Articles of Incorporation Templates by State

What Are Articles of Incorporation?

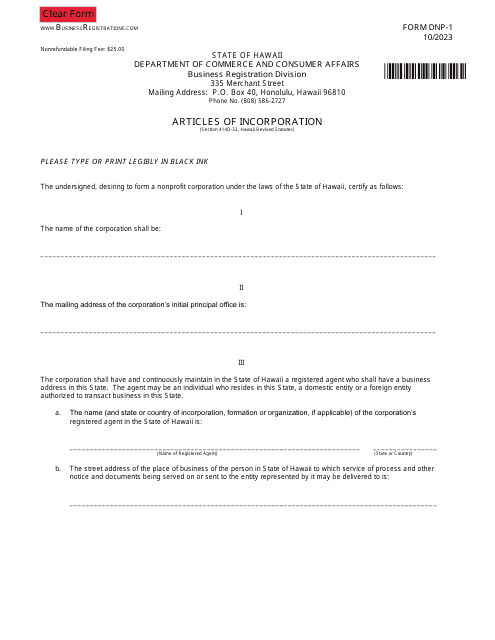

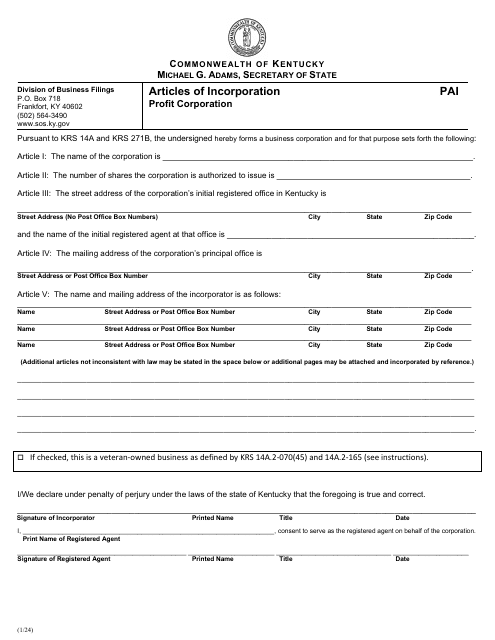

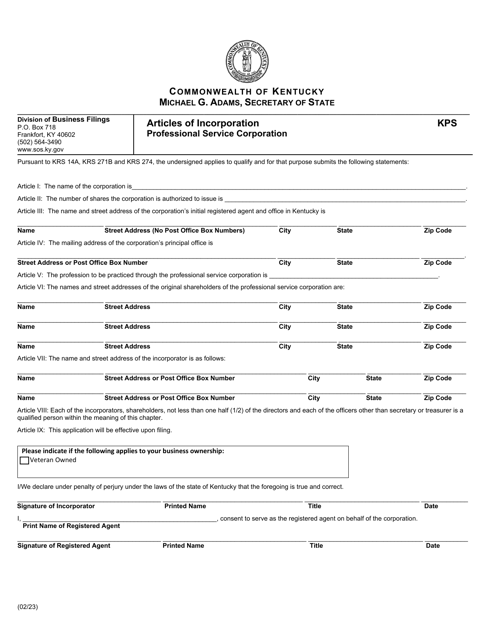

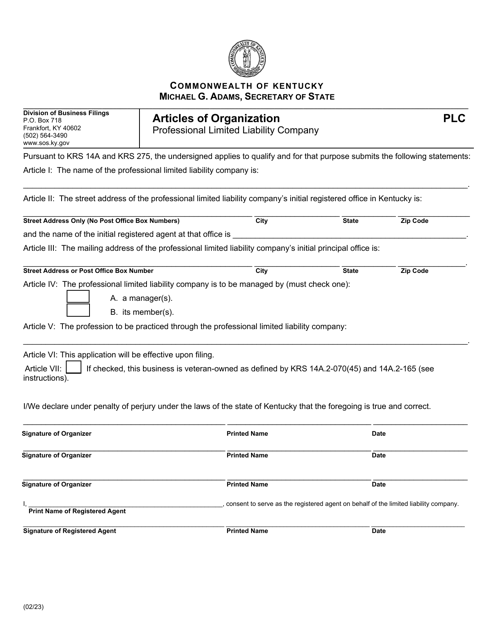

Articles of Incorporation are corporate charters (documents) that are the foundational deed used to establish a corporation in North America. Normally, they are filed with the Secretary of State. The document goes for companies with a specific tax structure that is designated by "Inc." or "Corp." In fact, it is not one document, but a set of formal documents filed to officially create a corporation, hence being referred to either as Articles of Formation.

Alternate Name:

