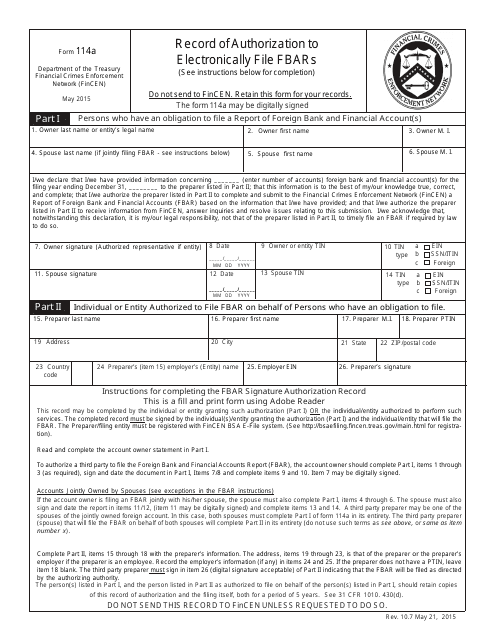

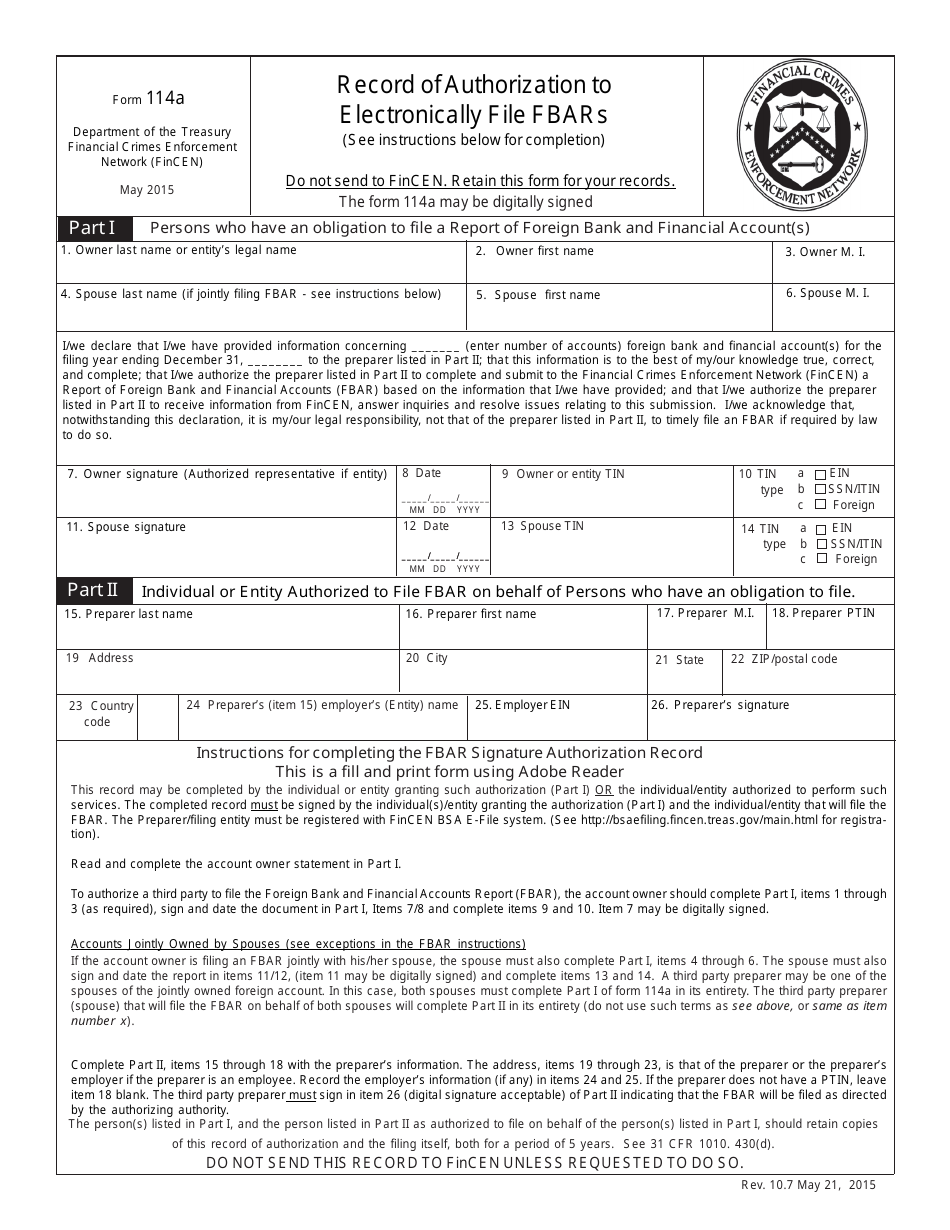

FinCEN Form 114A Record of Authorization to Electronically File Fbars

What Is FinCEN Form 114A?

FinCEN Form 114A, Record of Authorization to Electronically File FBARs is a document used to authorize the individual/entity to complete and file the FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). The completed record has to be signed by the individual/entity that grants the authorization and the individual/entity that will submit the FBAR. It is allowed to file using a third party preparer. The form is also used when financial accounts are owned jointly by spouses - both of them have to complete the form to designate or approve which spouse will be signing the report.

The latest version of the form was issued by the Financial Crimes Enforcement Network (FinCEN) on May 1, 2015 , with all previous editions obsolete. A FinCen 114A fillable version is available for download below.

The main form - FinCEN Form 114 - is a document used to report signature authority over or financial interest in foreign financial accounts, including bank accounts, mutual funds, trusts, brokerage accounts, etc. if the aggregate value of these accounts exceeds $10,000 during the year of the report. It must be submitted annually to the Department of Treasury. Even when the account does not produce taxable income, it is obligatory to file a report. The form must be sent on or before April 15 of the year that follows the calendar year being reported. It is mandatory to file FBAR electronically through the FinCEN Bank Secrecy Act E-Filing system; however, you can download the form below for information purposes.

FinCEN Form 114A Instructions

FinCEN 114A Form instructions are as follows:

- Part I - Persons who have an obligation to file a Report of Foreign Bank and Financial Account(s). Write down the owner's full name or the entity's legal name. State the spouse's full name. Declare that the information concerning the foreign bank and financial accounts is true and correct to the best of your knowledge. Certify that you authorize the preparer (indicated in the second section of the form) to complete and file the FBAR based on the provided information. The form must be signed and dated by the owner/representative of the entity and the spouse. State the taxpayer identification number of the owner/entity and the spouse and its type;

- Part II - Individual or Entity authorized to file FBAR on behalf of persons who have an obligation to file. This section contains personal information of the preparer - an individual/entity that will submit the FBAR. State the preparer's full name and the taxpayer identification number. Submit the full address. If the preparer is the entity, write down the employer's (entity) name and the employer identification number. The preparer must sign the form (a digital signature is acceptable);

- Do not submit the form with the 114 Report. It must be maintained with the filers' records. The preparer should also retain a copy of the record of authorization for a period of 5 years. You can complete and save it electronically. The form can contain a digital signature. It is only sent to the FinCEN if specifically requested. The Internal Revenue Service (IRS) may also request it, so keep the form to be made available to them as well;

- The form contains instructions for completing the document. You can refer to them to find out that items must be filled out. There are special instructions for spouses. Usually, they are required to file separate FBARs, so that the authorization form is not needed. However, if the account is jointly owned, it is recommended to prepare Form 114A.