This version of the form is not currently in use and is provided for reference only. Download this version of

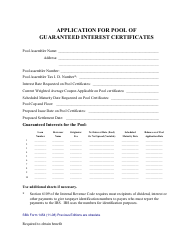

SBA Form 990A

for the current year.

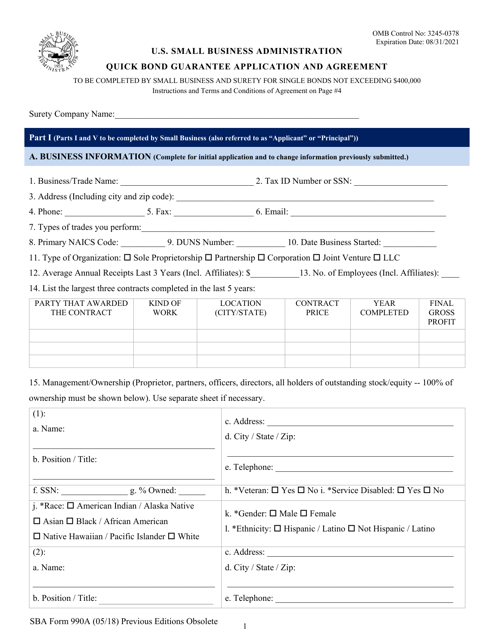

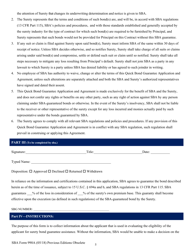

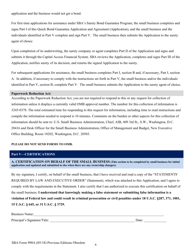

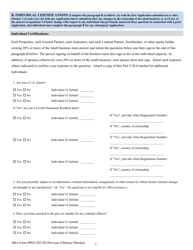

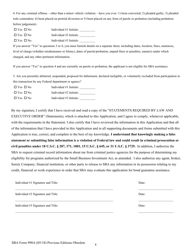