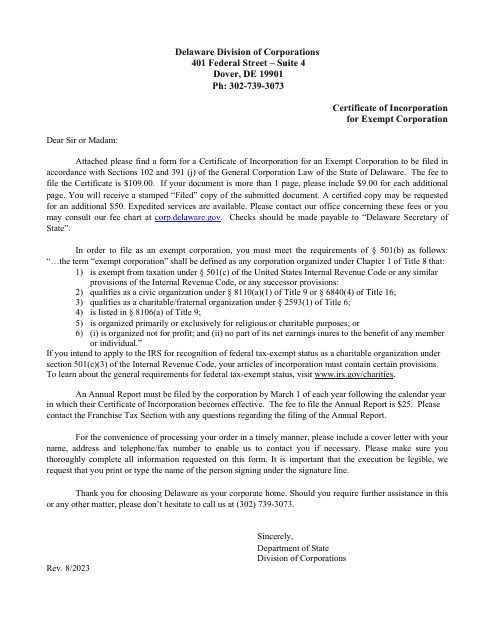

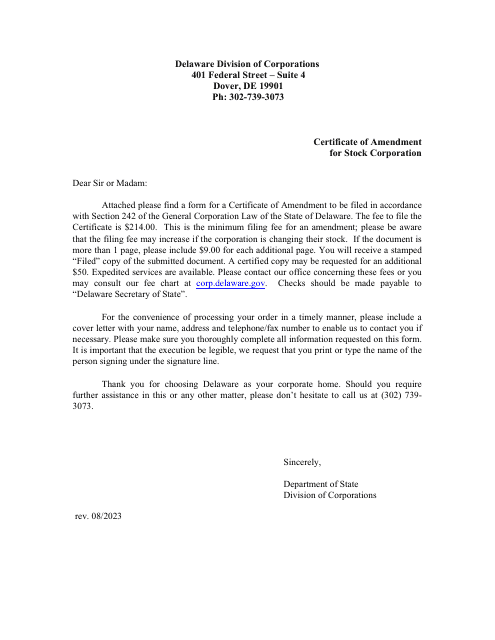

- Certificate of Incorporation.

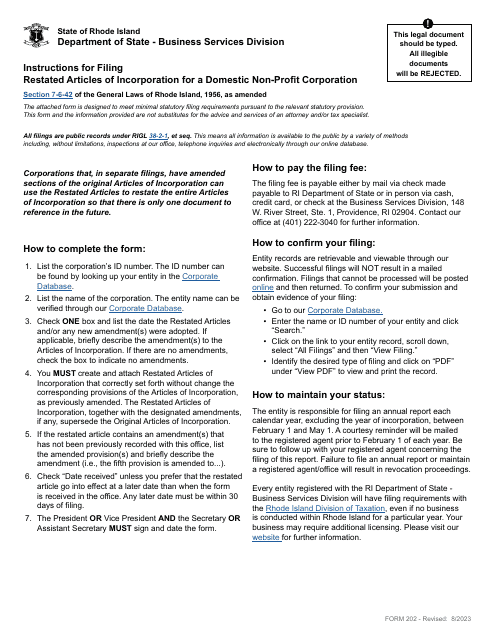

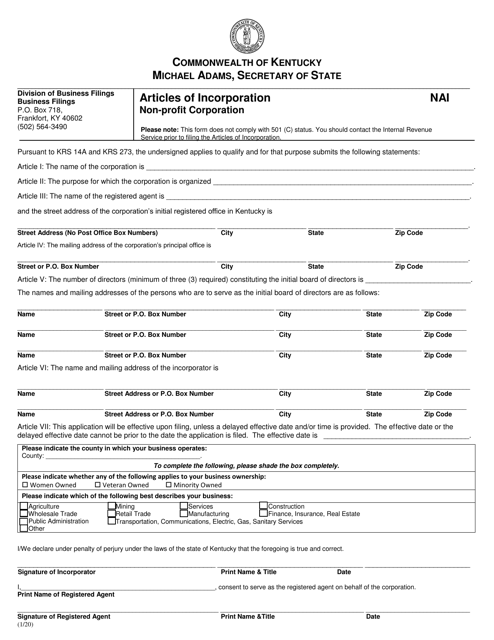

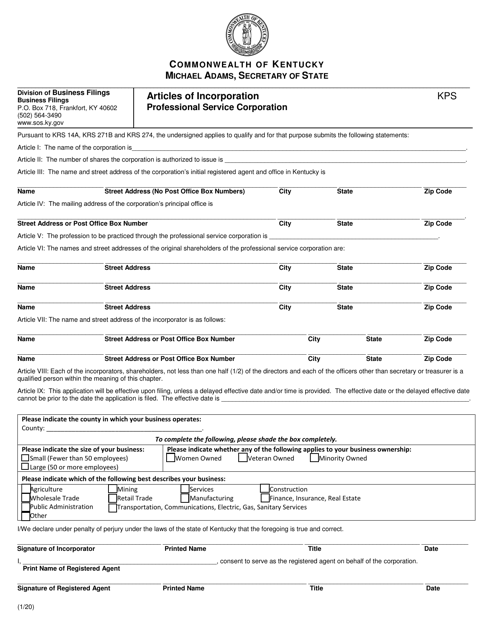

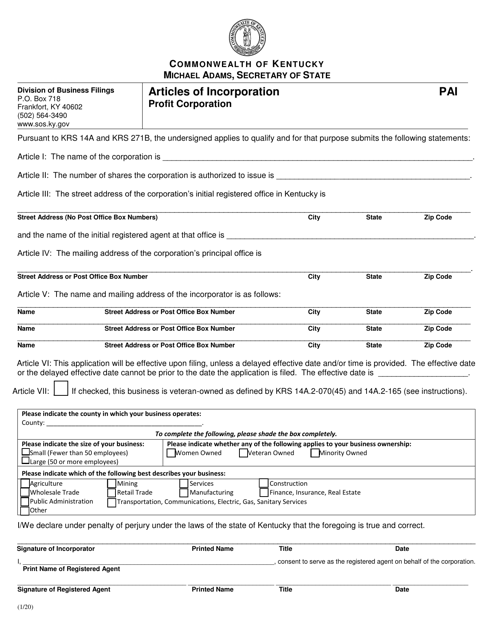

You can find various Articles of Incorporation templates down below, be it for a non-stock corporation, professional corporation, and so on.

A corporation should not be confused with Limited Liability Companies (LLCs) that need to file an entirely different set of articles. The main difference between the two lies in their tax structure. An LLC is taxed at the individual level (this type of taxation is known as pass-through taxation), a corporation is taxed both at the company level and at the individual level. There is also some difference as to the management structure of these two entities. Other differences include specifics of how profits and losses are handled by the two and how the ownership is dealt with.

What Is the Purpose of Articles of Incorporation?

