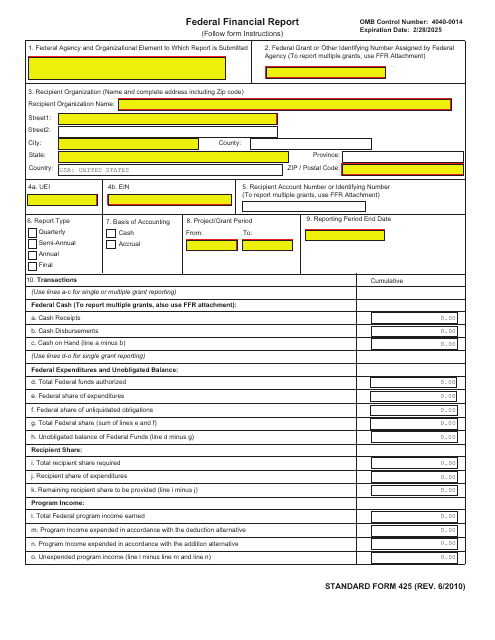

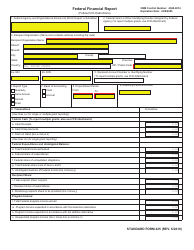

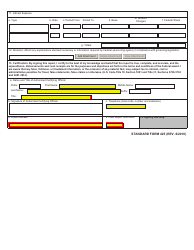

