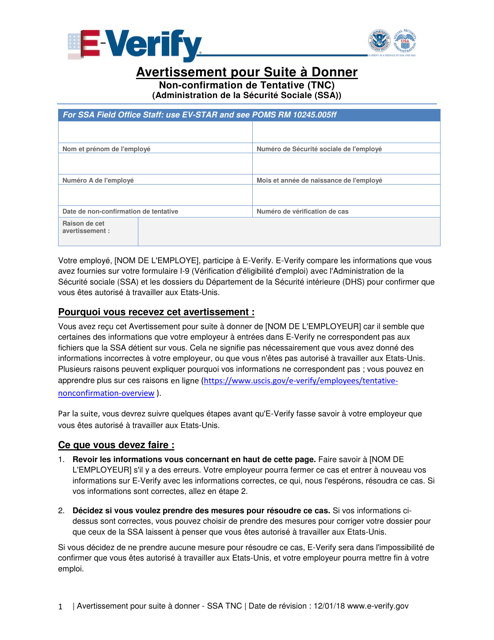

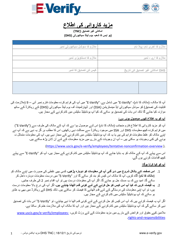

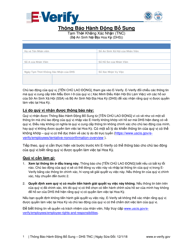

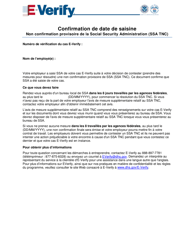

Further Action Notice - Tentative Nonconfirmation (Tnc) (French)

This is a 3-page legal document that was released by the U.S. Social Security Administration on December 1, 2018 and used nation-wide. The document is provided in French.

FAQ

Q: What is a Tentative Nonconfirmation (TNC)?

A: A TNC is a notice given to an employee when their employment eligibility cannot be confirmed based on the information provided in their Form I-9.

Q: What is the purpose of a TNC?

A: The purpose of a TNC is to inform an employee that there is a discrepancy or issue with their employment eligibility documentation.

Q: What should an employee do if they receive a TNC?

A: An employee should follow the instructions provided in the TNC notice and take appropriate action to resolve the discrepancy or issue.

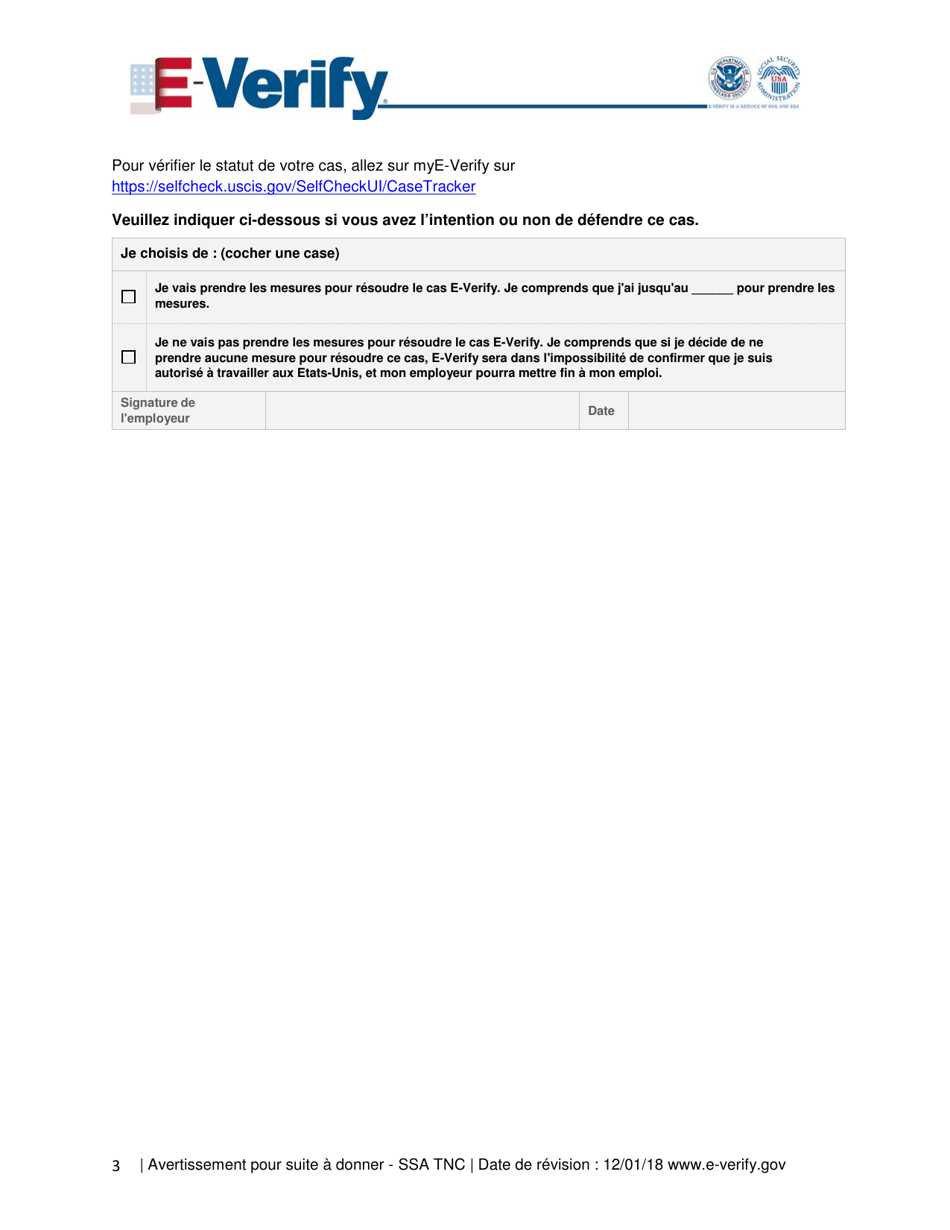

Q: What happens if an employee fails to take action to resolve a TNC?

A: If an employee fails to take action to resolve a TNC, it may result in termination of their employment or other adverse consequences.

Q: What information is included in a TNC notice?

A: A TNC notice will typically include information about the discrepancy or issue, as well as instructions on how to resolve it.

Q: Can an employee continue working while a TNC is being resolved?

A: Yes, an employee may generally continue working while a TNC is being resolved, unless the employer decides to terminate their employment.

Q: What documentation should an employee provide to resolve a TNC?

A: An employee should provide any additional documentation requested in the TNC notice to help resolve the discrepancy or issue.

Q: How long does an employee have to take action to resolve a TNC?

A: An employee typically has eight federal government workdays to take action to resolve a TNC.

Q: What should an employer do once a TNC has been resolved?

A: Once a TNC has been resolved and employment eligibility has been confirmed, an employer should update the employee's Form I-9 accordingly.

Form Details:

- The latest edition currently provided by the U.S. Social Security Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.