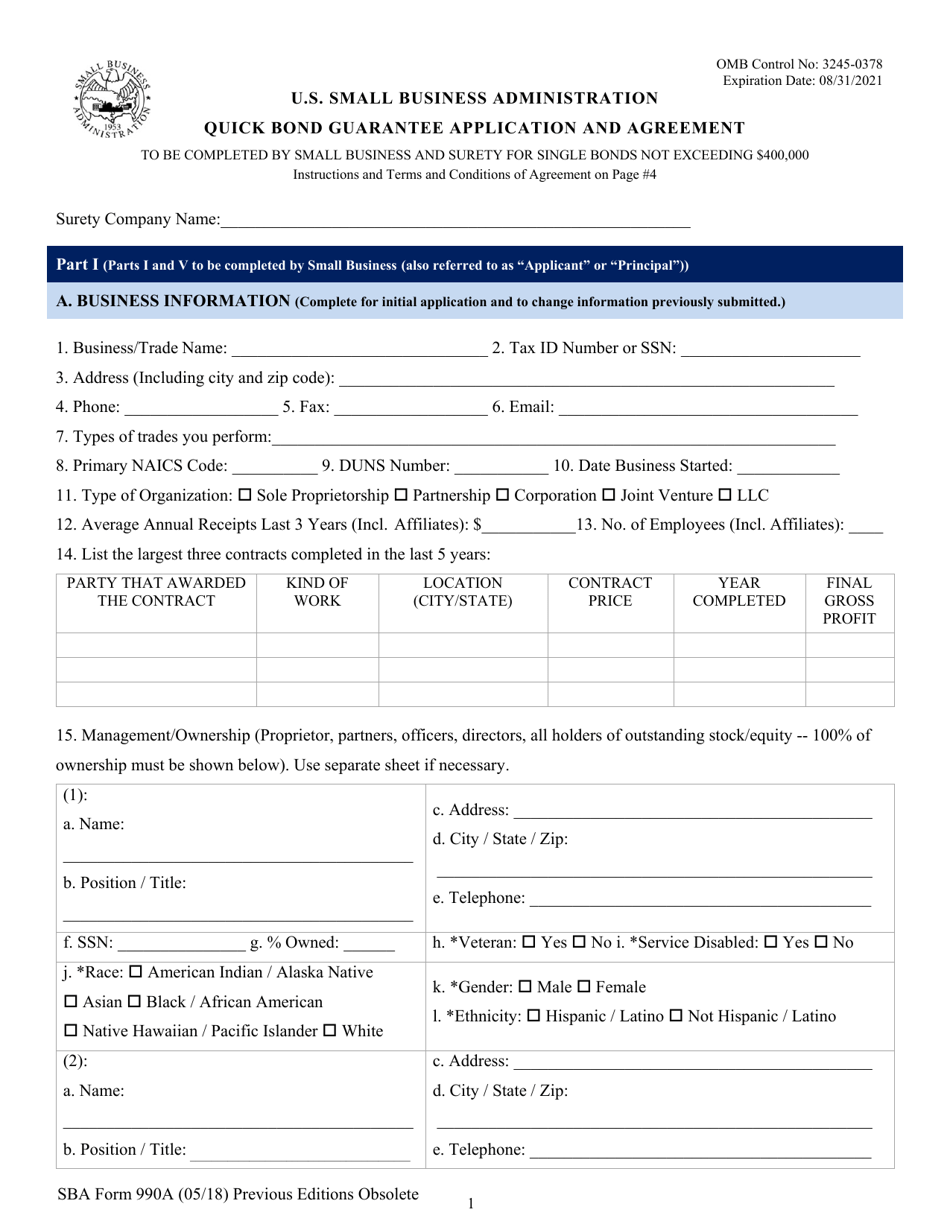

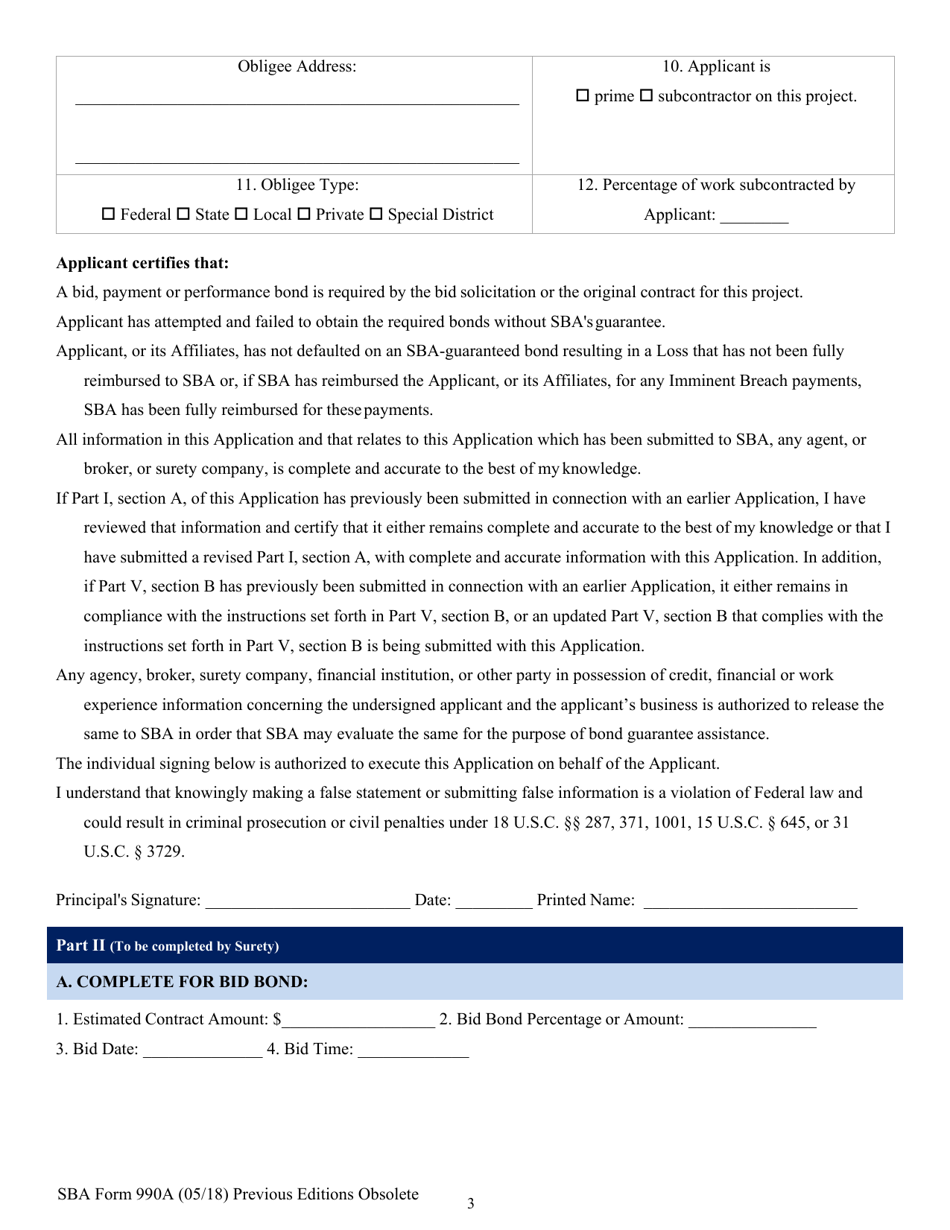

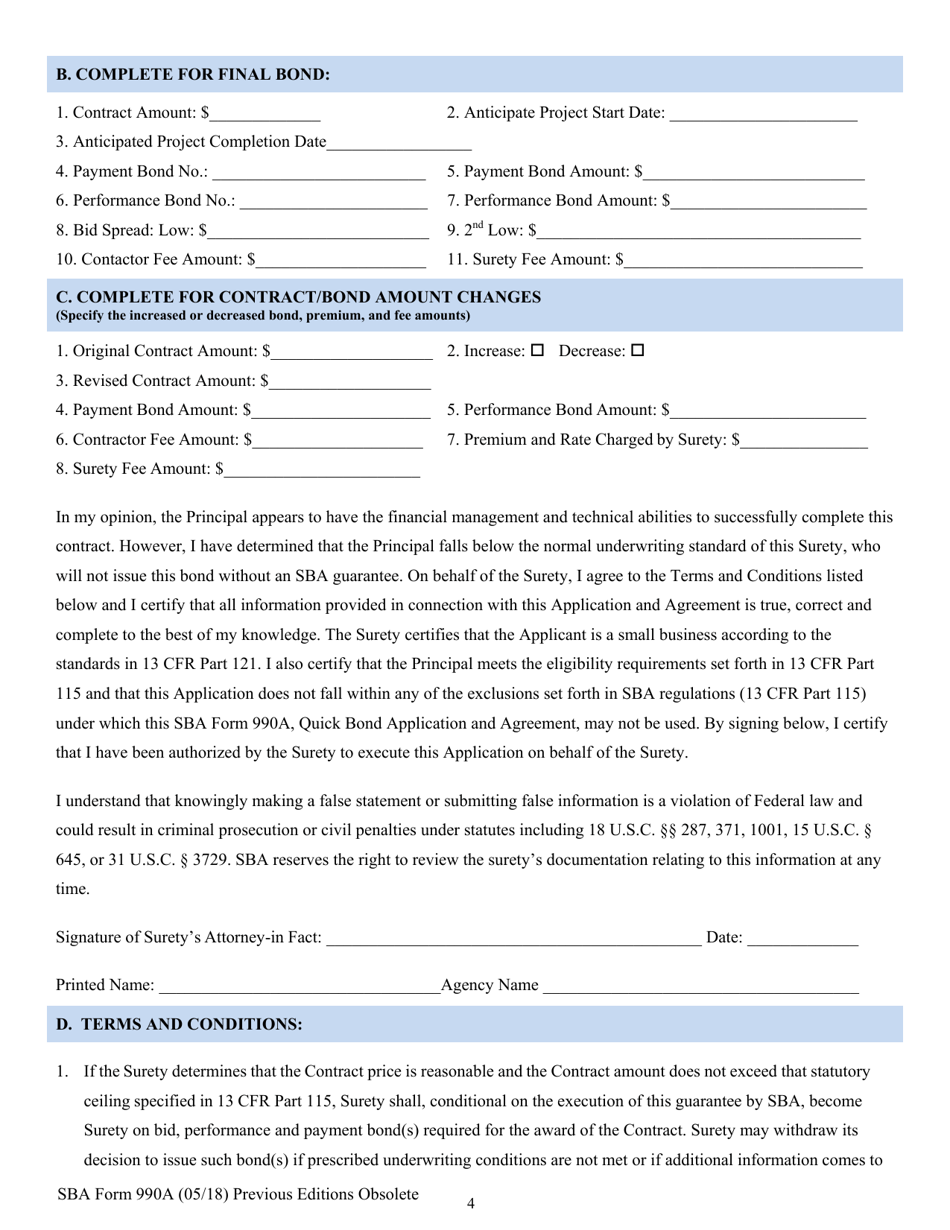

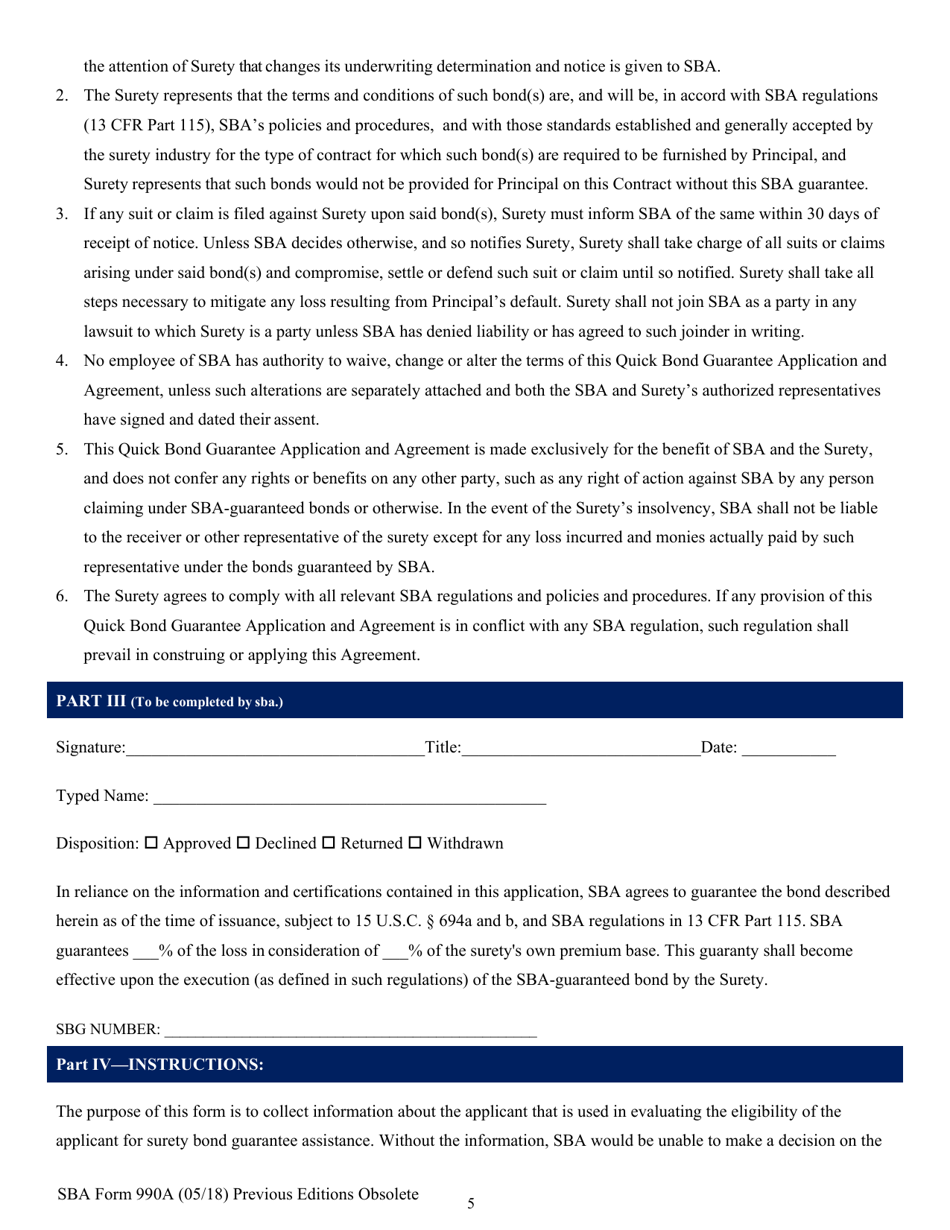

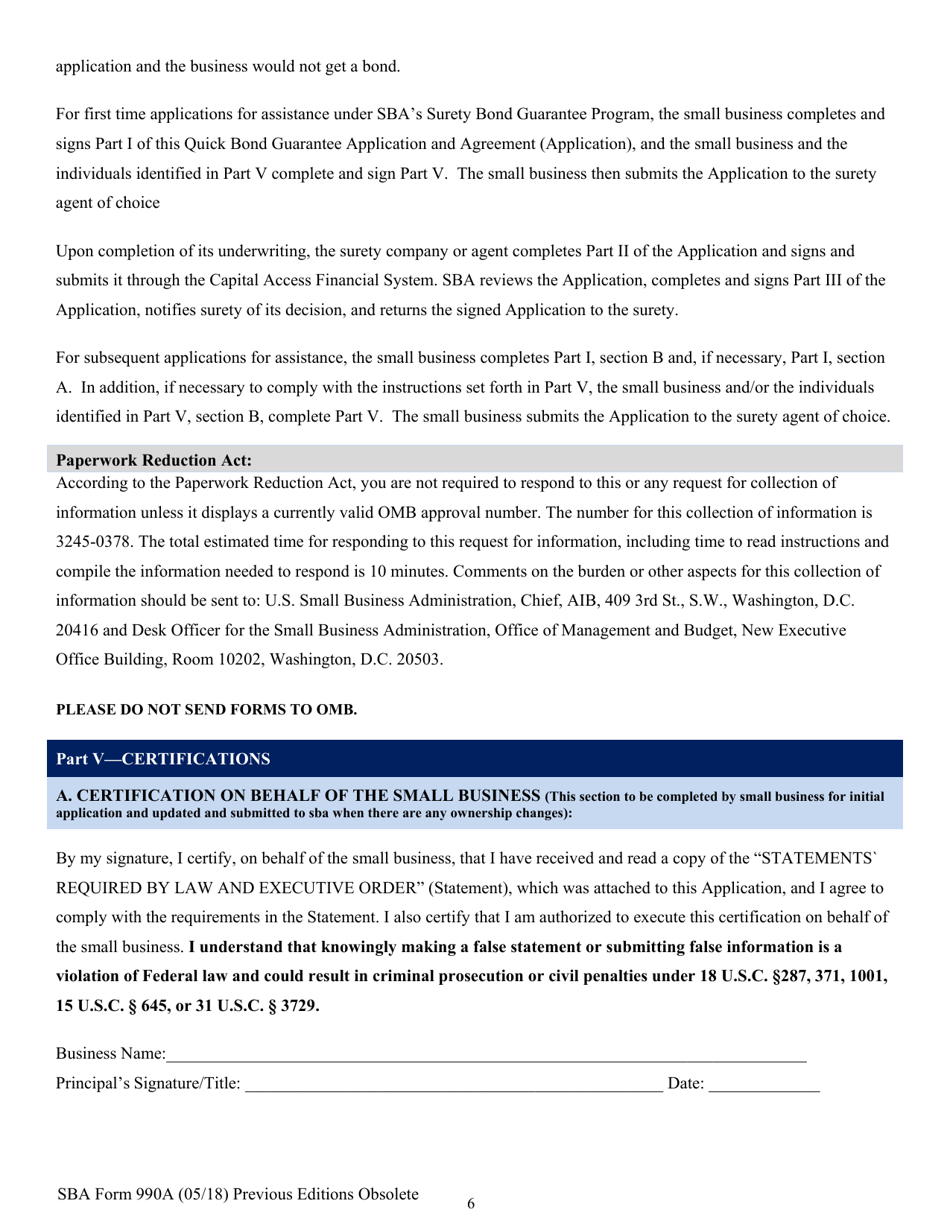

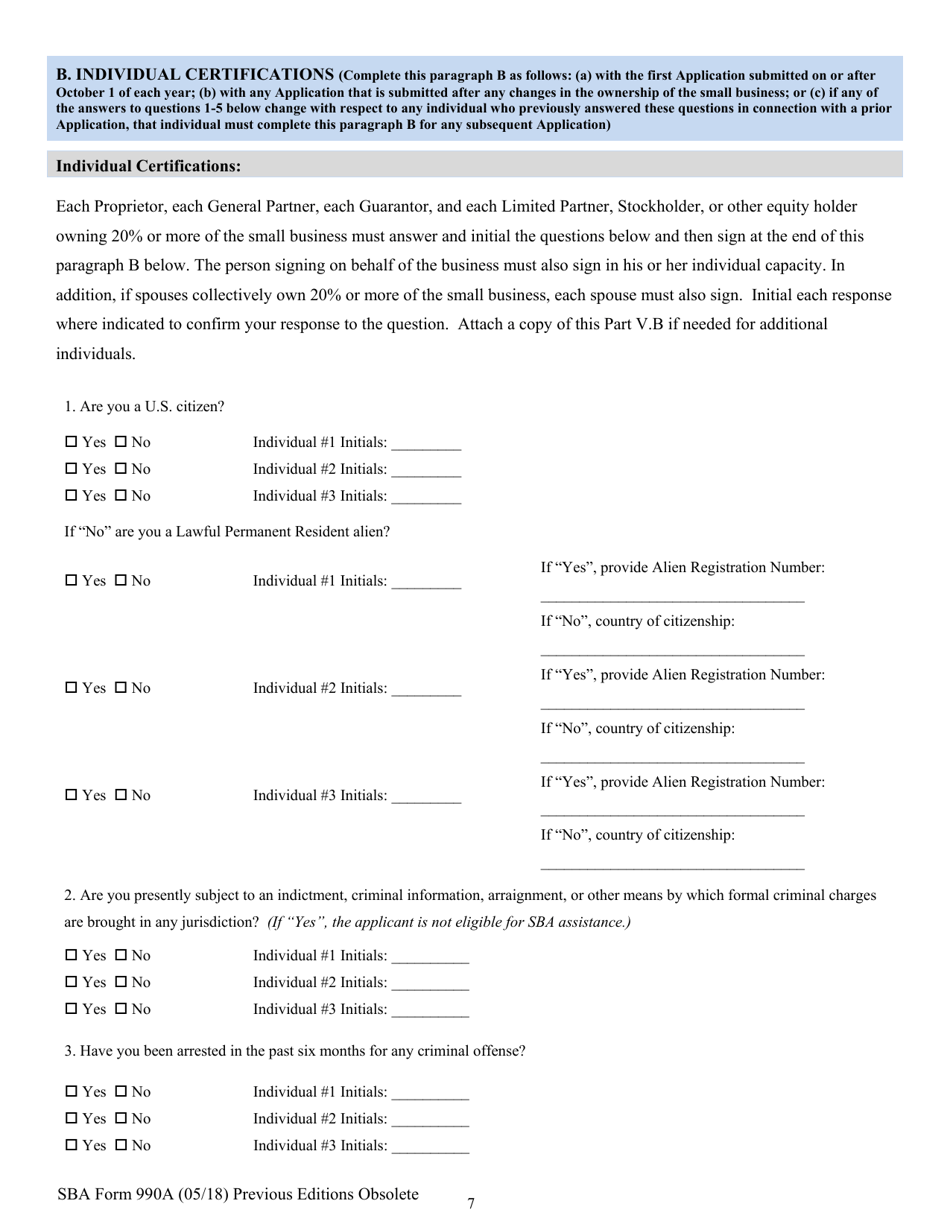

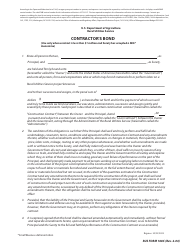

SBA Form 990A Quick Bond Guarantee Application and Agreement

What Is SBA Form 990A?