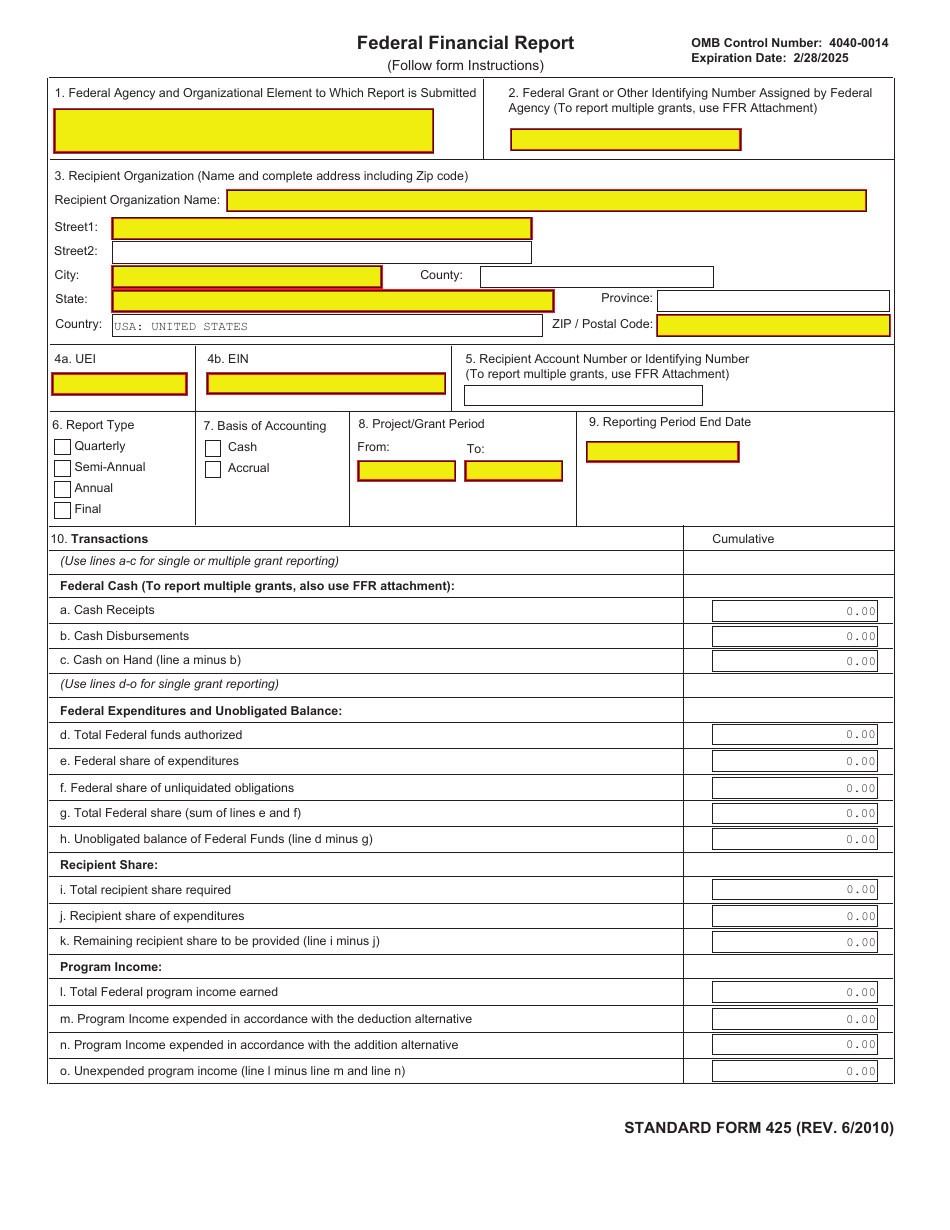

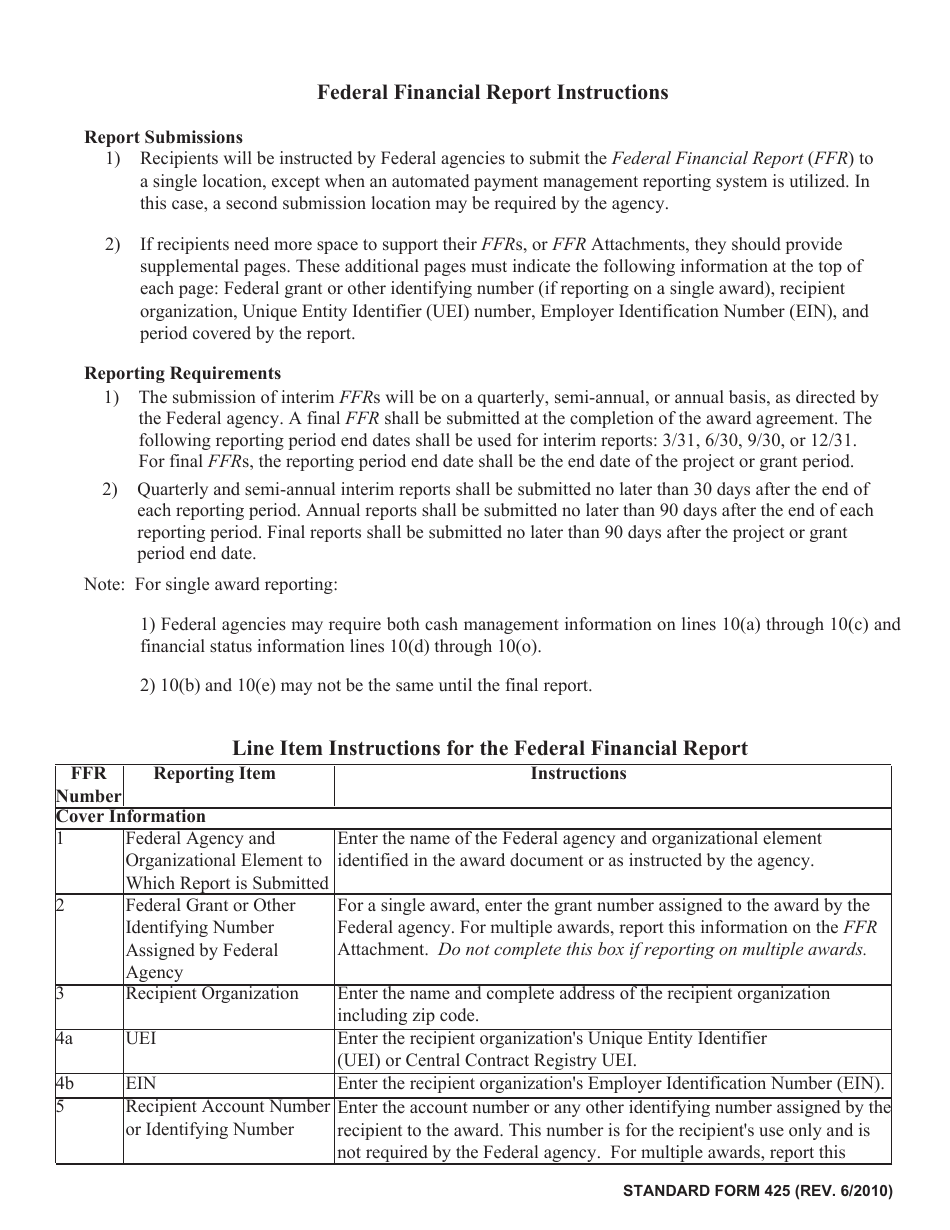

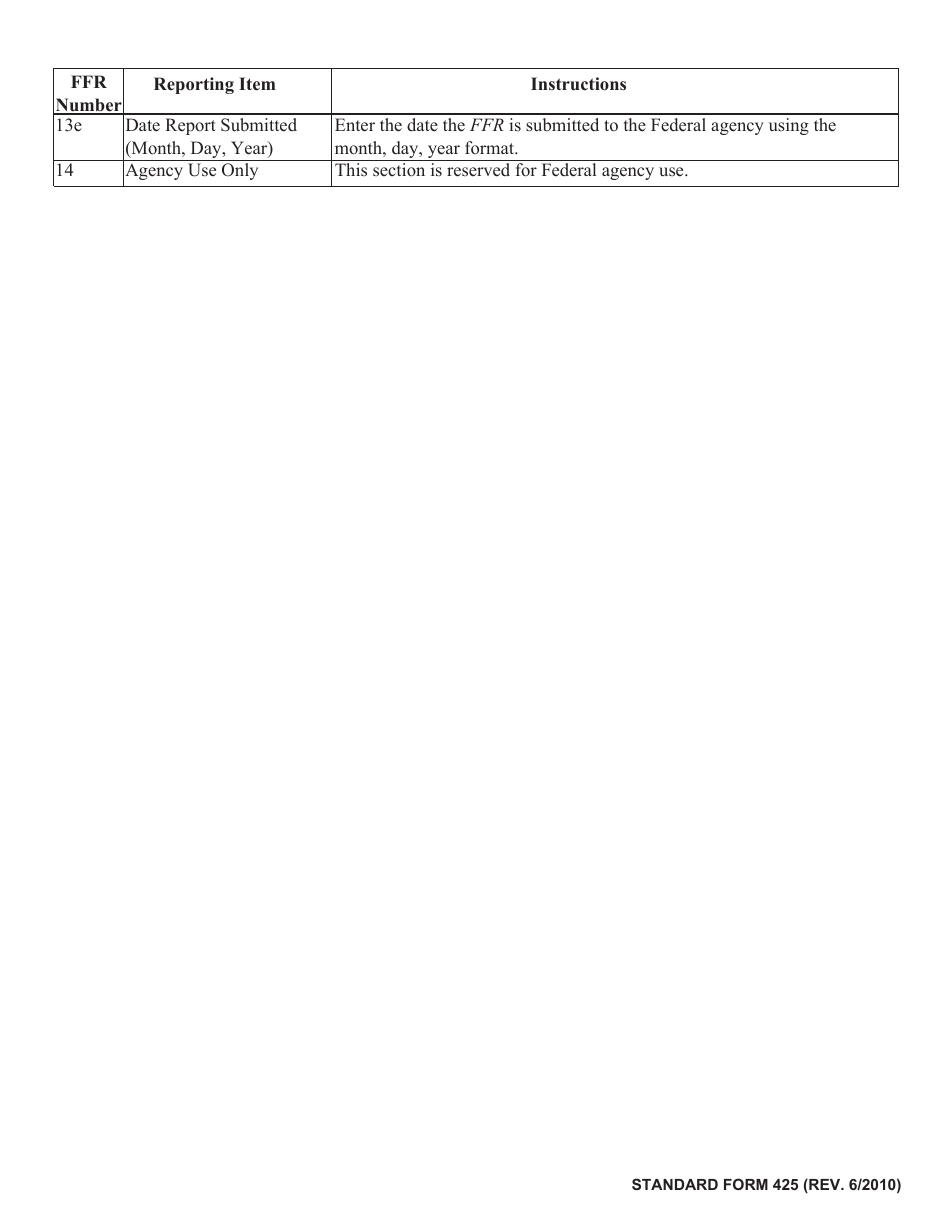

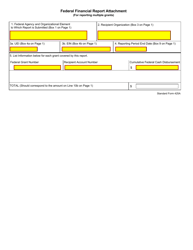

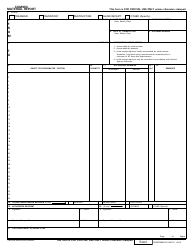

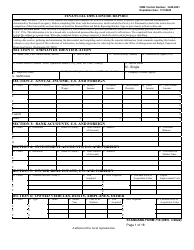

Form SF-425 Federal Financial Report

What Is Form SF-425?