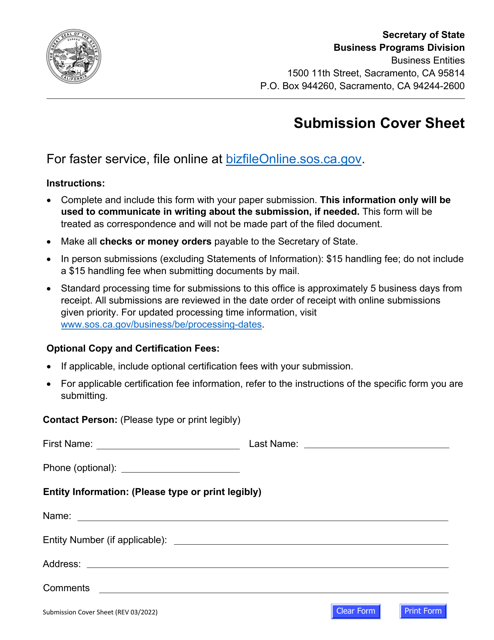

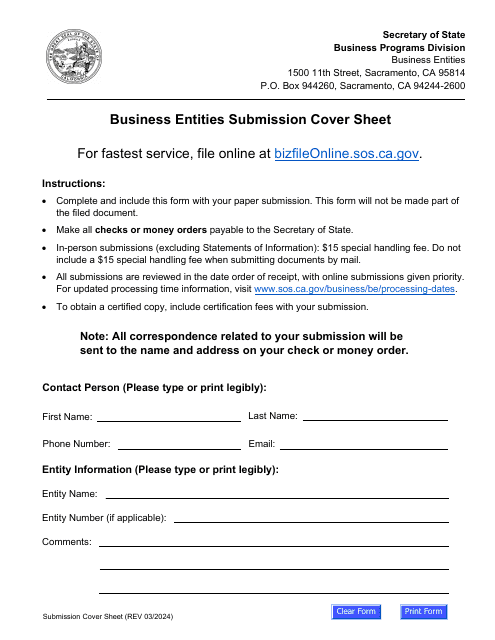

A vast majority of North American companies are registered as corporations. To be officially acknowledged as a corporation, your business must be incorporated. You do this by undertaking certain steps. The first step is filing the Articles of Formation for the company. By filing this document, you inform the local government of your plans to do business in that state.

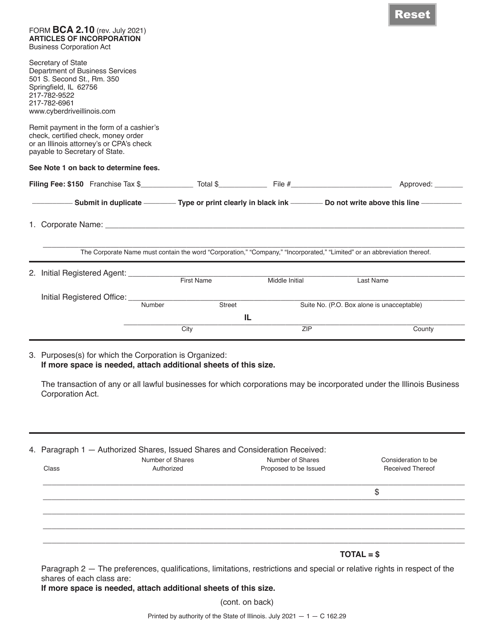

There is a filing fee to incorporate in the state ranging from $50 (Iowa, Arkansas, and Michigan) to $520 (Massachusetts) if filed online. There may be an additional franchise tax. Another important document for corporations is the Corporate Bylaws. It basically provides guidelines on how a corporation has to operate. Bylaws and Articles form the basis for the business.

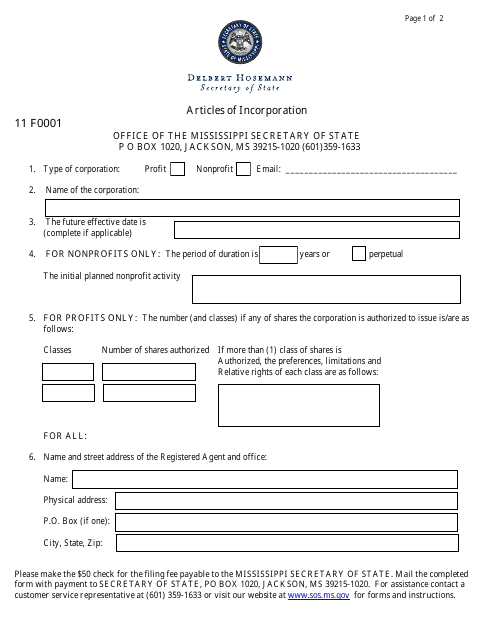

Filing for a certificate of incorporation gives your company certain benefits that a simple business does not possess. For example, you may acquire enormous benefits in the form of tax exemption and protection from creditors. The Articles become a public record listing all the important information about the business: its name, address (including the address of the registered agent), type of structure (profit, non-profit, non-stock, etc.), names of the board of directors, numbers of the authorized shares, people that own the corporation (stockholders), duration (if applicable) and name and address of the incorporator (person responsible for the corporation set up). This is not a complicated document. Basically, it requires the kind of information any business would provide for transparency.

Related Tags and Topics:

Documents:

510

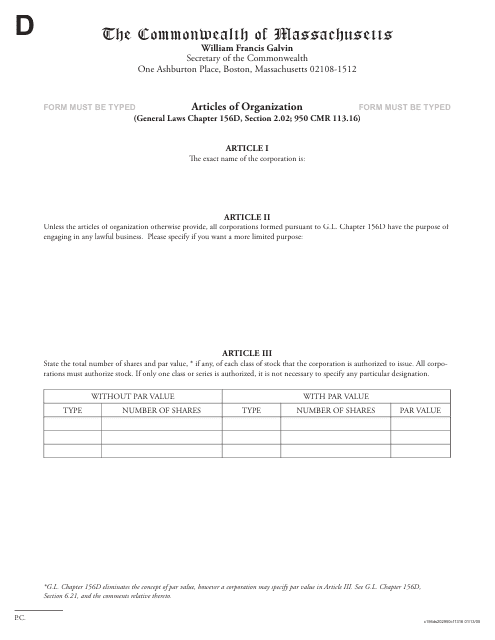

This Form is used for creating a Limited Liability Company (LLC) in Massachusetts. It includes information about the LLC's name, address, registered agent, and members.

