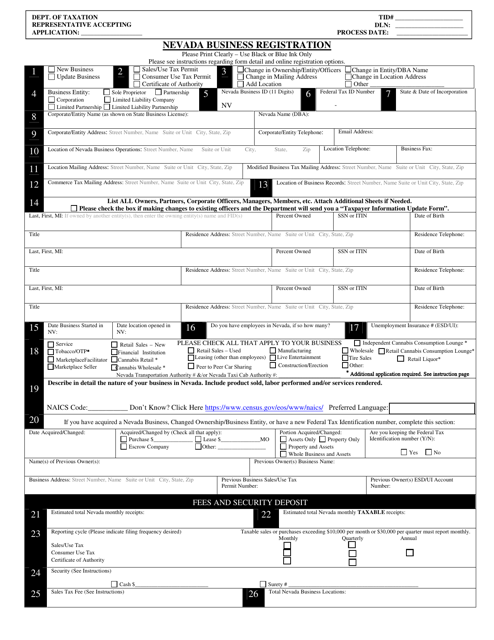

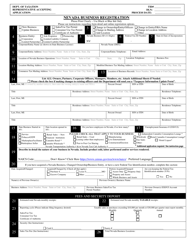

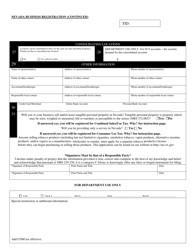

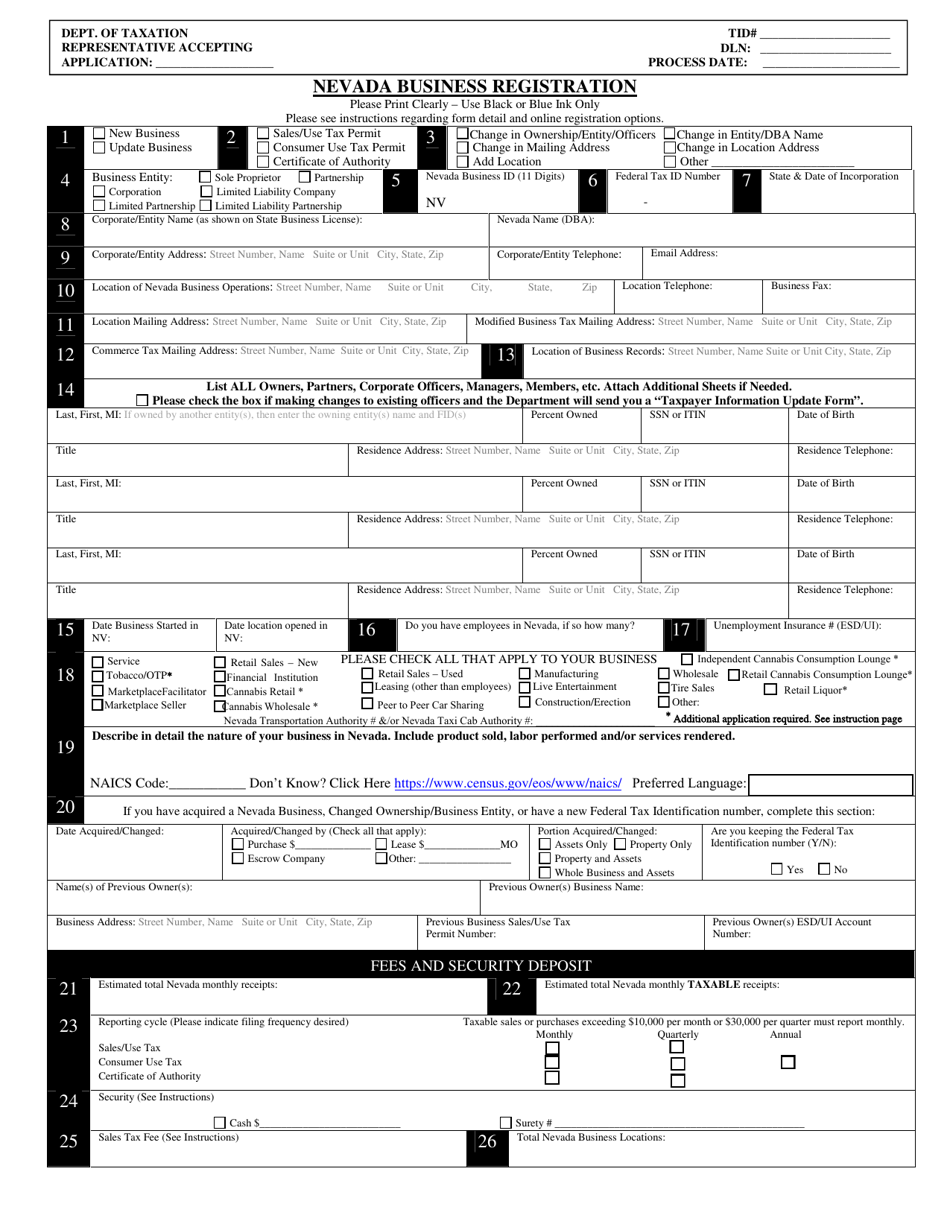

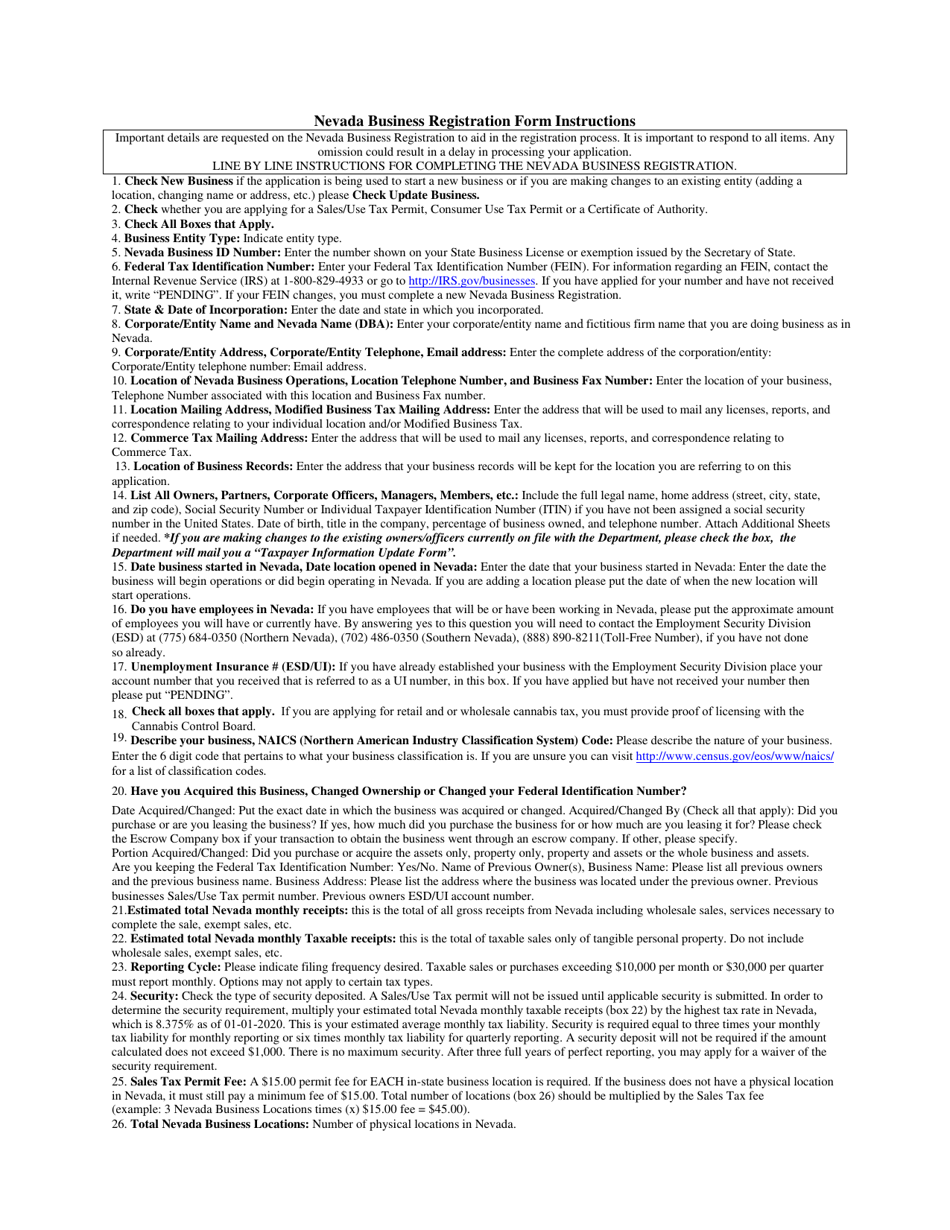

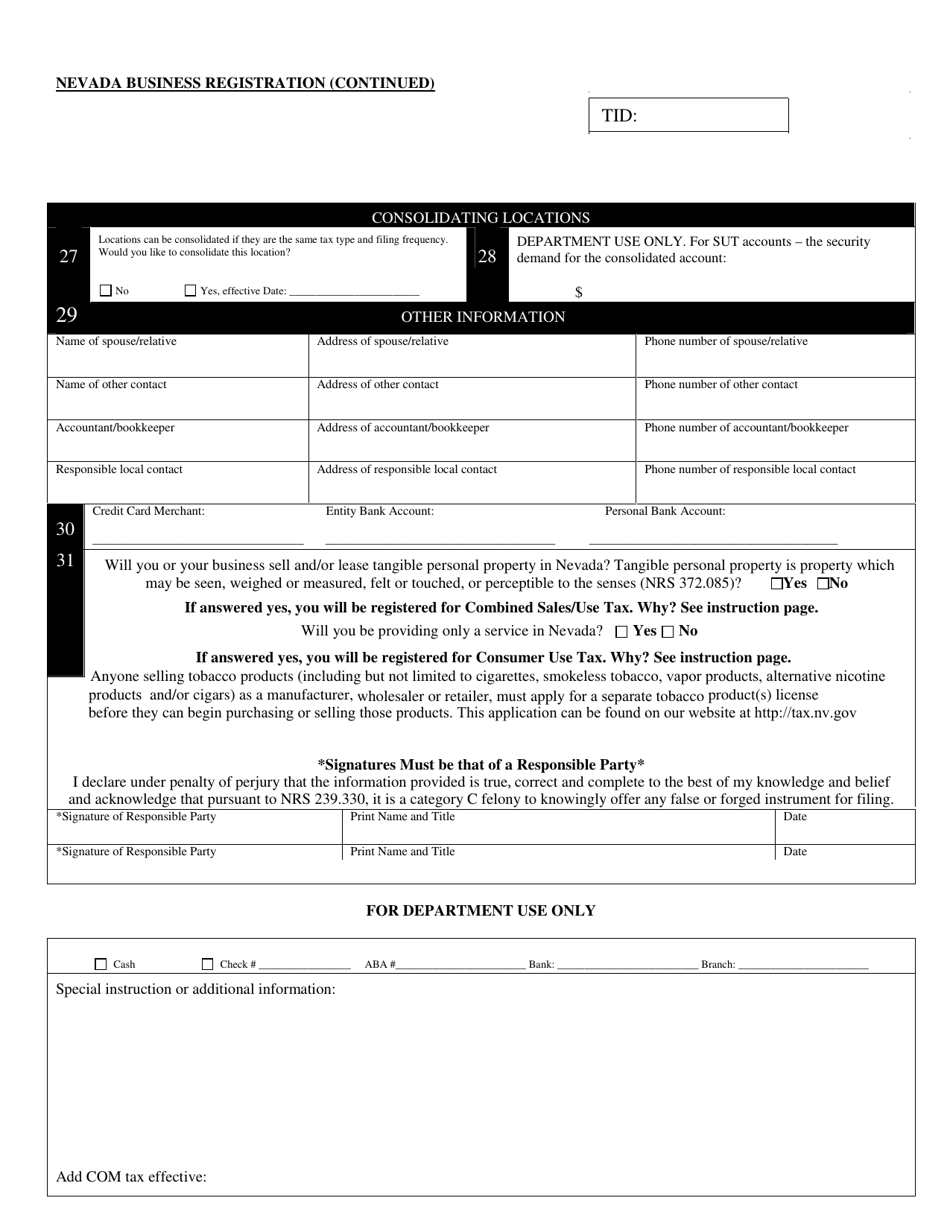

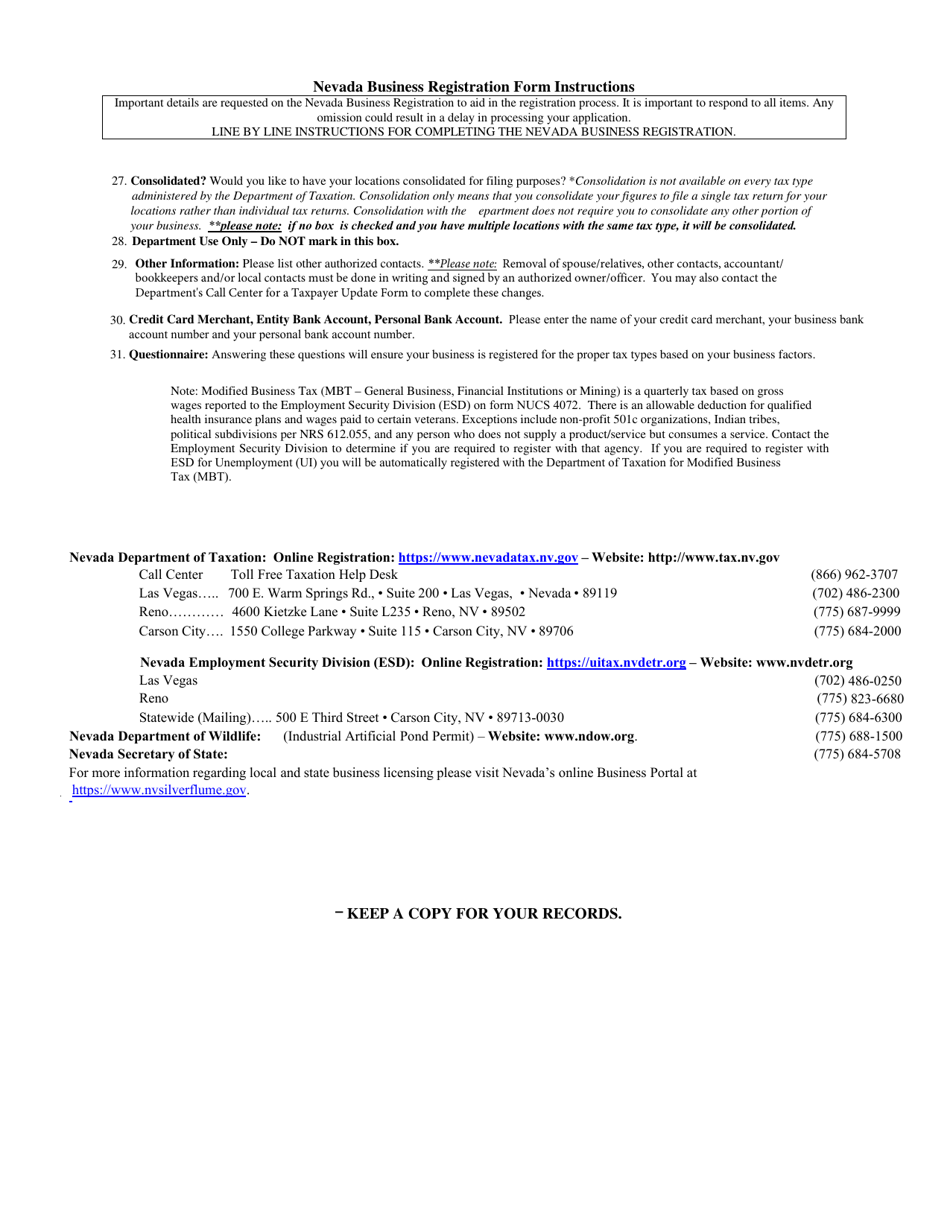

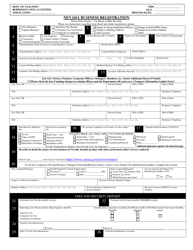

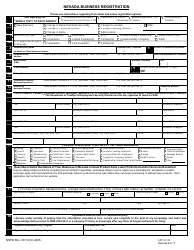

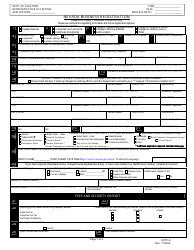

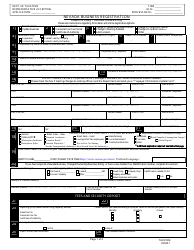

