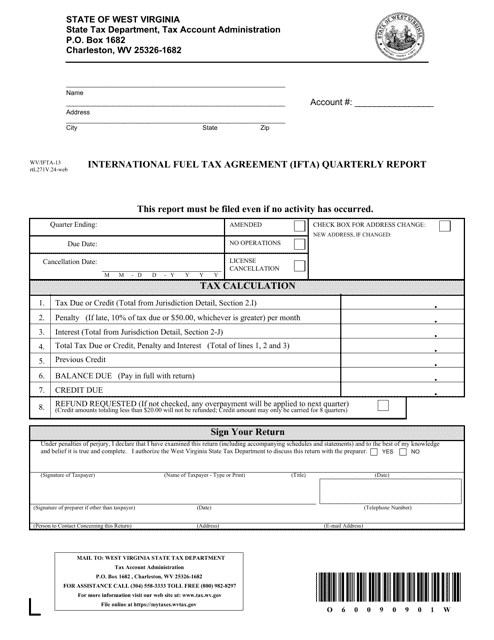

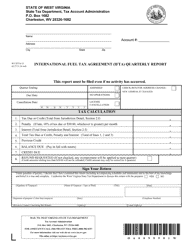

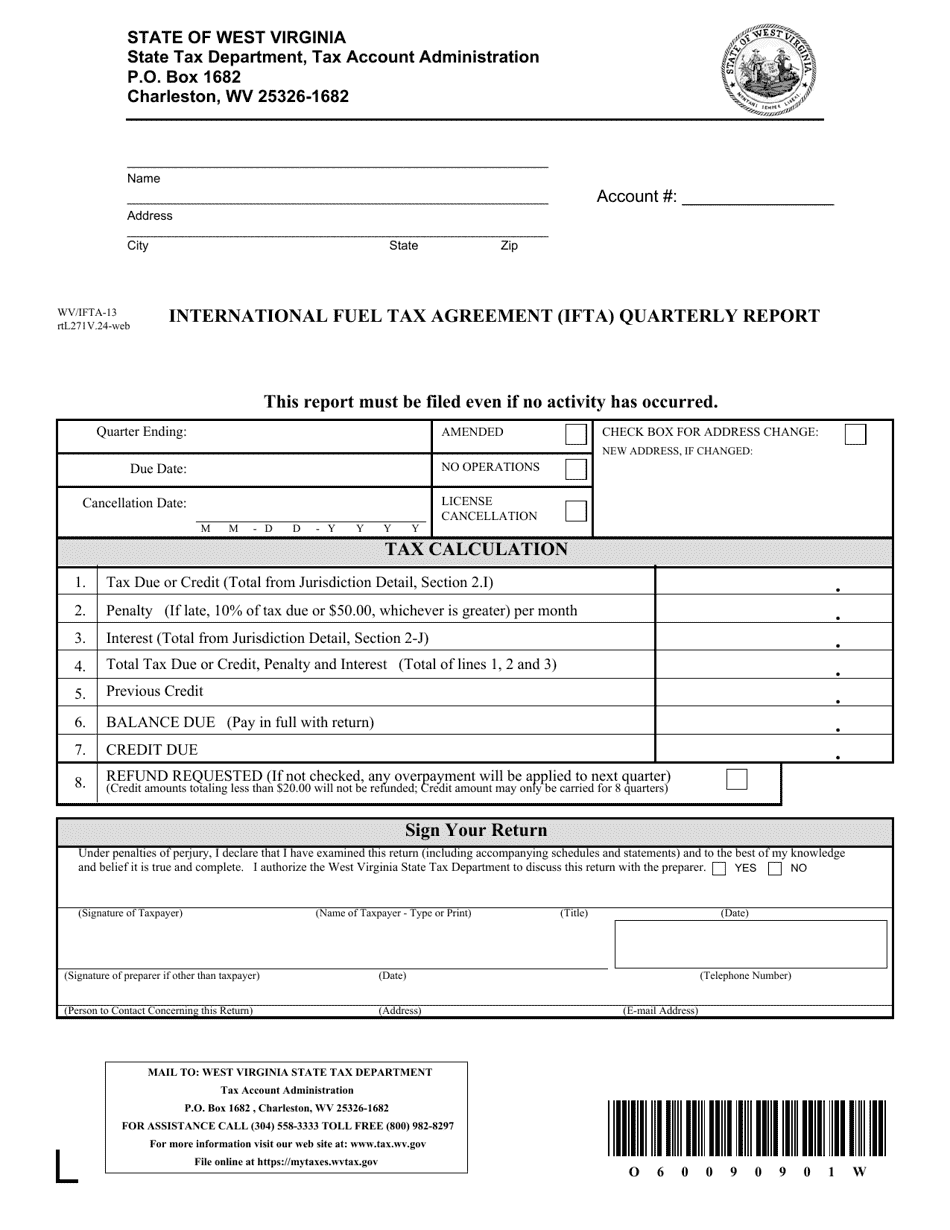

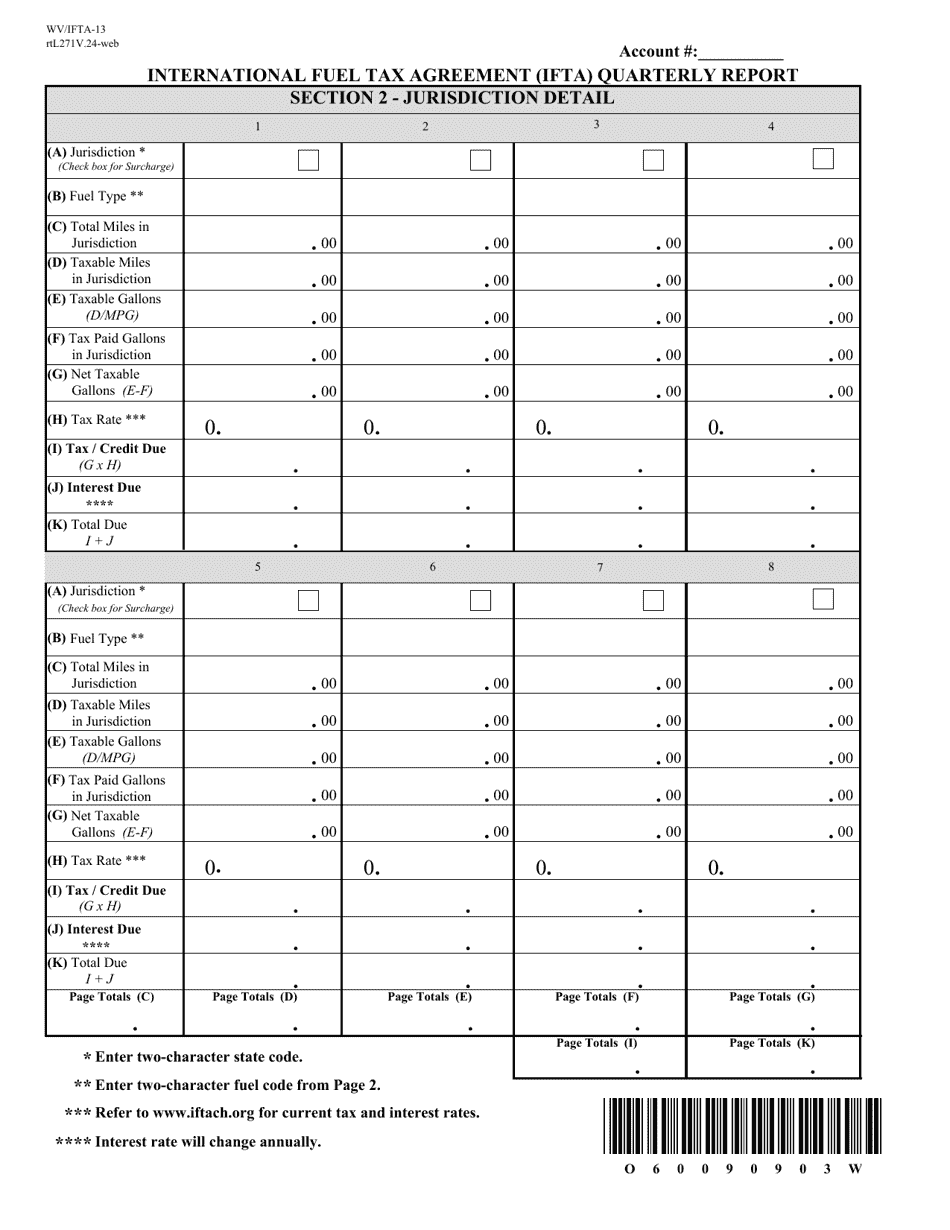

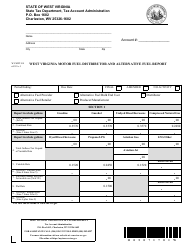

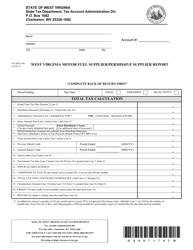

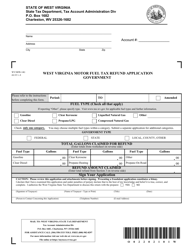

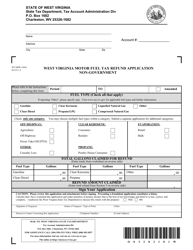

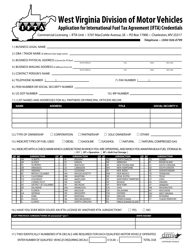

Form WV / IFTA-13 International Fuel Tax Agreement (Ifta) Quarterly Report - West Virginia

What Is Form WV/IFTA-13?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/IFTA-13 form?