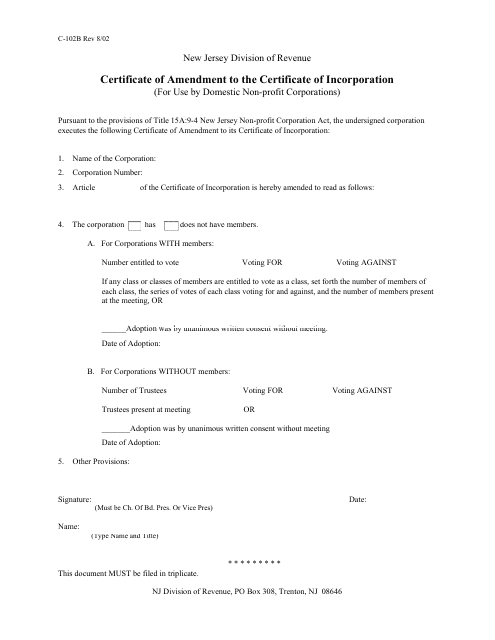

This Form is used for making amendments to a company's Certificate of Incorporation in the state of New Jersey. It provides a template for easily completing the necessary changes to the official documentation.

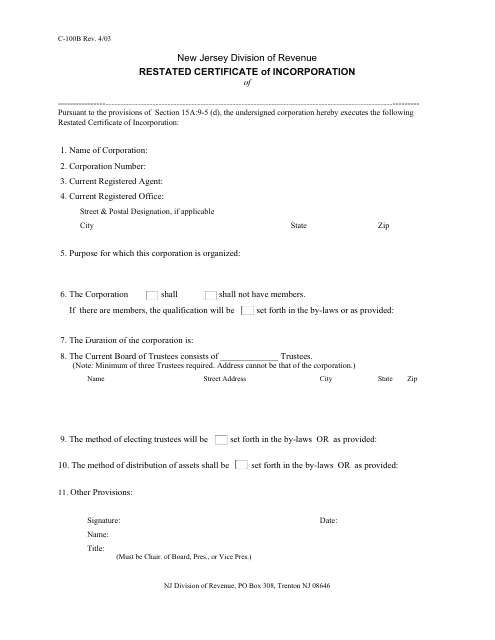

This form is used for restating the certificate of incorporation for a company registered in New Jersey.

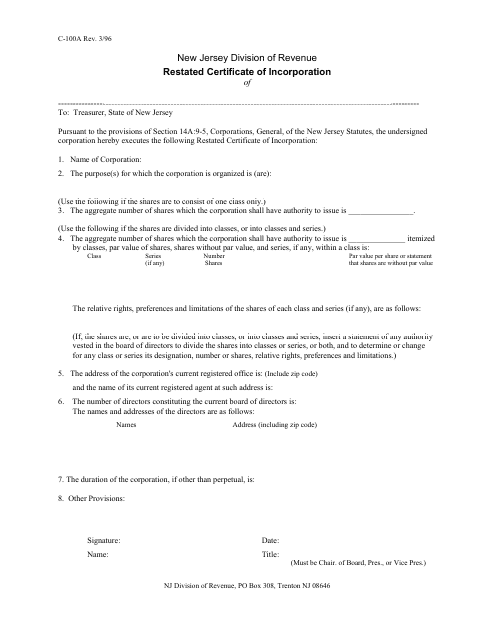

This Form is used for restating the certificate of incorporation for a company in New Jersey. It allows for updating or amending the original document.

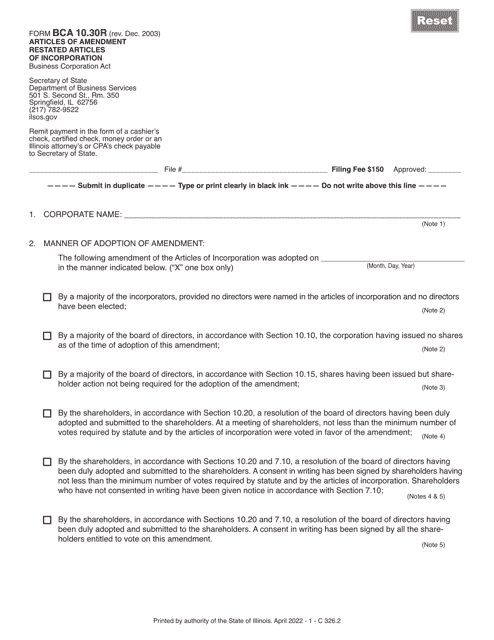

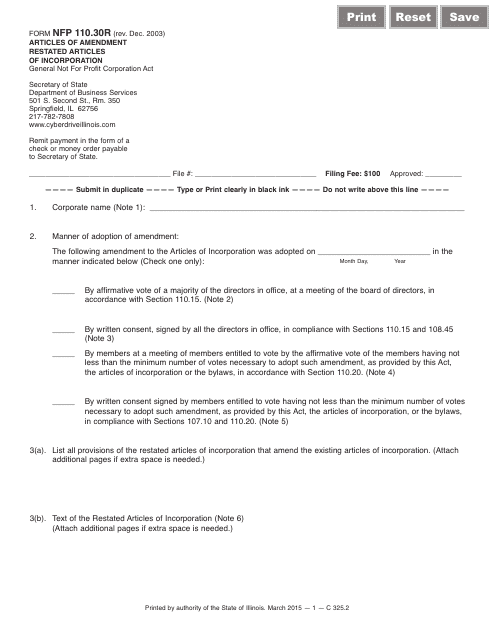

This form is used for filing restated articles of amendment for a corporation registered in the state of Illinois.

