themselves.

FAQ

Q: What is an Interspousal Transfer Grant Deed?

A: An Interspousal Transfer Grant Deed is a legal document used in California to transfer real estate between spouses.

Q: Why would I use an Interspousal Transfer Grant Deed?

A: You would use an Interspousal Transfer Grant Deed to transfer ownership of property between spouses, typically as part of a divorce or in order to change the way property is held.

Q: Are there any legal requirements for an Interspousal Transfer Grant Deed?

A: Yes, there are specific legal requirements for an Interspousal Transfer Grant Deed in California. It is recommended to consult with a professional or an attorney to ensure the document is prepared correctly.

Q: Can an Interspousal Transfer Grant Deed be used for other purposes?

A: While the primary use of an Interspousal Transfer Grant Deed is to transfer property between spouses, it may be used for other purposes, such as transferring property to a trust or gifting property to a family member.