This is a legal form that was released by the U.S. Small Business Administration on May 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SBA Form 990A?

A: The SBA Form 990A is a Quick Bond Guarantee Application and Agreement.

Q: What is the purpose of the SBA Form 990A?

A: The purpose of the SBA Form 990A is to apply for a Quick Bond Guarantee from the Small Business Administration (SBA).

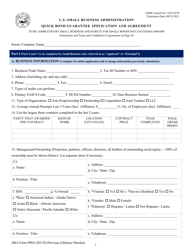

Q: What does the SBA Quick Bond Guarantee cover?

A: The SBA Quick Bond Guarantee provides a guarantee for bid, performance, and payment bonds for small businesses.

Q: Who can use the SBA Form 990A?

A: Small businesses that are eligible for SBA assistance and need a Quick Bond Guarantee can use the SBA Form 990A.

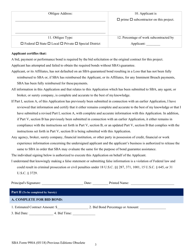

Q: Is there a fee for submitting the SBA Form 990A?

A: No, there is no fee for submitting the SBA Form 990A.

Q: How long does it take to process the SBA Quick Bond Guarantee?

A: The processing time for the SBA Quick Bond Guarantee varies, but it typically takes a few business days.

Q: Is the SBA Quick Bond Guarantee available for all types of bonds?

A: No, the SBA Quick Bond Guarantee is specifically for bid, performance, and payment bonds.

Q: What is the maximum amount of the SBA Quick Bond Guarantee?

A: The maximum amount of the SBA Quick Bond Guarantee is $250,000.

Form Details:

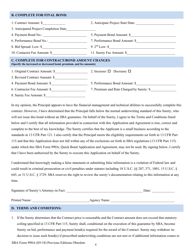

- Released on May 1, 2018;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 990A by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.