This Form is used for filing the Articles of Incorporation in the state of Mississippi to legally establish a corporation.

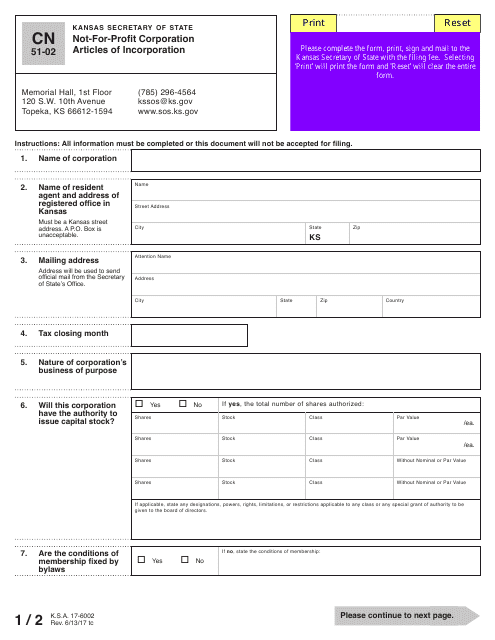

This document is used for filing the Articles of Incorporation for a not-for-profit corporation in the state of Kansas. It outlines the necessary information and requirements needed to establish the corporation.

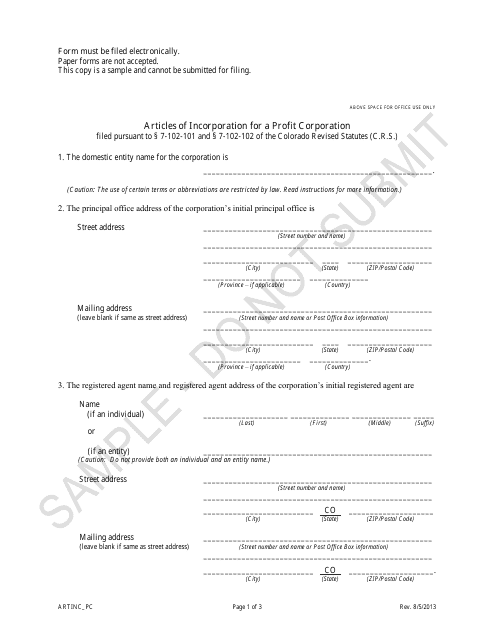

This document is a sample of the Articles of Incorporation for a profit corporation in the state of Colorado. It outlines the basic information required to establish a corporation, such as the company name, purpose, registered agent, and share structure. This document is a useful template for those looking to incorporate in Colorado.

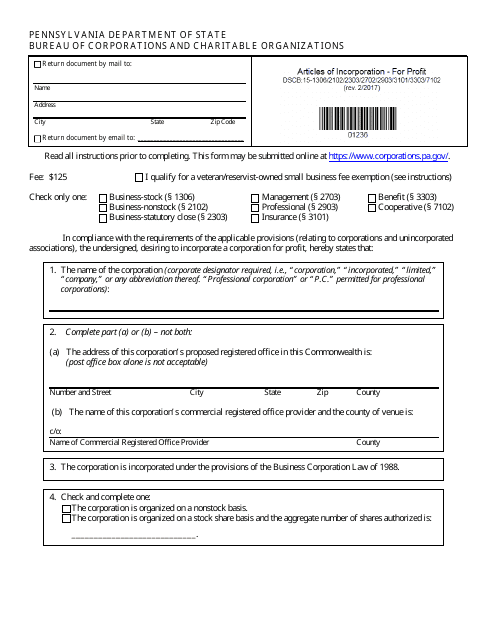

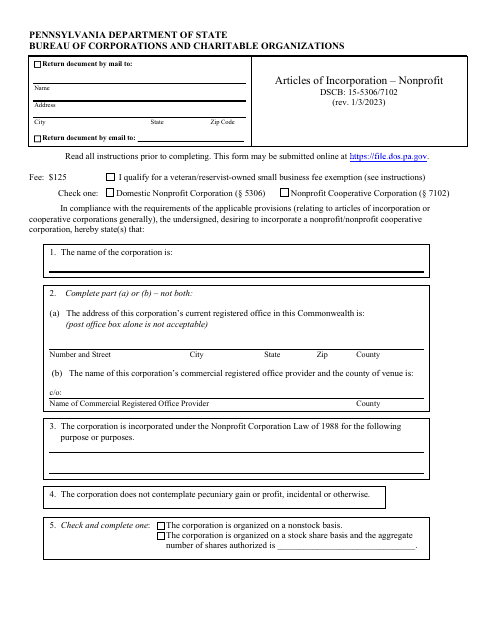

This Form is used for creating Articles of Incorporation for a for-profit corporation in Pennsylvania.

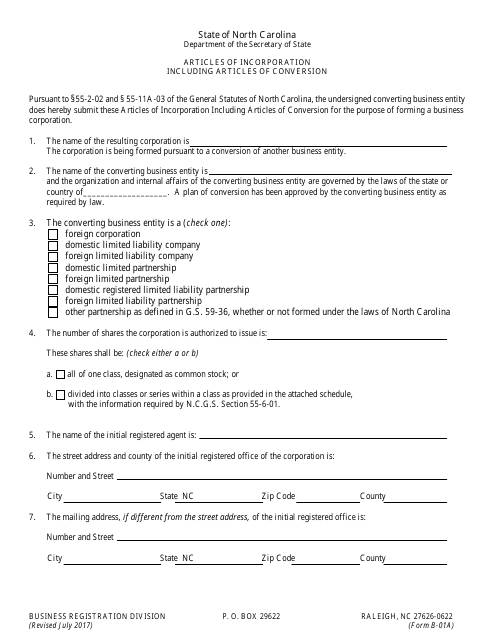

This document is for registering a corporation in North Carolina and converting the corporation's legal status.