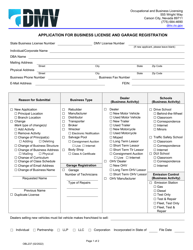

Nevada Business Registration - Nevada

Nevada Business Registration is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

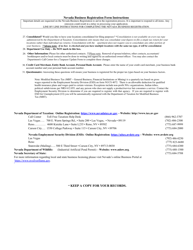

Q: How do I register a business in Nevada?

A: To register a business in Nevada, you need to file the appropriate paperwork with the Nevada Secretary of State.

Q: What paperwork do I need to file to register a business in Nevada?

A: You will need to file Articles of Incorporation for corporations or Articles of Organization for LLCs with the Nevada Secretary of State.

Q: How much does it cost to register a business in Nevada?

A: The cost to register a business in Nevada can vary depending on the type of entity and the services required. For example, the filing fee for a corporation is typically $75, while the fee for an LLC is $75.

Q: Do I need a business license in Nevada?

A: Yes, most businesses in Nevada are required to obtain a state business license from the Nevada Secretary of State's office.

Q: How do I get a business license in Nevada?

A: To get a business license in Nevada, you will need to submit an application to the Nevada Secretary of State's office and pay the required fee.

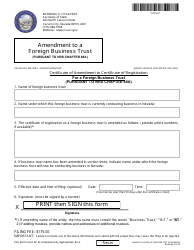

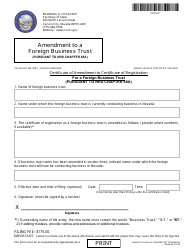

Form Details:

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.