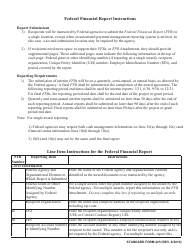

This is a legal form that was released by the U.S. General Services Administration on June 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-425?

A: Form SF-425 is the Federal Financial Report.

Q: What is the purpose of Form SF-425?

A: The purpose of Form SF-425 is to provide detailed information on the financial status and progress of federal grants or agreements.

Q: Who is required to submit Form SF-425?

A: Recipients of federal grants or agreements are required to submit Form SF-425.

Q: When is Form SF-425 due?

A: The due date for Form SF-425 varies depending on the grant or agreement. Recipients should refer to the terms and conditions of their specific funding.

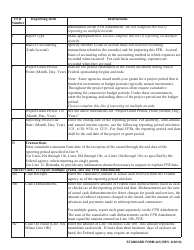

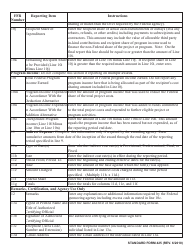

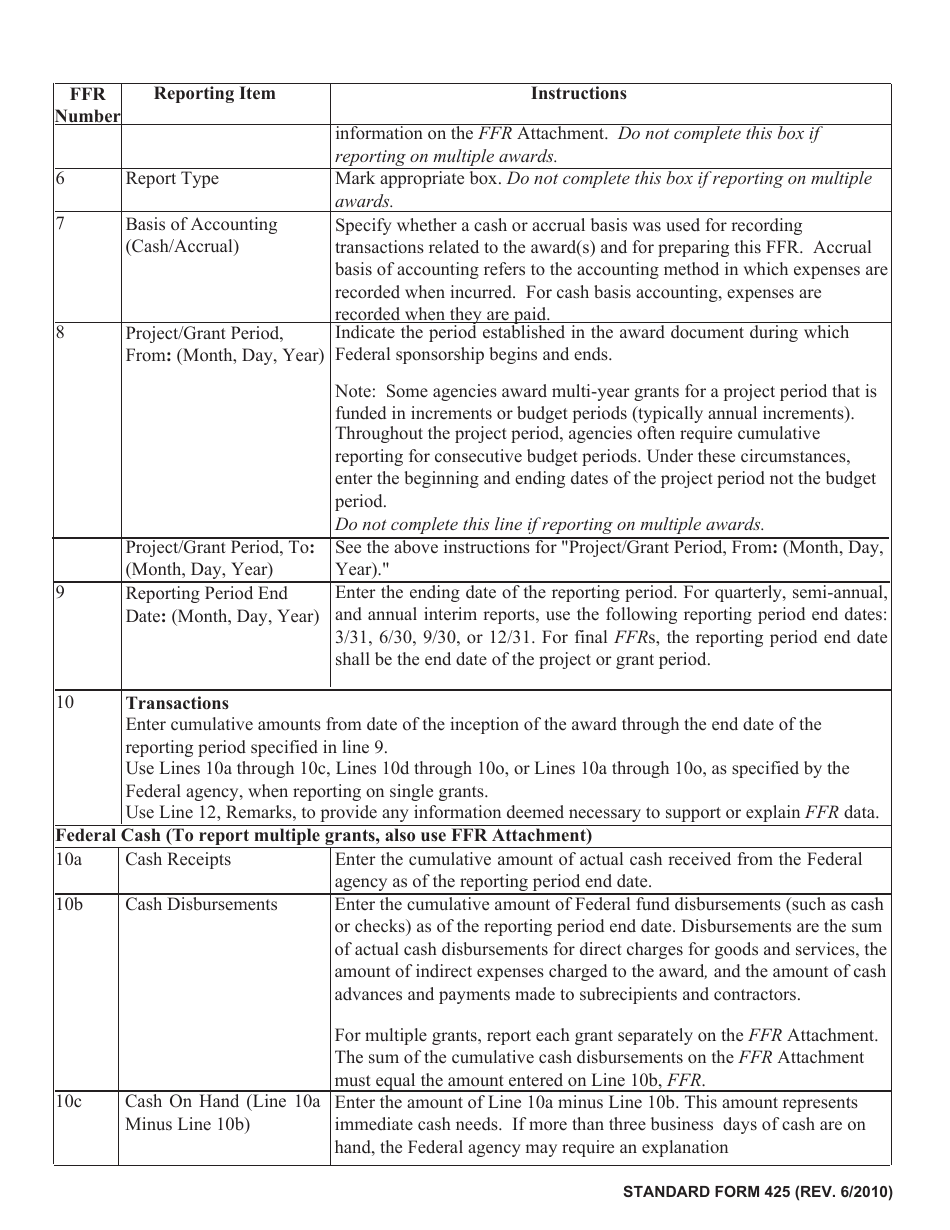

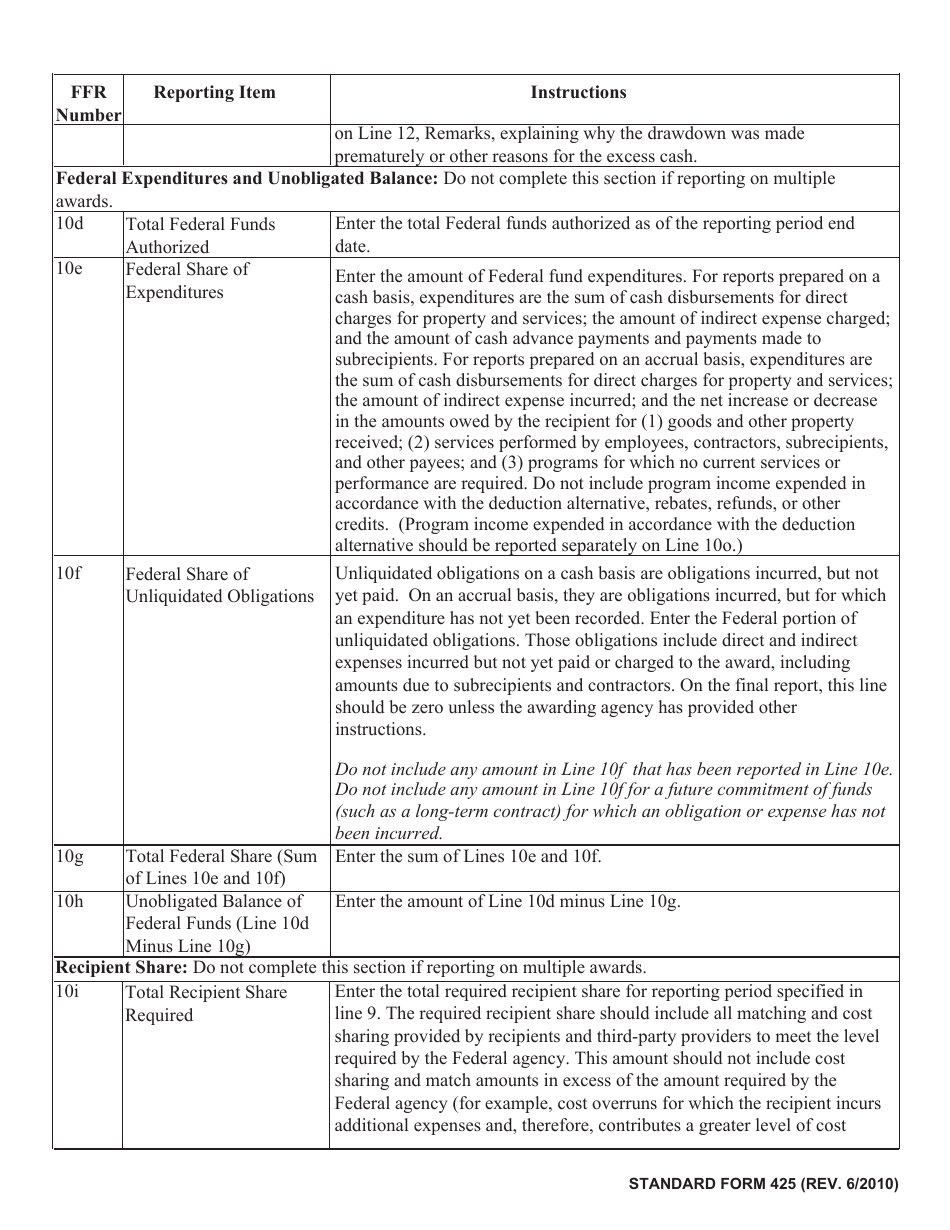

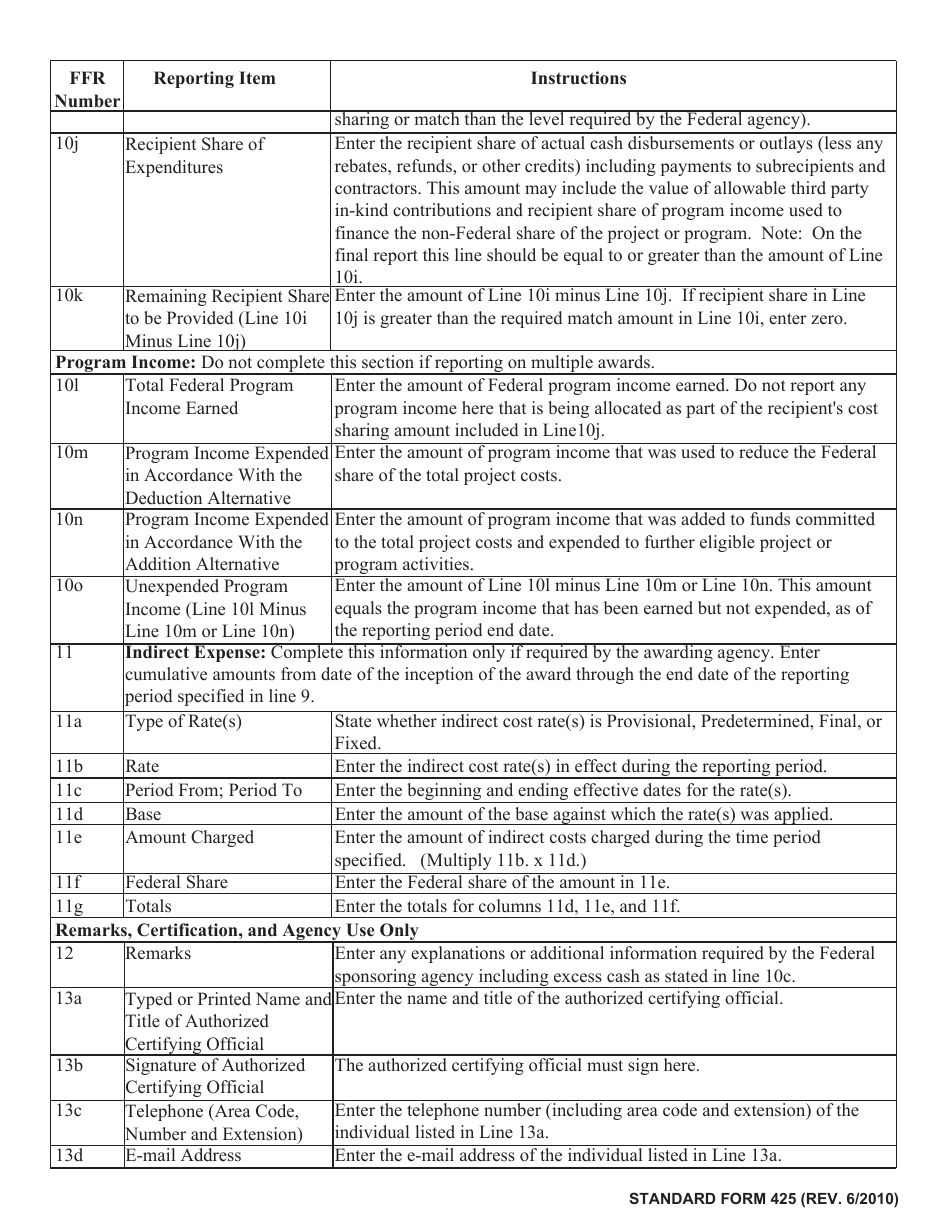

Q: What information is required on Form SF-425?