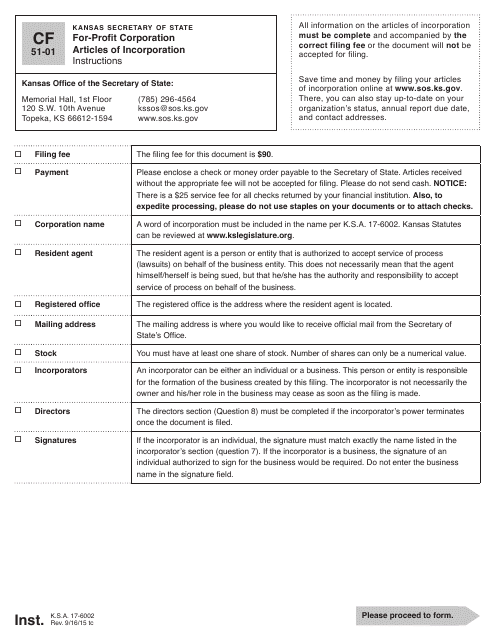

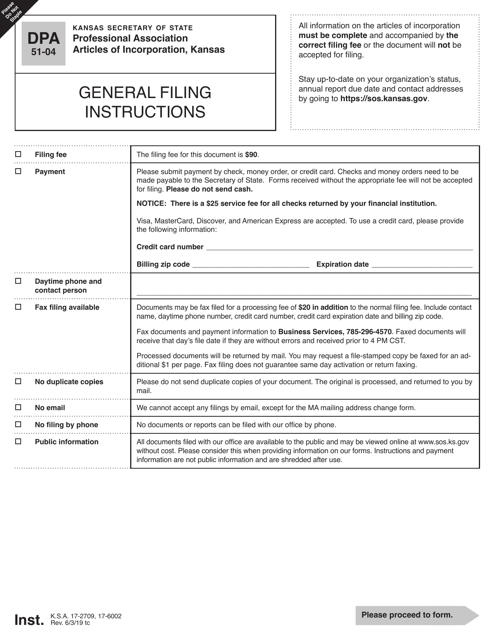

This Form is used for filing the Articles of Incorporation for a for-profit corporation in the state of Kansas. It is a legal document that establishes the creation of the corporation and includes important details such as the company's name, purpose, registered agent, and shareholders.

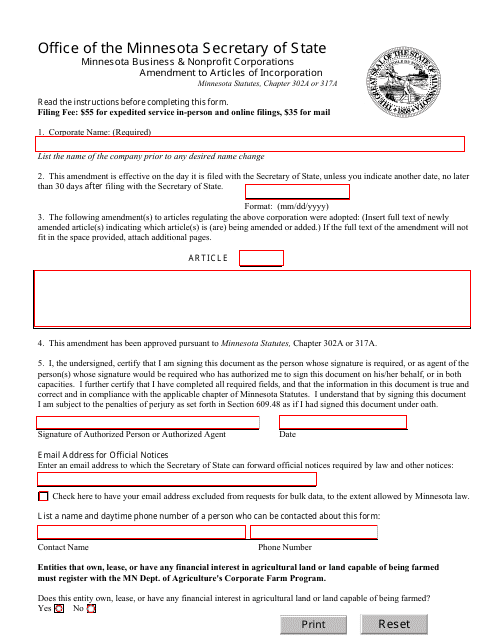

Minnesota Business & Nonprofit Corporations -amendment to Articles of Incorporation Form - Minnesota

This Form is used for making an amendment to the Articles of Incorporation for businesses and nonprofit corporations in Minnesota.

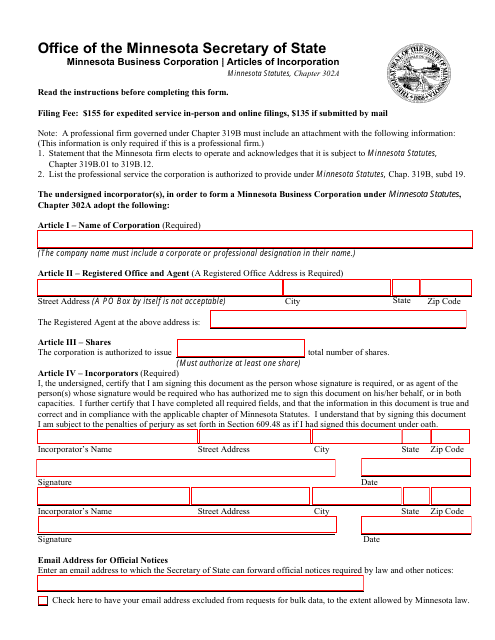

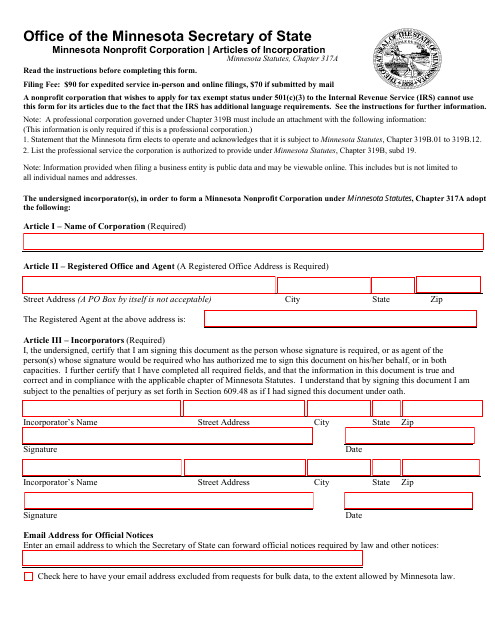

This document is used for incorporating a business in Minnesota. It is called the Articles of Incorporation Form and is required by the state's business laws.