A: The WV/IFTA-13 form is the International Fuel Tax Agreement (IFTA) Quarterly Report specific to West Virginia.

Q: What is the purpose of the WV/IFTA-13 form?

A: The WV/IFTA-13 form is used to report and remit fuel taxes for qualified motor vehicles that travel in multiple jurisdictions.

Q: Who needs to file the WV/IFTA-13 form?

A: Motor carriers that operate qualified motor vehicles and travel in multiple jurisdictions need to file the WV/IFTA-13 form.

Q: How often is the WV/IFTA-13 form filed?

A: The WV/IFTA-13 form is filed quarterly by motor carriers.

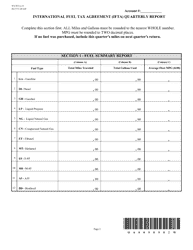

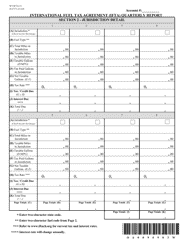

Q: What information is required on the WV/IFTA-13 form?

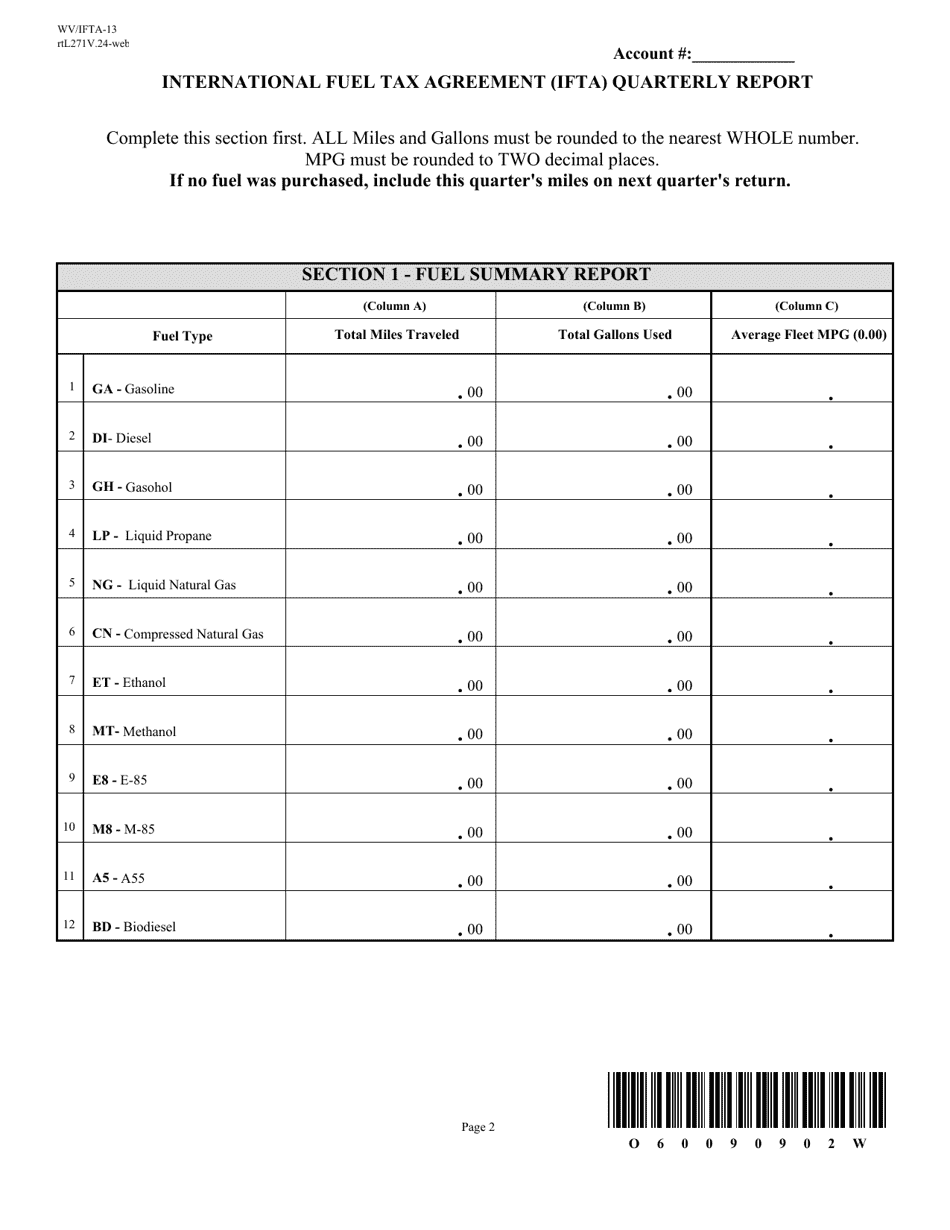

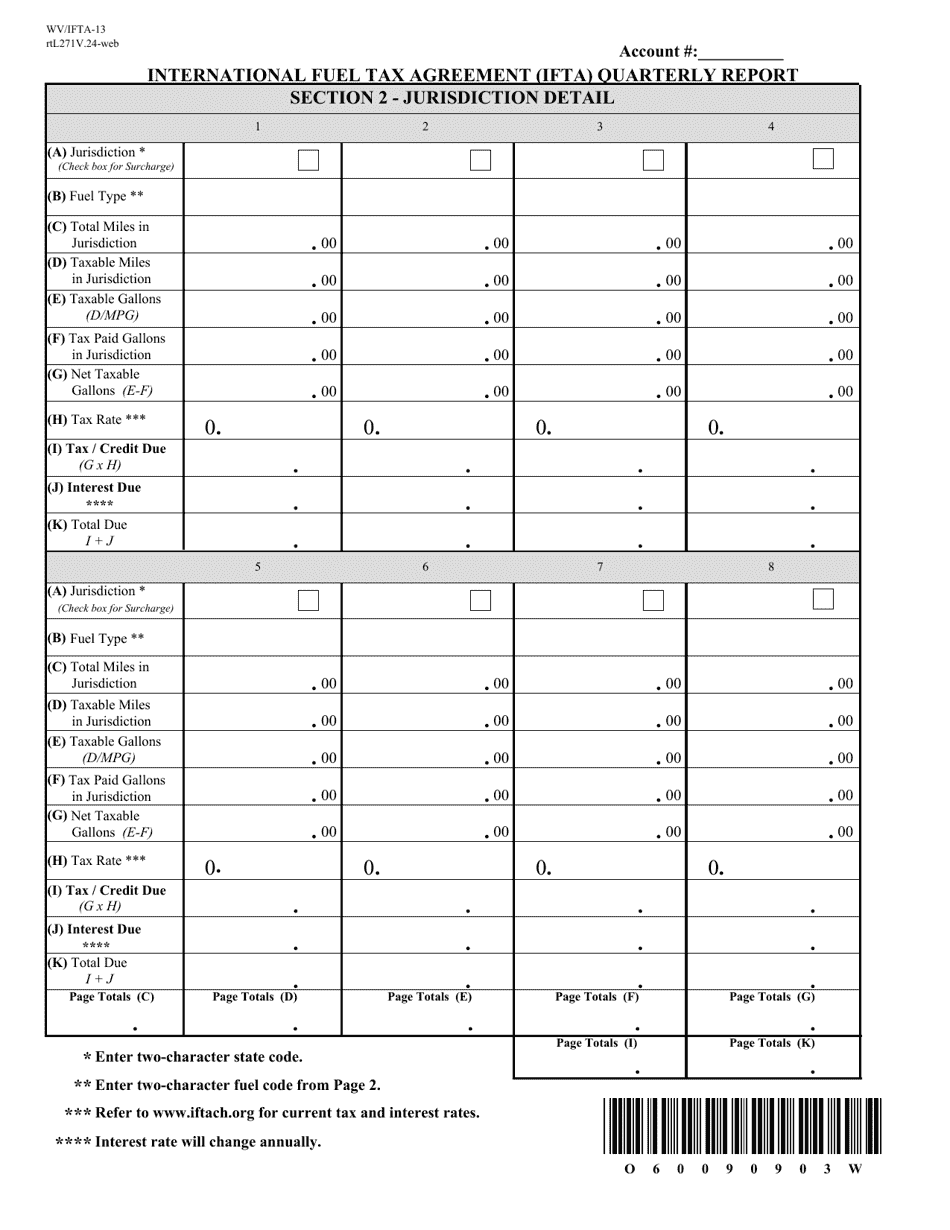

A: The WV/IFTA-13 form requires information such as total miles traveled, total taxable miles, total gallons of fuel consumed, and total tax due for each jurisdiction.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/IFTA-13 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.