A: Form SF-425 requires information on the expenditures, obligations, and unobligated balances of the grant or agreement, as well as a narrative description of the progress made.

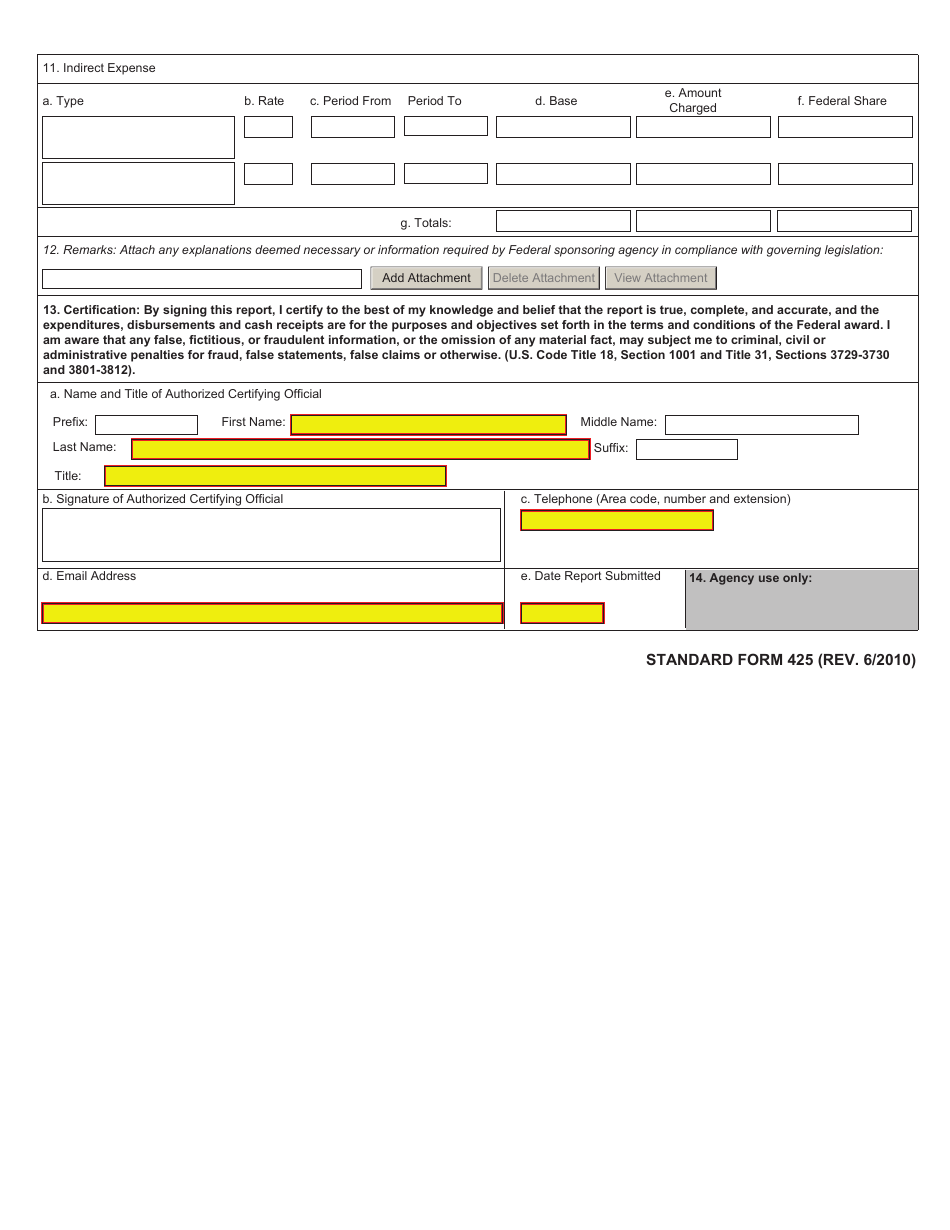

Q: Are there any penalties for not submitting Form SF-425?

A: Failure to submit Form SF-425 or submitting an incomplete or inaccurate report may result in the withholding of further payments or other enforcement actions.

Q: Can Form SF-425 be submitted electronically?

A: Yes, Form SF-425 can be submitted electronically through the Federal Financial Report system.

Form Details:

- Released on June 1, 2010;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-425 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.