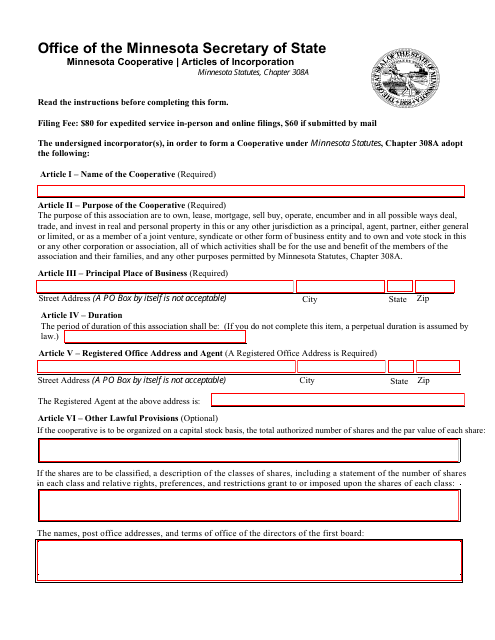

This type of document is used for filing the articles of incorporation for a cooperative in the state of Minnesota.

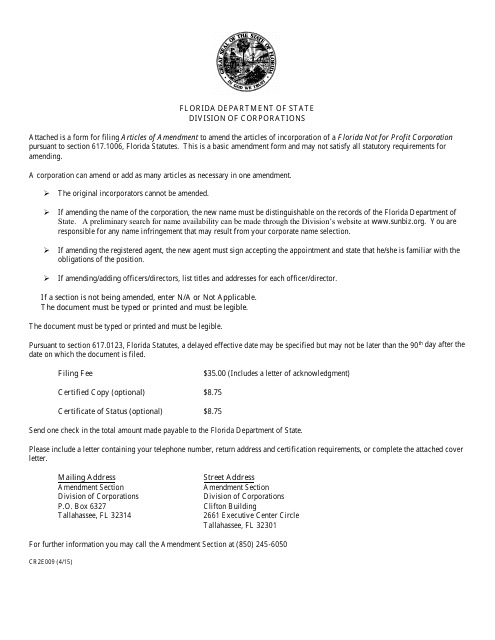

This document is used for making changes to the Articles of Incorporation of a Florida Not for Profit Corporation in Florida.

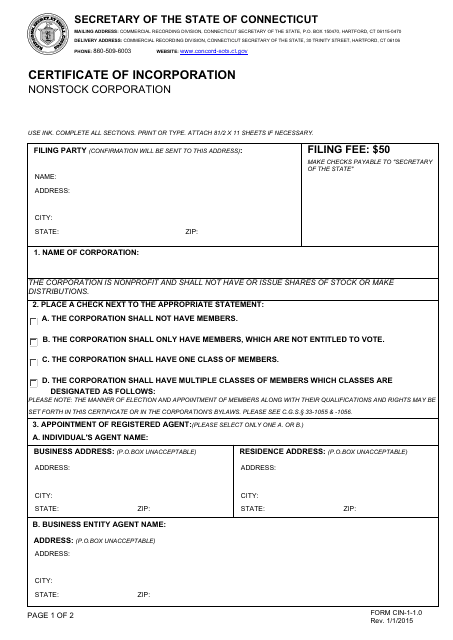

This document is used for obtaining a Certificate of Incorporation for a nonstock corporation in the state of Connecticut.

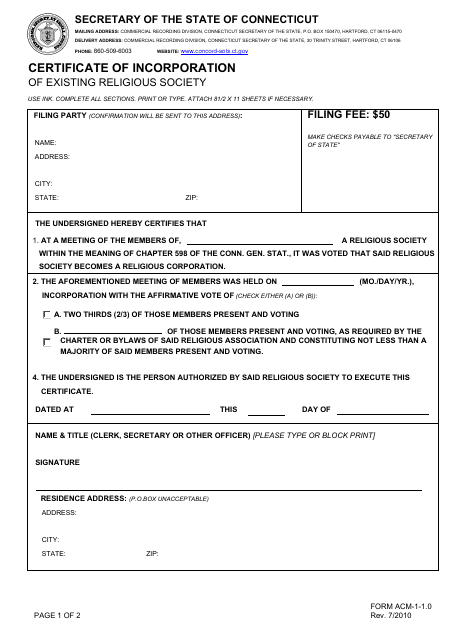

This Form is used for obtaining a Certificate of Incorporation in the state of Connecticut. It is required to form a corporation in the state.

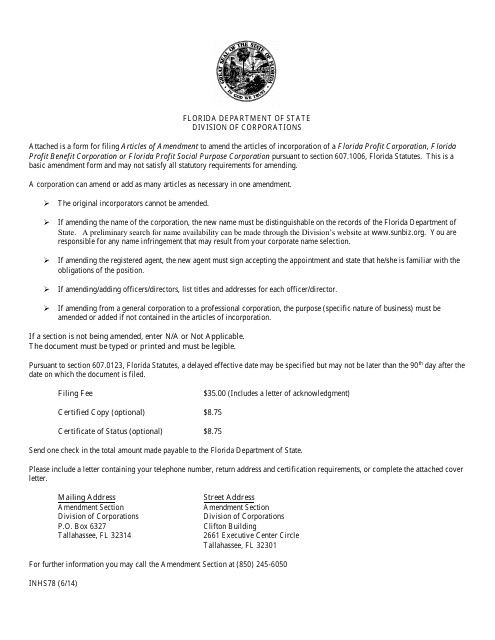

This Form is used for making changes to the Articles of Incorporation for a company registered in the state of Florida. It is used to amend or update important information about the company, such as the business name, address, or registered agent.

