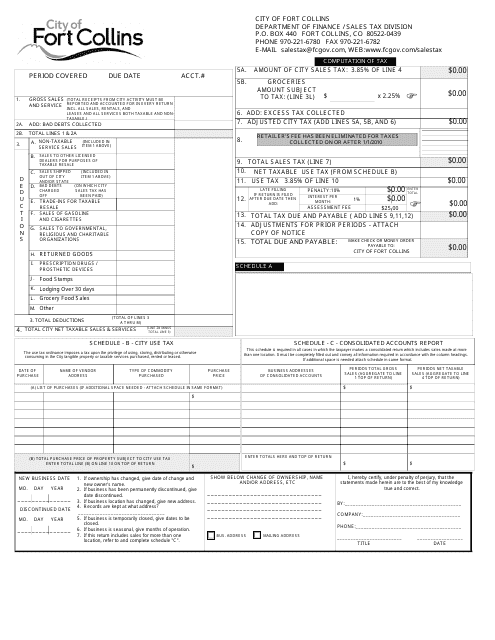

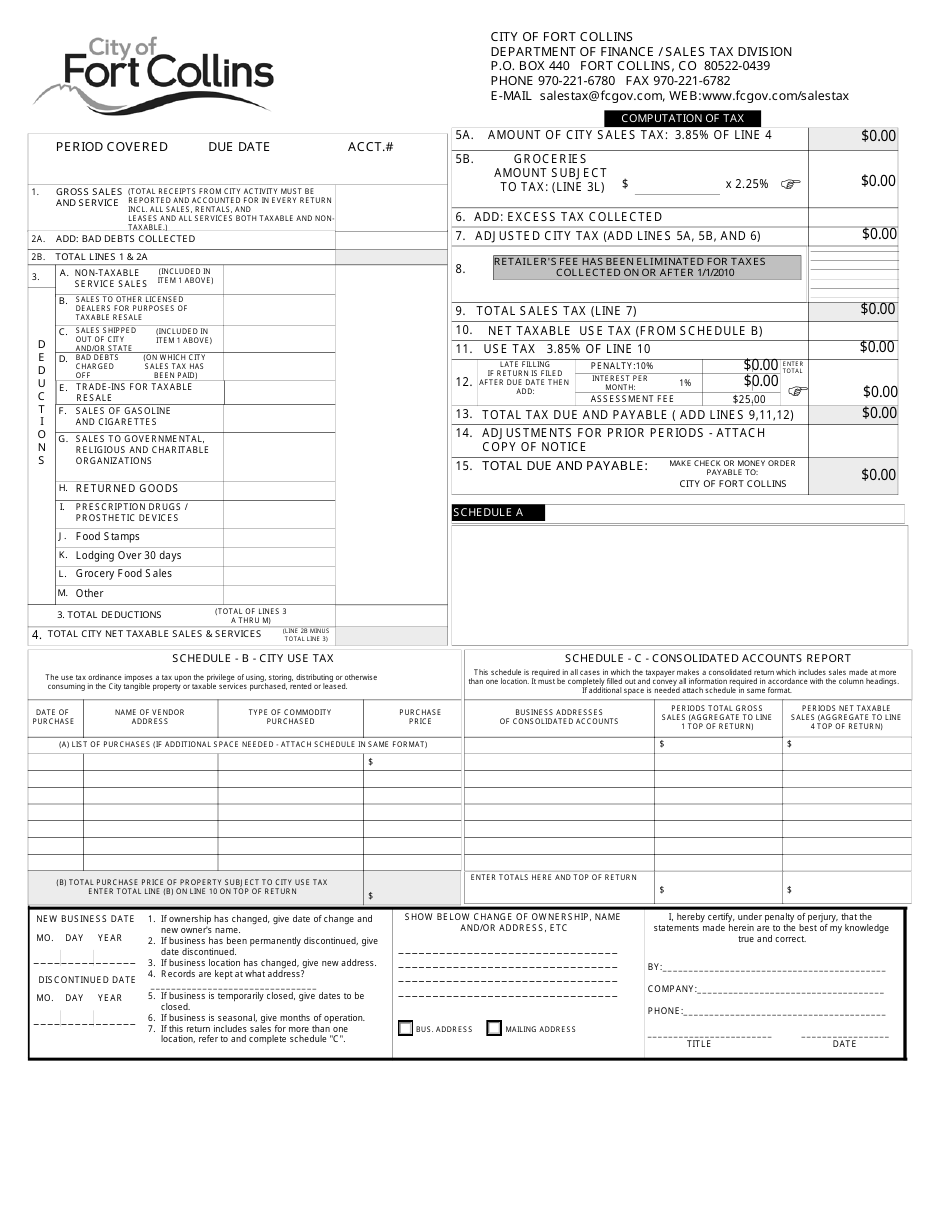

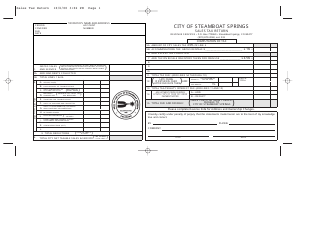

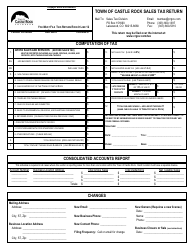

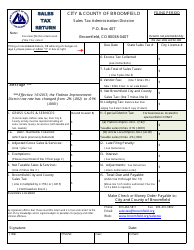

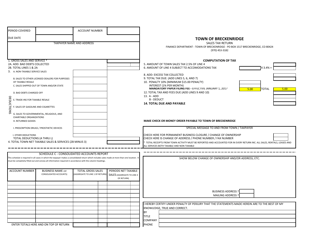

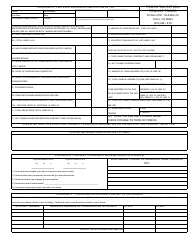

Sales & Use Tax Return Form - City of Fort Collins, Colorado

Sales & Use Tax Return Form is a legal document that was released by the Colorado Department of Revenue - a government authority operating within Colorado. The form may be used strictly within City of Fort Collins.

FAQ

Q: What is the Sales & Use Tax Return Form?

A: The Sales & Use Tax Return Form is a document used to report and remit sales and use tax to the City of Fort Collins, Colorado.

Q: Who needs to file the Sales & Use Tax Return Form?

A: Businesses that have conducted sales or used taxable items within the City of Fort Collins, Colorado are required to file the Sales & Use Tax Return Form.

Q: When is the Sales & Use Tax Return Form due?

A: The Sales & Use Tax Return Form is typically due on the 20th day of the month following the reporting period. However, it is recommended to check the specific due date on the form or with the City of Fort Collins.

Q: How do I complete the Sales & Use Tax Return Form?

A: The Sales & Use Tax Return Form requires you to report your sales and use tax liability, by providing information on your gross sales, taxable sales, and any applicable deductions or exemptions. It is recommended to review the form's instructions or seek assistance from the city's tax department for guidance on completing the form accurately.

Form Details:

- The latest edition currently provided by the Colorado Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.