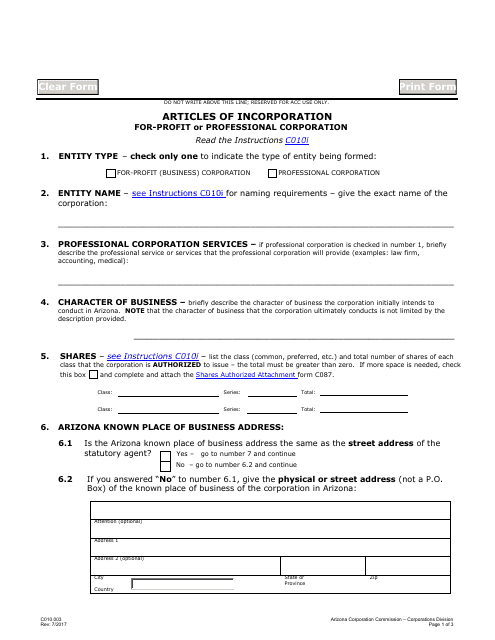

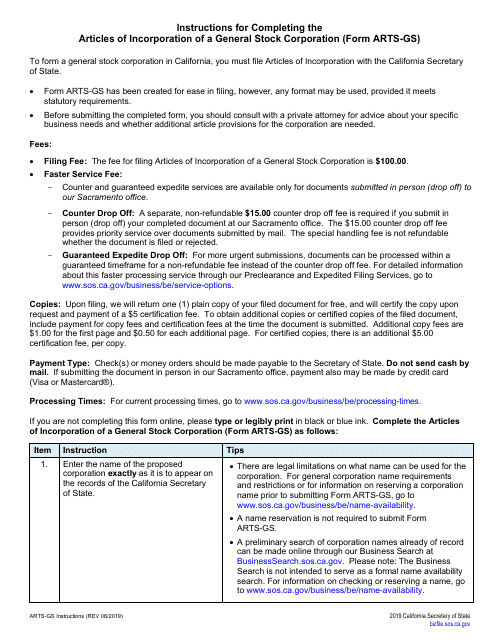

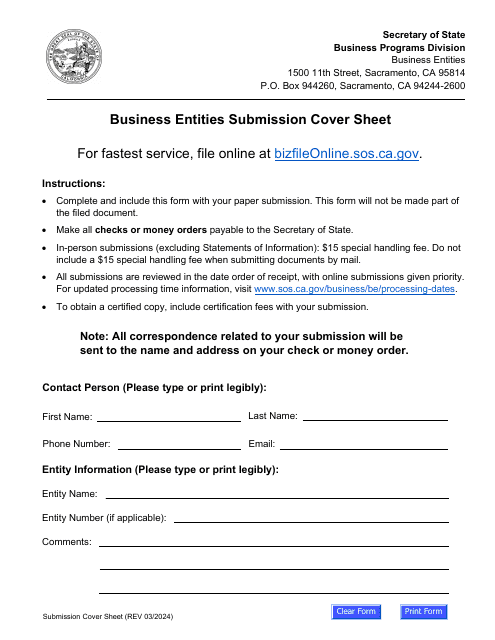

This document is used for filing the articles of incorporation for a for-profit or professional corporation in the state of Arizona.

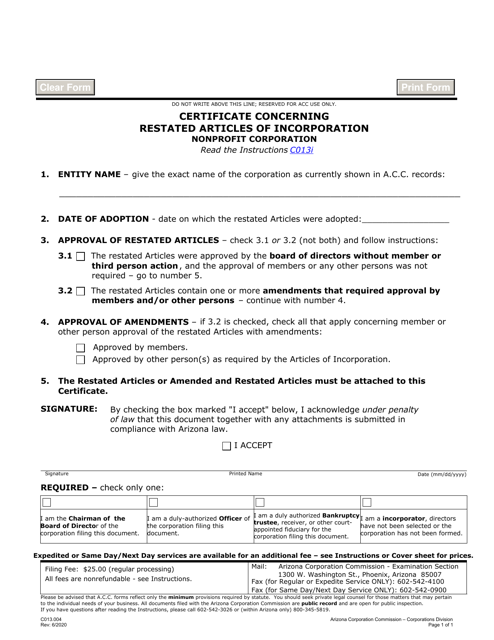

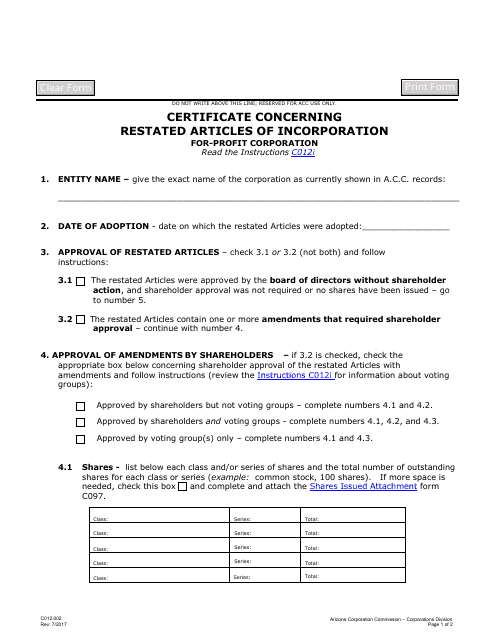

This Form is used for obtaining a certificate concerning the restated articles of incorporation for a for-profit corporation in Arizona.